How to Get Pesos in the US Affordably

If you’re planning your holiday to Mexico and need to buy pesos ready for your trip, you want to make sure you avoid the high fees of the airport. Find the best way to get pesos in the US without unnecessary costs.

Best places to get Mexican pesos in the USA in 2026

Before you transfer your dollars into pesos, you need to understand the different ways you can exchange to make sure you get the best deal. The easiest and cheapest way to purchase and use pesos is by opening a multi-currency account.

Best way to save on fees - Wise and Revolut multi-currency accounts

Best alternative - Prepaid travel cards

Most overrated - Local banks and credit unions

Best for emergencies - Banks and ATMs abroad

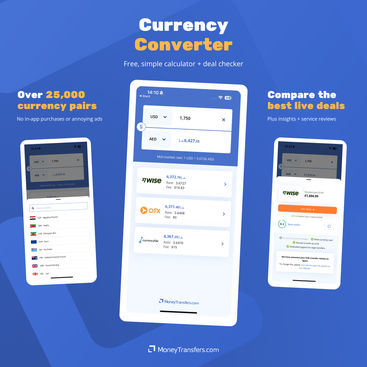

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Open a multi-currency account

Multi-currency accounts are the best, cheapest way to buy pesos with dollars. By opening a multi-currency account, you can exchange the amount of money you need into pesos, and keep them in the same account as any other money you have stored for travel expenses.

Online banks like Wise and Revolut are ahead of the curve with multi-currency accounts. With their mobile apps, you can set up an account in minutes and transfer your dollars to pesos in less than a week. To get started, you only need to download the app.

Which is better, Wise or Revolut?

Wise is the fastest and cheapest way to open a multi-currency account and get Mexican pesos in the US.

Once you’ve opened an account, you can order a Wise card for a one-time fee of $9. The card will allow you to spend overseas in the local currency, as long as you have the currency in your multi-currency account. You can also upload your card to Google Pay or Apple Pay, for easy contactless payments on the move.

There are no charges for contactless payments overseas using your Wise card, so long as you have enough of the required currency in your account.

If you have sufficient funds, Wise will also let you withdraw up to $100 a month from an ATM free of charge. A nominal fee will apply if you exceed this amount, or withdraw more than twice a month.

Revolut is also one of the best ways to get Mexican pesos, since it lets you store 28 different currencies in one account. Simply exchange the amount of pesos you need, and they’ll be automatically added to your account.

Revolut also has a free card, which allows you to withdraw from ATMs fee-free like a local wherever you are, provided you have the right currency in your account. This can be added to Apple Pay and your Google Wallet for easy contactless payments overseas.

It’s cheapest to exchange with Revolut during the week, when they offer the mid-market exchange rate without any markup. It’s more expensive at weekends and on national holidays when the markets are closed, when Revolut adds a 1% markup on all currency conversions.

Get a travel money card

Travel money cards have better rates than banks and airport exchanges, but they are not the cheapest way to get pesos. Multi-currency accounts are generally cheaper to set up, and often have fewer fees than travel money cards.

Travel cards like Currensea link to your bank account and deduct payments directly when you use them. The card converts the money and will often add a markup to the exchange rate each time you spend.

A slightly cheaper way to use a travel card is a prepaid currency card. Lots of global companies like Mastercard offer prepaid currency cards, and since you’re only making one exchange, you’ll pay less markup in total. This will involve extra planning for how much money you’ll need, but you can always get a top up if you need more while you’re away.

Remember, even though a travel money card may seem convenient, the exchange rates are usually high. Using this option to buy pesos will cost more than using Revolut or Wise.

Use local banks and credit unions

You can exchange money at all major banks and credit unions, but it's pricier than using multi-currency accounts or travel money cards to buy your pesos.

Local banks and credit unions are good for a quick-fix, but they’re more expensive than some of the other options we’ve mentioned, so we don’t recommend using them to buy pesos if you don’t have to.

Use a foreign currency exchange

You can buy Mexican pesos in the US through a foreign currency exchange, but they’re not the best value. If you buy pesos at a foreign currency exchange, it will usually cost more than if you do it at your bank. In this case, it may be quicker and cheaper for you to withdraw the local currency from an ATM at your destination, but the fees will still be high.

Places to avoid when exchanging for pesos

Many people still exchange money at airports and tourist areas, but this is the most expensive way to exchange currency. This is why you shouldn't exchange currency at airport desks.

Currency Exchange at the Airport

Pre-planning is crucial to getting a good deal when it comes to exchanging foreign currency. Last minute attempts to convert buy pesos at the airport exchange offices are not cost-effective.

Condé Nast Traveler says airport currency exchanges charge fees of $5 to $15. The exchange rate is usually 7% to 15% higher than the mid-market rate.

Free exchanges at the airport? They're not really free!

Beware of airport promises of free currency exchanges. They may not charge any fees, but their markup on the exchange rate is usually 7% to 15% higher than the mid-market rate.

Foreign currency exchanges in tourist-dense areas

Exchanging currency at national landmarks and tourist destinations is another big no-no.

To protect your money, avoid using small offices to exchange currency and purchase pesos. If you compare exchange rates and fees and use a multi-currency account before you leave, you can save money by avoiding unnecessary costs.

Visiting banks abroad

It can be tempting to exchange at a local bank when you arrive at your destination. It's best to only do this in an emergency, since the fees and exchange rates are high. Some banks may also charge for helping non-account holders.

If you don't have enough money while traveling, using your own bank card is often cheaper than exchanging at a foreign bank, but it’s still expensive. The best way you can save money on your peso exchange is to prepare in advance and open a multi-currency account before you travel. These usually offer the most competitive rates and the lowest fees on the market.

Getting pesos in the US - advanced planning will save you money

If you're going to Mexico and need some Mexican pesos, get a multi-currency account before you leave. Having a multi-currency card in your wallet and on your phone will not only save you on fees, but also reduce your risk of being a target for pickpockets by eliminating the need to carry large amounts of cash.

Explore more topics

FAQs

What’s the best place to get pesos before traveling?

What’s the best place to get pesos after traveling?

Should I buy pesos when I get to the airport?

What else do I need to travel to Mexico?

Can you get pesos at the US Post Office?

Can you get pesos from US banks?

How far in advance should I buy pesos for my trip?

What is the best way to pay when I'm in Mexico?

How much cash in pesos should I take?

Should I keep receipts for currency exchanges in Mexico?

Are there fees for using my card in Mexico?

How do I check the exchange rate I'm getting for USD/MXN?

What's the best way to exchange any leftover pesos?

Related Content

Contributors

.jpg)