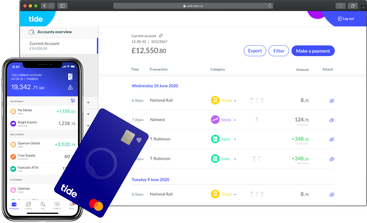

Tide focuses on building modern business accounts for the self-employed. It offers e-money accounts in partnership with PrePay Solutions (PPS) and business bank accounts in partnership with ClearBank.

Although Tide distinguishes itself from a bank, it is regulated by the Financial Conduct Authority (FCA).

It currently caters to more than 300,000 businesses.

Scoring Tide

Many people find their experience with Tide to be pleasing, as proven by its 4.1 ratings out of the maximum score of 5, based on Trustpilot reviews.

Using our scoring system, we're putting it to test. We've looked at their transfer fees and rates, limits and speed, user feedback, as well as features. Here's how it looks overall.

Pros

Cons

We've also looked at the online user reviews for Tide to see how users are rating international transfers.

Tide fees and exchange rates

Fees & rates

Tide uses GBP as its base currency due to its customer base.

It partners with Xignite to determine exchange rates. However, they do not display their exchange rates on their website.

Here's how users rated Tide's exchange rates since last year.

Transfer Rates

Tide charges a transfer rate of 0.50% of the total transaction amount. It provides a breakdown of international bank transfer fees before the transfer is done.

How Do Tide Transfer Fees Compare to Using a Money Transfer Provider?

Wise remains to be the top choice for sending payments or deposits abroad.

They consider the total amount sent, a flat fee, and the current money exchange rate for the breakdown of fees.

Additional Costs

Tide accommodates two types of transfers, which calls for two different additional costs.

For SEPA transfers: Tide adds 0.70 EUR to the total transaction

For SWIFT transfers: Tide adds 5 GBP to the total transaction. SWIFT transfers may automatically convert currencies depending on the recipient account. In that case, an equivalent of the 5 GBP in that currency gets deducted from the transfer amount.

Some recipient banks or other third parties may charge additional fees beyond the transfer.

Tide clarifies that it has no control nor visibility over those fees, so it cannot inform you before a transfer is made.

Here's how users rated Tide's fees since last year.

Transfer speed

Transfer speed

It uses Faster Payments services to accommodate payment services needs.

Although a successful transaction with this service should arrive in minutes, some payee banks may take two to four hours to process the transaction.

If the payment does not arrive after four hours, Tide suggests contacting its customer support.

Here's how users rated Tide's transfer speed since last year.

Transfer limits

Transfer limits

For a single inbound or outbound transaction, a 50,000 GBP limit is imposed. A 100,000 GBP monthly limit maximum is set for monthly outbound transfers.

If you need to exceed the said limits, you must contact Tide's Member Support team via the in-app chat for further instructions.

Product offering

Product offering

Here's how users rated Tide's features since last year.

Ease of use

Ease of use

Here's how users rated Tide's ease of use since last year.

Customer service

There are three customer support options available, all of which are available 24/7.

In-app Messaging – The support icon found at the bottom of the Tide app enables you to reach Tide directly by sending a new message. From there, the Tide Member Support team can be reached.

Email – Through hello@tide.co

Online feedback form – The form contains three required fields that will let you reach Tide remotely.

Here's how customers rated customer support features online.

Safety and trust

Security & trust

Here's how users rated Tide's security features since last year.

Customer feedback

User feedback

ANALYSIS OF USER REVIEWS

The online reviews for Tide Bank are mixed, with users frequently highlighting both the positives and negatives of the service.

On the positive, many appreciate the ease of use, the straightforward account setup, and the helpful app, which is particularly beneficial for business banking. Users also like the helpfulness of the customer service and the efficiency of the app in managing their banking needs.

However, there are specific issues that users have raised. Some customers experienced errors and confusion during the account setup process. Others have pointed out the lack of direct contact numbers for customer support, describing the service as "totally rubbish" in some cases.

Here's how Tide is rated online on average.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

Ease of Use | 2 | 1 | 2 | 1 | 3 | 3 | 0 |

Exchange Rates | 2 | 3 | 1 | 3 | 1 | 0 | 0 |

Features | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Fees | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

International Transfers | 5 | 5 | 5 | 5 | 5 | 5 | 0 |

Limit | 0 | 0 | 5 | 5 | 5 | 5 | 5 |

Safety | 2 | 2 | 2 | 2 | 4 | 1 | 0 |

Speed | 0 | 0 | 0 | 0 | 3 | 3 | 4 |

*0s represent no reviews for the given month.

How to sign up for Tide

Download the app

Navigate to the App Store or Google Store and search for the Tide app.

Once you find it, download the app.

Add and confirm your details

Open the app, and follow the prompts to sign up and fill in your details.

You might be required to submit a government-issued ID to confirm your identity.

Start sending

That's it! Once your account gets verified, you will be able to send and receive money (domestically or internationally).

International transfer requirements & details

To make an international transfer with Tide, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with Tide and their app.

Tide's SWIFT code is TIPLGB22.

Tide alternatives

Tide - A bank for self-employed

Tide is a UK-based business financial platform and was founded in 2015 with the vision of easing the minds of small businesses when it comes to monetary tracking and expenditures.

It has expanded its services to thousands of business owners and freelancers in a mere six years, resulting from its well-organized and user-friendly app, member perks, and straightforward pricing plans.

Your money is protected with FSCS for your issued invoices made through the app and up to £85,000 worth of deposits.

Despite the drastic effects of COVID-19, Tide has been well-equipped to adapt to the post-pandemic world with its Mastercard-powered contactless business card.

A bit more about Tide

Can I use tide for international bank transfers?

Can I use a tide debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks