Compare International Money Transfers + Find The Best Exchange Rates

Send money abroad using the best money transfer service for your needs. Compare features, get the best exchange rate possible, and avoid hidden fees.

Join thousands finding better deals every week - save today with MoneyTransfers.com.

Search Now & Save On Your Transfer

Today's Best Exchange Rates & Lowest Fees

We Test, Review, and Compare Money Transfer Companies

Our experts analyse the remittance market, helping you enjoy fast, cheap, and secure transfers. Read our comprehensive guides, transfer comparisons, and money transfer reviews.

Here are a few key facts about MoneyTransfers.com

Real-time deals: 30+ companies

Services compared: 200+

Brands reviewed: 140+

Daily comparisons: 30,000+

Monthly users: 100,000+

Money transfer guides: 2500+

Where Are You Sending Money Next?

Read our remittance guides where we break down the best money transfer services, fees, transfer speed, and delivery options.

Send money from United States

Send money from United Kingdom

Send money from United Arab Emirates

Send money from Philippines

Send money from India

Send money from Nigeria

Send money from South Africa

Send money from Canada

Send money from Australia

Send money from Qatar

Our Tools & Features

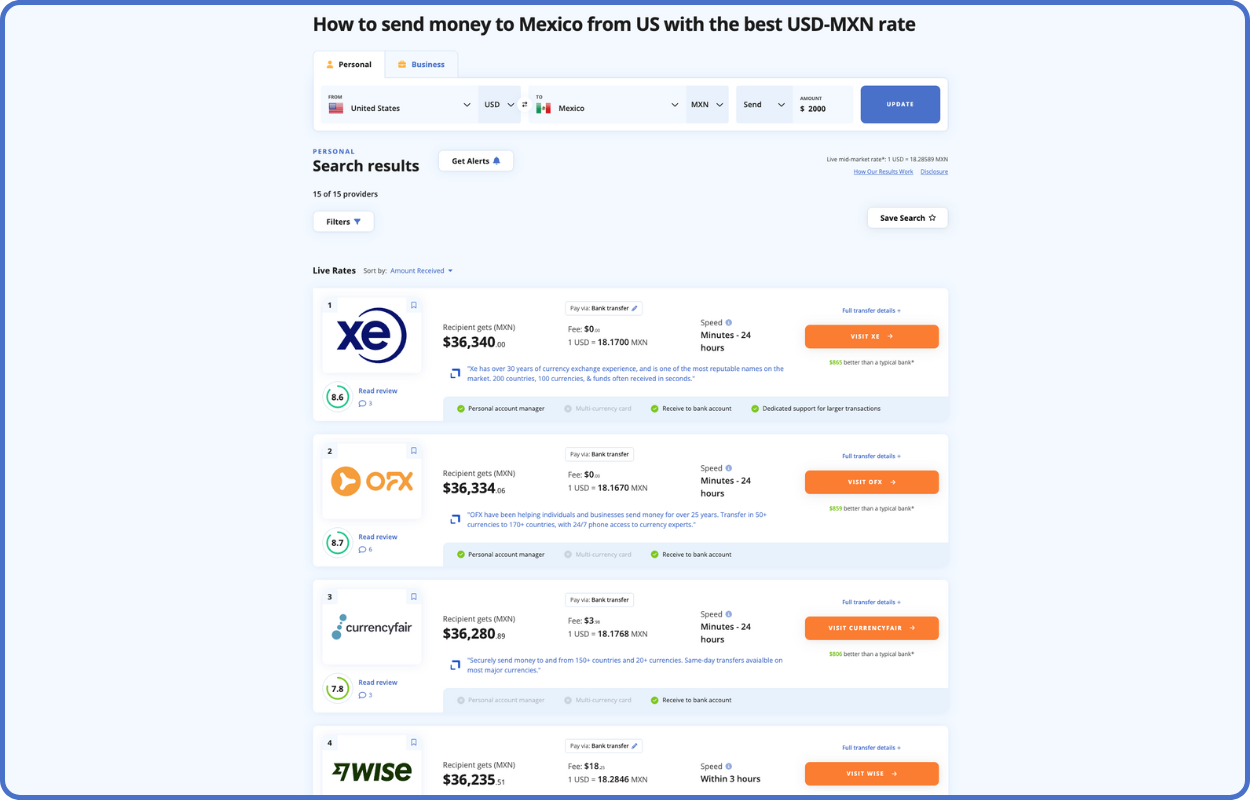

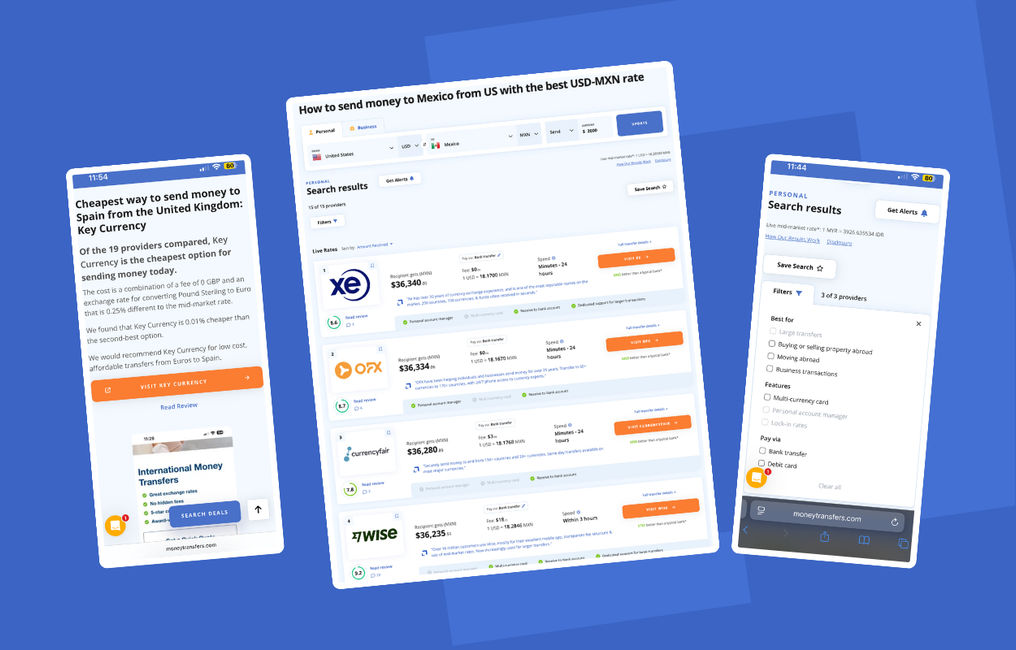

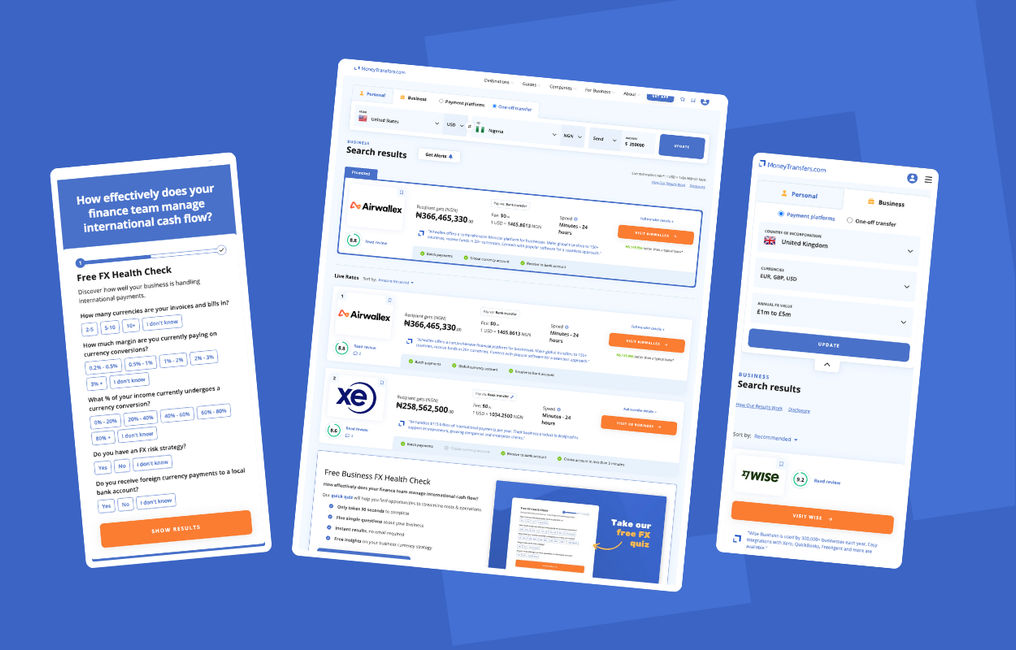

Live Rates Comparison

Compare live deals and exchange rates across 150+ countries, 80+ currencies, and 50,000+ corridors.

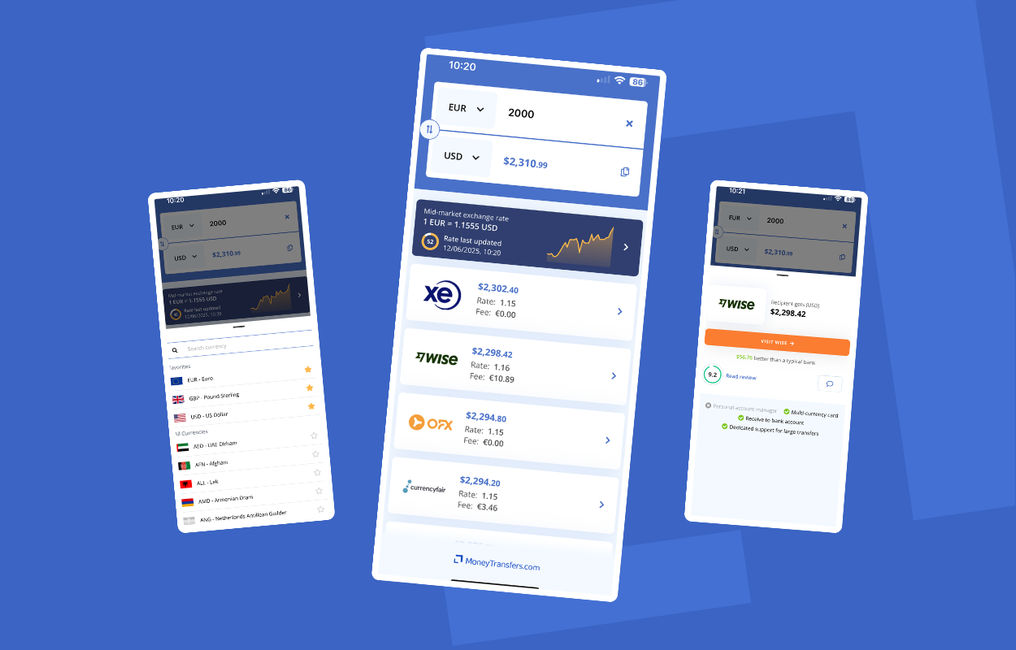

Money Transfers App

Get money transfer deals on the go, convert currencies, and find the best ways to spend abroad.

Real User Reviews

See what real users like you are saying about all money transfer companies.

Business Money Transfers

We compare and review international business money transfer companies across the market.

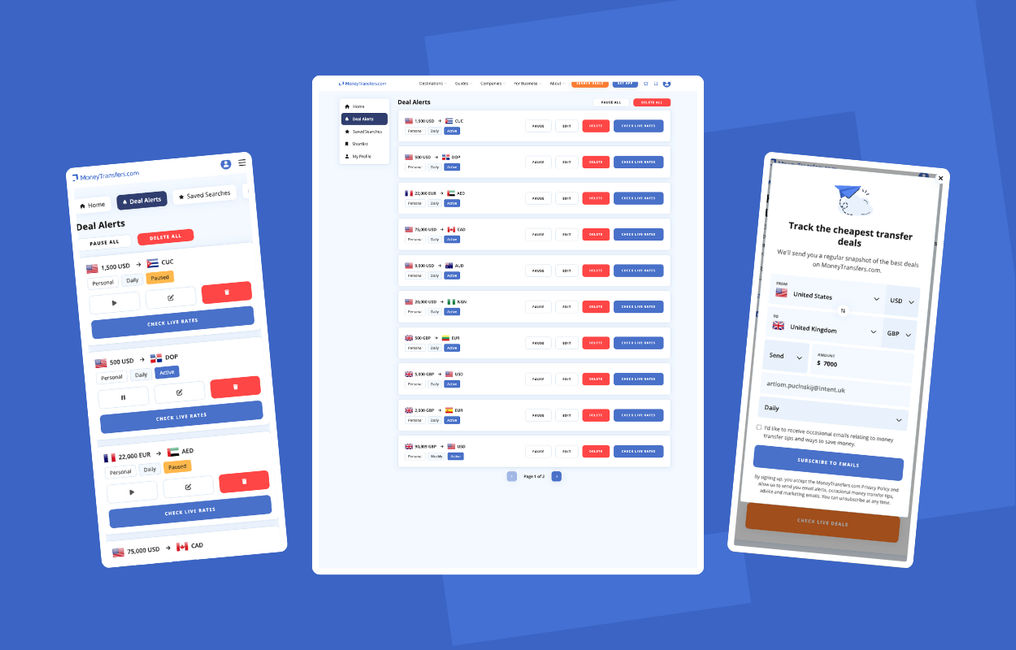

Rate Alerts

Stay on top of the exchange rates with our rate alerts. Run a search and click the rate alerts button.

Company Reviews

Our team has reviewed and analysed money transfer companies across the market.

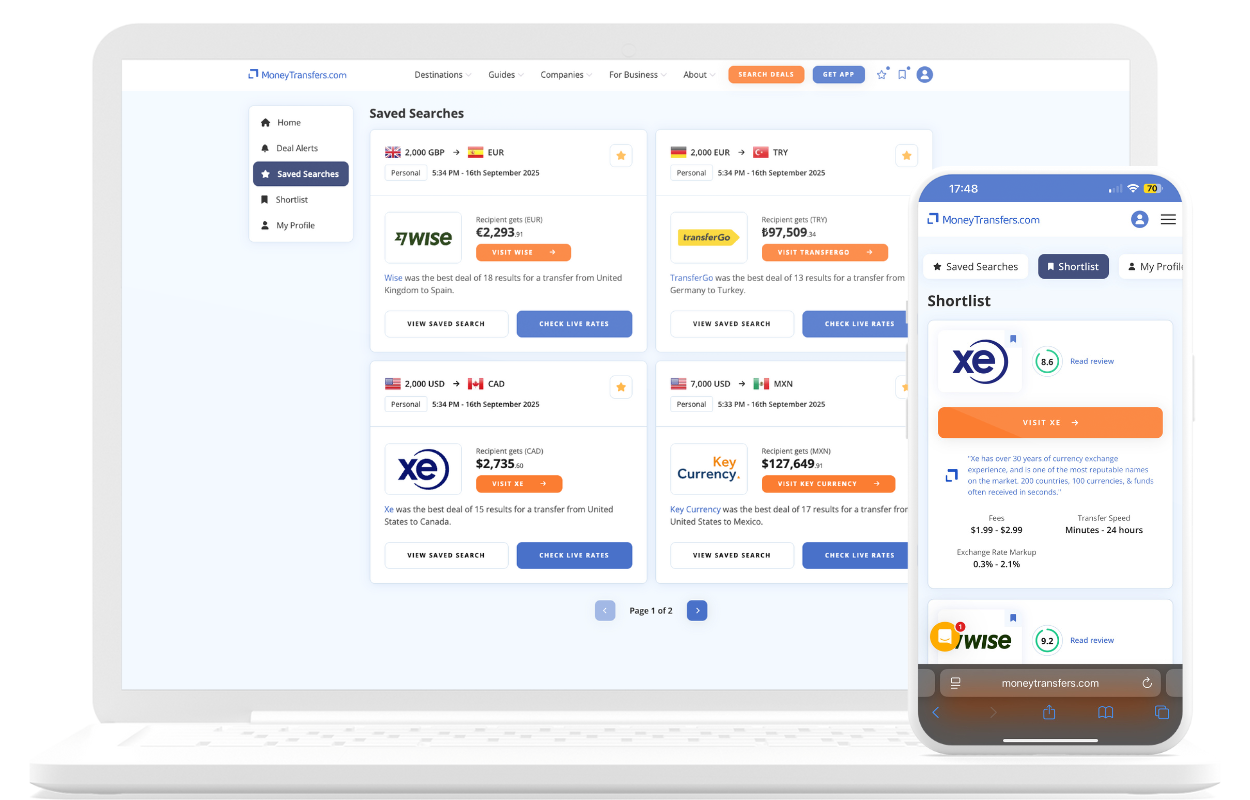

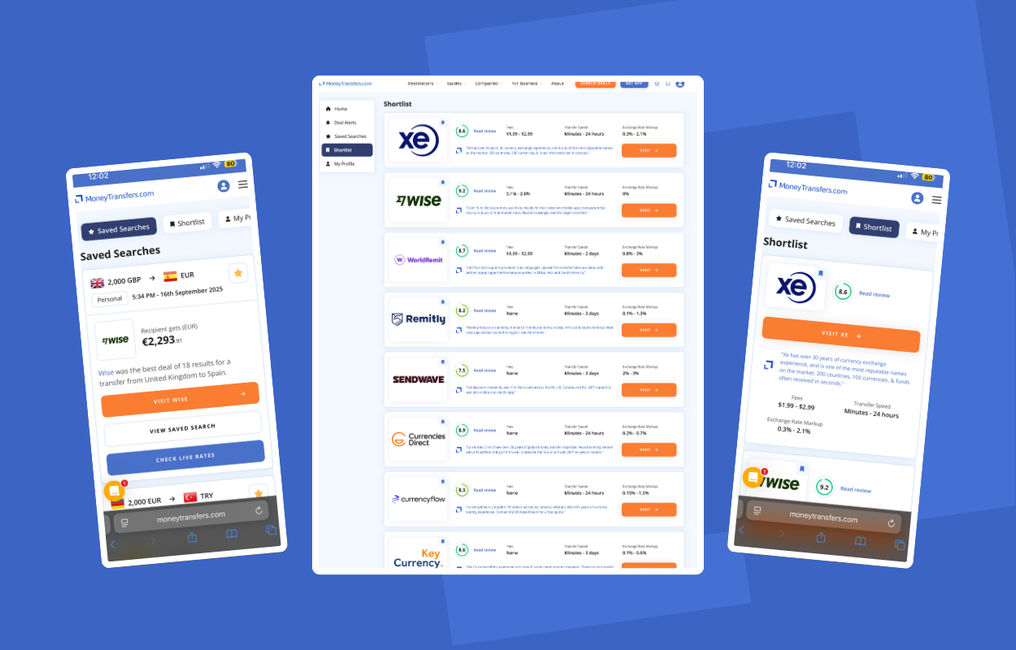

Compare, Save, and Shortlist Money Transfer Companies

Always ensure you're getting the best deal for your transfer.

Using our account option, you can:

Save searches

Shortlist providers

Ensure you're getting the full picture for your money transfer

Sync your data across all devices used

Stay in the loop with a MoneyTransfers.com account.

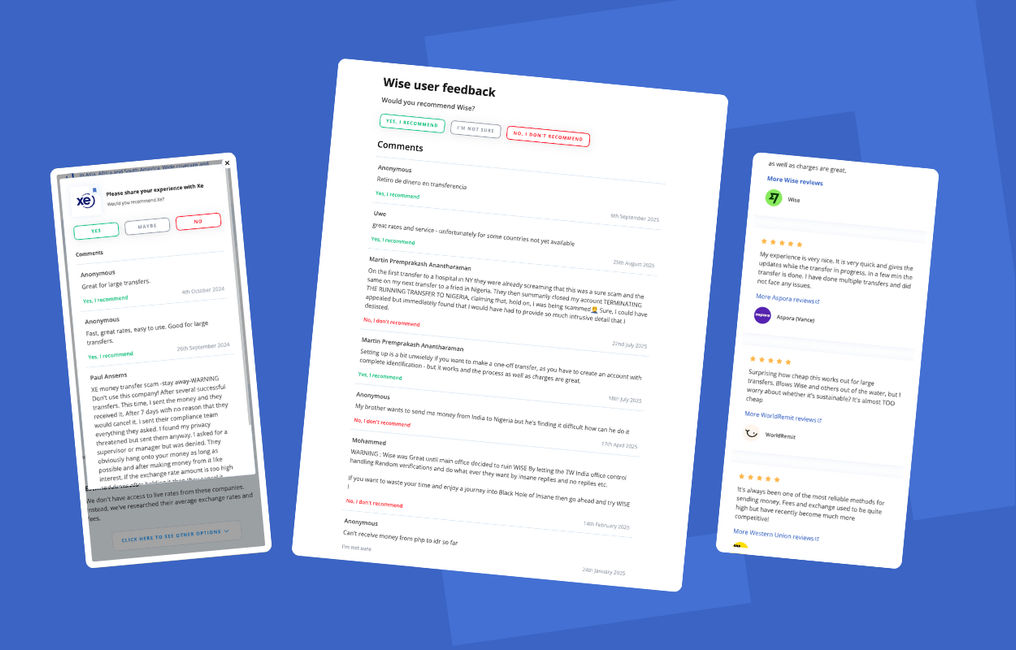

First-Hand User Reviews & Experiences

Check the latest reviews & comments to find out what real users think, or add yours.

Setting up is a bit unwieldy if you want to make a one-off transfer, as you have to create an account with complete identification - but it works and the process as well as charges are great.

My experience is very nice. It is very quick and gives the updates while the transfer in progress. In a few min the transfer is done. I have done multiple transfers and did not face any issues.

Surprising how cheap this works out for large transfers. Blows Wise and others out of the water, but I worry about whether it's sustainable? It's almost TOO cheap

It's always been one of the most reliable methods for sending money. Fees and exchange used to be quite high but have recently become much more competitive!

Regency FX are great. Sending my earnings in Saudi home, and the guy that looks after me is brilliant.

Watch Our Video Reviews of Top Money Transfer Companies

Money Transfer Comparisons

Why Thousands of Users Trust MoneyTransfers.com Comparison Every Week

30,000+ live deals scanned daily

Covering 150+ countries, 80+ currencies and 50,000+ corridors, giving you comprehensive and accurate comparisons. We even have access to exclusive deals from some providers.

Live API connections

Real time deals from money transfer providers like Wise, XE, Global66, WorldRemit, Airwallex and many more

Filter & sort

View your search results by payment method, features & use cases, instantly view fees, rates and transfer speeds, then sort by what matters most to you

Wide banking method support

Support for funding transfers using bank transfer, debit card and credit card, with payout options including send to bank, send to card, mobile money & cash collection

Send from $/£10 to $/£1million+

From remittances to the largest transfers, we have options for all - even offering advanced features like forward contracts, limit orders and hedging for six, seven and eight figure transactions

Comprehensive

We want to give you a full view of the market, including hundreds of money transfer companies. We don't let commercials or partnerships stop us from including companies on our pages. For us, being comprehensive is key.

Focus on financial education

Knowledge is power - MoneyTransfers.com empowers users to understand the world of currency and payments, with tips and guides integrated throughout the experience

Notifications

Create custom notifications for the latest money transfer deals by email, and be alerted when market movements affect the currencies that matter to you

Real insights & reviews

Unbiased review scores plus comments from real users give you a transparent understanding of company strengths and weaknesses

Free membership benefits

Create a free account to save searches, shortlist companies and manage email alerts

Unique MoneyTransfers.com mobile app

iOS and Android apps for currency conversion & money transfer deals

Business FX solutions

Dedicated search results for business users seeking competitive spot FX transfers or wider currency platform integrations

Seamless Currency Transfers For Every Goal

Compare Money Transfer Rates

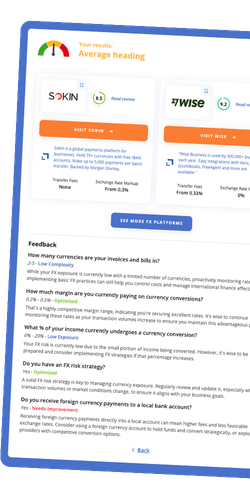

How Effectively Do You Manage International Cash Flow?

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out. Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

International business finance, simplified

About MoneyTransfers.com

Founded in 2019, MoneyTransfers.com is designed to transform the way you discover the best and cheapest deals when sending money across the world.

We believe transferring money between countries should be a quick and painless experience for everyone involved.

Our mission is to help individuals and businesses navigate the world of international money transfers with confidence, by providing transparent comparisons, real-world testing, and expert insights you can trust.

Find out more about what we do:

%201.svg)

Currency News & Forecasts in March

Get the latest on currencies and global payments.

FAQs

Read below for answers to the most commonly asked questions.

What is an international money transfer?

Why should I use an international money transfer provider to send money abroad?

What problems or issues could arise when sending money abroad?

Can I send money with MoneyTransfers.com?

Can I trust MoneyTransfers.com?

Compare Money Transfer Rates

.svg)

.png)