Xe Business overview

Features | Insight |

|---|---|

Monthly Fee | $0 |

Exchange rate | 1%-1.3% |

Transfer fees | From free, but some currencies incur costs |

Multi-currency account | ❌ |

Batch payments | ✅ Up to 1,000 payments |

Expense management | ✅ |

Pay invoices | ✅ Includes APIs for some accounting software |

Receive payments | ❌ |

Marketplace integration | ✅ |

API options | ✅ Leading currency converter API can be built into existing financial systems |

Manage Payroll | ✅ |

ATM Access | ❌ |

Forward Contracts | ✅ |

Scoring Xe Business

Xe Business offers strong all-round support for international business transfers. As part of our scoring process we have looked at product offering, cost, speed of transfers, safety and customer satisfaction.

Pros

Cons

Product offering

Product offering is excellent for risk management, batch payments and sending large amounts. Xe does not offer multi-currency local accounts.

Fees and rates

Transfer speed

Transfer limits

Ease of use

Safety and trust

Customer feedback

Analysis of online reviews

Online review software is unreliable because it averages out scoring across a company, for decades at a time. To give a clear view of how Xe Business is actually performing now, we analysed online review scores from a number of different sources, specifically for the business offering. This chart shows an average score out of 5, per month, since the start of 2023.

Xe Business accounts

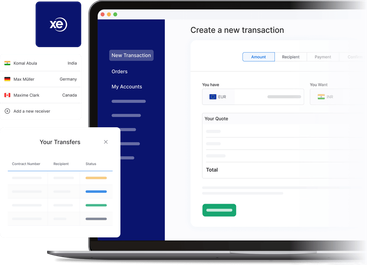

XE Business offers access to an online portal and management platform, but does not offer access to multi-currency accounts with local details in the same way Wise Business or Airwallex does.

This is not necessarily a negative, but for full end-to-end management, would mean you would need a different provider.

Provider

The product offering from Xe Business focuses more on risk management, sending money and integrating with accounting APIs and software.

The product is strong in this respect in that it adds to your existing accounting banking, as opposed to ‘replacing’ it in the form of a business bank account such as Revolut Business.

The account comes back with some credentials as well - $115 billion in annual transfers and over 275 million customers (across business and personal brands).

Supported local accounts and holding currencies

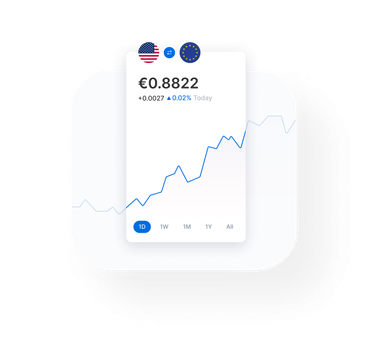

Xe Business offers access to over 190 countries and 130 currencies, this is one of the largest in the business market.

Transfer times and speeds to these countries will differ. For core business markets like USD, EUR and GBP - Xe Business offers almost instant, or same day transfers. For locations where transfers can be trickier, the transfer times tend to be a couple of days to five days.

When setting up a transfer however, this will be outlined.

Transfer types supported for US businesses are:

ACH direct debits (self service)

Wire transfers (self service)

Foreign currency exchange (through an agent)

Businesses in Canada can also benefit from using EFTs as well.

Send to almost any currency

Something that is a huge perk of using Xe Business is the ability to send almost any currency.

This is where the product is strongest, as when operating globally the need for a business multi-currency account is smaller.

As you can also use the API to integrate with certain account software.

Account limits and sending limits

Limits on transfers will differ based on the type of transfer being made.

These are:

Transfer type | Daily send limit |

|---|---|

ACH direct debit | $25,000 |

Wire transfer | $15 million |

Foreign currency exchange | $15 million |

ETFs (Canada only) | $33,000 CAD |

The limits on sending with Xe Business exceed that of the like of Revolut Business, but are lower than companies such as Wise Business which offers $50 million per day, or Moneycorp Business which has no caps.

Should this be a factor in decision making, then opt for Moneycorp Business over Wise Business - they, like Xe Business offer account management and better use of forward contracts.

If $15 million per day is enough, I’d recommend Xe Business over Moneycorp Business based on speed of transfers and the online portal for Xe Business being a little more intuitive.

Expense management

Expense management through Xe Business is more in the form of batch payments hooked up to accounting software, as opposed to being a standalone product.

Again, this isn’t a negative by any means. The way the API works with things like Sage, effectively gives you international expense management between the two systems.

Syncing between the API and accounting software is real time. Developer guidance, as well as support through Xe Business is available.

For companies without an existing core accounting software, this may not be the best option if expense management is important to the business.

You cannot input or send receipts directly to Xe Business, or make payment requests.

Sending and receiving payments

Sending money through Xe Business can be done in a few different ways - most notably, if you use the API you can send money directly from an accounting software like Sage.

Fees are only charged on transfers between the same currencies as standard, so USD to USD say. Xe Business standard fees aren’t quite clear however. As comparison to general fees though, Wise Business and Revolut Business both charge $10, Airwallex charges $1.50 - so there is a wide range that could potentially be paid.

Sending also benefits from a SWIFT Code GPI tracker, with real time tracking and payment confirmation included.

Sending to an individual

Sending to an individual is straightforward.

Through Xe Business itself, if not connected to an API, the process is straightforward.

Pick the amount, add recipient details, select a payment method confirm.

For both, you will get tracking information.

For larger payments, I’d recommend agreeing this over the phone with XE themselves. It’s possible to get a forward contract in place in this way.

Sending mass or batch payments

Sending through an integration

Interest on balances

As Xe Business is not operating as a bank account, interest rates are not available.

Account options

Xe Business is similar to Xe’s personal offering. The company offers API access, and accounting software integration for business users.

With Xe Business there are some areas lacking vs. competitors that many others offer. Not having an option to receive payments means no marketplace integration either.

Feature | Business | Personal |

|---|---|---|

Transfers at the mid-market rate | ✅ | ✅ |

Access to 130+ currencies | ✅ | ✅ |

Access to local accounts | ❌ | ❌ |

Earn interest on balances | ❌ | ❌ |

Multiple user logins | ✅ | ❌ |

Make batch payments | ✅ | ❌ |

❌ | ❌ | |

API access | ✅ | ❌ |

Accounting software integration | ✅ | ❌ |

Setup fees | None | None |

Integrations and APIs

I have touched on integrations and APIs already from a payments perspective, but there are some more options available.

Currency API

The XE Currency Data API is listed as part of the business offering, but is actually a standalone product in its own right. The data is used by companies such as Shopify and (oddly as there is no integration available) with Xero.

ERP integration

Compare Business Multi-Currency Business Accounts

Selecting a multi-currency account for business can feel a little tricky with different options, local accounts and features. We've broken down the top accounts across the industry at the moment.

Fees and rates when using Xe Business

Provider

Xe Business fee breakdown

Service | XE |

|---|---|

Domestic Transfers | Not available |

International Transfers | Fee free |

Currency Conversion Fee | From 1% |

Receiving Fee | Not possible |

Holding 70+ currencies | Not possible |

Card Payments | Not possible |

Monthly Fee | $0 |

Setup Fee | $0 |

Payment Tracking | $0 |

Mass Payout | $0 (currency conversion fees apply) |

Accounting Integrations | $0 |

Additional Fees | Not applicable |

Rates on batch payments

When planning a batch payment, you can use Xe Business to get a forward contract. This can also be used on large payments and would be expected to for part of a hedging risk management strategy within a business.

With a forward contract a company is legally bound to making the agreed payment by the end date. For regular batch payments like payroll, this can be hugely helpful.

Transfer speeds with Xe Business

Xe Business transfers are fast, generally within a day - although these can be up to 5 business days for harder to reach locations.

Provider

Speed of transfers with Xe Business by transfer type

Transfer type | Send time |

|---|---|

ACH direct debit | 1-5 days |

Wire transfer | 1-5 days |

Foreign currency exchange | 1-5 days |

ETFs (Canada only) | 1-5 days |

Xe Business service and account management

Xe Business comes with a few different options in relation to account management.

It is possible to work with a contact at Xe for risk management needs and there's also options for phone support and email support of individual transfers.

In testing we found:

Phone support

AVAILABILITY | 24/7 (general), 8.30 am to 5.30pm (business specific) |

|---|---|

RESPONSE TIME | Minutes |

LANGUAGES | English |

Phone support is useful on Xe for sorting out issues on accounts and is recommended ahead of any big transfers or what support on forward contracts or risk management is likely to be needed.

AVAILABILITY | 24/7 |

|---|---|

RESPONSE TIME | Within an hour |

LANGUAGES | Over 100 |

Email support is accessible and easy to use, we tested ahead of sign up with queries. This took a day or so to get a reply.

Help center

AVAILABILITY | 24/7 |

|---|---|

LANGUAGES | Over 100 |

The help center on XE Business can answer most queries, but not all. Like most help center options it is very functional and difficult to get a specific answer. Anything transaction and specific to an amount, the recommendation is to call XE Business.

Using Xe Business

Provider

We tested the following for ease of use

Invoicing

Integrations

Adding multi-user access for employees, roles and permissions

Paying-in and withdrawing funds

Eligibility and sign up

When signing up to Xe Business you will need the following:

Documents required

A supplier invoice (if the business was incorporated within the last 18 months)

Information required

Specific requirements for US businesses

Safety and regulation

Provider

Xe Business security measures

Xe is regulated as part of HiFX and offers some security measures as part of this.

The company monitors accounts for fraudulent activity, AML requirements and is encrypted for payments.

With HifFX as a parent and the overall strength, and history of Xe as a business - we have huge confidence in the safety of user funds.

Xe regulation

Xe Business is regulated in different markets, these are:

Market | Regulation |

|---|---|

USA | FinCen (Financial Crimes Enforcement Network) |

Europe | EBA (European Banking Authority) |

UK | FCA (Financial Conduct Authority) |

Australia | ASIC (Australian Securities and Investments Commission) |

New Zealand | FMA (Financial Markets Authority) |

Canada | FinTRAC (Financial Transactions and Reporting Analysis Centre of Canada) |

Not keen on Xe Business?

If you are unsure of whether Xe Business is for you, here's how they stack up in the market.

Feedback of Xe Business

Provider

Xe has just over 70,000 reviews on TrustPilot and is rated 4.3 out of 5. One of the core areas that users like are the quality in service and hands on approach. The other areas are the ease of using the Xe platform and simplicity of carrying out regular transfers.

As with all companies we looked specifically at a combination of review sites for the business offering from Xe. We found the average score since the start of 2023 was 3.80. 2024 however on its own shows an average review score of 2.5.

Xe user feedback

Comments

Cristobal Matute

I just sent money with them. I had tried before with Wise and my bank, but their support helped me a lot and gave me a better rate than both. They kept me informed at all times about where the money was and the ETA. I’ve had bad experiences in the past with companies losing my money for days

Ron T

This information is not accurate for XE business accounts. They do not charge a fee but instead, make their money by giving you a much lower exchange rate. It is much more than $4. e.g. We are being quoted $20 higher than the market rate on a $330 transfer. That is ~7%

Olanrewaju Ayodele

I just love the speed of your transfer