First EUR or GBP transfer is free

.svg)

This applies to all first time transfers from the UK, Germany, Ireland, and Italy.

.svg)

Is Aspora right for you?

Aspora is the uprising company for money transfers to India, with no exchange rate markup and extremely low fees.

Aspora is good if… | Find an alternative if… |

|---|---|

|

|

Scoring Aspora

The key areas of our Aspora review are focused on the fees & exchange rates, transfers limits & speed, product offering, ease of use, safety and customer feedback.

Below is a quick summary of Aspora. Each area is covered in more detail below.

Exchange rates & fees

Aspora offers extremely low fees, often capped at just 3 GBP/EUR/USD, and uses the real mid-market exchange rate (the “Live Google rate”), similar to Wise.

While you won’t always get the absolute best deal on every transfer, fees are minimal—especially on your first transfer, which is often free.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with Aspora, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

Aspora fees and exchange rates

Fees and rates

Exchange rates

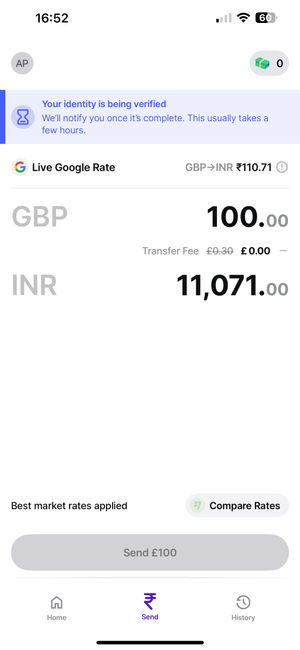

Aspora (previously Vance) uses a mid-market rate (they call it the Live Google rate) to transfer money from your country to India. This is similar to Wise, just on a smaller scale.

This simply means that whatever rate you see on Google or other exchange rate websites is what you will get.

In the past month, this was the average exchange rate:

Currency Pair | Mid-Market Rate |

|---|---|

AED/INR | 24.8839 / INR |

EUR/INR | 107.408 / INR |

GBP/INR | 122.6962 / INR |

Is this the best deal you will get on transfers to India?

Almost, but not always.

Some money transfer companies will give you better than the mid-market rate deals on your first transfer.

This is why it’s important to compare to see how much INR your recipient will get in the end.

International transfer fees

The fees charged by Aspora are more than competitive, ranging between 0.003% and 0.2% depending on the amount and your country.

The more you send, the cheaper it will be.

I’ve looked at a few examples, and it looks like all their fees are also capped at 3 USD/GBP/EUR.

Here’s an example of what GBP to INR fees look like:

Currency | Amount | Fee | Fee % |

|---|---|---|---|

GBP | 5.00 GBP | £0.01 | 0.20% |

GBP | 10.00 GBP | £0.03 | 0.30% |

GBP | 100.00 GBP | £0.30 | 0.30% |

GBP | 1,000.00 GBP | £3.00 | 0.30% |

GBP | 100,000.00 GBP | £3.00 | 0.003% |

AED | 4,687.87 AED | 0 AED | 0.00% |

EUR | 1,000 EUR | 3.00 EUR | 0.3% |

In addition, the first transfer from EUR and GBP to INR has no fees.

To put these numbers into perspective, let’s imagine you’re sending money from the countries below to India using a bank transfer, this is how much INR your recipient will get:

From | Amount | Aspora | Wise |

|---|---|---|---|

1000 GBP | 110,680.00 | 110,045.37 | |

3700 AED | 87,357.00 | 86,489.84 | |

1000 EUR | 95,780.00 | 95,114.70 |

*Rates taken on 09/04/2025 and includes the first free transfer offer.

Transfer speed

Transfer speed

There’s not much information on the transfer speed, and my account is now locked to the GBP transfers.

However, looking at other user reviews, some find speeds to be extremely fast while others say their transactions are being delayed.

Also, it is known that bank transfers can take between 3-10 days to process in many cases so its safe to assume that Aspora transfer speeds are on par with other money transfer companies.

What’s interesting is that T&Cs on Aspora mention the use of stablecoins for some transactions. This implies that some transfers can be quicker than traditional transfers to bank accounts in India.

Transfer limits

Transfer limits

Aspora has minimum and maximum transfer limits:

Min. Transfer | Max. Transfer |

|---|---|

5.00 GBP | 400,000 GBP |

5.00 EUR | 30,000 EUR |

- | 150,000 AED |

This is lower than similar companies such as Wise or XE, where the transfer limits go into the millions.

If you’re looking to send large amounts of INR in one go, we recommend finding an alternative.

Compare transfer options to India

Product offering

Product offering

All Aspora money transfers are done through their app, unlike with similar companies like Ria Money Transfers, where you can transfer online, in-app, or in the store.

Supported currencies & destinations

Currently, Aspora only supports transfers to India from:

And is planning to expand its offering soon to the following countries:

If you’re located in any of the countries currently not supported by Aspora, use our form below to quickly find the best company for your transfers to India.

Compare money transfer companies

Payment methods

Aspora offers a few deposit options, including:

Debit cards

Apple Pay

Bank transfers in the UK and the UAE

Ease of use

Usability

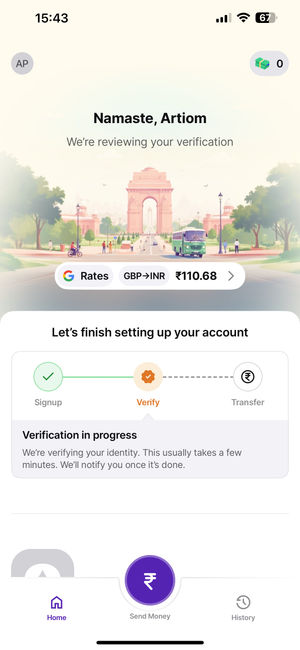

The app is extremely easy to use and navigate, mainly due to it only offering money transfer services to India. Here are the key features you will find inside the app:

Home

Here you will find the rate for your currency to INR. Not much to this; in a way, it currently looks and feels a bit too empty.

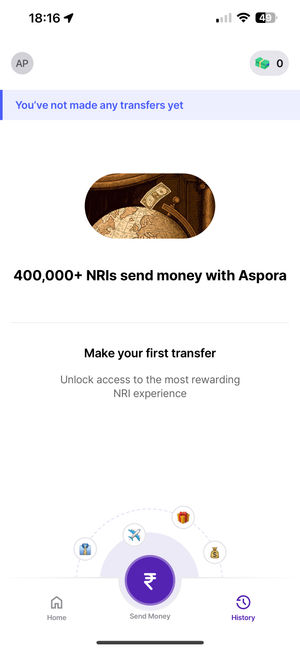

Send Money

This is where you initiate the transfer. Very simple and straightforward process.

History

This is where your transfers will appear, along with the statuses.

One very frustrating thing I came across is not being able to change your home currency.

This might not be a big deal if you’re always sending money from your local account, but it can be a problem if you have a different account or hold different currencies.

For example, I have EUR and GBP accounts that I want to use to make a transfer, but I am locked to only using GBP.

Customer service

You can contact Aspora through the in-app live chat as well as by sending them an email at help@aspora.com.

I’ve looked at the other reviews online and found that Aspora is getting a couple of recent reviews for its poor customer service. Especially regarding how long the replies take and how difficult it can be to resolve simple issues.

Unfortunately, this is fairly common for online money transfer companies. If you look at our Wise review or Revolut review, you will find the same problem.

In case you are sending a large amount and need to ensure you have a real human ready to talk whenever you need, we recommend looking into currency brokers.

Safety and trust

Safety features

Aspora operates legally across multiple jurisdictions under fully licensed and regulated entities.

It is compliant with financial regulations in:

The UK

Canada

Lithuania

UAE

Through locally incorporated companies or authorized partners.

Each entity is overseen by the relevant financial authority, ensuring regulatory protection for users throughout the payment process.

Here’s a table summarising the entities and who regulates them.

Jurisdiction | Entity Name | Regulator | License Type | Registration / License Number |

|---|---|---|---|---|

United Kingdom | Real Transfer Limited | Financial Conduct Authority (FCA) | Authorised Payment Institution | FRN 535949 |

Canada | Nesse Technologies Inc | FINTRAC | Money Service Business (MSB) | M23142925 |

Lithuania | Vance Techlabs UAB | Lithuanian Financial Crime Investigation Service (FCIS) | Virtual Asset Service Provider (VASP) | 306897823 (Legal Entity Code) |

United Arab Emirates | Lulu International Exchange LLC (partner) | Central Bank of UAE | Authorized Money Transfer Provider | — |

Customer feedback

User feedback

As it stands, there are only 45 reviews on Trustpilot, 3500 reviews on the App Store, and 5820 reviews on the Google Play store.

On Trustpilot, 86% of reviews are 5 stars, with many users commenting on the ease of use, low fees, and good transfer speed. On the negative side, many complain about slow customer service and delays in transfers (a bit contradicting).

On the App Store, they have a 4.2 / 5 rating, and on Google Play, it’s 4.6 / 5. Both have similar reviews to Trustpilot, where users love the service for its fees, ease of use, and simplicity, while others complain about the delays in response times.

Opening an account with Aspora

To open an account with Aspora, you will need the following:

Your basic details (Full name, address, etc)

Government ID for KYC

Apora app, as you can’t sign up through the website

Once you have these, the process is very straightforward. Simply open the app and follow the online prompts.

I’ve signed up, and it took me under 5 minutes.

However, the KYC process is taking much longer than usual. Meaning if you need to send money urgently, it might not be the best option.

Making international transfers

Similarly, the transfer process is straightforward once your account is verified:

Click the Send Money button

Add how much you want to send

Fill in the payment details

Fill in the recipient's details

Make your transfer

Canceling transfer

In theory, you can cancel the transfer by contacting Aspora through the live chat. However, most transfers are so fast that you won’t have time to reach the support and cancel it.

So make sure all the details are correct before you make the transfer.

Receive international transfers

The recipient will receive the transfer directly into their bank without them needing to do anything.

This also means that the recipient doesn’t need to have the app to receive the transfer.

How Aspora compares to other transfer services

Other Alternatives

Another alternative to money transfer apps is to use a challenger bank (also known as neo banks). These give you the benefit of a multi-currency account and banks in one app.

Aspora: Is it good for transfers abroad?

Aspora is great for making transfers to India.

That is… only if you live in the UK, UAE, Ireland, Germany, or Italy (at the moment) and are planning to make fairly small transfers as there are still issues with their support team being slow and unresponsive.

But otherwise, it is a great service with no exchange rate markup, extremely low fees, and fast transfer times.

We still recommend comparing your options, as some companies will give you a better-than-mid-market rate deal on your first transfer.

Find the best rates for your transfer

A bit more about Aspora

What is Vance?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services

Aspora user feedback

Comments

Rahul

I liked it, fast and few min to get the transfer done, app is also nice got a $25 bonus

Sudhakar

My experience is very nice. It is very quick and gives the updates while the transfer in progress. In a few min the transfer is done. I have done multiple transfers and did not face any issues.

Anonymous

Best rates, reliable, and great customer support. Really great experience sending money to my parents back in India.

Anonymous

This is a really good app, the only app that actually provides live google rates. Moreover the first transfer is free and you also get a 20 pound cashback on your first transfer.

Lavisha Moolchandani

My funds took lot of time to credit in bank account. The team doesn't address issue urgently. Very disappointed as this happened multiple times.

.svg)

.svg)