Mass International Payments for Business

Sending batch payments is the process of sending potentially thousands of payments. Forward contracts, good exchange rates and strong customer support can all make a huge difference in choosing the right way to send.

Search Now & Save On Your Transfer

Using a bank for just one international transfer is costly, using a bank for potentially thousands is simply bad business practice.

Businesses can save money by using specialist money transfer companies that offer batch payments with:

No transaction costs

Exchange rates which are much closer to the mid-market rate

Are aligned with a businesses currency risk strategy

In this guide I have compiled the best companies and used our data to give insights on what makes them a great choice for mass payments.

Mass international payments broken down

This type of money transfer refers to the process of paying multiple contacts simultaneously. This can be a one-off or recurring, automated payment.

Managing a mass payment comes with understanding the foreign exchange risk involved with the value, and working with a company to manage this risk.

Overall, International money transfer companies and forex management providers offer a better alternative for, regular and multiple, batch payments.

As an example:

Sending $100,000 in mass international payments

Provider type | Amount received |

|---|---|

Money transfer company | ✅ €91,507.45 |

Bank | ❌ €88,152.00 |

Within batch payments, we could recommend using a managed service provider. The best options for mass payments are:

Mass Payments | Total payments |

|---|---|

5,000 | |

5,000 | |

1,000 | |

1,000 | |

1,000 | |

1,000 | |

1,000 | |

1,000 | |

1,000 | |

500 |

Key points that need to be considered:

Exchange rate

Often paid per transaction. This means getting an exchange, or locking in a rate, that is beneficial to a business.

Fees per transaction

A provider with higher fees per transaction means an overall higher cost, when making potentially 1,000 transactions, a $3 equates to $3,000. It is important to shop around and get a good deal.

Currency risk

Managing currency risk correctly ensures a business is protected from moving exchange rates.

Each of the companies recommended for batch payments

Here’s a little more detail on each of the companies offering mass payments.

Xe Business is a great option for bulk payments, covering 190 countries. Conversion rates on transfers start from 1% in most cases, and Xe has no fees - even on larger transfers or bulk amounts.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | 1% |

Average fee per payment | No fees |

Managed service offering | Yes |

Supports file uploads | Yes |

Pros

Cons

Transaction details can be imported, exported for editing and updated in the system and there is also an API that works with a number of products like Sage and different levels of Dynamics 365.

The business offering from Xe is centred around improving business functions and streamlining global transactions. The mass payment element of this offering is a very nice extension to this.

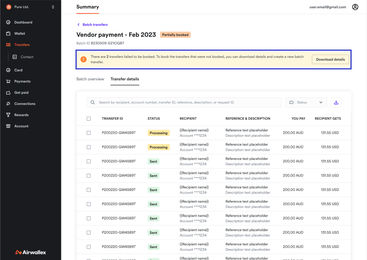

Airwallex is an all round international business transfer solution that excels in its batch payment offering. The system offered is easy to use, supports up to 1,000 payments and has a competitive exchange rate offering starting from 0.5%.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | 0.5% |

Average fee per payment | From $1 |

Managed service offering | Yes |

Supports file uploads | Yes |

Pros

Cons

The downside is forward contracts aren’t offered, but you can get a clear idea ahead of a payment whether the amount being sent will provide value for money.

Payments can also be set up to be made by whichever method is best suited - through a bank transfer, SWIFT or a local option.

This batch payment functionality sits nicely with Airwallex’s multi-currency account options as well, meaning you can make up to 1,000 ‘local’ payments as well.

Regency FX is a managed service money transfer provider that provides a hands-on service for international money transfers.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | 1.5% |

Average fee per payment | $0 |

Managed service offering | Yes |

Supports file uploads | No (managed service) |

Pros

Cons

Regency FX will work with you to make a mass payment at the best rate, this includes the use of forward contracts where necessary.

The difference between using a managed service like Regency FX, vs a digital only provider like Wise Business, is that the hands on approach can result in better results upon transfer. In effect, you are paying for the service as well.

Payoneer offers up to 1,000 but the amount you pay in fees (which can be up to 3%) might add up. There’s also no forward contracts, so currency risk is higher when using Payoneer.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | 1.5% |

Average fee per payment | Up to 3% in some cases |

Managed service offering | Yes |

Supports file uploads | Yes |

Pros

Cons

Where the service shines is its ability to link into different account options and integrations, and add multiple payout options within the same batches of payments.

In particular, Payoneer feels nicely set up for supplier or freelancer payments.

Wise Business offers mass payments as part of its suite that includes multi-currency accounts.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | Mid-market rate |

Average fee per payment | 0.33% |

Managed service offering | No |

Supports file uploads | Yes |

Pros

Cons

The offering at a cost level is one of the better options available on the market, although it does come with the need to facilitate the process yourself. In comparison, Regency FX’s managed service approach costs a little more overall, but will result in most of the work (beyond organising payments) completed for you.

That being said, for growing businesses with a need to regularly pay suppliers and expenses, the offering from Wise Business fits nicely into its all round product. The company is one of the best money transfer companies in the market at the moment, and its batch payment offering is an extension of this.

Revolut Business offers multi-currency options at its core, but has the ability to also provide a platform for mass payments.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | 0.5% |

Average fee per payment | 1%* |

Managed service offering | No |

Supports file uploads | Yes |

*payments on Revolut come in after thresholds are hit, for sending mass payments, we would assume these payments will always be hit as they start at $1,000.

Pros

Cons

Whilst businesses can send up to 1,000 payments and the platform is initiative; there are some areas where the account falls down. To access batch payments business will pay a monthly fee. If these payments are international, businesses will then pay a higher exchange rate after $10,000.

Overall, Revolut Business is a decent option if you already use the account - but if mass payments is at the core of what is needed for a new product, there are plenty of other, better, options available.

Sokin offers up to 5,000 batch payments in each transfer, the highest outside of companies like Regency FX where the process is managed through them as opposed to an upload.

Mass payments supported | 5,000 |

|---|---|

Average exchange rate | from 1.5% |

Average fee per payment | $0 |

Managed service offering | No |

Supports file uploads | Yes |

Pros

Cons

With the convenience of the 5,000 limit however, is an extra cost. Exchange rates start from 1.5, higher than the mid-market rate offered by Wise Business and the 0.5% offered by Airwallex. Both of these also have more options within the account overall.

This being said, Sokin does offer fee-free transfers and a multi-currency account with 4 core options (USD, GBP, EUR, and CAD) and APIs to hook the account up with.

Moneycorp is a business money transfer provider operating at the very top of the market. This company has over 40 years experience in international transfers and has a network of banks that allows it to move money in bulk as needed.

Mass payments supported | 1,000 |

|---|---|

Average exchange rate | From 2% |

Average fee per payment | $0 |

Managed service offering | Yes |

Supports file uploads | Yes |

Pros

Cons

The benefit of using Moneycorp for mass payments is that they will work with businesses ahead of time, years even, to determine a forex risk strategy. This strategy will include stop loss or forward contracts as well. These both allow businesses to plan payments, including regular payments, effectively.

There is also an API that can be accessed and built into existing accounting systems to aid in batch payments and the ability to pay invoices or expenses in bulk.

All-in-all, as part of a wider international transfer need, there’s a lot to like about Moneycorp’s mass transfer options.

Mass payments in action

Instead of having to make multiple individual payments, businesses will input all details in bulk - usually in the form of a file upload - alongside payment routes.

.svg)

Payment rates and fees will then be confirmed and transfers are made.

Where there are forward contracts or stop loss orders in place, these will also be factored in.

Fees apply to mass international payments for business

Fees for mass payments do differ per provider, but generally you pay per transaction if a fee is attached. However, most companies as listed above do not charge a fee for batch payments.

Instead, companies providing the service will factor costs into exchange rates. The benefit to a money transfer company offering the service is they are securing a larger transfer. The benefit to the end user, or business, is they secure a better rate across a larger amount of money.

This can feel a little daunting, but providers will give a breakdown of how the payment or cost will be structured. Where there are multiple batches of payments involved, this will also be provided.

Companies like Airwallex, upon upload of batch payments, will provide a breakdown of amounts, the amount the recipient will receive and the status of payments.

Benefits of batch payments

Beyond the obvious elements of using batch payments to save on international transfer costs and manage currency risk, there's a number of benefits to them.

Cash flow management

Batch payments, particularly when paired with an accounting integration like Xero, can improve cash flow management. Making multiple payments gives a clearer picture of liquidity, and when doing this internationally can provide (when timed right against the exchange rate) a boost to international finances.

Payment data accuracy

Making international payments in mass, with moving exchange rates, can improve data accuracy. Where contracts have been used, this makes the process very simple. In one scenario, where 500 payments are setup without knowing the exchange rate, vs. one where 500 payments are setup with an exact cost - the difference in business knowledge can be huge.

Better risk management

As well as hedging risk, batch payments aid in reducing fraud. At a base level, by carrying out a batch payment, fewer people are involved. Also, fraud detection becomes simpler across large scales of money.

Read more on forward contracts

Forward contracts can also be used as part of risk management when making mass payments. These come with the benefit of locking in an exchange rate ahead of time.

Batch payments and business bank accounts

When carrying out batch payment you do not need to be banking with the provider being used, but it is possible to do so.

For example, Airwallex offers multi-currency bank accounts. From these it is possible to carry out ALL of your your international business banking. However, you can just use them for sending business transfers internationally and leave a bank account central and somewhere else.

Avoid using a bank

In banking, mass international payments are typically referred to as bulk transactions, and some financial institutions may offer these services, but not all.

Keep in mind that with a bank there will be fees and exchange rates in the region of 3-7%, compared to the 0.5% offered by Airwallex.

Over $100,000 of mass payments, this potentially $6,500 in extra cost that goes straight to the bank.

Generally, we recommend business owners use a specialist money transfer company to arrange mass international payments.

Interested in multi-currency accounts?

Should multi-currency business accounts be of interest, we'd recommend reading our guide on the best options.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources and further reading

Related Content

Contributors

.svg)