Understanding Foreign Exchange Rates Risk

Foreign exchange risk (or FX risk) is the chance of losing money when the value of one currency changes compared to another.

It might have no impact on small conversions but can be a big risk to large transfers. For example for mass business payments or buying a property abroad.

This guide will help you understand key risks and mitigate the potential loss of assets.

Search Now & Save On Your Transfer

Foreign exchange rate risks explained

Put simply, foreign exchange risk refers to the chance that an investment’s value could decrease due to changes in currency exchange rates.

When dealing with foreign currencies, business owners often tap into currency forecasts to anticipate potential market fluctuations, but it is no easy task.

Regardless of the size of your business venture, understanding and mitigating foreign exchange risk should be a high priority when planning for successful cross-border transactions.

FX risk impact on international transfers

Foreign exchange risk can impact the financial positioning of a business and there is the risk potential whenever a business deals with currency conversion.

This is because the rate could change between the time of the transaction and the time the payment has been received and converted into local currency.

These fluctuations in the exchange rate can impact:

Business paying employees

Businesses and companies often use mass international payments to pay foreign suppliers, contractors, or employees which are most vulnerable to substantial foreign exchange risk.

Investors

Types of foreign exchange risks

Next, we will run through the three main types of risk experienced by business owners or investors.

Transaction risk

This risk involves real cash flow movements when setting up a business transaction or investment in a foreign currency.

The value of the base currency is exposed from the time between entitlement and payment as changes in the foreign exchange rates mean these payments could change in value

Translation risk

This refers to the exchange rate risk associated with investors or businesses that deal in foreign currencies and list foreign assets on their balance sheets.

Anyone dealing with foreign assets is required to convert the value from foreign currency into the local currency of the business or investor

Operating risk

This type of risk refers to the long-term market value of a company or investor’s assets.

It is caused by the effect of unexpected changes to the currency which may impact a company’s or investor’s cash flows.

Mitigating foreign exchange risks

Companies counter the risk of market fluctuations affecting their international transfers and payments by adopting foreign exchange instruments.

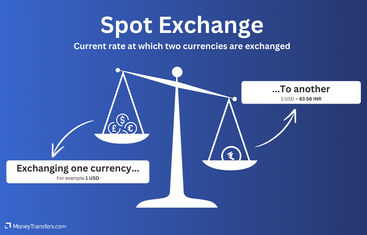

Spot exchange rate

These allow an individual or firm to buy the required foreign currency at a so-called Spot Rate at the time of transaction.

This eradicates the time gap when agreeing on a price and making a payment.

For example

If you were located in the US and wanted to buy goods from a company in India using INR, you could simultaneously sign the contract and buy INR to pay the company in India.

This works even if the payment was not due for a few weeks, thus removing the risk of INR depreciating in the intervening period

This is what it would look like based on the example above.

| USD | INR Price |

|---|---|

| 10000 USD | 921134.95 |

| 20000 USD | 1842269.90 |

| 50000 USD | 4605674.75 |

| 100000 USD | 9211349.50 |

| 300000 USD | 27634048.50 |

| 500000 USD | 46056747.50 |

| 1000000 USD | 92113495.00 |

| INR | USD Price |

|---|---|

| 10000 INR | 108.56 |

| 20000 INR | 217.12 |

| 50000 INR | 542.80 |

| 100000 INR | 1085.60 |

| 300000 INR | 3256.80 |

| 500000 INR | 5428.00 |

| 1000000 INR | 10856.00 |

Hedge exchange

Hedge exchange is an agreement between two parties to make a foreign currency trade in the future, with the cost of that transaction being agreed beforehand.

The sole purpose of a hedge exchange is to protect a current position or upcoming international transaction.

When you consider that in the past decade, EUR/USD went from 1.32 EUR in 2013 per USD to 1.08 in 2023, it is clear that the fluctuations could cost you a lot of money.

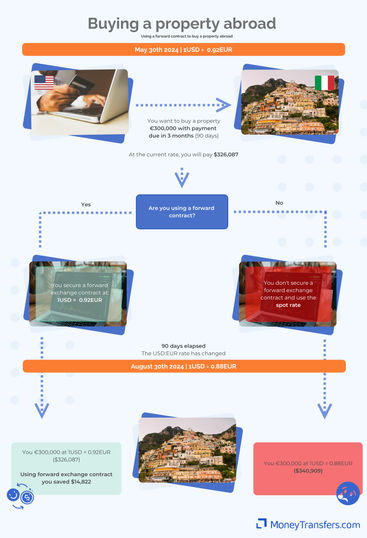

One of the most common hedge exchange strategies is forward exchange contracts.

Foreign exchange contracts allow anyone to exchange currencies at a fixed price on a future date.

For example, let's say you're in the US and want to buy property in Italy.

Let's assume the property costs €300,000 and is due in 90 days and the exchange rate at the time is 1 USD to 0.92 EUR.

At the current rate, it would cost you $326,087 but you still have 3 months to save up and get everything in order. In 3 months, the rate changed and is now 1 USD to 0.88 EUR.

If you were using a spot rate (the live rate at the given time) you'd be spending $14,822 more than if you've used a forward contract.

Here's how it looks:

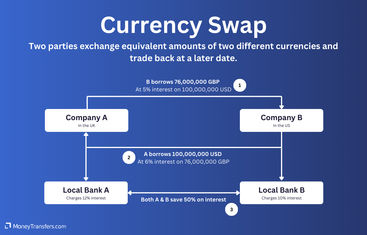

Currency swap

A currency swap is an interest rate derivative whereby two parties exchange the principal amount of a loan and the interest in one currency, for the principal and interest in another currency.

For example

If a British company needs EUR and a French company needs a similar amount of GBP, the British company could borrow GBP while the French company borrows EUR.

The companies will then swap the currencies, as per the prearranged terms, giving each company the foreign currency it needs while allowing each party to pay back the loan in its local currency, thus eliminating foreign exchange rate risk.

Money transfer brokers

Another way to mitigate foreign exchange risks is to use a specialized money transfer broker with experience in large transfers.

One of our recommended options for this is RegencyFX.

RegencyFX is great for any type of large transfer, be it international mass payments or buying a property abroad.

With their experience in the market, they can assist you every step of the way, provide insights into taxes, set up forward contracts, and recommend strategies for mitigating exchange risks.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

To recap: What are the FX risks?

Foreign exchange risk poses a very real threat to the value of international business transfers, as outlined in the scenarios on this page.

With our help, you can save yourself money and stress, by familiarising yourself with the possible outcomes and implementing the recommended tools detailed in this guide.

If you're looking to make a large transfer, be it for business or making a large purchase, a great way to start is by finding a reliable company to facilitate your transfer.

Use our form below to find the best money transfer operator for your needs.

Lock the exchange rates with top money transfer providers

Sources & further reading

Related Content

Contributors

April Summers

.svg)