The Best Multi-currency Business Accounts

The multi-currency account market is growing steadily. Businesses operating in multiple locations, with remote staff and an international client base can take advantage of competitive exchange rates and integrate international finance into accounting apps.

The best option on the market is Airwallex, but each business has different needs. We've highlighted each of these in detail.

Airwallex is our top rated multi-currency business account, offering access to 12 local accounts across 40 countries. Transfers start from 0.5%.

Multi-currency accounts for businesses enable holding and managing multiple currencies and low conversion fees. Account providers include Airwallex (12 local accounts), Wise Business (10 local accounts), Payoneer (9 accounts), and OFX (7 local accounts). Each offers unique features such as batch payments, accounting software integrations, and varying fees.

Using a traditional bank account for international finance is costly due to poor exchange rates and high fees.

At one end, this is simply more expensive. At the far end it creates unnecessary foreign exchange risk.

A multi-currency account allows businesses to hold and manage international currency in local accounts. They also allow businesses to carry out transactions from one account.

These accounts are beneficial for businesses looking to reduce the amount spent on conversion. They can also deal with expense management and batch payments to staff or suppliers.

Best multi-currency business accounts

The best multi-currency accounts for businesses at the moment are:

Features to consider

Users of accounts should note that there is a difference between a local account, where you will get account details, and one account that gives you access to currencies. On the surface they do largely serve the same purpose, but there could be a difference in cost or limits on an account to be aware of.

To give a full breakdown of how accounts are chosen, we have rated them based on how each of the features in a multi-currency account performs:

Local accounts and currencies supported

This includes local accounts, but also how many currencies you can send to. This also includes how many currencies you can receive from.

We rate each provider that offers more access to local bank accounts higher.

Local accounts include those where you get account details, not just access to the currency.

Integrations

How the service integrates with other accounting software is important. Accounts often can integrate with services like Xero or Sage, but not all do. If this feature is a must it is good to understand up front.

Accounting

Xero, Sage, QuickBooks, Microsoft Dynamics 365

Marketplace support

Website CMS

Monthly fees, exchange rates and other fees

Multi-currency business accounts often have complex fee structures. This ranges from fees for transfers to different costs for additional services.

Any cost has been measured against mid-market rates and the cost of sending/receiving money.

ATM and account use

Businesses will often have people on the move, and with different countries, customs and payment types - may need access to cash from time to time.

As part of how accounts are ranked, we have also considered ATM access and limits.

For the most part, these come at a slightly increased cost - in some cases charges in excess of 3.5% for withdrawing money. So, it pays to understand the differences in cost associated with accessing an ATM through a business account.

Customer reviews

One of the bigger factors in choosing a business product is - does it work for my business, and can I see a case study?

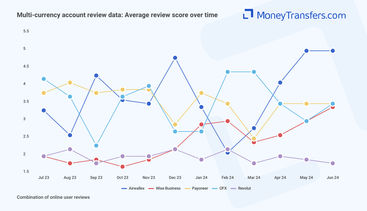

The biggest area where this can be utilised is customer reviews. We have crunched numbers on all of them, specific to business account needs, to give an overview of who is best.

Here is how each of the accounts listed has reviewed on average, over the last 12 months.

*Sokin and Multipass have been omitted from the graph due to a lack of customer reviews

Best accounts in detail

Airwallex is a top choice for businesses as it offers a multi-currency business account with 14 local accounts. More than any other provider on the market.

When testing we found that the rating for its business offering has been steadily increasing over the last 18 months.

Overall, Airwallex offering is wide-ranging and well-rounded. The coverage is strong and exchange rates on transfers (at 0.5%) are competitive.

Pros

Cons

Local accounts offered

The Wise business account offers access to 10 local currency accounts, integration with various account softwares and the best cost of transferring on the market. This cost of sending money through the Wise Business account is conversions at the mid-market rate, plus a 0.33% fee on transactions.

Where the offering is lacking slightly is on support, it is pretty much an online only platform.

There’s also no card support as standard, so for ecommerce businesses it results in a slightly weaker option.

Something to note, cards are not currently being issued in the US. There is currently no confirmation from Wise on when these will become available again.

Pros

Cons

Local accounts offered

Payoneer is a multi-currency business offering that provides access to 9 local accounts in total, has some nice integrations with things like Upwork for freelancers and is great for growing businesses.

It is third on our list overall because it does not offer guaranteed rates or forward contracts like Airwallex and Wise Business.

Also, card payments are limited to USD, GBP, EUR and CAD. Outside of these currencies a 3.5% fee will be added on top of spending.

Depending on where businesses spend, this cost could change the value of the account considerably.

Pros

Cons

Local accounts offered

OFX Business offers 7 local accounts. These are across the core markets like USA, Canada, Europe and the United Kingdom.

OFX is lower down our list than Airwallex and Wise Business because it does not offer such a wide-range of products and services, although its multi-currency account option is strong.

The account comes with the ability to pay suppliers and staff, with batch payments being limited to 500 per transaction. This compares to the 1,000 widely seen and the 5,000 offered by Sokin.

The account has a Xero and Amazon marketplace integration as standard, as well as API support.

Pros

Cons

Local accounts offered

Sokin is a relatively new option to the business multi-currency account space and offers 4 local currency accounts and access to IBANs in multiple currencies. Whilst it does come with limitations, it’s an option for businesses with regular payments in mind.

The account allows you to make up to 5,000 batch payments, making it the best option for mass business transfers. It also offers a 1.2% transaction fee on incoming international card payments, compared to the likes of Airwallex where this amount is 4.8%.

Pros

Cons

Local accounts offered

Revolut Business offers access to GBP and USD local accounts, and payments too and from around 40 more countries.

The account is convenient in places, but comes with a monthly fee (which others do not) and transfers at the mid-market rate are capped at $1,000 on the basic account and $10,000 on the Grow account.

This being said, the ability to send and receive money is easy to use and the account offers a huge amount of card support options. Up to 200 virtual cards per account can be issued. These can be used for spending, although conversion rates will be paid at the time of transaction.

Pros

Cons

Local accounts offered

Like Sokin, Multipass is a relatively new product offering the ability to transact in around 70 currencies. Local accounts are only available in the UK or EURO however.

Multipass makes our list of the better accounts in part due to scope of the product, despite its relatively new (and smaller offering).

The company offers local accounts, card payments, batch payments and international money transfers for businesses. The difference here to someone like Wise Business, where the product is more developed, is that it feels very much like an MVP product at this stage.

Although it is new, the company is fully regulated and offers a decent multi-currency option.

Pros

Cons

Local accounts offered

Recapping

Moving business finances to a multi-currency account can make a huge difference to risk management and international finance. Here is a recap of what to look up for in a multi-currency business account.

Local accounts are not the same as holding currencies.

A local account will give you bank details in a specific region and works as a local bank account.

Holding currencies can often be sent and received. A conversion rate will be paid to move them into a local account.

Accounts often come with additional features like batch payments and expense management.

Accounts can be hooked up to existing accounting software like Xero.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources and further reading

Related Content

Contributors