Chase for international wire transfers

Here’s a quick overview of Chase and how it compares to an average money transfer provider.

Transfer type | Chase | Money Transfer Companies |

|---|---|---|

Sending fees | $40 - $50 | $0 - $20 |

Receiving fees | $0 - $15 | $0 |

Exchange Markup | 2% - 7% | 0% - 2% |

Transfer Times | 3 - 5 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Chase

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Whilst we think Chase is a great bank and a viable option to be used as a personal account, it doesn't offer the best options for international money transfers. For lower value transactions the $50 fee is much larger than any money transfer provider - many of these will have fees starting at $0. For larger transactions, the exchange rate offered by most banks (Chase included) does not stack up against a money transfer provider.

For example, a $10000 money transfer to Germany through XE, will have no fees and an exchange rate of 0.92 - meaning the recipient would receive €9297 in around 1-2 hours, with the average Chase Bank exchange rate of 5% - the recipient would receive €8839 in 3-5 business days.Mehdi Punjwani

Chase fees and exchange rates

Fees and rates

US banks typically charge high fees and apply margins on the exchange rates. Cumulatively, these charges form the bulk of international transfer costs.

Exchange rates

Chase Bank buys and sells foreign currency at the mid-market exchange rate in the foreign exchange market, which is the exchange rate you’ll find on any given day via Google or our currency converter.

However, like most banks, Chase sells foreign currency to customers with a margin added to the exchange rate.

This means that when sending money abroad, you are unlikely to get the same exchange rate you find online.

Chase Bank states that its foreign exchange rates are determined by their “sole discretion” and that Chase Bank exchange rates “will include a spread and may include commissions or other costs that we, our affiliates or our vendors may charge”.

Upon further research and analysis, we’ve found Chase Bank to apply margins of 2%-7% to the exchange rates depending on the currency.

This means that you will be charged 2% - 7% on top of the real mid-market rate.

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

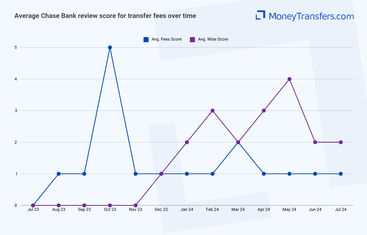

We’ve taken a look at what other users have to say when it comes to the exchange rates. Here’s how users rated Chase’s exchange rates online.

International transfer fees

Here’s a breakdown of Chase Bank international wire transfer fees.

Wire Transfer Type | Fees | Description |

|---|---|---|

Domestic and International Incoming Wire |

| A wire transfer is deposited into your Chase account |

Domestic Wire | $35 per transfer | A banker helps you send a wire to a bank account within the U.S. |

Online Domestic Wire | $25 per transfer | You use chase.com or Chase Mobile to send a wire from your account to a bank account within the U.S. |

Consumer USD/FX International Wire | $50 per transfer | A banker helps you send a wire to a bank account outside the U.S. in either U.S. dollars (USD) or foreign currency (FX) |

Consumer Online USD International Wire | $40 per transfer | You use chase.com or Chase Mobile to send a wire from your account to a bank account outside the U.S. in U.S. dollars (USD) |

Consumer Online FX International Wire |

| You use chase.com or Chase Mobile to send a wire from your account to a bank account outside the U.S. in foreign currency (FX) |

This may not look like much, but it quickly adds up with large amounts and frequencies.

We’ve compared Chase Bank's international transfer fees against money transfer providers.

Assuming you want to send $1000 to a bank account in the following counties, here’s what you’d pay in fees.

Destination | Chase Bank | Wise Transfer |

|---|---|---|

$40 + ~5.5% markup | $10.79 + 0% markup | |

$40 + ~5.5% markup | $10.64 + 0% markup | |

$40 + ~5.5% markup | $10.36 + 0% markup |

Similarly to exchange rates, we’ve looked at how users rated Chase’s international transfer fees.

Transfer speed

Transfer speed

Chase will provide you with a date when your funds will be available to your recipient when sending an international transfer from a personal account.

As a rough guide, international wire transfers are typically made available to the receiving bank account within 3 - 5 business days.

Wire Transfer Type | Transfer Time |

|---|---|

International Incoming Money Transfer | 3-5 business days |

International Wire Transfer: In Branch | 3-5 business days |

International Wire Transfer (sent and received in USD) | 3-5 business days |

International WireTransfer (sent in USD received in foreign currency) | 3-5 business days |

When it comes to speed, here’s how online users rated Chase Bank online.

Transfer limits

Transfer limits

Chase Bank is not very transparent about its transfer limits, especially when compared to similar banks such as Bank of America.

However, this is what it looks like in general.

Transfer Type | Limit |

|---|---|

Wire Transfers (Daily) | $250,000 or available balance (business customers may request higher limits) |

ACH Transfers (Daily) | $25,000 (Standard), $100,000 (Chase Private Client and Chase Sapphire Banking) |

Zelle Transfers (Domestic, within the Chase app) | $500 to $10,000 per day (based on recipient and other factors) |

Zelle Business Transfer | $7,500 per day |

Private Banking Account Transfers | $5,000 per transaction, $40,000 per calendar month |

Money Orders | $1,000 |

Checks | $2,000 to $100,000 per day, $5,000 to $500,000 over 30 days |

The maximum daily limit on wire transfers with Chase is $250,000 or whatever your available balance is, although business customers can request a higher limit than this.

Most ACH transfers are capped at $25,000 per day, however, Chase Private Client and Chase Sapphire Banking limits are $100,000 per day.

If you are transferring money domestically within the US using Zelle within the Chase app, you can send between $500 and $10,000 depending on the recipient and other factors (with business transfers capped at $7,500).

Chase Bank automatically determines the limits and puts them into tiers like so:

Tier 0: $500 per day

Tier 1: $2,000 per day

Tier 2: $5,000 per day

Tier 3: $10,000 per day

Private Banking accounts can send up to $5,000 in a single transaction per day, and up to $40,000 in a calendar month.

The average rating of the online reviews looks like this in terms of Chase Bank’s transfer limits.

Product offering

Product offering

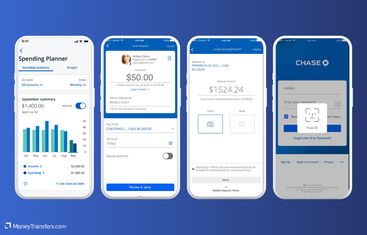

Mobile app

Chase Bank has a free app that is available on both Android and iOS. The app provides secure account access from anywhere in the world, allowing you to manage your money, set up payments and transfers, and freeze your card or transactions if you lose your card.

Foreign currency exchange

Chase Bank offers foreign currency exchange services for over 70 currencies to all its customers.

To exchange foreign currencies, you will need to have an active Chase Bank account in good standing.

Fees for foreign currencies depend on multiple factors and are only available through your local branch. This means you will need to contact them directly to get your specific exchange rates.

Chase Connect Global Transfers

Chase Connect Global Transfer enables businesses to send international wire transfers in over 140 currencies to more than 90 countries.

The platform offers real-time exchange rates, dual approval for security, and detailed payment tracking.

Fees vary by currency and country, with potential additional charges from intermediary banks.

Transfers must meet specific limits based on account settings and can be processed same day if submitted within cutoff times.

Chase Connect Global Transfers also supports scheduled and recurring payments, with funds debited directly from a linked Chase account.

Similar to other parts of this review, we’ve looked at what users had to say about Chase Bank’s product offering. Here’s how the average reviews look compared to Wise (a money transfer provider).

Ease of use

Ease of use

Any bank must be easy and convenient to use. We’ve had a look at what users are saying online and put it on the graph below.

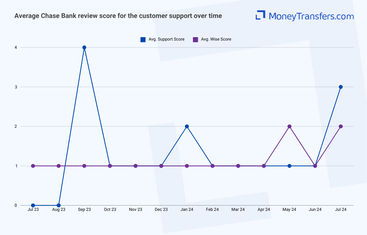

Customer service

Chase offers multiple support options. Here’s a breakdown of the main options you have:

Phone support: Call Chase customer service at 1-800-935-9935 for general inquiries and account assistance. For specific services like credit card issues, call 1-800-432-3117 for credit cards.

Online chat: Available through the Chase website or mobile app, online chat provides real-time assistance for banking questions and account issues.

Secure messaging: Log in to your Chase account and use the secure messaging feature to send and receive messages regarding your account or other inquiries.

Branch visits: Visit any Chase branch for in-person assistance with account management, loan inquiries, or other banking services.

ATM support: Chase ATMs offer assistance for transaction issues and provide contact information if further help is needed.

Social media: Chase provides support through their official social media channels like Twitter (@ChaseSupport) and Facebook, where you can get responses to general inquiries.

Email support: While Chase does not typically offer direct email support, you can use the secure messaging feature on their website for inquiries.

Dispute resolution: For issues related to disputes or fraud, contact Chase at the specific number provided for disputes, usually found on their website.

Accessibility support: Chase offers specialized assistance for customers with disabilities through their dedicated phone line and services tailored to meet accessibility needs.

Investment services support: For support related to investment accounts, call 1-800-392-5749 or visit a Chase branch that handles investment services.

If you need assistance with your transfer or have any issues, use the following details to contact Chase Bank.

Support Option | Contact Details |

|---|---|

Phone Support | 1-800-935-9935 (General Inquiries) |

Credit Card Support | 1-800-432-3117 |

Online Chat | Available via the Chase website or mobile app |

Secure Messaging | Through Chase account login |

Branch Visits | Find the nearest branch via the Chase website or app |

ATM Support | Contact information available on Chase ATMs |

Social Media | Twitter: @ChaseSupport, Facebook: Chase |

Email Support | Not directly available; use secure messaging |

Dispute Resolution | Specific number for disputes (check Chase website) |

Accessibility Support | Dedicated phone line (check Chase website) |

Investment Services Support | 1-800-392-5749 |

We’ve also looked at the online reviews for Chase Bank’s security features. Here’s what it looks like when you average out the ratings.

Safety and trust

Safety and trust

Being one of the biggest high street banks, Chase has multiple layers of safety and security features. Below is a quick overview of key safety features.

Multi-factor authentication (MFA): Requires multiple forms of verification for accessing accounts online and via mobile.

Encryption: Uses advanced encryption techniques to protect sensitive customer data during transactions.

Biometric authentication: Supports fingerprint and facial recognition for mobile app access.

Card controls: Allows customers to manage their debit and credit cards, including locking and unlocking.

Identity theft protection: Offers services to help detect and resolve identity theft issues.

Online security center: Provides resources and tips for protecting personal and financial information.

EMV chip technology: Issues cards with EMV chip technology for enhanced security during transactions.

Transaction monitoring: Regularly monitors and analyzes transactions for unusual activity and potential fraud.

Mobile banking security: Implements strong security measures for mobile banking, including app-specific protections.

Password protection: Enforces strong password policies and regular updates to enhance security.

Real-time fraud alerts: Sends real-time alerts to customers in case of suspected fraudulent activities.

Secure payment solutions: Provides secure payment solutions such as tokenization and secure payment gateways.

Zero liability protection: Offers zero liability protection on unauthorized transactions on debit and credit cards.

Chase QuickPay® with Zelle® security: Ensures secure transactions through Chase QuickPay® with Zelle®.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

Customers particularly like the excellent customer service and easy-to-use app provided by Chase Bank.

Many find the bank’s high-interest savings accounts and efficient dispute processes beneficial.

The ability to chat with a person quickly through the app is also praised, and some users value the bank’s responsiveness to feedback.

Many mention the early release of funds from direct deposits.

On the downside, some users report frustrations with Chase’s small business services and online banking platform, which they find cluttered with advertisements.

There are complaints about long holds on cashier's checks, which are seen as a violation of regulations.

The mortgage process is also criticized for being cumbersome, with some users feeling misled about closing cost offers.

Finally, customers have experienced difficulties accessing statements and navigating the app, leading to considerations of switching banks.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 0 | 1 | 1 | 0 | 1 | 2 | 1 |

Fees | 1 | 1 | 2 | 1 | 1 | 1 | 1 |

Exchange Rates | 0 | 0 | 1 | 1 | 1 | 1 | 1 |

Speed | 4 | 1 | 1 | 0 | 0 | 0 | 0 |

Limit | 1 | 1 | 2 | 1 | 1 | 1 | 1 |

Features | 3 | 2 | 1 | 2 | 1 | 1 | 1 |

Ease of Use | 0 | 4 | 2 | 0 | 0 | 0 | 3 |

Safety | 0 | 1 | 1 | 1 | 1 | 1 | 1 |

Customer Support | 2 | 1 | 1 | 1 | 1 | 1 | 3 |

Opening an account

To open a bank account with Chase Bank, make sure you’ve got the necessary information to hand first. This includes:

Your social security number

Driver’s license or state-issued ID

Contact information (name, address, email, phone number, DOB)

Once you have all the details ready, you can either choose to apply for a new account online or visit a local branch.

Follow these steps to open an account with Chase Bank.

Choose the type of account

Gather required documents

Visit the Chase website or branch

Complete the application

Fund your account

Review and submit

Verify your identity

Set up online banking

Receive your account details

Start using your account

Making international transfers

International transfer requirements & details

Once you have the account ready you can make a transfer. For international transfers you will need to have the following information ready:

Recipient’s Full Name

Recipient’s Address

Recipient’s Bank Name and Address

Recipient’s Bank SWIFT/BIC Code

Amount to be Transferred

Your Citibank Account Details

Transfer Purpose (if applicable)

Chase Bank’s swift code is CHASUS33.

Making wire transfers

Once you have all the details ready, follow these steps to send money abroad.

Login to Citibank online banking

Navigate to the transfer section

Select 'International transfer'

Enter recipient details

Provide your bank account details

Enter transfer amount

Review exchange rates and fees

Verify and confirm the transfer

Receive confirmation

Prefer a video? No worries, here's a video on how to make a wire transfer from Chase:

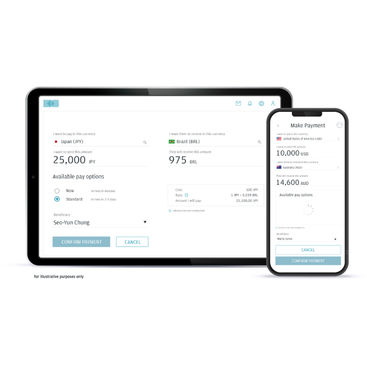

Use Wise to send money from your Chase account

It may be simpler to fund your transfer with your Chase account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Chase account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

You’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 021000021.

For international wire transfers, you’ll need to supply your SWIFT code or BIC: CHASUS33.

The bank name and address

Chase Bank’s address for wire transfer is 383 Madison Avenue, New York, US.

Your account number, name, and address

You’ll need to supply your complete Chase account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Chase compares to money transfer services

Chase Bank is a great bank for daily finance management, but if you want to make transfers abroad, we’d recommend looking for a better alternative.

Transfer services like Wise are around 16% cheaper than Chase, and they’re very easy to use.

Here’s an overview of the top alternatives:

If you’re a Chase Bank account holder, you can save money on your international transfers by using these alternatives.

Don’t worry, all of them can be funded from your Chase account.

Xe Money Transfer provides some of the best FX rates in the industry.

They match the mid-market rate for most currency pairs and you can check the live rates on the homepage.

Their fees are lower than what you get charged at Chase Bank for international transfers.

Xe offers transfers to over 170 countries and in 65 currencies. This is enough flexibility to meet the needs of most international money transfer customers.

Wise is a FCA-regulated company that has an excellent reputation. Transparency and low fees are the pillars on which they built the brand.

They offer no markup on international transfers (compared to 2% - 7% added by Chase) and they charge around 0.35% fee on every transfer (vs $50 by Chase).

Wise supports over 50 currencies and offers a multi-currency account.

Their payment and cash-out options make Wise an accessible platform for most users.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Chase: Is it good for transfers abroad?

Overall, Chase Bank is a secure and reliable financial institution for managing your money.

As one of the largest banks in the US, you can be sure you’re dealing with a trusted provider who will safely help you transfer your money wherever you need it to go.

However, for sending money internationally, you will almost definitely find a better deal with a specialist money transfer provider.

Use our comparison form below to get the best transfer rates for your needs.

Find the best rates for your transfer

A bit more about Chase

Can I open a Chase Bank account in any country?

Can I use Chase UK for international transfers?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks