OFX Business overview

Features | Insight |

|---|---|

Monthly Fee | $0 |

Exchange rate | From 1.3% |

Transfer fees | $0 |

Multi-currency account | 7 |

Batch payments | ✅ (500) |

Expense management | ❌ |

Pay invoices | ✅ |

Receive payments | ✅ |

Marketplace integration | ✅ |

API options | ✅ |

Manage Payroll | ✅ |

ATM Access | ❌ |

Forward Contracts | ✅ |

Scoring OFX Business

Our key measures when testing OFX Business for international business transfers were the strength of the product offering, cost of service and transfers, speed, safety and customer satisfaction.

Pros

Cons

Product offering

OFX Business offers access to 7 multi-currency accounts in total, one of the higher numbers on the market. There are no payment limits and batch payments are capped at 500, slightly below the likes of Wise Business at 1,000.

Fees and rates

Transfer speed

Transfer limits

Ease of use

Safety and trust

Customer feedback

Online review software is unreliable because it averages out scoring across a company, for decades at a time. To give a clear view of how OFX Business is actually performing now, we analysed online review scores from a number of different sources, specifically for the business offering. This chart shows an average score out of 3.99 5, per month for business services, since the start of 2023.

OFX Business multi-currency accounts

The OFX Business account is a multi-currency account option that offers access to 7 currencies in total, allows a business to send and receive in over 50, hooks up to Xero and provides risk management services. All-in-all it’s a flexible account offering options for growing businesses and enterprises.

Provider

Supported local accounts and holding currencies

The amount of currencies offered by OFX Business is at the higher end of the market with 7. For comparison, Wise Business offers 10 and Airwallex offers 12. Sokin, a relatively new player in the market, offers 4 and Payoneer offers 9.

All of these accounts offer USD, EUR, and GBP.

Currency | Account Details |

|---|---|

AUD | Account number and BSB |

CAD | Account number, institution number, transit number |

EUR | IBAN, SWIFT/BIC |

GBP | Account number, Sort code |

HKD | Account number, bank code, branch code |

USD | Account number, Routing number (ABA), SWIFT/BIC |

SGD | Account number, SWIFT/BIC |

Sending currencies

The currencies that can be sent via OFX Business are:

Europe

EUR, GBP, CHF, DKK, HUF, NOK, PLN, SEK, AZN, BGN, CZK

North America

South America

Asia

Australia and Oceania

Africa

Whilst a wide range of currencies are included here, this isn’t at the same level as Wise Business (over 70 currencies) or Sokin (75 currencies).

South America in particular is under-represented by OFX Business, but access to key North American, Asian and European markets still allows for versatility.

Account limits and sending limits

Account limits on OFX Business are open and as such there are no restrictions.

This is a perk in favour of OFX Business when dealing in particularly large amounts. Wise Business has limits of $50 million, Sokin of $15 million.

Timeframe | Limit |

|---|---|

Daily | No limit |

Weekly | No limit |

Monthly | No limit |

Outside of this, these limits through OFX Business might need additional clearance or be subjected to limits based on government regulations.

Generally speaking USD, GBP and EUR can be moved freely with the correct documentation. KRW and CNY (amongst others) are subject to more government regulations.

Forex risk management

OFX Business offers a range of forex management options, including forward contracts and strategy. Something that is worth noting here, Moneycorp business account probably offers one of the best risk management services in the market - and Moneycorp transfers are powered by OFX.

Expense management

Expense management through OFX Business is in the form of mass payments and paying overseas staff through invoices.

The account does not have any type of virtual or physical card. Companies like Airwallex offer this service as part of their multi-currency option. So a euro card can be hooked up to a EUR account for example, and multiple cards can be used to track different expenses.

For OFX Business, this does sound like a next natural step - but it currently is not available.

Sending and receiving payments

Sending and receiving business transfers through the OFX Business account is easy and comes with a few options.

Sending money in OFX Business

Exchange rate | From 1.3% |

|---|

OFX Business has a decent platform for sending money.

Transactions can be tagged as necessary.

The exchange rate (from 1.3%) isn’t overly competitive against Wise Business (at the mid-market rate) or Airwallex (0.5% on weekdays).

There are however no fees associated, although banks may charge a receiving fee.

Sending mass or batch payments

Sending through an integration

Receiving money

Interest on balances

Earning interest on balances can make a huge difference to risk management. OFX Business does not offer interest within its multi-currency accounts.

Currency | OFX Business interest rate |

|---|---|

USD | Not offered |

EUR | Not offered |

GBP | Not offered |

If earning interest is an important factor then Wise Business offers the best interest rates on multi-currency business accounts.

Integrations and APIs

Whilst Xero is one of the biggest account softwares on the market, it is not the only one. As such, OFX Business integration only working with Xero at this time puts it at a weaker level than competitors.

Accounting Integrations | Xero |

|---|

As an example, Wise Business is accessible to users of:

Xero

QuickBooks

FreeAgent

RECASH

QuickFIle

Ember

FreshBooks

Oracle NetSuite

For companies looking for integrated multi-currency support, it does leave the door open to opt for a different provider.

APIs

Whilst it may feel that OFX Business integration is lacking in options, the API offering is one of the best on the market.

This API is actually used by Moneycorp Business for transactions, so essentially it is the same network. Outside of this the API is used to fuel international payments from banks.

Support for developers and sandbox environments are available.

Compare Business Multi-Currency Business Accounts

Selecting a multi-currency account for business can feel a little tricky with different options, local accounts and features. We've broken down the top accounts across the industry at the moment.

Fees and rates when using OFX Business

OFX Business has no fees attached to transfers and exchange rates are within the range of what you would expect to find within business accounts.

Provider

Currency conversion costs are higher on weekends (like Revolut Business which adds 1%), but other than that the cost from OFX Business is competitive.

Where the company’s fees fall short is the exchange rate, with many companies in the business transfer space offering rates below 1% as standard.

Service | OFX |

|---|---|

International Transfers | $0 |

Currency Conversion Fee | From 1.3% (extra at weekends) |

Receiving Fee | $0 |

Holding currencies | $0 |

Card Payments | Not available |

Monthly Fee | $0 |

Setup Fee | $0 |

Payment Tracking | $0 |

Mass Payout | $0 |

Accounting Integrations | $0 |

Additional Fees | Not applicable |

As a comparison, Airwallex offers an exchange rate of 0.5% with 1.3% offered here.

So for every $10,000 sent to EUR at a mid-market rate of 0.9351 EUR + each exchange rate:

Company | Exchange rate | EUR received |

|---|---|---|

Airwallex | 0.5% | €9304.245 |

OFX Business | 1.3% | €9229.437 |

Rates on batch payments

Over the course of batch payments, this cost adds up.

When sending batch payments I would recommend using the 24-hour customer service option with OFX Business to determine if a better rate than is advertised is available, or if there’s a possibility to lock in a rate on a forward contract.

Against the lives of Wise Business, who are offering the mid-market rate plus a 0.33% fee, this would make 500 transactions approximately 1% more expensive.

This 1% across $1,000,000 is $10,000. If payments are regularly made (say monthly), this could result in spending an additional $120,000 a year just in exchange rates.

Speed of transfers with OFX Business

Transfer speeds with OFX are usually same day, or within a day. Bigger transfers, like with most providers, will take a little longer. The customer service offered by OFX Business means it is possible to discuss any larger transfers in advance for a little more clarity where needed.

Provider

Transfer speed with OFX Business can be instant, but will generally be within 1 or 2 maximum.

Countries where there are restrictions and regulations imposed by governments can see transfers take a little longer.

OFX Business service and account management

OFX Business offers 24/7 phone support for account queries and sending payments.

For comparison, Moneycorp offers office hours support in the USA.

Working with a direct contact will also allow for tailored options for businesses to be put in place. This account manager level access, particularly within risk management, can result in huge savings for businesses.

Customer service options

Phone support

The perks of having 25]4/7 phone support should not be understated. For enterprise level businesses, operating in multiple timezones, this is a unique offering on the market.

Availability | 24/7 |

|---|---|

Response time | Minutes |

Languages | English (Tbc others) |

Availability | 24/7 |

|---|---|

Response time | Within an hour |

Languages | English (Tbc others) |

Help center

The OFX Business help center is ok.

It lacks some of the deeper insights you would expect, like seeing a fee schedule, that others offer. Often, the answer will be ‘in your OFX account’. As such, it can feel unhelpful. This being said, with the hands on approach of account management and 24 hour phone support - most queries can be answered quickly.

Availability | 24/7 |

|---|---|

Languages | English (Tbc others) |

Using OFX Business

Overall, the OFX Business platform is intuitive and easy to use. It comes highly recommended as it takes some of the features from the personal platform and enhances them for different business needs.

Provider

We testing the following for ease of use

Invoicing

Integrations

Adding multi-user access for employees, roles and permissions

Paying-in and withdrawing funds

For each option the process was simple and easy to follow, Wise is very much a platform where you can see within one or two actions, how to achieve what you need to achieve.

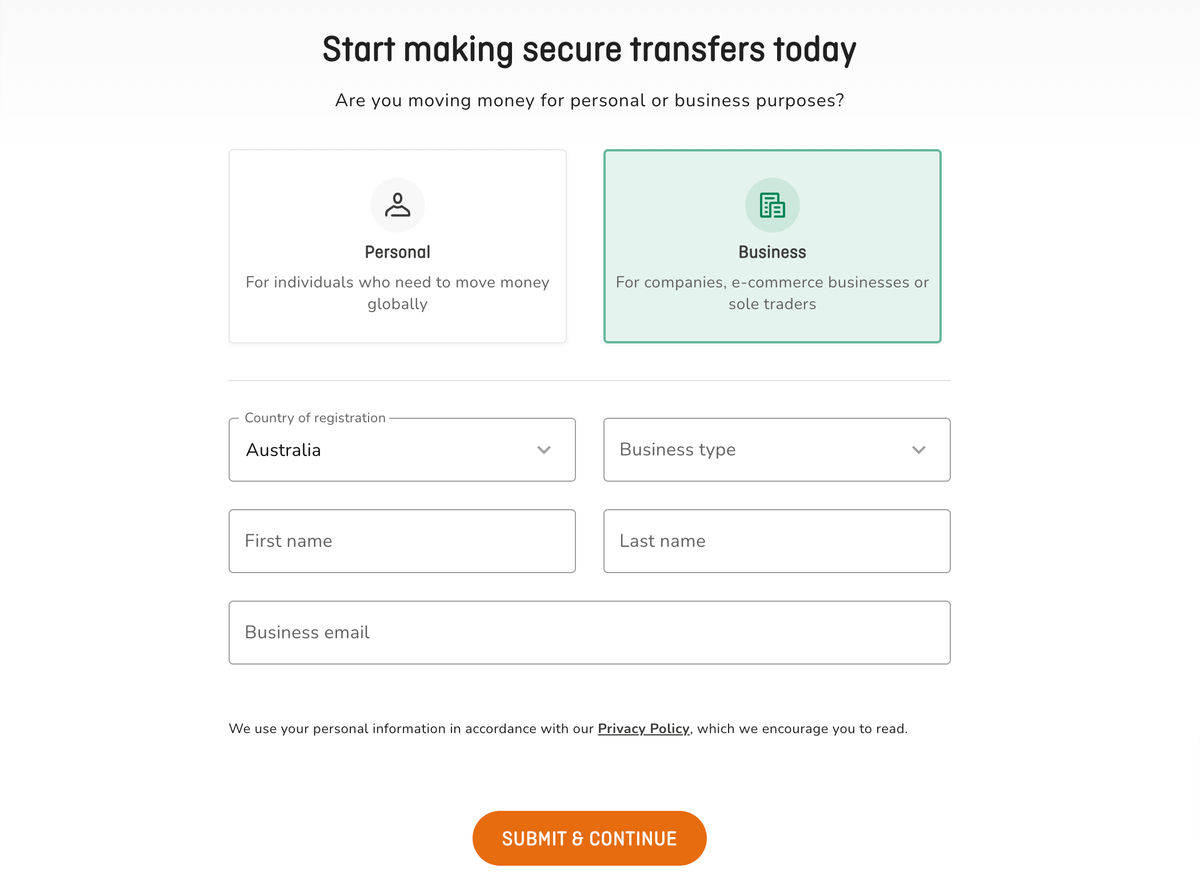

Eligibility and sign up

Eligibility on an account is limited to registered businesses or those operating in different marketplaces (like Amazon or eBay).

The process will require a couple of steps.

First off, register to sign up on the site.

There’s no surprises here, this will be some basic details about the business. Those signing up will need contact details.

Confirm the local accounts you want

Once signed up, OFX Business will confirm with you the local accounts you need access to.

It is possible to set accounts up at a later point with OFX Business. So, starting with one account is possible.

Provide documentation

Documentation for verification will need to be provided.

This will change depending on the type of business, length of time action and registered location.

Wait for verification

Throughout this process there may be requests for additional documents or clarification.

Completed verification is usually within a week at most.

Safety and regulation

OFX Business is heavily regulated and provides businesses with the a number of security features like 2FA and regular auditing.

Provider

OFX Business is regulated in US states by FinCEN. This is standard across the US for money transfer operators.

It also holds an Australian Financial Services Licence (AFSL) issued by the Australian Securities and Investments Commission (ASIC). This licensing grants OFX the authority to deal in and offer financial product advice concerning derivatives and foreign exchange contracts.

In addition to Australia, OFX is registered and regulated in the United States, Hong Kong, the United Kingdom, New Zealand, and Canada.

These regulations mandate that OFX maintain client funds in segregated accounts, separate from its business accounts. This practice ensures the safety of customer funds even in the event of financial instability within the company.

Furthermore, OFX is legally required to adhere to a minimum capital threshold.

Not keen on OFX Business?

If you are unsure of whether OFX Business is for you, here's some alternatives - many of these also offer local account options.

Other review scores

OFX Business has scored an average of 3.99 out of 5 across online review sites since the start of 2023. This average, specifically for its business services, has dropped from just over 4.25 since June 2023.

OFX user feedback

Comments

Anonymous

yes i have company to use.