How to Get Japanese Yen in the US With Low Fees

If you're traveling to Japan and need to buy Japanese yen, remember one rule: avoid high airport fees. In this guide, we will help you find out the best, cheapest way to get Japanese yen from the USA.

Best places to get Japanese yen in the USA in 2026

Before exchanging your dollars for Japanese yen, you should check the different ways you can buy them to make sure you get the best deal. Multi-currency accounts are the cheapest and most convenient way to get Japanese yen and spend them overseas.

Best way to save on fees - Wise and Revolut multi-currency accounts

Best alternative - Prepaid travel cards

Most overrated - Local banks and credit unions

Best for emergencies - Banks and ATMs abroad

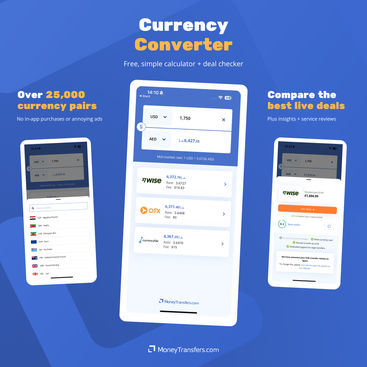

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Open a multi-currency account

Multi-currency accounts are the best, cheapest way to buy Japanese yen with dollars. With multi-currency accounts, you can convert your money into Japanese yen and keep it in your account for future use while traveling.

Wise and Revolut are way ahead of their nearest online multi-currency competitors. You can download their mobile apps and open an account in minutes. When you have an account, you can easily exchange dollars for Japanese yen and store them in your account, ready to spend.

Wise is the best provider of multi-currency accounts, and you can use it in the US to get Japanese yen very easily.

To open an account with Wise, all you have to do is download their app and follow the instructions. You can order a Wise card for a one-time fee of $9. You can use this card to spend money in other countries without paying fees for exchanging currency, as long as you have enough Japanese yen in your account.

You can also use a digital card on your phone with Google Wallet or Apple Pay for online and contactless payments.

If you’ve got enough Japanese yen in your account, you’ll also be allowed to withdraw up to 30,000 yen ($200) from ATMs without a charge. A fee of 70 yen ($1.50) will apply per transaction if you exceed this amount, or if you withdraw cash more than twice a month.

Revolut also provides a great multi-currency account. You can store 28 different currencies in a Revolut account. Just exchange the yen and you can access them.

Revolut offers a free card. You can use it at ATMs abroad without paying extra fees for foreign transactions. Just make sure you have enough Japanese yen in your account. Card payments made abroad incur a small fee. You can add your card to Apple Pay or Google Wallet if you like to make contactless payments with your phone.

Note: Exchanging with Revolut is more expensive during the weekend, when a 1% markup is added to the mid-market exchange rate on transactions. It’s cheaper to exchange money on a weekday, when no markup is added to the mid-market rate.

Note: Interested in Wise and Revolut?

Check out our Wise versus Revolut comparison to find out which is better for your next trip to Japan and for your everyday multi-currency payments.

Get a travel money card

Travel money cards aren’t as cheap as multi-currency accounts, but they offer better rates than banks and airport exchanges. Cards like Currensea link directly to your local bank account and deduct payments as you make them. Your card then converts the money and often adds a markup on the foreign exchange fees whenever you spend.

The more cost-effective travel cards are prepaid. Many global companies, such as Mastercard, provide prepaid currency cards. By using these cards, you only exchange money once and pay a lower markup because of your pre-payment.

Keep in mind that you’ll need to plan ahead to get the most of this deal, as any future exchanges will have a new markup added.

You can buy Japanese yen in the US using travel money cards, but the exchange rates are usually higher than multi-currency accounts. You’ll get less yen for your money than if you used a multi-currency account with Revolut or Wise.

Use local banks and credit unions

Local banks and credit unions will be able to exchange money, but it’s a more expensive option. You’d be better off using a multi-currency account.

This is one of the more traditional methods of exchanging money, and is still very popular. You can exchange Japanese yen at your bank, but multi-currency accounts and travel cards have better rates.

Use a foreign currency exchange

A foreign currency exchange is another traditional option for getting Japanese yen, but they’re not the cheapest. Foreign currency exchanges generally cost more than banks, so you’ll probably find a better deal exchanging in your local branch.

Tip: Check the exchange rate before you buy

A good way to make sure you’re getting a good deal is to check the rate and market conditions before ordering foreign currency. If the current exchange rate is much lower than the one being offered by your bank, you’ll probably find cheaper options elsewhere.

Places to avoid when exchanging for Japanese yen

Believe it or not, some of the most expensive places to exchange money are still some of the most popular. The traditional places commonly associated with exchanging currency, like airports and exchange depots in tourist spots, are the most expensive options available.

Here are some of the places you should avoid when exchanging your dollars for Japanese yen.

Currency Exchange at the Airport

Planning in advance can save you a lot of money when it comes to exchanging Japanese yen. Last minute attempts to buy yen at airport exchange offices are very expensive.

Condé Nast Traveler says airport currency exchanges charge fees of $5 to $15. The exchange rate is usually 7% to 15% higher than the mid-market rate.

Beware! Free currency exchanges at the airport aren't free at all

Even if airports don't charge 'fees' for their currency exchanges, they add huge markups to the exchange rates. They're usually between 7% and 15% higher than the standard bank rate.

Foreign currency exchanges in tourist-dense areas

Foreign currency exchange businesses target tourists and charge higher fees in popular areas of Japan. It’s always best to plan ahead and buy the yen you need before you travel to make sure you’re not caught out by high fees in last-minute emergencies.

Visiting banks abroad

Visiting banks abroad is another expensive way to buy yen. It’s best to only do this in an emergency, as the fees and foreign exchange prices will be high. Some major banks may also charge for helping non-account holders.

If you don't have enough money, using your own bank card is usually cheaper than exchanging at a foreign bank. However, it's still not cost-effective. The best way to save money when buying yen is to prepare your accounts in advance so you know you have everything you need.

Getting Japanese yen in the US - be prepared or face the fees

If you’re going to Japan, you’ll need to purchase yen for holiday spending. To save money on your exchange, open a multi-currency account and exchange yen before your flight. With your card, you can spend money like a local, save on fees and exchange rates, and have peace of mind knowing everything's sorted.

Explore more topics

FAQs

What’s the best place to get Japanese yen before traveling?

What’s the best place to get Japanese yen after traveling?

Should I buy yen when I get to the airport?

What else do I need to travel to Japan?

Can you get Japanese yen at the US Post Office?

Can you get Japanese yen from US banks?

How far in advance should I buy Japanese yen for my trip?

What is the best way to pay when I'm in Japan?

How much cash in yen should I take?

Should I keep receipts for currency exchanges in Japan?

Are there fees for using my card in Japan?

How do I check the exchange rate I'm getting for USD/JPY?

What's the best way to exchange any leftover Japanese yen?

Related Content

Contributors

.jpg)