Wise vs Revolut: Fees, Exchange Rates, and Features Compared

Wise is our winner when it comes to making international money transfers abroad.

Get Wise if you make frequent transfers abroad, and Revolut if you need an all-in-one banking app.

In this comparison, we’ll take a look at when you should be picking Wise or Revolut.

We’ll compare Wise and Revolut based on the key differences and what needs they solve.

The key difference between Wise and Revolut is that Wise is a fintech company specializing in local-to-local money transfers while Revolut is a neo-bank, offering a range of services beyond money transfers.

While both operate a network of local bank accounts around the globe to keep the fees low, Revolut has to keep their fees slightly higher to maintain all other services compared to Wise.

An overview of Wise vs Revolut

If you do not have either one, here’s a quick overview of when it’s best to use Revolut or Wise:

Wise is better for… | Revolut is better for… |

|---|---|

|

|

A note from me

I’ve had and used Revolut since 2018, and Wise since 2021.

Personally, I find myself using Revolut much more often than Wise, but that’s simply because of the convenience.

Yes, Wise is usually cheaper, but most of my family and friends abroad also have Revolut, making it a bit easier for us.

On occasional international transfers, I’m happy to pay the few cents difference in fees over the convenience I get, considering I never reach my 1,000 / month limit.

However, this does not mean I would not recommend Wise.

When I’m asked "Is Wise or Revolut better?", I find the simplest answer to be:

Get Wise if you need to make frequent or large international transfers to bank accounts.

Get Revolut if you need a bank, make small transfers abroad (less than 1,000 / month in your currency), and have friends or relatives who also use it.

Both are good for traveling assuming you don't go over the 1,000 limit with Revolut.

If you're still unsure, send me an email with your questions, and I'll help you decide.

The difference between Revolut and Wise is actually not that big.

If you don’t have either one, here’s a quick overview:

Exchange rates and fees

Wise | Revolut | |

|---|---|---|

Exchange rate | ✅ Mid-market rate | ❌ ~0.25% markup (based on a sample of 30 currency pairs I’ve tested). Plus an additional 1% on the weekends |

Currency exchange fee | ✅ None | ❌ Free up to 1,000/month in your currency; 1% after on the Standard plan (0.5% in the US) |

International transfer fee | ✳️ From 0.33% depending on the currency | ✳️ 0.15% variable fee with minimum and maximum limits depending on the currencies |

Multi-currency account and cards

Features

Speed and limits

✅ - Winner, ❌ - Loser, ✳️ - Equally good or bad

Wise vs Revolut exchange rate and fees

Wise wins this round, it is cheaper than Revolut Standard in most cases (refer to the end of this section for some examples).

Please note

I am based in the UK, meaning all my Revolut fees are calculated in GBP based on my tax residency.

I've used my own experience, my Revolut & Wise apps, and my accounts to get all the data & examples.

For the US on the other hand, I've used Revolut's US documentation to fill in the gaps in costs and fees while checking my app where available.

However, just like with anything, whichever you pick depends on your goals and needs:

Pick Wise if you know you will be converting more than 1,000 (of any currency) per month

Pick Revolut for the same currency transfers

Pick Revolut Standard if you know you will be sending less than 1,000 (of any currency) per month

If you’re reading this, you are probably interested in making international transfers.

Even if it’s sending less than 1000 per month, for an odd chance of sending more, and to avoid a 1% weekend charge, I think Wise is a better choice here.

Here’s a summary of Wise’s and Revolut’s fees:

Wise | Revolut* | |

|---|---|---|

Exchange rate | Mid-market rate | ~0.25% markup (based on a sample of 30 currency pairs I’ve tested). Plus an additional 1% on the weekends. |

Currency exchange fee | None | Free up to 1,000/month (GBP, EUR, and USD); 1% after on the Standard plan (0.5% in the US). |

International fee | From 0.33% depending on the currency. | 0.15% variable fee with minimum and maximum limits depending on the currencies. |

Card transfer fee** | None | Varies from €0.20 - €57.50 (~$0.21 - $59.76)* depending on the amount and the country. |

P2P transfer fees | Free | Free |

Local payment fees | Free | Free |

SEPA payment fees | Free | Free |

Receiving local payments | Free | Free |

Receiving USD wire and Swift payments | $6.11 | Free |

Receiving CAD Swift payments | 10 CAD | Free |

*Since Revolut is based in the UK and EU, most of their base fees are set in GBP or EUR.

**Transfers directly to card numbers outside of Wise or Revolut cards.

Additional SWIFT Charges

The intermediary banks may charge additional fees for transfers over the SWIFT network. These fees are outside of Wise’s or Revolut's control.

With Wise, you can send money at the mid-market rate any day of the week.

Revolut exchange rates on the other hand are a bit worse.

Revolut adds a markup of ~0.25% to the exchange rates for each transfer and an additional 1% outside of business hours (Monday-Friday NY time).

I once made a transfer early on Monday (GMT) and was charged a 1% additional fee, that’s because Revolut's working hours are EST (Friday 17:00 - Sunday 18:00), meaning for them it was still Sunday.Financial Content StrategistArtiom Pucinskij

Wise’s fees are also much easier to read and understand compared to Revolut fees.

In both cases, fees are affected by the transfer origin, destination, and deposit / receiving methods.

As well as, in both cases if you’re sending money between users (Revolut to Revolut and Wise to Wise), transfers are free.

For those based in the US

If you are based in the US (and your tax-residency is set to the US within the Revolut app), there are additional fees for non-USD domestic transactions and transfers abroad.

These charges apply for any domestic transfers in non-USD currency (within the US) or to internatinoal banks (banks outside of US).

For transfers under $200 you will be charged up to 5% of transaction amount.

For transfers over $200 you will be charged up to $10 depending on the transfer amount.

It’s also worth noting that Revolut offers a “Pay All Fees” feature for certain currencies (only available in the UK and Switzerland for now).

This feature allows you to pay one flat fee to cover all possible fees (even the ones charged by other intermediary banks).

For example, if you know your transfer will be over the SWIFT network involving many banks and you’re sending a large amount, you can pay a single fee to cover all these network costs.

Now, I’ve looked at both apps on my phone and tried making a few transfers to see which will result in more money, and here are the results.

To make the comparison fair, I’ve picked bank account deposit as the receiving method on both apps and the cheapest funding method for Wise (Wise balance in most cases):

Sending 1,000

Currencies | Amount | Wise receive amount | Revolut receive amount |

|---|---|---|---|

USD to USD | 1,000 USD | 994.59 USD | 998.49 USD |

GBP to USD | 1,000 GBP | 1,266.92 USD | 1,269.76 USD |

GBP to EUR | 1,000 GBP | 1208.12 EUR | 1,211.08 EUR |

USD to EUR | 1,000 USD | 946.74 EUR | 950.18 EUR |

USD to GBP | 1,000 USD | 780.32 GBP | 783.10 GBP |

Sending 2,000

Sending 20,000

Account tiers

Wise only offers a single free plan.

Revolut on the other hand offers one free account type (Basic) and four additional ones that come with a monthly fee:

Plus - £3.99/month (Not available in the US)

Premium - £7.99/month ($9.99/month in the US)

Metal - £14.99/month ($16.99/month in the US)

Ultra - £45/month (Not available in the US)

With any of the paid plans, you get access to more budgeting and banking features, as well as cheaper rates on international money transfers.

On paper, with the Revolut Premium plan and up, you will get more money out of your transfer than with Wise.

However, to make this worthwhile and cover the monthly cost you need to be making multiple large transfers a month to cover the cost and make it worthwhile.

As a general rule of thumb, I would recommend Revolut Premium if you are planning to make at least 2 transfers of 2,000+ GBP/EUR/USD per month, every month.

If not, Wise would be a better option.Financial Content StrategistArtiom Pucinskij

You can learn more about the plans in our Revolut review, but to summarize, with paid plans you get:

Larger ATM withdrawal limits

More RevPoints

Bigger cashback

On the Plus plan, you get a £3,000 fair usage limit instead of £1,000.

In the US, on the Premium plan you et $10,000/month instead of $1,000.

On Premium or higher, there is no fair usage limit.

Transfer speed

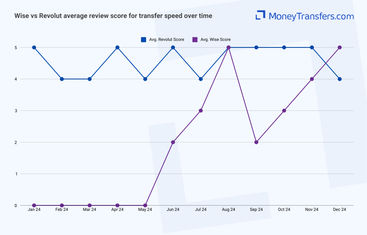

Wise also wins this round. Wise is generally faster than Revolut, although on paper their transfer times are largely the same.

Here’s a summary of Revolut's vs Wise's speed:

Wise | Revolut | |

|---|---|---|

P2P transfer speed | Instant | Instant |

International transfer speed | Instant - 7 days | Instant - 7 days |

The reason I’ve given Wise a win here is that I’ve had transfers frozen in the past with Revolut, leading to 14-day wait times.

Once, I had received £10,000 and Revolut froze my transfer due to AML checks, and the second time my family relative had to receive £20,000 and they delayed the transfer due to the sender's bank.Financial Content StrategistArtiom Pucinskij

As for Wise, we’ve had a few MoneyTransfers.com users comment that they are slower than they used to be:

It used to be always instant, now it may come right away or it can take 5 even 7 days to get the money.MoneyTransfers.com user

In most cases, however, for both Wise and Revolut, most transfers will be instant (or take a few hours) and can take up to 3 days depending on the countries and the network used.

In some cases, especially with SWIFT transfers, it can take up to 5-7 days for the transfer to complete depending on the intermediaries involved.

Transfer limits

It's very close, but Revolut has no limit for most currency transfers, bringing it the win.

Wise’s limits are in the millions, however, they are not 100% transparent with what they are.

Each currency has its limits on Wise (for all I’ve checked it was in the millions).

Here’s a summary of the transfer limits for Wise and Revolut, based on the USD transfers:

Wise | Revolut | |

|---|---|---|

Wire transfer | 1,000,000 USD per transfer | No limit |

USD balance top-up | 6,000,000 USD per transfer | No limit |

ACH payment | 50,000 USD daily or 250,000 USD per 60 days. | No limit |

Debit/credit card | 2,000 USD daily or 8,000 weekly | No limit |

SWIFT | 1,600,000 USD per transfer | No limit |

Receiving limit | 35,000,000 USD per year | No limit |

As I’ve mentioned, each currency on Wise will have its own set of limits, but most go into the millions, at least with a wire transfer deposit.

Revolut on the other hand, has no limits of its own, but they do mention that sending or receiving bank and country might have their own limits.

Even though there is no limit on Revolut, don’t forget about the "1% fair usage limit" (0.5% in the US) which is applied to anything over 1,000 (in any currency) sent per month on the Standard Plan (there’s no limit on Premium or higher plans).

Product offering

Overall, Revolut has a better product offering than Wise.

So, is Revolut better than Wise? Not really, as with anything it depends on what you are looking for:

Pick Wise if you want a multi-currency account. Better for travel, keeping and swapping currencies, sending money between accounts, and having local account details.

Pick Revolut if you need to convert a lot of currencies, they offer more currency pairs and support more countries.

Pick Revolut if you want an all-in-one banking app and features, they have more of them.

Revolut’s card is available in more locations, so there’s more chance it will be available for you.

Multi-currency account

Wise offers a better multi-currency account compared to Revolut in 99% of the cases.

Please note

Similar to the rates and fees section, I've used Revolut's documentation to fill in the gaps for the US card fees.

On the other hand, Wise debit card is not available in the US so I've used a currency converter to give rough estimates.

If you’re looking for a multi-currency account, I would look at it this way:

Pick Wise if you need to exchange and hold multiple currencies, they offer more choices. This is particularly useful for traveling abroad.

Pick Wise if you need to have local account details (useful for receiving cheaper payments)

Pick Revolut if you’re traveling abroad to countries not supported by Wise and want to spend in local currency (which is always cheaper)

Here’s a summary of the multi-currency account details for both Wise and Revolut:

Wise | Revolut | |

|---|---|---|

Currencies to hold | 45 | 37 |

Currencies to exchange | 48 | 37 |

Currencies to spend | 48 | 152 |

Currencies to send abroad | 30 | 41* |

Local accounts | 10 | 1 |

SWIFT accounts | 21 | 37 |

*BOB, CRC, EGP, GTQ, IDR, INR, MYR, PEN, PHP, and VND can’t be sent outside of Bolivia, Costa Rica, Egypt, Guatemala, Indonesia, India, Malaysia, Peru, Philippines, and Vietnam, respectively.

Wise offers more with their multi-currency offering, you get to hold and exchange more currencies, you get more local accounts, and pairing it with the low fees, Wise is a great overall choice.

It’s worth noting that for the Wise local account, you will need to deposit 20 (in your currency) to open your first local account.

The big exception is that Revolut offers more currencies in general, but most of these are rare, or what we call “exotic” currencies that the majority of people won’t need.

Supported currencies for international money transfers

Revolut wins here, Revolut supports more countries and currencies in general compared to Wise.

If this is what matters to you, picking the right company is easy:

Pick Wise if you plan to send different currencies, they offer more currencies you can send.

For anything else, pick Revolut.

Here’s a quick summary of supported countries and currencies for Wise and Revolut.

Wise | Revolut | |

|---|---|---|

Base currencies | 41 | 16 |

Destination currencies | 51 | 89 |

Currency pairs | 1023 | 1691 |

Countries supported | 50 | 220 |

Revolut simply offers more choices when it comes to currencies and countries.

With Wise, you can send more currencies, which is useful if you’re making payments to different countries, it will be cheaper to pay from a local account as no conversion takes place.

Cards and withdrawals

Revolut also wins this round. Revolut is a bank, so they can offer more features with their cards compared to Wise.

Wise | Revolut | |

|---|---|---|

Card cost | 7 GBP / ~8.78 USD (+optional express delivery fee) | 4.99 GBP / $0.00-$5.00 for standard delivery |

Card renewal cost | 2.50 GBP / ~3.13 USD | £5 / $5 per card (+ delivery fee) |

Monthly ATM withdrawals | 2 + 0.5 GBP / ~$0.63 per withdrawal after | In the UK it is 5 + 2% after or £1 minimum, while in the US there are no minimum withdrawals for In-Network ATMs (limits apply for Out-of-Network). |

Monthly ATM limit | £200 / ~$250.77 + 1.75% over £200 / ~$250.77 | In the UK it's £200 + 2% after or £1 minimum. In the US it is $1000 + 2% after or $1 minimum for In-Network ATMs. For Out-of-Network ATMs it's 2% for all. |

Topping up e-wallets | 2% | Free |

Virtual cards | Free | Free |

Revolut is available in more countries, their cards have higher ATM withdrawal limits than Wise, are cheaper compared to Wise, and Revolut offer virtual cards.

Wise card is available in:

Australia, Brazil, Canada, the EEA (European Economic Area), Japan, Malaysia, New Zealand, Philippines, Singapore, Switzerland, and the UK.

Revolut is available in:

I also think it’s fair to say that it is more convenient to have a bank debit card from Revolut, than the pre-paid debit card from Wise.

Additional perks

Revolut is better than Wise when it comes to other features and perks.

This is a slightly unfair comparison as Revolut is a bank, and can offer more banking features, but we can’t ignore it.

Here’s a very brief summary of other features you get from both companies:

Wise | Revolut | |

|---|---|---|

Interest | Yes on GBP, EUR, and USD | Yes on 25+ currencies |

Exclusive and personalised cards | No | Yes starting from the Plus plan |

Cashback | No | Yes and RevPoints |

Perks and discounts | No | Yes |

Kids account | No | Yes |

eSim data plans | No | Yes |

Airport lounge access | No | Yes |

Multiple insurance covers | No | Yes depending on the plan |

Commodity trading | No | Yes |

Cryptocurrency trading | No | Yes |

Revolut allows you to access extensive account features.

They offer a wide range of other services, including insurance, open banking, and investment opportunities.

They also offer extras for paid premium members through their tiered subscriptions Plus, Premium, Metal, and Ultra. Each comes with monthly fees.

Wise offers the option to ‘turn on interest’, investing your money to earn more.

Aside from this, Wise doesn’t offer any add-on features that can compete with Revolut.

Business accounts

A Wise business account is better than a Revolut business.

Both Wise and Revolut offer personal and business accounts. You can learn more about each in our reviews:

But here’s a quick roundup of each:

Like Wise personal accounts, the Wise business account lets you make international payments in multiple countries at cheaper rates compared to Revolut.

Wise business accounts are also compatible with accounting apps like Xero, QuickBooks, and FreeAgent.

The Revolut business account gives you multi-user access to the company accounts, allows you to track your team’s spending, and manage wider business expenses.

Both personal and business Revolut customers get a tiered subscription offer, starting with a free account under the basic plan, ranging to Grow, Scale, and Enterprise accounts.

Revolut business plan monthly account fees

Customer service and experience

I don’t think Wise or Revolut have good enough customer service to win. There is no winner here.

Wise offers a live chat feature, call center helpline, and email support, while Revolut customers can access the live chat feature, but you’ll need to pay for premium membership to access priority support.

Taking into consideration my own experience with Recolut support, and the experience of users from MoneyTransfers.com with Wise, it is clear that neither of the companies offers good customer support or experience.

Here are a few examples for each company.

Funds sent with Wise were not received

One of our users recently commented that they made a transfer to Canada and money has not been received.

When contacting the support, Wise staff said the money was paid out and has not been able to resolve this issue, and the money has still not been delivered as promised.

They said "Wise must be capable of tracking the funds and providing precise details about where exactly the money is, who received it, and to which bank account it was deposited."

You can read the full comment lower down this page.

Frozen funds on Revolut

A few years back my family member received multiple large payments from the EU to their Revolut account which triggered AML checks and required additional verifications.

After submitting all the required docs, the account (and money) was frozen.

They’ve started a chat with support and it took them over a week to respond, and another 3 weeks of back-and-forth messages to unfreeze the account.

These are just two examples that happened around me, but if you check either of the companies on Reddit, you will see mass issues with support.

Unfortunately, this is the case with 99% of the “online” companies.

Is support your number one priority?

If support is your priority, for example, you’re sending large amounts of money, I suggest you read our guide to currency brokers.

Undoubtedly you will get 100% better support from a broker than from an online-only company like Revolut or Wise.

Ease of use

Wise wins this round simply because they are easier to use when it comes to making money transfers.

With its much simpler product offering, Wise is the easiest app to use. You can see your account balance clearly, split by currency, with your transaction history available in one tap.

The range of extra features available on Revolut, along with the tiered membership system, make it slightly more complicated to navigate - although the update released in November 2023 made the app a lot easier to use.

Below I’ve recorded the process of depositing and making international money transfers on both accounts to see which is easier and quicker:

Revolut doesn’t let screen recording (a plus one for their security and safety), so I had to use a slideshow of screenshots to illustrate the depositing and making transfers.

Depositing money into the account

Wise

First deposit with Wise takes a bit longer than with Revolut, but all further deposits are a breeze.

Revolut

Revolut offers more deposit options than Wise, in this example I've used Apple Pay and was done in 4 clicks.

Making international payments

Wise

Making transfers with Wise is much easier than with Revolut. The process is streamlined and there's no clutter.

Revolut

Revolut prioritizes transfers to other Revolut users, making bank transfers a bit longer and more complicated.

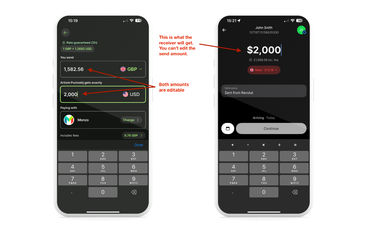

One of the biggest advantages of Wise over Revolut in terms of usability, is that you can control the send and the receive amount. So if you want your recipient to get $2,000 you can write that in.

With Revolut, you can only enter the receiving amount, so if you want to send 2,000 GBP, you’ll need to keep tweaking the receiving amount until it matches 2,000.

Here’s what I mean:

Safety and regulations

Revolut wins this round, although it's a very close one.

Revolut currently holds an Electronic Money (e-money) license in the UK without FSCS protection.

However, their savings accounts are held at partner banks with FSCS protection.

This means if you want to keep large sums of money in Revolut, you can keep them in the savings account and have it protected by FSCS in the UK (up to £85,000 per bank) and FDIC in the US (up to $250,000).

This does not mean Wise or Revolut are not safe.

It means that they have to take different (and extra) steps to ensure the safety of your funds, known as safeguarding.

Both companies are authorized to make financial transactions and are regulated by authorities (you can learn more about regulators in our guide).

Wise is regulated in multiple countries (you can find a list here), while Revolut holds a UK banking license (with restrictions) and is regulated in the EU by the Bank of Lithuania.

Safeguarding vs FSCS protection

Traditional banks often lend money to others, this includes your money as well.

To ensure nothing happens to your money, FSCS protects your funds up to a certain amount (usually £85,000).

Other financial services such as Wise or Revolut, do not lend money, but can’t get the FSCS protection.

Instead, they split your money from their money and never mix, ensuring it’s available when you need it, this is known as safeguarding.

If this is your main concern, consider this:

Use Wise for large transfers as it’s cheaper, but don’t hold large amounts in your account, withdraw it to your bank.

If you need to hold larger amounts, use Revolut savings accounts as they are held in 'real' banks and are covered in the UK.

In either case, I’d recommend not holding large amounts for very long in either of the accounts and withdrawing it to your brick-and-mortar bank. Especially considering the issues with customer experience.

Customer feedback

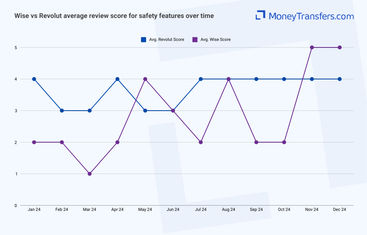

It's very close here, but Revolut sneaks ahead. Revolut's positive feedback is more consistent compared to Wise's.

Both companies have a rating of 4.3/5 on Trustpilot and 4.7 on the App Store, but Wise is slightly ahead on Google Play.

Trustpilot | App Store | Google Play | |

|---|---|---|---|

Wise | 4.3 (240,000 reviews) | 4.7 (80,000 reviews) | 4.6 (1,100,000 reviews) |

Revolut | 4.3 (173,000 reviews) | 4.7 (50,000 reviews) | 4.4 ( 3,000,000+ reviews) |

Here’s how the user feedback has changed over the past months for Revolut vs Wise (switch between tabs for different categories):

We’ve also had a lot of comments coming from our users about both companies:

Wise user feedback

Comments

Russell Pinkes

I can’t send money to Belize

Revolut user feedback

Comments

Anonymous

Family purpose

Alternative to Wise & Revolut

Wise and Revolut aren’t the only well-known online-only banks in the US.

Monzo has partnered with Wise to allow you to make international money transfers affordably.

You can transfer money directly from your Monzo account by choosing ‘Transfer Internationally’.

You’ll then get a full breakdown of the transfer fees.

This makes Monzo the perfect middle ground between Wise and Revolut.

You get the benefit of Wise for international transfers, but keep the banking features similar to Revolut in a fully licensed bank.

You should consider a few other top companies for digital banking and sending money abroad.

I recommend our most popular guides:

These will give you the full picture of how Wise and Revolut compare to their rivals.

Alternatively, here’s a list of full reviews for the top companies similar to Wise and Revolut.

A bit more about Wise and Revolut

Wise vs Revolut for travel, which is better?

Is Revolut cheaper than Wise?

Does Revolut or Wise have better exchange rates?

Are Wise and Revolut cards compatible with Apple Pay and Google Pay?

More comparisons

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources and further reading

Related Content

Contributors

.png)

.png)