Due to its business model - the bank functions solely as a digital entity - the company’s overheads are substantially lower than traditional brick-and-mortar banks such as HSBC and Barclays.

This means Starling is in a better position to offer better deals on financial services including no ATM or transaction fees overseas and no monthly fees.

Further advantages of banking with Starling include quick and easy onboarding for new customers, 24/7 customer support, digital spending reports, and instant payment notifications.

Scoring Starling Bank

Using our scoring system, we’ve looked at how Starling Bank stacks up against other neobanks in terms of speed, limits, exchange rates, and fees. Here's how it looks in summary.

Pros

Cons

We've also looked at the online user reviews for Starling Bank to see how users are rating international transfers.

Starling Bank fees and exchange rates

Starling Bank fees & rates

“Send money abroad with no hidden fees” is how Starling Bank pitches their international transfer services; but just how much are the fees?

We want to take a closer look at the cost of Starling cross-border payments by identifying the different fees and rates of exchange.

Exchange rates

As a challenger bank, Starling is keen to appeal to customers of long-standing financial institutions who are looking elsewhere for more competitive international banking services.

One way to entice these customers is by offering highly desirable, bank-beating exchange rates.

According to their website, the most common international remittances are Euro, US Dollar, South African Rand, Polish Zloty, and Thai Baht transfers.

To better understand the bank’s rate of exchange, we utilized Starling’s Foreign Exchange Rates function to research each of these top international transfers.

We discovered the bank’s profit margins range from as low as 0.003% (GBP/USD) to 0.13% (GBP/THB).

Only a fraction above the mid-market rate, Starling Bank’s slim profit margins are far more favorable than other UK banks which tend to apply exchange rate markup between 2 - 4%.

Here's how users rate Starling Bank online for its exchange rates.

Transfer fees

Starling Bank applies a flat fee to each international transfer and these fees are determined by the type of payment chosen.

There are two options to choose from:

Low-Cost Payment: For customers prioritizing price over speed - this option cannot be recalled or canceled - transfer fees for this service cost 0.4% of the total amount (minimum £0.30 per transfer)

SWIFT Payment: This type of transfer is sent via the SWIFT network which makes it far easier to track the status of these payments. Transfers sent using this option will be deposited directly in the recipient’s bank and costs the sender the same 0.4% in transfer fees, but with an additional delivery fee of £5.50

How Do Starling Bank Transfer Fees Compare to Using a Money Transfer Provider?

Finding a reliable and secure free money transfer service is incredibly rare (and not always a good idea) especially when it comes to international transfers to more remote regions.

Starling Bank’s transfer fees are pretty competitive when compared to the services offered by leading money transfer providers like Wise and OFX, and remain a great deal lower than most major banking institutions.

Additional costs

In addition to the 0.4% transfer fee, local network fees apply to the following countries:

Austria

Belgium

Czech Republic

Estonia

Eurozone

Finland

France

Germany

Hungary

Ireland

Italy

Latvia

Lithuania

Luxembourg

Netherlands

Poland

Portugal

Slovakia

Slovenia

Spain

United States

Here's how users rate Starling Bank's transfer fees.

Transfer speed

Starling Bank transfer speed

Starling Bank offers instant domestic transfers but international transfers generally take 1 - 3 working days to arrive with the recipient.

SEPA transfers are only processed during working hours and national holidays may interfere with processing times.

Here's how users rate Starling Bank online for its transfer speed.

Transfer limits

Starling Bank transfer limits

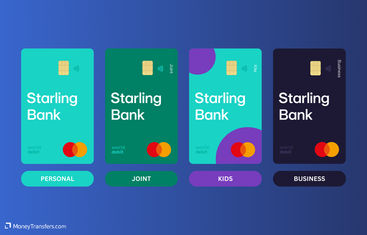

Starling Bank has a daily limit of £10,000 on both Personal and Business Starling Bank accounts.

Here's how users rate Starling Bank online for its transfer limits.

Product offering

Product offering

Here's how users rate Starling Bank online for its features.

Ease of use

Starling ease of use

Starling Bank accounts are entirely managed via the mobile app which can be downloaded for free on iOS and Android.

The application has been awarded 4.8/5 stars by Google Play Store customers and 4.9/5 by App Store: these high scores are higher than many competitors in the financial services sector.

Here's how users rate Starling Bank for its ease of use.

Starling Bank customer support

Designed to function solely as a smartphone application, there is no browser-based interface or physical branch locations, which may be problematic for anyone who prefers in-person or desktop banking.

However, the following customer services are available:

24/7 in-app live chat: also available through the website

Email: Designated customer service email address: help@starlingbank.com

Phone: UK-based emergency helpline for lost or stolen cards: 0207 930 4450

FAQ Help Centre: with transparent and detailed information categorized for Personal, Business, and Joint Account holders

Social media channels: Starling Bank is active on Twitter, Facebook, LinkedIn, Instagram, YouTube and Flipboard

And here's how users rated Starling Bank for its customer support over the past year.

Safety and trust

Starling security & trust

Here's how users rate Starling Bank online for its safety features.

Customer feedback

User feedback

ANALYSIS OF USER REVIEWS

The reviews for Starling Bank are overwhelmingly positive, with users frequently praising the ease of use and efficiency of the banking service.

Customers love the straightforward setup and management of accounts, particularly highlighting the utility of both personal and business banking. Users seem to enjoy the bank for its great customer support, seamless money transfers, and the effective use of the Starling card.

However, some users reported issues with customer service responsiveness and occasional technical glitches.

Here's how users see Starling Bank based on online reviews.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 1 | 1 | 1 | 2 | 1 | 0 | 0 |

Ease of Use | 4 | 5 | 4 | 4 | 3 | 3 | 0 |

Exchange Rates | 5 | 5 | 5 | 5 | 5 | 4 | 0 |

Features | 0 | 5 | 0 | 5 | 0 | 0 | 0 |

Fees | 1 | 0 | 5 | 0 | 0 | 0 | 0 |

International Transfers | 5 | 4 | 4 | 5 | 5 | 5 | 0 |

Limit | 0 | 0 | 0 | 0 | 0 | 5 | 5 |

Safety | 4 | 3 | 4 | 4 | 4 | 5 | 5 |

Speed | 0 | 0 | 0 | 4 | 3 | 4 | 0 |

*0s represent no reviews for the given month.

How to sign up with Starling Bank

Customers will need a government-issued photo ID such as a driver's license, passport, or UK residence card as well as proof of address, such as a utility bill, council tax letter, or a statement from another UK bank.

Opening a multi-currency account

Customers looking to open a Starling account in EUR must first apply for a UK current account.

Once your account has been approved you will be able to add a Euro account through the app.

Opening an account

Registering for a Starling Bank account is easy and the entire process can be completed online by following these 5 steps:

Download Starling Bank app

Download the Starling Bank app by clicking Get the App on the company’s website. Once downloaded you will need to select I’m New to Starling to begin the sign-up process.

Pick an account

You will be able to choose from a Personal or Business account and, after selecting from these options, you will be asked to enter a mobile number.

Once you have entered your phone number, you will receive a 6-digit verification code via SMS and be asked to set up further security authentication in the form of a passcode and fingerprint ID.

Enter your details

Next, you will need to enter your details such as full name, home address (you will need to confirm whether you have resided at this address for more than 6 months) date of birth, and email address.

Once you have completed this section, the Starling app will verify your identity by checking it against a government-issued photo ID and selfie video.

At this point, you will be asked to upload a copy of your photo ID before following the video guidelines using your smartphone camera.

Complete income questionnaire

After verifying your identity, Starling will ask a few questions regarding your total income and where your income comes from.

When you have entered this information you will be asked to review the bank’s terms and conditions, rates, fees, as well as the privacy notice.

If you are happy with the terms outlined in this section, click Submit Application.

Wait for the verification

On average Starling Bank takes 3 - 5 working days to verify your information and approve your application for a Personal or Business account.

Once you receive approval via email you will be able to make an international money transfer.

Transferring money

Navigate to Payments

Open the Starling Bank app and click on the Payments tab: on this page, you will see the Send Money button.

Once you click this there will be two options: Nearby Payments and Foreign Exchange Rates.

You will need to select the latter option to initiate an international bank transfer.

Enter the amount

On the Foreign Exchange Rates page, the total amount You Send in GBP will be displayed, followed by the amount They Receive in the chosen currency.

Underneath this information, the exchange rate and transfer fees will be presented, alongside the Available Delivery Options.

Enter the amount you wish to send in the You Send - GBP section, and this amount will be converted in the They Receive section.

Choose payment method

Select from SWIFT Payment or Low-Cost Payment and select Pay New at the bottom of the page.

This will bring you to the New Payee page where you will be asked for the full name, address, and bank details (including SWIFT/BIC and IBAN/Account number) of your recipient.

Once these details have been entered, click Next and Starling Bank will confirm the recipient’s bank account information which you can choose to Save for future use.

Confirm the details

Enter the amount you wish to transfer from funds available from your bank account balance along with a payment reference, the date you want to send the money, the frequency (one-off payment or every day/week/month), and the Reason for Payment.

Once you have completed each section and are happy with the transfer details, tap Pay.

Send away

After the payment has been submitted you will be able to view the transfer details by tapping the Home tab.

Delivery speed will be determined by the destination country and currency, as outlined in the above section.

International transfer requirements & details

To make an international transfer with Starling Bank, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with Starling Bank and their app.

Starling Bank's SWIFT code is SRLGGB2L.

Starling Bank alternatives

Starling is one of the more popular banking apps in the EEA and the UK (along with Monzo).

They offer a range of features, transparent and low fees, and are easy to use.

However, if you're looking for frequent international transfers, large international transfers, or business banking, we'd suggest the following alternatives.

Starling Bank - More than just another account

It is safe to say Starling Bank exceeds expectations laid out by its banking predecessors, and it is certainly an excellent bank account for anyone who frequently travels.

The secondary Euro account is likely to prove helpful for an array of customers such as international students, expats, or anyone making regular international transfers.

Starling Bank goes above and beyond to provide affordable and accessible international banking services and this extends to the exchange rates and transfer fees they offer.

A bit more about Starling Bank

Can I use starling bank for international bank transfers?

Can I open a Starling Bank account in any country?

Can I use a Starling Bank debit card when travelling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks