Best Ways to Send Money to France from the USA

Compare all the services available to find the fastest and cheapest options to send money from United States to France with the best exchange rates.

Use our in-depth analysis to select a provider to send money to the France. Read our expert reviews to get all the details on fees, rates, and opinions from other users like you.

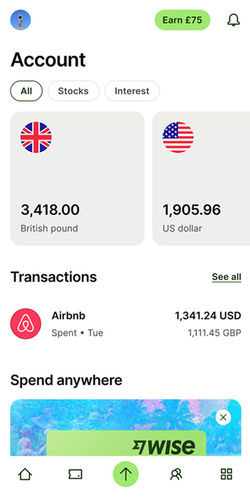

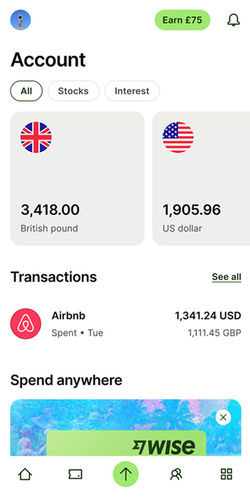

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Currencyflow is a new FX broker with a focus on transparent, fair rates and accessible customer service. Contact the UK-based team for a free quote."

"Currencyflow is a new FX broker with a focus on transparent, fair rates and accessible customer service. Contact the UK-based team for a free quote."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

We recommend Wise for sending money to France

When choosing a method to send money to France, you'll want to consider factors like convenience, cost, and transfer times.

We tested the 15 largest providers and Wise stands out for its mix of cost, speed, and user-friendliness.

These suggestions were created by combining data from thousands of real-life searches conducted by individuals who wanted to send money to France.

About money transfers to France from United States

To ensure you get the best deal for your money transfer from USA to France we've compared 15 providers.

The cheapest way to send money to France: Key Currency

We tested 15 providers and found Key Currency to be the cheapest. Currently Key Currency is 0.01% cheaper than the second-best option.

The $0 transfer cost represents the most common fee for USD to EUR International transfers.

If you want to secure the best rates on a USD to France transfer, make sure you pick Key Currency to send your money online.

*The most common fee applied to USD-EUR by Key Currency.

Of course, we'd recommend you compare to ensure you find the cheapest for your option.

The fastest way to send money to France: Wise

Our data shows that Wise is the fastest way to send money from United States to France, although it's best to check your specific transfer as the speed of a transfer can be impacted by the sending amount.

The 'fastest' way to send money is defined by the overall speed of sending money from United States to France - this includes deposit, transfer and withdrawal timeframes and often differs per currency.

Tips for transfers to France

Most major banks in France will facilitate a money transfer from the United States - but in short, they're more expensive and the transfer will take longer to arrive.

Bank | USD to EUR Rate ($1 = €) | USD to EUR Timeframe | Fees |

|---|---|---|---|

Key Currency | 1 USD = €0.8454 | 0-2 Days | $0 |

Chase Bank | €0.9117 | 7 days | $50 (minimum) |

Bank of America | €0.9129 | 7 days | $50 (minimum) |

Wells Fargo | €0.9058 | 7 days | $30 (minimum) |

Need to send over $10,000 to France?

Opt for a service proven with large transfers when size matters. For transfers over $10,000, your best bet is Wise.

While Wise may not always be the cheapest or fastest way to send USD from United States to France, it’s the provider that will keep you safe and relaxed while your money moves into EUR.

How long do money transfers to France take?

The time it takes to send money to France can be anywhere from minutes to days with a money transfer company, but will likely be at least one week if using a bank directly. The final time will depend on a variety of factors including the provider, the amount, how you're paying, and how the recipient will receive their money in France.

With everything taken into account, the fastest international money transfer provider to France is Wise and transfers are likely completed within 2 days (if under $10000), usually within hours.

Using a combination of searches for transfers between the USA and France here are the average times you can expect from the best money transfer companies vs banks.

Amount Sent | Money Transfer Company | Banks |

|---|---|---|

Up to $5,000 | 2 hours | 7 days |

$10,000 | 1 day | 7-10 days |

$100,000 | 5 days | 14 days + |

International transfer limits through everyday banks like Chase Bank to France have a cut-off time of 4pm EST, otherwise, they won't be processed until the next business day.

You should also be aware that whilst money transfer companies process these payments same day, some countries will have banking institutions that process slower, so you may still see a couple of days at the end of the transfer before the money shows in an account. On the whole, France and USA are relatively well connected with EUR and USD being two of the biggest currencies globally, so payments are generally complete within the day.

We'd recommend searching for the exact amount you want to transfer to ensure you have all the information for your specific USA to France transfer needs.

Calculate Your Exact Fees for Sending Money to France

Ensure your documents are ready

When sending money from the USA to France you will need to provide personal information and proof of who you are. You will also need the details of the recipient (including where you want to send the money).

Contact details: The contact details you will need will include an address and phone number. It's possible to use either a home or mobile number. In most cases we suggest using a mobile number, as many companies will provide access to a money transfer app as well, and will often verify payments or logins through messages.

Photo ID: When sending money from the USA to France, or anywhere else for that matter, the ID that you'll be able to use will include:

Passports

Drivers licenses

Military ID cards

Social security cards.

If you're a French national living in the USA, you can use your French passport, although may need to provide proof of residency such as visa papers. These additional checks may add a little more time to the sign-up process with a provider and may need verification, so if you want to send money quickly be sure to have everything at hand to avoid any delays.

Proof of address: Some providers may ask you to share a utility bill as proof of address.

Tax obligations on money transfers to France

If you are sending more than $10,000 to France, you will have to let the IRS know - even if there is no tax due. Each US resident can make up to $17000 in tax-free transfers per year, although if these transfers are to a French spouse the amount jumps to $175000. A married couple can also merge allowances (upping the basic limit to $34000).

Taxes may be due in France depending on the amount and why the money is being sent

If the money is being sent as a gift from USA To France, and you are related, you can send the amount tax-free - but it will depend on the person you are sending to. For example, a family member with a disability can receive up to €159,325 tax-free, but a great grandchild just €5,310. After these allowances, the amount of tax paid on transfers into France is:

Taxable share after allowance | Tax rate |

|---|---|

Up to €8,072 | 5% |

€8,072 - €12,109 | 10% |

€15,932 - €552,324 | 20% |

€552,325 - €902,838 | 30% |

€902,839 - €1,805,677 | 40% |

Above 1,805,677 | 45% |

VAT and purchases

Any money transferred for purchases will be subject to value-added tax (VAT) in France. The standard VAT rate in France is 20%.

Property purchases

Money transfers for buying property in France will need clearance from customs for proof of funds and will be subject to all of the necessary property taxes in the country at the point of purchase.

For expats in France, there are also ongoing property taxes to be aware of, which while not impacting the immediate transfer of money, will impact your ongoing costs.

Net asset values | Percentage applicable |

|---|---|

Below €800,000 | 0.00% |

Between €800,000 – €1300,000 | 0.50% |

Between €1,300,000 – €2,570,000 | 0.75% |

Between €2,570,000 – €5,000,000 | 1.00% |

Between €5,000,000 – €10,000,000 | 1.25% |

Above €10,000,000 | 1.50% |

When buying a property in France, we'd recommend dealing with an agent who can also provide a breakdown of ongoing costs ahead of any transfers.

Loans and credit

If you are transferring money as part of a loan or credit agreement, we'd recommend dealing with a currency exchange company that can help with the process. Tax on transfers for this use case will depend on interest rates at the time of transfer, expected time to repay, the purpose of the loan, and your relationship with the borrower.

Customs notifications

Any cash transfers from the USA to France that result in over €10,000 being received are subject to customs declarations, this includes multiple smaller transfers that eventually add up to over the amount. Then, any transfers resulting in over €50,000 received in France require proof of origin for the funds.

Amount Sent | French Declaration |

|---|---|

Less than $10000 | Not needed |

More than $10000 (cash) | Needed |

$50000 | Proof of origin of funds |

Both of these need to be declared in ADVANCE of a transfer being made, and not doing so could significantly impact the time it takes to send money between USA and France. Any false declarations or non-disclosure of cash transfers from the USA to France can result in the confiscation of funds or a fine of up to 50% of the amount transferred.

For larger money transfers amounts we would recommend a personal service, like that offered by a currency broker.

United States to France: the mid-market rate

When it comes to calculating the costs of money transfers between United States and France, the mid-market rate paired with fees can make a big difference:

The Mid-Market Rate: Today, the USD-EUR mid-market rate equals to 0.8482. Keep in mind that this rate fluctuates all the time.

The USD-EUR average exchange rate of the past week has been 0.8482, with a highest of 0.8507 and a lowest of 0.8458.

When in doubt, use Wise. On average, Wise hovers just -0.02% above the mid-market rate.

Fees and Markups: That's where Wise shines, combining the best of both worlds: excellent USD to EUR rates that are only -0.02% away from the average.

Stay ahead of the USD to EUR exchange rate

The average exchange rate from USD to EUR has been 0.8482 over the last week.

During this time, the highest value on has been 0.8507, with a low of 0.8458.

Wise has offered the best exchange rate for United States to France in this period.

Want to secure the best USD-Euro exchange rates?

Sign up for our rate alerts to get an insight into the best time to move your money from United States to France!

How to get the best USD to EUR exchange rate

Identifying the best USD to EUR exchange rate can take a bit of work because it involves more than just checking a single number. Currently, 1 USD will buy you 0.84821EUR, but it is subject to constant fluctuations and will vary significantly depending on the money transfer company you use. For example, out of 15 companies offering money transfers to France, Wise appeared 100% of the time in our comparison offering the best USD-EUR rates, only -0.02% away from the average.

To secure the best USD to EUR transfer rate, you should:

Understand how exchange rates work: Current exchange rate for USD-EUR is 0.84821, meaning this is how much Euros you will get for exchanging 1 US Dollar. This rate fluctuates constantly due to factors such as economic indicators, geopolitical events, and market demand.

Keep an eye on the mid-market rate: In the past 7 days, the average exchange rate between USD-EUR was 0.8482, today it's 0.84821. This rate fluctuates by the minute, and major changes can happen without much notice.

Monitor exchange rates: Sign up for our rate alerts service and receive weekly, bi-weekly, or monthly email updates for USD - EUR rates directly to your inbox. Monitoring exchange rate fluctuations allows you to spot trends and get better deals.

| USD | EUR Price |

|---|---|

| 1 USD | 0.85 |

| 5 USD | 4.24 |

| 20 USD | 16.96 |

| 100 USD | 84.82 |

| 1000 USD | 848.19 |

| 10000 USD | 8481.89 |

| EUR | USD Price |

|---|---|

| 1 EUR | 1.18 |

| 5 EUR | 5.89 |

| 20 EUR | 23.58 |

| 100 EUR | 117.90 |

| 1000 EUR | 1178.98 |

| 10000 EUR | 11789.82 |

Payment methods available to fund your United States to France transfer

Bank Transfers

Traditional bank transfers are often the default option for sending money from United States to France.

By using a money transfer company, you can make a bank transfer, funding your Key Currency account, as this offers the best service to send USD to France with this payment method.

Key Currency is the cheapest provider for bank transfers from the 15 we tested when sending USD to France.

With a fee of USD0 to send money from United States to France, Key Currency offers a great combination of competitive exchange rates and lower fees.

Debit and prepaid cards

Sending money from United States to France with a debit or a prepaid card is very simple with Xe.

Xe is a leader in debit card payments for transfers from United States to France, competing among a total of 15 active money transfer companies on this route. They consistently rank at the top in this category.

Credit cards

Credit card deposits are the most expensive option for transfers to France because of cash advance fees and any other credit card provider charges.

We recommend sticking to the bank and debit card deposits when sending money to Colombia.

If you still want to use a CC deposit, we recommend on our site to get the latest EUR transfer deal.

Credit cards often have addition fees: using a credit card to transfer money often results in a fee being charged by your card issuer. That's why we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between France and United States.

Our comparison engine and algorithms evaluate providers based on over 25 factors.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from United States to France .

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send USD to EUR.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from United States

Send money to France

Contributors

.svg)