How to Get Euros in the US and Avoid High Fees

Are you planning a trip to Europe but don't know how to buy euros in the US without high fees? Find out how you can purchase euros in the US and why a multi-currency account could help you avoid unnecessary costs.

- Over 16 million customers

- Multi-currency account available

- No hidden fees

Wise is the fastest and cheapest way to get EUR in the US.

To get euros in the US, the best options include multi-currency accounts, such as Wise and Revolut, which offer low fees and competitive exchange rates. Avoid high-fee airport exchanges and tourist spots. A prepaid travel card is also a convenient alternative for quick transactions.

Best places to get euros in the USA

To find the best place to get euros in the US, you need to understand the various options available to you. Smart travelers who want to save money and time prefer the multi-currency account instead of going to banks or using airport currency exchanges.

Best way to save on fees - Wise and Revolut multi-currency accounts

Best alternative - Prepaid travel cards

Most overrated - Local banks and credit unions

Best for emergencies - Banks and ATMs abroad

Read on to discover the best places to buy euros in the US, avoiding high fees and currency exchange losses.

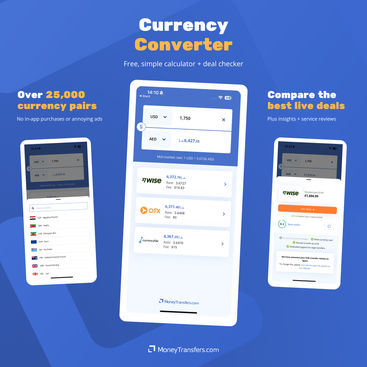

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Open a multi-currency account

Multi-currency accounts are the best, cheapest way to buy euros with dollars. Instead of converting a fixed amount of dollars into cash, multi-currency accounts let you exchange a specific portion of your total account balance and keep it in euros within the same account.

Online banks like Wise and Revolut dominate the scene here. They both offer a great service and let you buy euros with US dollars in seconds from their mobile apps. To buy euros online, simply download the free app and create an account with these services.

Below are two brief summaries that provide helpful information about these services. We also have a detailed comparison of Wise vs Revolut that covers features, benefits, and plans.

Wise is probably the fastest and cheapest way to open a multi-currency account and get euros in the US.

Once you set up an account with Wise, you'll receive a Wise card, allowing you to spend in various currencies. For a one-time $9 fee you can get the Wise virtual multi-currency card as soon as you activate your account.

The physical Wise debit card may take up to 5 days to arrive. You can easily use it with ApplePay and the Google Pay app as a convenient way for online and contactless payments in euros.

If your account has sufficient funds, you can use the Wise card to pay and withdraw up to $100 per month from ATMs without any charges. However, a nominal fee applies if you withdraw cash more than twice a month. You may find it more convenient to pay directly by card rather than withdraw cash.

Revolut is also one of the best ways to get euros, since this bank lets you store 28 different currencies in one account. With the free Revolut card, you can spend like a local wherever you are.

Throughout the weekdays when the market operates, Revolut offers the mid-market exchange rate without any added markup. But during weekends, they impose a 1% markup on all currency conversion requests. Debit card transactions come with a fee of 0.7% when made in the European region.

Revolut will send you a free physical multi-currency debit card too, with a small delivery fee. You can also add a virtual card to ApplePay and GoogleWallet for contactless payments and as a convenient way to spend for your online purchases.

Get a travel money card

Travel money cards have better rates than banks and airport exchanges, but they are not the cheapest way to get euros when it comes to rates and fees.

Travel cards such as Currensea link to your bank account and deduct payments directly when you use them. The card converts the money and usually charges a markup on the exchange rate.

If you want to plan your holiday spending and stay within your budget, consider using a prepaid currency card. Once the money reaches the card, you can use it to spend while you’re away, or go for a top up if you find you need more.

Remember, even though a travel money card may seem convenient, the exchange rates are usually higher. Using this option to buy euros will cost more than using Revolut or Wise.

Use local banks and credit unions

You can exchange money at all major banks and credit unions, but it's pricier than using multi-currency accounts to buy your euros online via their apps or travel money cards.

If you need to convert money quickly, this may be a useful option to get cash. However, they are more expensive compared to other choices on this page, so we don't recommend using them to buy currency or have dollars you want to switch to euros.

Use a foreign currency exchange

Buying euros in the US? Foreign currency exchange services are popular, but not the best value to buy currency before you travel.

If you buy euros at a foreign currency exchange, it will probably cost more than if you do it at your bank. In this case, it may be quicker and cheaper for you to withdraw the local currency from an ATM at your destination.

Places to avoid when exchanging for euros

The best deals are available through multi-currency accounts, with travel money cards not far behind. Unfortunately, you only find these options by actively searching for the best ways to buy euros.

Many people still exchange money at airports and tourist areas, but it can be more expensive than to withdraw cash from ATMs across Europe. If you want to know why you shouldn't exchange currency at airport desks, read the next section.

Currency Exchange at the Airport

Pre-planning is crucial to getting a good deal when it comes to exchanging foreign currency. Last minute attempts to convert money at the exchange offices at the airport are not cost-effective.

Condé Nast Traveler says airport currency exchanges charge fees of $5 to $15. The exchange rate is usually 7% to 15% higher than the mid-market rate.

Free currency exchanges at the airport? I don't think so!

Even if airports don't charge 'fees' on their exchanges, they add huge markups to their exchange rates, usually between 7% and 15% higher than the standard bank rate.

Foreign currency exchanges in tourist-dense areas

Exchanging currency at national landmarks and tourist destinations can be costly.

To protect your money, avoid using small offices to exchange currency and purchase euros. If you compare exchange rates and fees and use a multi-currency account, you can save money by avoiding unnecessary costs.

Visiting banks abroad

It can be tempting to exchange at a local bank when you arrive at your destination. It's best to only do this in an emergency, since the fees and exchange rates are high. Some banks may charge for helping non-account holders.

If you don't have enough money while traveling, using your own bank card is cheaper than exchanging at a foreign bank, but still expensive. The best way you can save money is to prepare in advance and open a multi-currency account before you travel. These usually offer the most competitive rates and the lowest fees in the market.

Getting euros in the US - plan ahead and reap the rewards

If you're going to Europe and think you'll need Euros, get a multi-currency account. Having a multi-currency card in your wallet and on your phone will not only save you on fees, but also reduce your risk of being a target for pickpockets by eliminating the need to carry large amounts of cash.

Explore more topics

FAQs

What’s the best place to get euros before traveling?

What’s the best place to get euros after traveling?

Should I buy euros when I get to the airport?

What else do I need to travel to Europe?

Can you get euros at the US Post Office?

Can you get euros from US banks?

How far in advance should I buy euros for my trip?

What is the best way to pay when I'm in Europe?

How much cash in euros should I take?

Should I keep receipts for currency exchanges?

Are there fees for using my card in Europe?

How do I check the exchange rate I'm getting?

What's the best way to exchange any leftover euros?

Related Content

Contributors

.jpg)