Our Review of CurrencyFair

CurrencyFair was founded in 2010, and has been providing money transfers for over a decade. With over 150,000 customers signed up and a network of over 150 countries to which you can send money, they’re a solid option for those looking for a new provider.

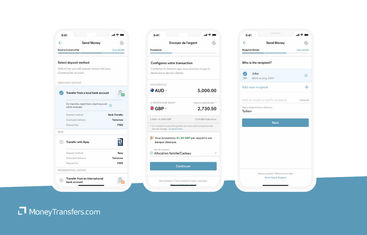

The remittance review team at MoneyTransfers.com has analyzed CurrencyFair’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback. We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture on how good CurrencyFair really is.

How MoneyTransfers.com rates CurrencyFair

Fees & Rates

Fully transparent about their costs, with a flat fee structure and competitive exchange rates, CurrencyFair gets a solid score for their affordable money transfers.

Service

Ease of Use

Safety & Trust

Customer Feedback

“While CurrencyFair is strong in a few areas, namely its affordable rates and fees, the service itself is not as slick as many of its competitors. It’s worth checking out if they can facilitate your transfer as you might get a good price, but we’d recommend keeping your options open.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like CurrencyFair?

Pros

Cons

How much does it cost to send money with CurrencyFair?

This is how we rated CurrencyFair based on its fees and exchange rates. Find the best rates for your specific transfer with our comparison tool.

Compare providers

CurrencyFair charges a small transfer fee plus a slight markup on the mid-market exchange rate. You’ll find that the total cost of your transfer will depend on:

How much you send: We found that larger transfers with CurrencyFair tend to get slightly better exchange rates. And of course as with any percentage fee, the cost will go up the more you’re sending

The country and currency you use: Different currencies will also have different exchange rates and markups

What are CurrencyFair’s transfer fees?

CurrencyFair charges a flat fee of €3 or the currency equivalent - it won’t change for different amounts, currencies or destination countries. We appreciate fees like this as it’s much easier to factor into the total cost of your transfer.

CurrencyFair exchange rates

According to CurrencyFair, on average their customers pay 0.53% of the total amount in exchange rate markups, in addition to the flat fee. In our research we found CurrencyFair’s rates to be relatively good compared to the competition - particularly for euro to pound and US dollar to rupee transactions.

If you want to try for a better exchange rate, CurrencyFair also offers a Marketplace, which lets you trade currencies with other users who are sending money the reverse way. You can set your own exchange rate for these transfers. However this is not currently available in the USA.

To put all these numbers into perspective, here's a real-time view of current exchange rates and fees charged by CurrencyFair for sending USD to different countries:

Currency pair | Exchange rate | Transfer fee | Exchange rate markup | Amount received |

|---|---|---|---|---|

USD / AED | 3.6465 | $4.08 | 0.71 | AED 36,450 |

USD / CAD | 1.3608 | $2.92 | 0.63 | $13,604 |

USD / EUR | 0.8575 | $3.48 | 0.58 | €8,572 |

USD / GBP | 0.7467 | $3.33 | 0.65 | £7,464.5 |

USD / IDR | 16813.2000 | $1.18 | 0.69 | Rp 168,112,000 |

USD / INR | 91.6125 | $1.3 | 0.67 | ₹916,005 |

USD / MXN | 17.1174 | $3.86 | 3.67 | $171,105.53 |

USD / THB | 31.4915 | $3.95 | 0.59 | ฿314,790 |

USD / VND | 25893.3000 | $3.95 | 1.24 | ₫258,829,426.8 |

USD / ZAR | 16.4890 | $1.5 | 0.80 | R 164,865 |

“CurrencyFair’s fees are arguably their strongest feature, so it’s definitely worth seeing if they can offer a good rate on your transfer. A flat fee structure is always welcome, and their exchange rates are relatively affordable compared to other providers.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is CurrencyFair’s money transfer service?

Here's how we rated CurrencyFair based on the overall quality of service it provides. However its outside our list of top money transfer companies for their service - other providers like WorldRemit are rated higher.

Compare providers

CurrencyFair offers a powerful money transfer tool, able to send funds to countries around the world. It also gives you access to a multi-currency wallet as well as business services. A popular provider despite not being a household name, we’ve dived into CurrencyFair’s services to see how good they really are.

How fast are CurrencyFair’s transfers?

According to CurrencyFair, most of their transfers should be completed within a few days - which isn’t as fast as many other providers who can offer transfers within minutes or hours, or at least on the same day. Remember, CurrencyFair only accepts bank transfers as payment, which is why it can take one or two days to process at least.

When paying in US dollars, CurrencyFair estimates that it’ll take 1-2 business days for them to receive the money - then the time it takes for them to pay out varies by currency. Here are the payout times for currencies supported by CurrencyFair when sending US dollars:

Currency | Transfer time | Currency | Transfer time |

|---|---|---|---|

UAE dirham | One business day | South Korean won | 0-1 business days |

Australian dollar | One business day | Mexican peso | 0-1 business days |

Canadian dollar | Two business days | Norwegian krone | 0-1 business days |

Swiss franc | 0-1 business days | New Zealand dollar | 1-3 business days |

Czech Koruna | 0-1 business days | Philippine Peso | 0-1 business days |

Danish krone | 0-1 business days | Polish zloty | 0-2 business days |

Euro | 1-2 business days | Swedish krona | 0-1 business days |

Pound sterling | 0-1 business days | Singapore dollar | 0-1 business days |

Hong Kong dollar | 0-1 business days | Thai baht | 1-4 business days |

Hungarian forint | 0-1 business days | US dollar | One business day |

Indonesian rupiah | 0-1 business days | Vietnamese dong | 0-3 business days |

Israeli new shekel | One business day | South African rand | One business day |

Indian rupee | 0-1 business days |

How much can I send with CurrencyFair?

There is no maximum limit for how much you can send with CurrencyFair - which is great, especially for those planning on big transfers. The minimum amount you can transfer is €8 or the currency equivalent.

What kind of transfers can I make with CurrencyFair?

When you send money with CurrencyFair, you’ll always have the option of paying by bank transfer. But while it mentions that your other options vary by currency and location, it does not actually say which options are available.

The only pay out method available is a deposit into the recipient’s bank account - so if you’re looking to send money for a cash pickup, or to someone’s mobile wallet, you’ll be better suited to another provider.

Where can I send money with CurrencyFair?

You’ll be able to send money to the following countries with CurrencyFair:

Aland Islands | Algeria | American Samoa | Andorra | Angola |

Anguilla | Antigua And Barbuda | Argentina | Armenia | Aruba |

Australia | Austria | Bahamas | Bahrain | Bangladesh |

Barbados | Belgium | Bermuda | Bhutan | Bonaire, Sint Eustatius And Saba (Netherlands Antilles) |

Botswana | Brazil | British Virgin Islands | Brunei Darussalam | Bulgaria |

Burkina Faso | Cameroon | Canada | Cape Verde | Cayman Islands |

Chad | Chile | China | Colombia | Cook Islands |

Costa Rica | Côte D'ivoire | Croatia | Curaçao | Cyprus |

Czech Republic | Denmark | Djibouti | Dominica | Dominican Republic |

Ecuador | Egypt | El Salvador | Equatorial Guinea | Estonia |

Eswatini | Faroe Islands | Fiji | Finland | France |

French Guiana | French Polynesia | Gabon | Gambia | Georgia |

Germany | Ghana | Gibraltar | Greece | Greenland |

Grenada | Guadeloupe | Guam | Guernsey | Holy See (Vatican City State) |

Honduras | Hong Kong | Hungary | Iceland | India |

Indonesia | Ireland | Isle Of Man | Israel | Italy |

Jamaica | Japan | Jersey | Jordan | Kazakhstan |

Kenya | Kiribati | Korea (South) | Kuwait | Latvia |

Lesotho | Liechtenstein | Lithuania | Luxembourg | Macau |

Macedonia, The Former Yugoslav Republic Of | Madagascar | Malawi | Malaysia | Maldives |

Malta | Marshall Islands | Martinique | Mauritania | Mauritius |

Mayotte | Mexico | Micronesia, Federated States Of | Monaco | Mongolia |

Montenegro | Montserrat | Namibia | Nauru | Nepal |

Netherlands | New Caledonia | New Zealand | Niger | Nigeria |

Niue | Norway | Oman | Palau | Papua New Guinea |

Peru | Philippines | Pitcairn | Poland | Portugal |

Puerto Rico | Qatar | Réunion | Romania | Rwanda |

Saint Barthélemy | Saint Helena, Ascension And Tristan Da Cunha | Saint Kitts And Nevis | Saint Lucia | Saint Martin (French Part) |

Saint Pierre And Miquelon | Saint Vincent And The Grenadines | Samoa | San Marino | Sao Tome And Principe |

Saudi Arabia | Senegal | Seychelles | Singapore | Sint Maarten (Dutch Part) |

Slovakia | Slovenia | Solomon Islands | South Africa | Spain |

Sri Lanka | Suriname | Svalbard And Jan Mayen | Sweden | Switzerland |

Taiwan, Province Of China | Tajikistan | Thailand | Timor-Leste | Togo |

Tokelau | Tonga | Trinidad And Tobago | Tunisia | Turkmenistan |

Turks And Caicos Islands | Tuvalu | United Arab Emirates | United Kingdom | United States |

Uruguay | Uzbekistan | Vietnam | Virgin Islands, U.S. | Wallis And Futuna |

Zambia |

However, CurrencyFair do not allow transfers into local currencies for all of these countries - the only currencies you can send money to be received in are the following:

AED | AUD | CAD | CHF | CZK |

DKK | EUR | GBP | HKD | HUF |

IDR | ILS | INR* | MXN | NOK |

NZD | PHP | PLN | SEK | SGD |

THB | USD | VND | ZAR |

How good is CurrencyFair’s customer service?

CurrencyFair’s customer service team is available by phone and email, although they aren’t open 24/7 which isn’t ideal. There is no live chat option, and the email form only allows you to send a query if you’ve already made a transfer. Here’s how we got on with their team

Chat

Availability | 24/7 - just a chatbot, no human |

|---|---|

Response time | Instant |

Languages | English |

The help center has a ChatBot that answers your questions by directing you to relevant guides, but as it’s entirely AI it is somewhat limited in how it can help.

Phone

Availability | 7am-10pm Monday to Thursday, 7am-8pm Friday |

|---|---|

Response time | No answer |

Languages | English |

We called CurrencyFair’s customer support team to ask a few general questions about setting up an account, canceling a transfer, and what kind of rates we might get when sending money. The person we spoke to was exceptionally helpful and informative, explaining how rates are decided, why the markup is added, and they didn’t hesitate to compare their rates to what you’d get with a bank.

Availability | 7am-10pm Monday to Thursday, 7am-8pm Friday |

|---|---|

Response time | Within an hour |

Languages | English |

We sent an email asking for more information about CurrencyFair’s exchange rates and fees, and they got back to us within an hour, but asked for our unique CFID before we could proceed. We found it a little frustrating that we had to be fully signed up before we could access support.

Help center FAQs

Availability | 24/7 |

|---|---|

Languages | English |

The help center guides are detailed and helpful, and there are lots of them - and the ChatBot almost serves as an intelligent search function - which is definitely useful.

What else can I do with CurrencyFair?

In addition to international money transfers, with a marketplace that allows customers in certain regions to set their own exchange rates and trade with other users, CurrencyFair also offers other products and services.

With CurrencyFair you can open a multi-currency account that lets you send and hold money in over 20 currencies. It supports money transfers to and from over 150 countries, and you can get same day transfers with major currencies.

Multi-currency accounts are useful for expats, travelers and anyone who regularly deals with multiple currencies - and CurrencyFair’s offering is pretty good. However it is also limited by the low number of supported currencies - so if you’re looking for something more global you might be tempted by a larger provider.

.

“CurrencyFair is a fairly strong provider, offering a powerful money transfer tool as well as other useful services. While other providers do put on a better showing, if CurrencyFair offer a good rate then their money transfer service is well worth trying.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How easy is CurrencyFair to use?

Here’s how we rated CurrencyFair based on how easy it is to open an account and send money.

Compare providers

We went through the process of signing up to CurrencyFair on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

Signing up with CurrencyFair

Signing up to CurrencyFair should only take a few minutes - so let’s start at their homepage.

Download the app

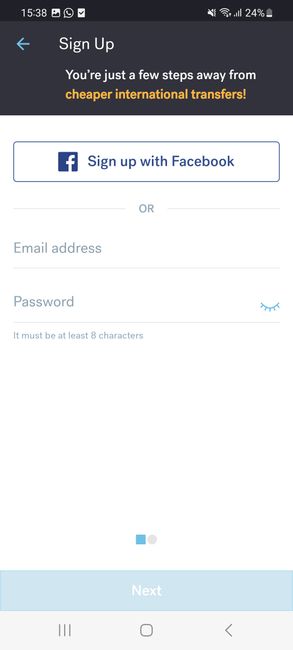

We downloaded the CurrencyFair app from our app store and opened it on our device

Select account

We were asked if we wanted to open a personal or a business account, and we chose personal

Add your email

We added our email address and created a password - though there is an option to sign up with a Facebook account

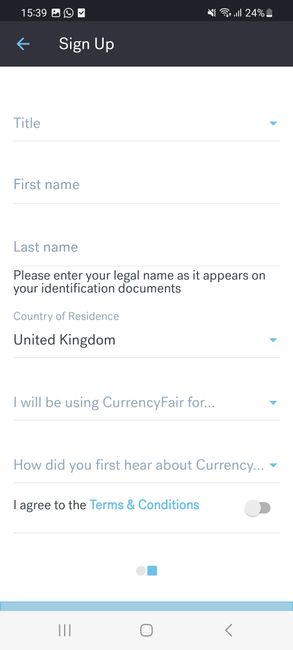

Add personal details

We were asked to give our name, country of residence, how we’ll be using CurrencyFair and how we heard about them

Activate your account

Before we could send money we needed to activate our account, which involved giving our postcode, date of birth, phone number and nationality

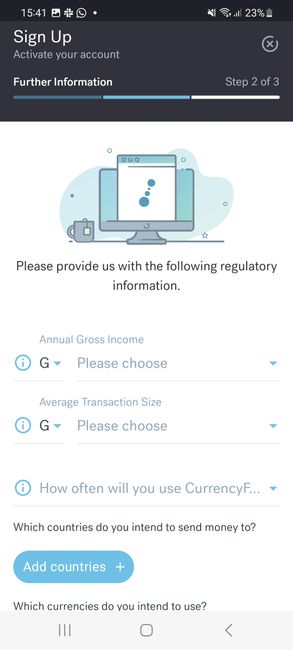

Give regulatory information

We also needed to give our annual gross income, average transaction size, an estimation on how often we’ll use CurrencyFair, which countries we intend to send money to and which currencies we intend to use

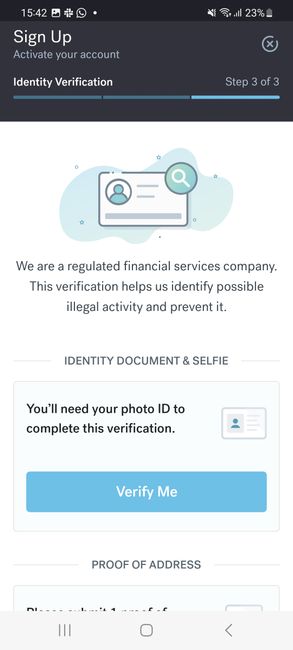

Verify your identity

The next step was to verify our identity by uploading a photo ID document, proof of address and a selfie

We thought the verification step was a little strange, as we weren’t told when our identity had been verified so we could make a transfer.

Sending money with CurrencyFair

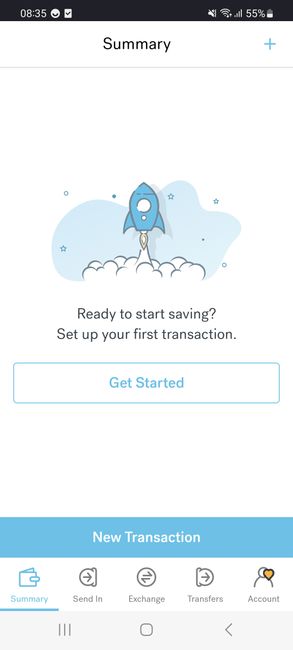

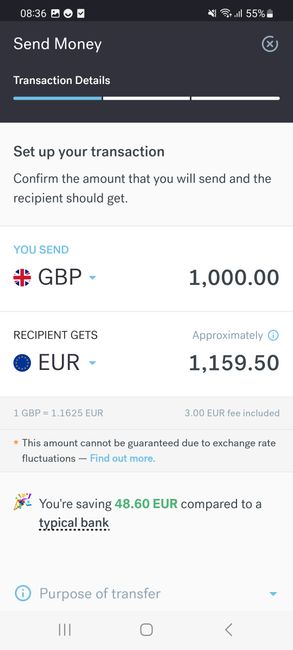

We used CurrencyFair to send GBP to EUR - here’s how it went:

Initiate transfer

We clicked on Get Started to initiate a transfer in the CurrencyFair app

Add transfer information

We chose the currency we wanted to send and what we wanted to be received, as well as the amount

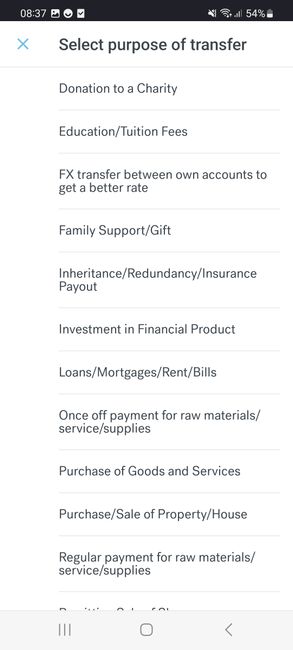

Choose purpose

We were asked to give the purpose of the transfer from a provided list

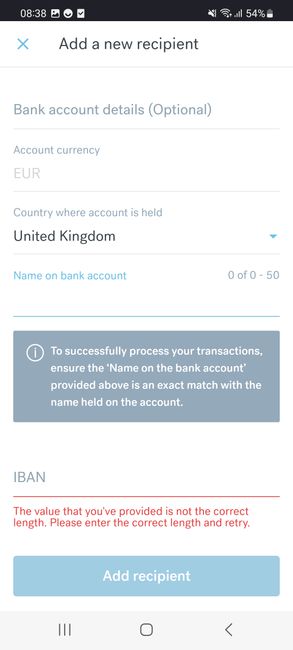

Add recipient

We chose the option to add a new recipient and added their information, including their country and bank details

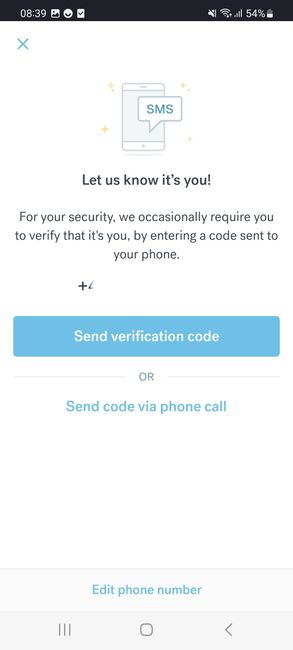

Verify phone

We verified ourselves via a code sent to our mobile phone

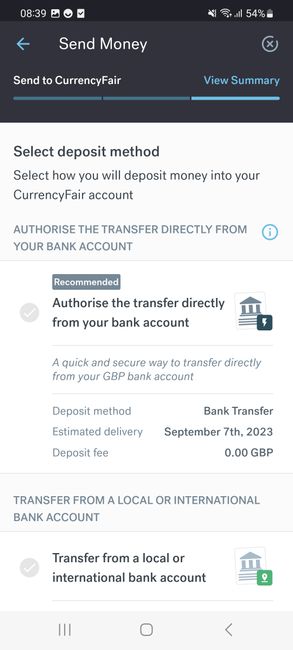

Choose deposit method

We chose to deposit from our own bank account

Review transfer

We reviewed the details of the transfer, confirmed our payment and finalized the transaction

We found the CurrencyFair app had a few issues when we were using it, being very slow to load and occasionally freezing between screens. Additionally, connecting our bank account didn’t work in the app, so we had to transfer the money manually, which we took points off for.

“Sending money through CurrencyFair was mostly straightforward, though the app had a few issues with freezing and loading, and the bank account deep link didn’t work. It wasn’t ideal, but the transfer still went through so the issues weren’t that serious. However there is still room for improvement, as there are other providers with sleeker and smoother apps out there.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is CurrencyFair?

This is how we scored CurrencyFair based on its transparency, safety and security. They rank outside our list of top providers for safety and trust.

Compare providers

CurrencyFair claims to have helped hundreds of thousands of customers move over €13 billion since being founded in 2009. With plenty of customers and reviews, it is a popular money transfer provider - and like all on MoneyTransfers.com it’s fully authorized and regulated.

We took a deep dive into how CurrencyFair practices, who they’re regulated by, and what security features they use.

Is CurrencyFair authorized to provide money transfers?

CurrencyFair is fully regulated and authorized to provide international money transfers by the following regulators:

In the EU: Regulated by the Central Bank of Ireland pursuant to Regulation 18 of the European Union Payment Services Regulations 2018

In the UK: Registered with the Financial Conduct Authority, registration number FRN 522602

In Singapore: Regulated Money Changer and Remittance Company authorized by the Monetary Authority of Singapore under the Money-Changing and Remittances Business Act

In Australia: Regulated by the Australian Securities and Investments Commission, AFSL number 402709

In Hong Kong: Licensed as a Money Service Operator under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance

Is CurrencyFair safe and secure?

According to CurrencyFair’s website, it adheres to the standard practice of segregating customer funds in separate accounts from corporate funding. This ensures client money is protected in the event that CurrencyFair should become insolvent.

It also employs two-factor authentication, 256-bit encryption via SSL from VeriSign, and stores all data in a secure, safeguarded facility. Data is backed up on a multiple region multi availability zone AWS cloud.

These are robust measures that you would expect from a money transfer provider that prioritizes customer security and safety. CurrencyFair details their thorough verification methods, systematic procedures and checks on their website.

Is CurrencyFair transparent?

CurrencyFair is fully transparent with its transfer fees and exchange rate markups, though it does not disclose that the exchange rate markup contains the bulk of the overall cost.

What do other customers think of CurrencyFair?

This is how we rated CurrencyFair based on the feedback they've received from their customers, on Trustpilot, the App Store, and Google Play. It ranks low on our list, only ahead of XE and Western Union - however it’s worth noting that the Google Play rating significantly drags the average down.

Compare providers

CurrencyFair has helped hundreds of thousands of customers move money, so it’s always useful to see what some of those people have said about their experiences. We’ve looked at CurrencyFair’s ratings on Trustpilot as well as both major app stores - here’s what we found.

What is CurrencyFair rated on Trustpilot?

CurrencyFair is rated as Excellent on Trustpilot, with a score of 4.4 from over 6,500 reviews when this article was written. This is a very good score, although the number of reviews is relatively low compared to some of the bigger providers - but still nothing to be balked at.

Some of the positive reviews praise their exchange rates, customer service, and efficiency of the overall process. However, negative feedback mentions trouble with the verification process and some payments not going through. According to Trustpilot, CurrencyFair responds to 87% of reviews, usually taking less than 24 hours to do so.

What is CurrencyFair rated on the Apple App Store?

CurrencyFair’s iOS app is rated 4.7 out of 5 on the Apple App Store in both the UK and Ireland (from 822 and 266 ratings respectively), and 4.4 out of 5 on the US App Store from only 79 ratings. These are low numbers when it comes to the amount of times they’ve been scored, so it’s worth taking the ratings with a pinch of salt.

Looking at the reviews, the positive feedback revolves around the easy-to-use app, fees and rates, and the overall quality and efficiency of their transfers. However, some negative feedback mentions the app not functioning correctly, as well as some criticism of their customer service.

What is CurrencyFair rated on the Google Play Store?

CurrencyFair’s rating on the Google Play Store is considerably lower than their other scores, at 2.5 stars out of 5 from 915 reviews and 50,000+ downloads. Many negative reviews mention lost money and incomplete transactions, with difficulties dealing with their customer service team. Positive reviews mention rates, although they also say other providers have similar or better rates, and again the overall efficiency of the app when it does work.

It’s hard to compare the two very different app store ratings, but there are similar themes across all reviews. We would suggest to use with a little caution, perhaps with small transfers first.

Our MoneyTransfers.com expert says

“CurrencyFair stands out with its transparent fee structure and its peer-to-peer exchange platform, offering customers a way to get the best rate for their money transfers. It’s worth trying to to see if you can find a good rate when sending money, although we did have a few issues using the app. CurrencyFair’s customer support team was also very helpful and informative, which is important.”Jonathan Merry, Founder, MoneyTransfers.comJonathan Merry

Frequently asked questions about CurrencyFair

Do I need an account to receive money with CurrencyFair?

Do I need a bank account to join CurrencyFair?

Is CurrencyFair legal to use?

Who owns CurrencyFair?

Can I open a CurrencyFair account in any country?

Compare CurrencyFair to our other providers

Our final verdict

CurrencyFair is certainly a provider worth considering, and its unique approach to exchange rates with its peer-to-peer platform presents an opportunity to find better than mid-market rates. However it has its flaws too - so if you're looking for a more polished and reliable service you might find more joy with providers like Wise and WorldRemit.

CurrencyFair user feedback

Comments

Anonymous

I dont give out my SS number online

Mark

I have money to send, but I'm not going to send a utility bill, this is ridiculous.

Anonymous

Another site thats makes you jump through hoops, Do you want my first born child too?