XE Money Transfers is a provider with over thirty years of experience arranging global remittance. They have one of the largest money transfer networks in the world, covering over 190 countries in 100+ currencies.

The remittance review team at MoneyTransfers.com has analyzed XE’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback. We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture on how good XE really is.

XE review

Fees & Rates

XE’s fee structure means smaller transfers always incur a fee, no matter what currency - and exchange rates for low amounts tend to be quite high. However larger transfers see better rates and no fees, so it balances out overall.

Service

Ease of Use

Safety & Trust

Customer Feedback

“XE offers one of the biggest money transfer networks in the industry, offering relatively quick transfers at low rates. We thought their app was easy to use, finding the process of sending money straightforward and without much difficulty. XE’s support team is useful too - the overall experience was positive, and we wouldn’t have an issue using them again. However, you might find there are better options if you’re based in Asia or Africa, as XE does not offer much support in these regions.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like XE?

Pros

- Its wide network: Xe has 190+ supported countries and 100+ currencies, making them a powerful remittance provider

- Its customer support: The customer support team was helpful and efficient

- Its fee structure: XE charges no fees for transfers over $1000, and are fully transparent with its fee

Cons

- Its limited support for Asia and Africa: Currently XE does not support many transfers from countries in Asia and Africa

- Its exchange rates: XE offers somewhat uncompetitive exchange rates compared to other providers

Fees and exchange rates

This is how we rated XE based on their fees and exchange rates - they place outside our top ten providers in terms of cost. Find the best rates for your specific transfer with our comparison tool.

Compare providers

XE charges a flat transfer fee on amounts below a certain threshold, and provides free transfers if your send amount exceeds this. However, they do charge a markup on the exchange rate, and it tends to be higher on lower transfers.

When sending money with XE, the overall cost will depend on:

How much you send: Sending an amount over the threshold for your currency means you’ll avoid paying a transfer fee, while larger transfers often see better exchange rates

The country and currency you use: Different currencies have different fee thresholds and exchange rate markups - you’ll be able to see this when you set your transfer up

How you pay: XE, like many other providers, sometimes charge extra for card payments - while credit card payments generally include a cash advance fee from your issuer

XE transfer fees

XE changed their fee structure on the 14th of April 2023, around a week before we wrote this review (good timing, right?), which we confirmed on a call with their customer service team. See the full fee table below:

Country of registration | Minimum transfer amount to qualify for no send fee | Send fee (if less than qualifying amount) |

Australia | 500 AUD | 4 AUD |

Canada | 500 CAD | 3 CAD |

European Union countries | 250 EUR | 2 EUR |

New Zealand | 500 NZD | 4 NZD |

United Kingdom | 250 GBP | 2 GBP |

United States | 500 USD | 3 USD |

Previously, XE only charged a fee of £2 or €2 for transfers over £250 or €250 from the UK or the EU - while all transfers from the US, Canada, Australia and New Zealand were free. Now, transfers below $500 from any of these countries will incur a fee of $3 in the US and Canada, and $4 in Australia and New Zealand.

You can also pay by credit card or debit card, which are usually faster options than bank transfers, but this comes with an extra percentage fee in some countries.

Overall our team thinks these rates aren’t bad if you’re more likely to make bigger transfers, but if you’re regularly sending small amounts then the fees can add up quickly.

XE exchange rates

The exchange rate you’ll get with XE varies depending on the country and currency you’ve chosen.

Our data shows their average markup on the exchange rate is usually between 1% and 1.2% - which is quite competitive compared to other providers on our list.

We've outline live Xe exchange rates here.

It’s also much lower than banks, which routinely offer markups of around 3-7%, and PayPal, which charges 6-8%. However, it’s higher than providers like Wise, who charge the exact mid-market exchange rate with no markup at all.

However we noticed that XE’s exchange rates tend to be much higher for smaller transfers, and generally speaking are on the high end compared to other providers.

To put all these numbers into perspective, here's a real-time view of current exchange rates and fees charged by XE for sending USD to different countries:

Currency pair | Exchange rate | Transfer fee | Exchange rate markup | Amount received |

|---|---|---|---|---|

USD / AED | 3.6400 | $0 | 0.90 | AED 36,400 |

USD / AUD | 1.5037 | $0 | 2.15 | $15,037 |

USD / CAD | 1.3707 | $0 | 2.13 | $13,707 |

USD / DOP | 63.7400 | $0 | 0.49 | $637,400 |

USD / EUR | 0.8424 | $0 | 2.08 | €8,424 |

USD / GBP | 0.7353 | $0 | 2.18 | £7,353 |

USD / INR | 87.5066 | $0 | 0.36 | ₹875,066 |

USD / MXN | 18.1900 | $0 | 1.48 | $181,900 |

USD / NGN | 1464.2143 | $0 | -0.27 | ₦14,642,143 |

USD / ZAR | 17.1480 | $0 | 0.65 | R 171,480 |

“XE offers a powerful money transfer service, but it isn’t always the cheapest - especially for smaller transfers. We’d recommend comparing your options for any transfer you make before going with XE, just to ensure you’re getting the best price available.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is XE's money transfer service?

This is how we rated XE based on the overall quality of service they offer. This puts them high up on our list of top ten providers for their services, alongside other providers like WorldRemit and Currencies Direct.

Compare providers

Offering reliable and straightforward money transfers, XE are relied on by millions every year thanks to the quality of their service. We’ve closely assessed their transfers, from the different routes and currencies offered to their speed and transfer limits - here’s what we found out.

Speed of transfers

XE’s money transfers can take anywhere from minutes to days. The range given on its website is from one to four working days, but it depends on how you pay as well as the countries and currencies involved.

They do also say that over 90% of their transfers are completed within 24 hours, which isn’t bad at all. It’s worth noting that their debit and credit card transfers are usually much quicker than bank transfers.

Transfer limits

XE, like many money transfer providers, have their own limits in place for how much you can send abroad using their services. If you use XE to transfer money online, your upper limit will be $535,000 per transfer from the US. Their full list of limits by region is below:

Region | Online transfer limit |

US | $535,000 or sending currency equivalent |

UK and EU | £350,000 or sending currency equivalent |

Canada | $535,000 or sending currency equivalent |

Australia and New Zealand | $750,000 or sending currency equivalent |

The limits are different if you’re using the app. Depending on the currencies and countries involved, you’ll be able to send a maximum of around $50,000 - $60,000 according to their customer service team.

Additionally, if you’re in the US or Canada and paying by a SWIFT wire transfer, rather than ACH, credit card or debit card, you’ll have to pay at least $3,000.

If you’re sending by cash pickup, you’ll be able to send 3,000 of your local currency per transfer, and you’ll be allowed to make five transfers a day.

So from the USA, this would be $3,000 per transfer, five times a day - unless you’re in Oklahoma, Arizona or New Mexico. People in these states can only send a maximum of $999.99 per day for cash pickup - for higher amounts you’ll need to show additional documentation.

Cash pickups from anywhere in the US to Nigeria have a maximum limit of $500.

If you’re paying by credit or debit card from the US, you’ll be limited to $3,000 a day maximum, and no more than five transfers a day.

These aren’t spectacularly high transfer limits compared to other providers, like Wise and TorFX.

We suggest registering with Xe online and then giving their account management team a call so they can assist you with any higher value transfers.

Type of transfers available

When you send money with XE, you’ll be able to pay for your transfer via the following methods:

ACH bank transfer

Money transfer providers like XE often have a network of bank accounts across the globe, which means they can move money around without it ever crossing international borders. As a result, they can avoid using the SWIFT banking system and the associated high fees - so making an ACH transfer directly to XE is often the cheapest method.

However, according to XE, it’s unlikely to be the fastest - in fact, it can take up to four business days for an ACH payment to be processed.

Wire transfer

Debit card

Credit card

These are the standard options for paying for a transfer, so it’s good to have them all available, even if not every method is available in every location. Keep in mind that if your transaction begins in a currency different from the home currency in the sending country, you might only be able to pay by bank transfer.

Where you can transfer money

At the time of writing, there was some contradicting information on XE’s website - in some places it said they covered over 170 countries and almost 100 currencies, while other places said it was 130 countries.

We called up their customer service team to confirm, and they currently cover over 190 countries in 100+ currencies (in line with apps like Revolut, Wise, and Remitly). You’ll be able to find a full and accurate list of countries and currencies they offer for bank-to-bank transfers in their help center.

Additionally, for cash pickups they have over 500,000 locations around the world. This wasn’t previously the case until they started piggybacking on Ria Money Transfer’s own cash pickup network - the two providers are owned by the same holding company.

Compared to other providers, XE has an extensive list of locations to which they cater - so they’ll be a reliable option for many of the most popular money transfer routes.

Customer service

XE has a few different customer service options available, but the live chat feature was only available once we’d signed up. We put their agents to the test on each channel to sort out some issues we’d been experiencing - here’s what we found out:

Live chat

Availability | 24 hours, Monday to Friday |

Response time | Within two minutes - we were connected immediately |

Languages | 100 languages |

We connected to their live chat feature - a robot answers and you can ask to talk to a human immediately. At 3pm, we were connected to a human straight away. We chose to ask about their service status, as XE’s service had actually been down for a few days prior to us writing this review.

They said the service was back up but we told them we were still getting errors when trying to send money - they asked for a screenshot which we provided. They asked for a moment to check, and after less than a minute they provided me with a screenshot of them doing the same transaction. They offered to have their IT team update us with an email when they have information.

We then used their live chat feature late to close our account. Their robot took care of it, we didn’t need to talk to an agent - and they promised to keep us updated by email.

Phone

Availability | Monday to Friday |

Response time | Within ten minutes - our call was answered in seconds |

Languages | English only, but you can call from over 20 territories |

We called up to ask about their transfer fees, with the information on-site having recently been removed. Our call was answered within a minute, and we were connected to an agent immediately. We asked about their fees and whether this had changed recently, and after a few minutes they confirmed that their fee structure had indeed changed.

They told us what the new fee structure was, which we’ve included in the table further up. But they said that as more changes are currently being made to their fee structure, they aren’t able to put up a full list of fees yet. They were helpful and informative, without any major delay.

Availability | 24/7 |

Response time | Within 48 hours |

Languages | Over 100 languages |

We emailed to ask which countries and currencies you could arrange a cash pickup in as a delivery method. Before we sent the email, once we’d finished typing the message, it came up with some automatic suggestions for help center articles - but none we targeted specifically at what we wanted to know.

They prompted more articles once we’d sent the email, and offered to close the issue automatically if they were helpful, but none provided all the information we wanted.

Help center FAQs

Availability | Online |

Languages | English, Spanish, French, Dutch |

Their help center is well organized, with a useful search function that lets you find what you need easily. The articles are short and clear, with useful links to related articles and ones you’ve read recently. It’s not ideal that their fee information had disappeared and we hope it returns once they’ve finalized their fee structure.

Additional services

XE’s main service is international money transfers, so they don’t really offer much else. You can, however, use XE’s currency conversion tool to find exact mid-market rates, as well as view historical data on their currency charts, and set up rate alerts for different currency pairings. It’s worth noting that XE also provides business money transfers.

“As with any company this size, you would expect XE’s level of service to be high. With a wide range of supported currencies and transfer methods, a good showing from its customer support team, and relatively high sending limits, XE’s money transfer service definitely stands out.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Ease of use

Here's how we rated XE based on how easy it is to open an account and send money. XE came high in this ranking, along with providers like Instarem and CurrencyFair - but in our testing we found they were a bit more difficult to use than other services such as Wise or WorldRemit.

Compare providers

We went through the process of signing up to XE on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

Signing up with XE

Signing up with XE is straightforward and only takes a few minutes whether you use their desktop site or mobile:

Open XE's money transfer service

We opened XE's website, but you can also download its app

.png)

Register

We clicked on ‘register’ and entered our email address and new password for our account

.png)

Verify email

We confirmed our email address using a six-digit two-factor authentication code

.png)

Choose location

We chose our country of residence and agreed to the terms and conditions

.png)

Add personal information

We gave our name, date of birth, phone number and address

Add security

If you’re using the app, you can enable biometric authentication

.png)

Send money

Once finished you’ll be ready to start sending money

From start to finish it took less than three minutes for us to sign up to XE - not bad at all, in our opinion.

Sending money with XE

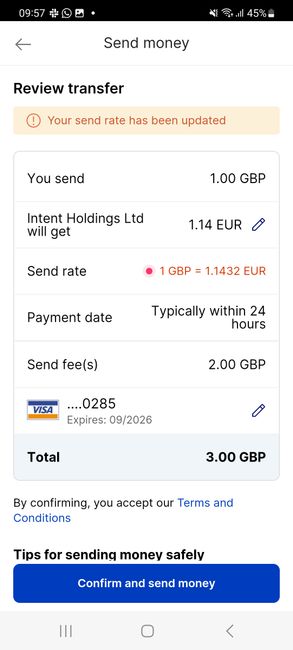

We used XE to convert £100 into euros - here’s how it went:

.jpg)

Enter transfer details

We entered the amount of money we wanted to send and which currency we wanted to convert to

.jpg)

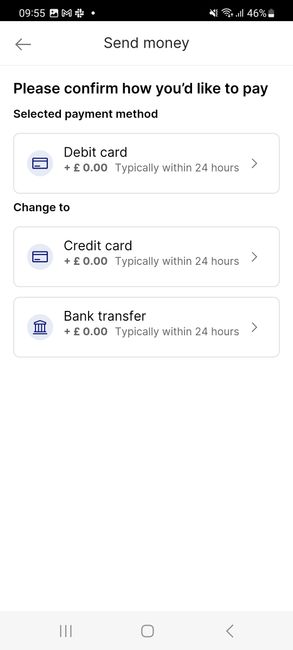

Choose payment method

We selected our payment method - the options were debit card, credit card and bank transfer, and we chose debit card

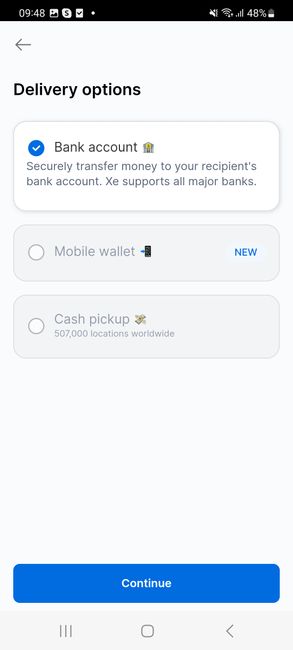

Choose delivery method

We chose to deposit the money into the recipient’s bank account, but the other options were mobile wallet deposit and cash pickup

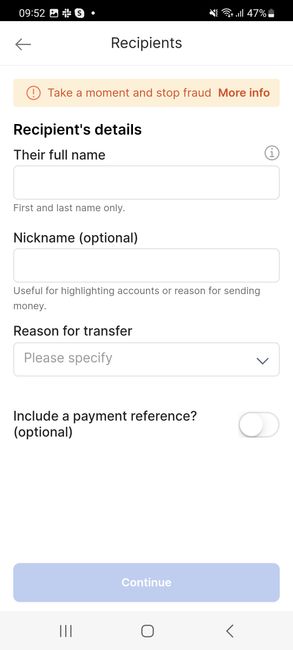

Add recipient details

First we had to choose who we were sending money to, either ourselves, someone else or a business. We added details about the recipient, including their full name, an optional nickname, and a reason for the transfer. Then we added their IBAN

Add payment details

We added our payment details, including the cardholder name, card number, expiry date and CVV number

Review transfer

We reviewed the transfer, confirmed it, and went through our bank’s security page

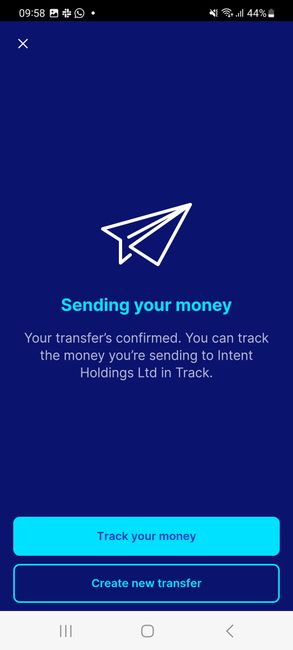

Confirm and track

Once the transfer had been confirmed, we could track it until it was done

We sent the money at 9:59am on a Wednesday, and the money was received at 11:06am on the same day. It took one hour and seven minutes vs the expectation of within 24 hours, which we were more than happy with.

“We found it very straightforward to send money with XE - it took minutes to sign up and set up a transfer, and it was complete in just over an hour. This is exactly the kind of experience you’d like to have when sending money abroad, so XE gets plenty of points here.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is XE?

Here's how we rated XE based on their safety, security, transparency and trustworthiness. They rank close to the top of our provider list alongside Wise, TorFX and Currencies Direct.

Compare providers

XE claims to have processed over $115 billion for over 112,000 customers in 170 countries, and their 25 years in the business certainly shows they know what they’re doing. They wouldn’t be on the MoneyTransfers.com panel otherwise - we ensure every provider on our website is fully reputable and credible.

We took a deep dive into how XE practices, who they’re regulated by, and what security features they use.

Is XE authorized to provide money transfers?

XE is authorized to provide money transfer services in every region it operates in. This includes:

Europe: XE operates in Europe under XE Europe B.V., authorized by the Dutch Central Bank - its license number is R149006

UK: XE operates under HiFX Europe Limited, authorized by the Financial Conduct Authority - its license number is 46244

Australia and New Zealand: XE operates under HiFX Limited, regulated by the Australian Securities and Investments Commission (ASIC) in New Zealand, with an Australian Financial Services License number 240915. Also as HiFX Australia Pty Limited, regulated by ASIC in Australia with a license number 240917

Canada: XE operates under HiFX Canada Inc., authorized and regulated by the Financial Transactions and Reporting Analysis Centre of Canada, with the registration number M16372531, and with Revenu Quebec, license number 903281

USA: XE operates under Continental Exchange Solutions, Inc., licensed by the Department of Financial Services of the State of New York, the Georgia Department of Banking and Finance (NMLS ID 920968), the Connecticut Department of Banking (NMLS MT-920968), the Massachusetts Division of Banks (FT920968) and all other US jurisdictions

Security

XE is a safe and trustworthy company to use when sending money abroad. They move over $10 billion annually around the world in money transfers, and employ ‘enterprise-grade security measures’, as stated on their website.

XE also states that they have joined forces with HiFX to build state of the art security, stable and scalable infrastructure, services for anti money laundering and fraud prevention, and much more. Owned by the NASDAQ-listed company Euronet Worldwide, XE complies with strict regulatory standards and are authorized and regulated by all relevant governing bodies.

Fee transparency

XE are transparent with all their costs, showing all fees and exchange rates when you input details about your transfer, as well as transfer speed and amount received. However, XE doesn’t make it obvious that the bulk of their fees are hidden in the exchange rate - unlike some other providers.

Customer feedback and user reviews

This is how we rated XE based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It’s not the highest on our list by any means, with Wise, Instarem, WorldRemit, Atlantic Money, and many more ranking higher. However it does beat providers like CurrencyFair and PayPal.

Compare providers

XE is one of the longest standing money transfer providers, however they are falling slightly behind when it comes to third-party reviews. Customer feedback is an important factor when it comes to looking at providers, as you’ll get real life examples of how good or bad their service can be. We’ve looked at their reviews on Trustpilot as well as both app stores to see what people have been saying.

Trustpilot

XE is rated as ‘Great’ on Trustpilot, with a score of 4.1 from over 57,000 reviews when this article was written - and 82% of their ratings are five stars. This is a relatively high score considering how many reviews they’ve had - only four other providers have more Trustpilot reviews than XE.

According to Trustpilot, XE replies to 99% of all negative reviews - which is an incredible response rate. They also reply to reviews in under 24 hours, which is rapid compared to other providers.

The App Store

XE has two versions of its app on the Apple App Store, a US version and a GB version. They’re both rated well though - XE has 4.3 out of 5 on US store, from 5.3k ratings; and they have 4.1 out of 5 on UK store, from 2.7k ratings.

However, reading the reviews tells a slightly different story. There are a fair number of one-star reviews complaining about lost money and poor customer service on the US store, and complains about the app’s functionality on the GB store.

Apple doesn’t display all the reviews for each app, and gives a mix of reviews from 2017 to 2022 - so you might want to take these with a pinch of salt.

Google Play

XE’s score on the Google Play Store is significantly lower, achieving 3.5 out of 5. However this is from over 100,000 reviews - and the app has been downloaded over ten million times.

The newest reviews are a mixed bag, with some positive reviews praising the app for its speed and reliability while others slate it for lost money, bugs and poor customer service.

Those looking specifically for money transfer apps can use our in-depth comparison as a starting point.

“XE is one of the world’s biggest money transfer providers, and they’ve been around for a long time. With a huge network of supported countries and currencies, a smooth app and plenty of customer service options, you can bet that XE will be a reliable option for most money transfers.”Financial content specialist, MoneyTransfers.comArtiom Pucinskij

XE - Lowest fees for the large transfres

XE is a strong money transfer provider with high limits and solid security, but they do fall behind competitors in key areas.

Their customer feedback remains mixed, and their average transfer speed is lower than some other providers.

While the fee structure looks appealing, you may not get the best rates on the market when you use XE.

But it’s always worth comparing, as their sheer range means they’re often going to be an option when you need to send money abroad.

A bit more about XE

Do I need an account to receive money with XE?

Do I need a bank account to join XE?

Is XE legal to use?

Who owns XE?

Can I open a XE account in any country?

Compare XE with other providers

Xe user feedback

Comments

Anonymous

The transfer rate was way lower than displayed on the comparison site.

Anonymous

Great for large transfers.

Anonymous

Fast, great rates, easy to use. Good for large transfers.

Paul Ansems

XE money transfer scam -stay away-WARNING Don't use this company! After several successful transfers. This time, I sent the money and they received it. After 7 days with no reason that they would cancel it. I sent their compliance team everything they asked. I found my privacy threatened but sent them anyway. I asked for a supervisor or manager but was denied. They obviously hang onto your money as long as possible and after making money from it like interest. If the exchange rate amount is too high and drops after holding it then they cancel it. WARNING Don't use this company!

.svg)