IBAN Calculator: Find Your IBAN Code

Our IBAN calculator is used to find an IBAN using other bank details. It's useful when you need to make a payment (business or personal) or initiate a money transfer.

This guide covers step-by-step instructions. It also covers the benefits of our IBAN calculator and its use cases.

Calculate an IBAN

What is an IBAN calculator?

Unlike an IBAN checker, which checks if an IBAN is correct by confirming information such as the BIC/SWIFT code, bank name, address, and country, a calculator is used to calculate exact bank account information for those who need to find an IBAN.

Banks arrange national or local account details into a string of alphanumeric characters and so IBAN calculators are used to convert this information into the International Bank Account Number needed when transferring funds to an international account.

How to use our IBAN calculator?

The process is simple, here's a quick step-by-step breakdown:

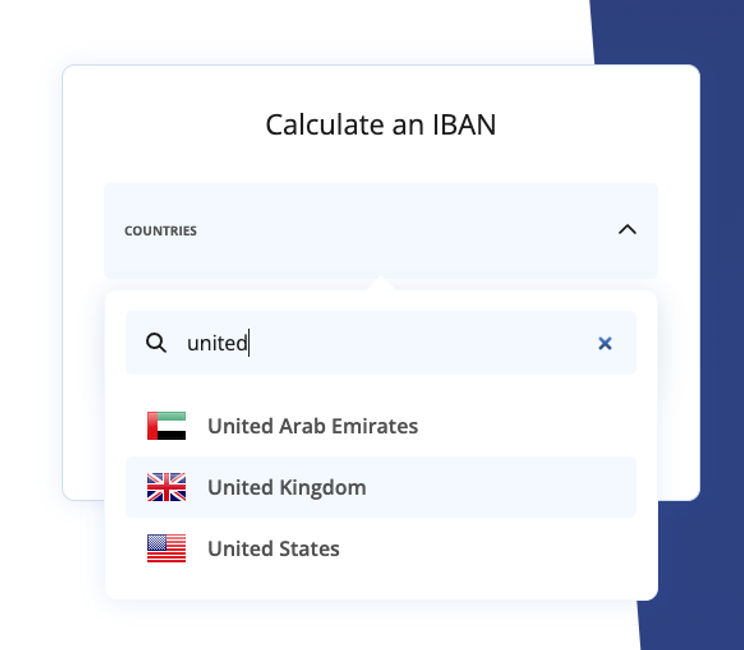

Find your country

Using the form above, find your country from the dropdown list.

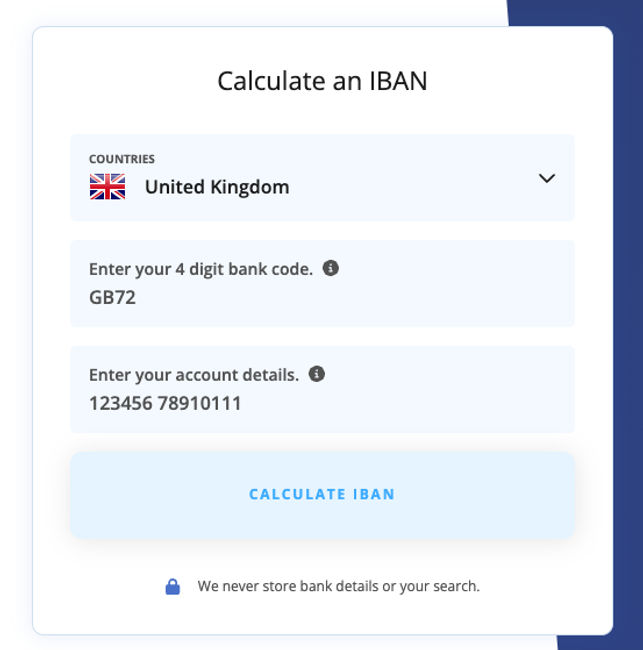

Enter your details

Fill in the details and click the "Calculate IBAN" button.

For the details:

Bank Code: This is a 4-digit number you can find in your account statement or by contacting your bank.

Account details: Is a combination of your sort-code and account number

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

Reasons to use the IBAN calculator

There are several reasons to use the IBAN calculator, here are a few:

Converting national account numbers to IBANs

When you have a domestic bank account number and need to convert it into an IBAN for making or receiving international payments.

Facilitating cross-border payments

Businesses dealing with international clients or suppliers need to provide or obtain IBANs for smooth cross-border payments. Using the IBAN calculator will simplify the process.

Streamlining payroll processes

Companies with employees in different countries use IBAN calculators to convert local account numbers to IBANs for international salary transfers.

Supporting SEPA transfers

Within the SEPA zone, IBANs are mandatory for euro-denominated transfers. An IBAN calculator helps convert local account details to IBANs required for these transactions.

IBAN explained

IBAN stands for International Banking Account Number and it is used to identify bank account details of a recipient. The format of an IBAN consists of a two-digit country code, two check numbers, a four-digit bank code, a six-digit bank branch code, and an eight-digit bank account number, like so:

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

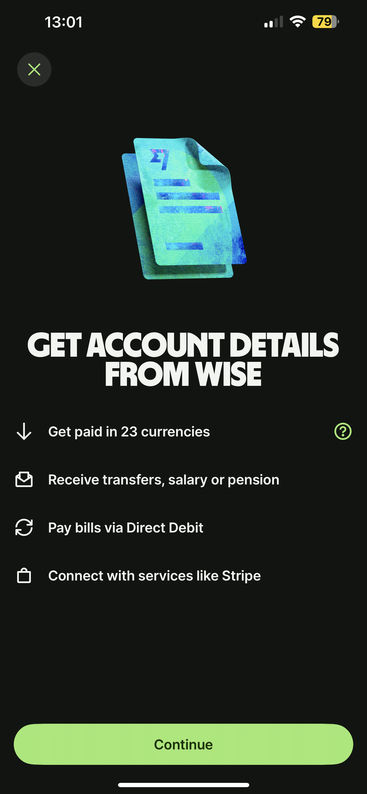

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

How an IBAN works

Used when transferring money overseas to a foreign country, IBANs are formatted in the following order, containing the following information:

Country code – A code that is specific to a certain country

Check number – A two-digit code used as a redundancy check to detect errors in identification numbers

Bank identifier – The unique identifier for the domestic bank

Account number – The bank account identifier

Who uses IBANs?

The system was originally developed by the European Committee of Banking Standards (ECBS) in 1997, as a way of creating a standardized method of identifying international bank accounts. The system has since been adopted by banks and financial institutions in countries all over the world, with 80 regions now using IBANs.

A bit more about IBAN calculators

Are there any other ways to find IBAN?

Can I generate IBAN for any bank using this calculator?

What details do you need to use this IBAN calculator?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

To recap: There are many ways to calculate IBAN

There are several ways to calculate an International Bank Account Number, whether it be for yourself or the recipient in a foreign country.

We hope this guide has provided enough information to equip our readers with the advice they need to efficiently source the details needed to successfully transfer funds from an account in one country to another account in a different country.

Since you are trying to calculate IBAN, we suspect you want to transfer money abroad. If you're still using your bank, you might be overpaying.

We suggest you give money transfer providers a try, as they offer similar if not better service, are much cheaper, and are just as easy to use.

Use our form below to find the best alternative to traditional banks.

Find a better alternative to bank transfers

Sources and further reading

Related Content

Contributors

April Summers