How to Send Money to Someone Without a Bank Account

There are many options to send money to someone without a bank account. These include cash transfers, money orders, prepaid card transfers, and more.

However, your money transfer needs to be not only secure but also efficient and easily accessible.

Here, we'll go over all the ways you can send money to someone without a bank account.

We'll also outline our service recommendations and considerations to make.

Search Now & Save On Your Transfer

It is possible to send money to someone without a bank account by sending to a money transfer app, cash pickup, digital wallet or direct to debit card. WorldRemit, Xe and Xoom all offer services that support sending money without the need of a recipient bank account.

Consider this before you send

Millions of migrants around the world send money to predominately unbanked populations such as India, China, and the Philippines.

Currently, there are 7.1 million Americans in the US without a bank account, as well as, 1.3 million Britons.

Before making a transfer abroad, you should consider the recipient's needs and ensure they receive their money safely and with minimal loss.

Who are you sending money to? And why?

With this in mind, it is important to consider why people do not have a bank account.

If it is due to technological challenges: consider sending a simple, more traditional remittance.

If they are unbanked due to age or location: ensure the money-sending method you opt for is accessible (such as cash pickup options).

It is wise to assess the circumstances of the money transfer by asking the following questions;

Will this be a domestic or international money transfer?

Will this be a one-off or a series of payments?

How quickly does the person require this money?

What will this cost both parties?

How easily accessible is the money?

Now that you know the key areas to consider, let's take a look at the different ways to send money to someone without a bank account.

Ways to send money to someone without a bank account

Here are the top ways you can send money to someone without a bank account:

Money transfer provider

Money transfer providers let you as a sender deposit money using your preferred method. And the receiver can pick up money in various ways that work for them (without a bank account).

This can be picked up from a local store, getting them deposited into a pre-paid card, or getting them into a multi-currency account.

Money transfer providers are the cheapest and quickest option to send money to someone without a bank account.

Prepaid debit card

You can purchase a pre-paid card and send it to the receiver. The receiver will then use it to top up the funds.

Alternatively, once they have the card, you can send money to them from your bank account.

Digital wallets

The receiver can also use a digital wallet such as PayPal. You can then send money using PayPal and the receiver will be able to spend it where PayPal is accepted.

However, PayPal charges high fees so we don't recommend using this option.

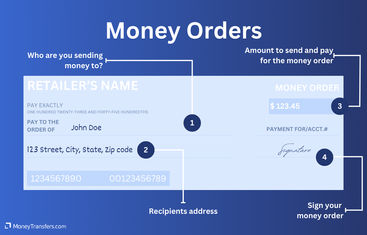

Money orders

Another way to receive money without a bank account is via postal order (also known as money order).

This is usually done through the post office.

You as a sender will need to go to the post office, fill in the postal order form and money will be posted.

The receiver will need to come to the same post office, provide the reference number, and collect the cash.

Now that you have identified the main obstacles and understood the unique requirements, you will be in a better position to consider the most suitable option for you.

We have put together a list of the most reliable options for sending money to someone who does not have a bank account.

Sending cash with a money transfer provider

Before international banking was widely available, sending cash through money transfer providers was a reliable option for many.

It remains one of the safest and most simple ways to send money to someone without a bank account.

Companies such as WorldRemit and Xoom offer first-rate deals on cash transfers.

WorldRemit offers instant cash delivery, with payees able to pick up the cash within minutes of the transfer.

The company is a global service provider that employs sophisticated safety measures to ensure your money gets to the recipient safely and quickly.

WorldRemit determines fees based on the destination and monetary value of the cash transfer.

Service charges are displayed on the transfer interface so customers know in advance how much it will cost.

Xoom is another reputable cash transfer service, offering users the option to arrange cash pick-up as well as door-to-door cash deliveries.

The company has partnered with several providers to facilitate the pickup function.

The fastest transfers are available when paying with a credit or debit card or via PayPal.

As with WorldRemit, Xoom takes the destination and transfer method into account when charging fees.

Finally, consider your transfer options: are you setting up your money transfer online, over the phone, or in person?

The delivery speed for sending money this way differs depending on the company, with faster deliveries costing more for both parties.

Top tip: Location, Location, Location!

For in-person cash collection, we suggest finding out which money transfer provider is located closest to your recipient, to ensure the payee can easily access the agent.

Once a location has been confirmed, make sure you relay all the required details to the recipient who is collecting the cash.

Compare money transfer providers

Sending a prepaid debit card

A prepaid debit card is a sensible way to send money to someone without a bank account.

Like an ordinary debit or credit card, these prepaid cards are available from major global payment companies like Mastercard or Visa, but they will not be tied to a bank account.

You can also purchase prepaid debit cards online through vendors like Amazon and Walmart, or over the counter at supermarkets or the post office.

Here's how the process would work:

The sender needs to buy a pre-paid card and post it to the receiver (with NO cash loaded).

Once the receiver gets the card, the sender needs to load funds onto it using the transfer method of their choice.

Once money has been loaded onto the prepaid debit card, the recipient is free to use it to withdraw money, go shopping, or order items online.

When the funds on the prepaid debit card need replenishing, cash can be used to top up the account balance.

Features of prepaid cards can include the option to transfer funds, establish direct deposits, and manage the balance using a mobile app.

Safety first!

In the interest of security, we recommend sending the prepaid card to the recipient before loading any funds onto it.

Once the prepaid card has safely reached its destination, the recipient can top it up using cash, or the sender can deposit an online payment into the account.

More on card transfers

Sending money to a digital wallet or via P2P apps

The majority of modern smartphones come with mobile wallets like Apple Pay Cash or Google Pay pre-installed on the device (also known as digital wallets or e-wallets).

Generally speaking, mobile wallets work with point-of-sale (POS) systems all over the world, however, in certain countries there may be compatibility issues with the brands of mobile devices and POS systems.

P2P apps are similar to digital wallets. But the key difference is the functionality.

P2P apps don't always let you store multiple payment methods, offer a different set of features, and most come with virtual bank cards.

In both cases, the sender and the receiver will need to have the app installed before they can transfer funds.

The key advantage of P2P apps is the small fees for making transfers (depending on the location and transfer amount).

However, these are not widely available all over the world.

In both cases, it might be tricky to withdraw money if you don't have a physical card, so better to use it to spend money rather than withdraw.

What about PayPal?

Another alternative is PayPal.

You can also use the PayPal app to transfer money, as it doesn't require a bank account to receive the funds.

PayPal is a great digital wallet for accessibility but often comes with higher fees and you can't withdraw the balance to cash (can only spend it).

Sending a postal or money order

A money order - also known as a postal order - is similar to a cheque, but does not require the assistance of a banking institution.

Much like a cheque, a money order comes in the form of a paper slip with the value printed on the front.

When sending a money order to someone without a bank account, the sender will pay for the desired value, completing the money order form and signing their name.

Unlike a cheque, when the money order arrives with the payee, it can be cashed out over the counter and does not require the help of a bank.

It is often cheaper and easier to cash out the money order with the same provider who issued the money order in the first instance.

As long as the sender retains the receipt and proof of purchase, the money order can often be tracked or canceled if necessary.

This long-standing money transfer method is readily available around the world and can be purchased over the counter from post offices, supermarkets, and other major retailers.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: how to send money to someone without a bank account?

The task of sending money to someone without a bank account may seem challenging at first, but thanks to ever-evolving advancements in fintech, the possibilities are plentiful.

We would not recommend posting cash to the payee under any circumstances, even if this is something you have done before.

Instead, familiarise yourself with the global payment providers as many of the options available are flexible.

Compare money transfer providers

Sources & further reading

Related Content

Contributors