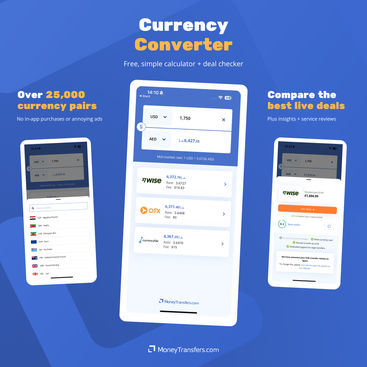

Using our currency converter

Use our currency converter to get the latest exchange rates. Simply change the currencies in the form above and the exchange rate will update.

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

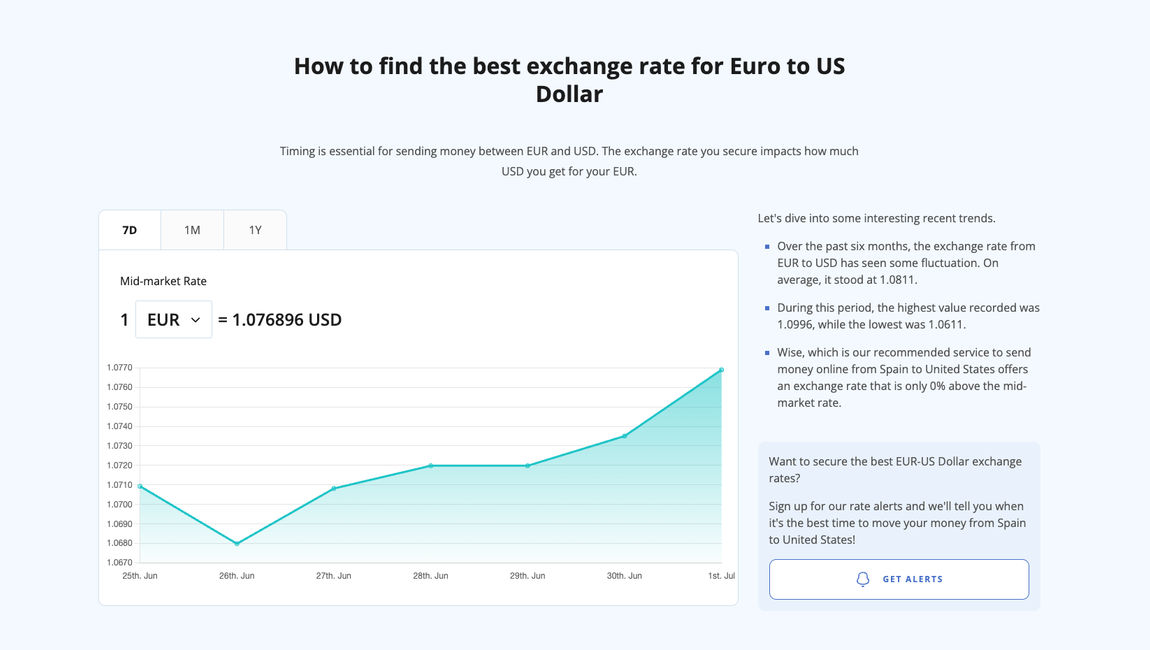

Alternatively, use the graph below to check the exchange rate in the past 7 days, 1 month, or 1 year.

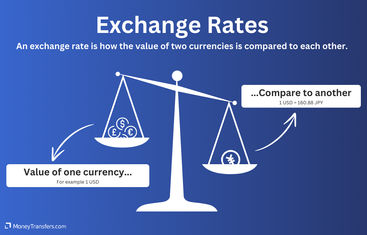

Exchange rates explained

An exchange rate is the value of one currency when converting it to another currency.

For example, the US dollar-to-pound sterling exchange rate is how many pounds sterling you would get in exchange for one dollar.

For you, this means that when you are sending money abroad, for example from the US to the UK, you are essentially buying pounds with your dollars.

Finding and getting the best exchange rate

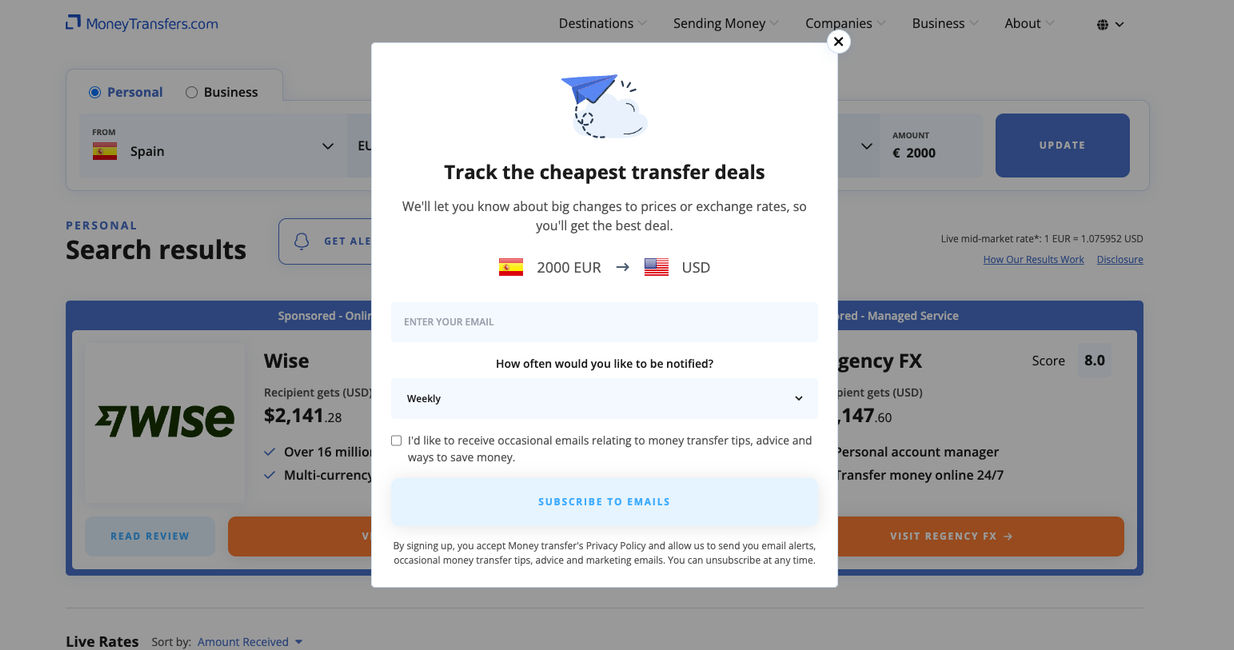

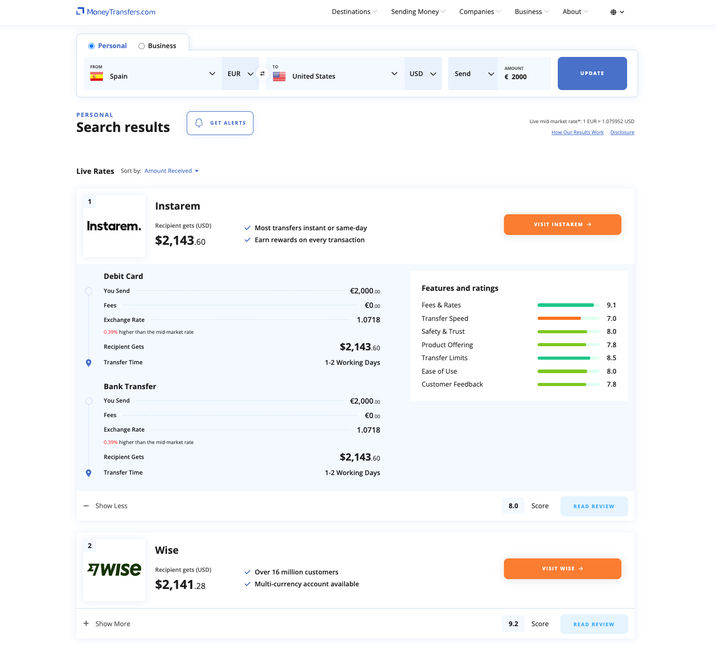

Using our is the easiest way to find out how to get the best exchange rates for your money transfer.

We scour the market to find the best deals from the biggest providers, helping you to compare them by the exchange rates offered, transfer fees, transfer times, and more.

To get started, simply fill in the form below and get the best rates for your transfer.

Compare and get the best exchange rate

But to give yourself the biggest chance of getting a favorable rate on your transfer, we would recommend you also:

Check the mid-market rate

Exchange rates fluctuate by the minute, so if you know you’ll be sending money along a specific route sometime in the future, staying on top of movements can help you time your transfer and get a better rate

Sign up for rate alerts

MoneyTransfers.com rate alerts can help you do this, giving you weekly, bi-weekly, or monthly updates for as many currency pairs as you choose

Choose the right provider

Ensuring you have the right provider for your transfer needs helps you keep costs low, whether it’s for specific payment or delivery methods or friendlier rates for the amount you want to send

Need to take currency abroad?

Mid-market exchange rates

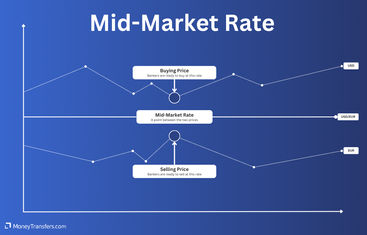

The mid-market exchange rate, sometimes known as the interbank rate, is the midpoint between the buying and selling price for each currency involved in the transaction.

It’s essentially the standard exchange rate for the transaction, determined by natural market forces and agreed upon by the world’s major banks.

Some providers such as Wise offer the mid-market exchange rate for their money transfers, and this will likely be the best rate on offer for your transfer.

Other providers may add a small margin to their exchange rates, which lets them make a profit off of the conversion. However, some might publish these openly, for example, XE publicly shows their rates, whereas others will hide it.

To get a good deal, you need to know the current mid-market rate, which you can find in the table below (for EUR/USD pair).

| EUR | USD Price |

|---|---|

| 1 EUR | 1.18 |

| 5 EUR | 5.88 |

| 10 EUR | 11.76 |

| 25 EUR | 29.40 |

| 50 EUR | 58.79 |

| 100 EUR | 117.59 |

| USD | EUR Price |

|---|---|

| 1 USD | 0.85 |

| 5 USD | 4.25 |

| 10 USD | 8.51 |

| 25 USD | 21.26 |

| 50 USD | 42.52 |

| 100 USD | 85.05 |

Currency forecasts

Unsure when is the right time to buy your currency? Use these currency forecasts to get an idea of what is happening on the market.

Exchange rate margin and markup

An exchange rate margin or markup is an extra charge incorporated into the exchange rate given by some money transfer providers.

You’ll be able to notice the difference between the rate provided by your provider and the mid-market rate - the extra they’ve added on is essentially a profit margin.

Money transfer services usually make their profit in two ways;

Either by adding an exchange rate margin as described above.

Or charging a transfer fee.

Transfer fees are generally more transparent as you’ll see the fee upfront, while exchange rate markups or margins can sometimes hide the additional cost charged by the provider.

Of course, some providers charge both - and it can sometimes vary by payment method, amount you’re sending, the currencies involved, and more.

A bit more on currency conversions

Who decides the exchange rate?

What affects the exchange rate?

How can I follow exchange rates for different currencies?

How do changes in the economy affect exchange rates?

Why do exchange rate fluctuate?

What is the difference between a 'buy' and 'sell' rate in currency exchange?

How do I convert one currency to another?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Get better rates with money transfers

If you're converting currencies to transfer money abroad, we suggest you compare top money transfer companies using our comparison system. Fill in the details below to get the latest rates and deals suitable for your needs.

Find the best transfer company for your needs

More currency exchange guides