Sokin overview

Features | Insight |

|---|---|

Monthly Fee | $0 |

Exchange rate | From 0.3% |

Transfer fees | $0 |

Transaction limits | None |

Multi-currency account | 75+ currencies |

Batch payments | ✅ Up to 5,000 payments |

Expense management | ✅ |

Pay invoices | ✅ |

Receive payments | ✅ |

Marketplace integration | ✅ |

API options | ✅ |

Manage Payroll | ✅ |

ATM Access | ❌ |

Forward Contracts | ❌ |

Video summary

Scoring Sokin

Sokin offers a strong product in terms of core accounts and batch payments. However, the lack of forward contracts might put off companies looking for more access to currency risk tools.

Pros

Cons

Product offering

Sokin's product offering is strong, with 4 local accounts and support for many other currencies. It falls down due to a lack of card support and risk management services. Batch payments of up to 5,000 are a plus however.

Fees and rates

Transfer speed

Ease of use

Safety and trust

Customer feedback

Analysis of online reviews

Online review software is unreliable because it averages out scoring across a company, for decades at a time. To give a clear view of how Sokin is actually performing now, we analysed online review scores from a number of different sources, specifically for the business offering. This chart shows an average score out of 4.47 out of 5, per month, since the start of 2024, when Sokin started gathering reviews. February drops as there were no reviews of relevance online in that month.

Sokin multi-currency accounts

Sokin offers a newer, lesser known, alternative to international finance. The company offers the ability to hold 75 currencies and utilise local accounts. In fact, they offer more local accounts than Revolut Business.

Provider

Supported local accounts and holding currencies

Similarly to Wise Business, Sokin offers the ability to Send/Receive, hold currencies and have a local account.

The options differ depending on the currency, but this freedom is refreshing alongside the likes of Wise Business who have dominated the personal space for many years and have started moving into the business space more recently.

Local accounts with Sokin

For comparison, Wise Business offers 10 local accounts, Airwallex 12 and Sokin 4.

Established money transfer companies that focus on risk management and transfers specifically (like Moneycorp or XE Business) do not offer multi-currency accounts.

Currency | Account details |

|---|---|

USD | Account number |

CAD | Account number, bank code |

EUR | IBAN |

GBP | Account number, sort code |

Holding currencies

Sokin further benefits from the ability to hold up 75 currencies as well.

This means regular transfers in and out can be managed effectively, without a need for conversion.

As a comparison, Wise Business offers around 40 currencies that can be held.

The currencies that can be held are also particularly widespread and all offer sending and receiving ability as well.

These currencies are:

Africa

AOA, XOF, BWP, XAF, CDF, DJF, EGP, SZL, ETB, GMD, GHS, GNF, KES, LSL, LRD, MGA, MWK, MRU, MUR, MAD, MZN, NAD, NGN, RWF, SLL, ZAR, SSP, TZS, TND, UGX, ZMW, ZWL

Asia

BDT, CNH, HKD, INR, IDR, ILS, JPY, JOD, KWD, LBP, MNT, MMK, NPR, PHP, QAR, SAR, SGD, LKR, THB, AED

Europe

EUR, BGN, HRK, CZK, DKK, GBP, HUF, NOK, PLN, RON, CHF, SEK, TRY

North America

CAD, HTG, MXN, USD

Oceania

AUD, NZD

South America

BRL

Other sending currencies

The global coverage offered by Sokin is fantastic in my opinion. The benefit of business transfer companies like Sokin or Wise Business is that they offer the ability to circumvent bank changes for incoming payments as well. The wide range of supported currencies means the Sokin can really aid a business in accessing specific markets.

Expense management

Expense management is listed as an offering by Sokin, but this is more just in the actual payments - which could be for anything.

One of the downsides to an account that offers a lot, is the lack of card use.

Historically, in around 2021, Sokin did seem to offer cards as there are card fees and limit schedules (for Euro in particular). These are no longer active.

Sending and receiving payments

Sokin’s payment platform is simple to navigate, and API integration allows switching between a traditional accounting platform.

This is similar to other fintech’s like Wise Business or Airwallex - although both of these it should be noted are much further in their evolution than Sokin.

That’s not to say it is not useful, but there is an element of work in progress with any new company that should be expected.

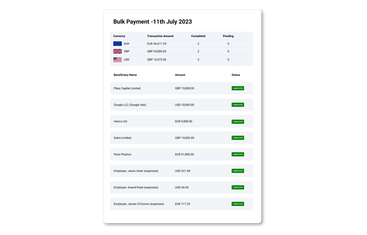

Sending mass or batch payments

Batch payment limit | 5,000 |

Sending batch payments through Sokin offers more scope than most money transfer platforms. As leaders in the business space, Payoneer, Wise Business and Airwallex offer 1,000 transactions per batch payment - Sokin offers 5,000.

This is significantly more when considering the number of international employees or payments could run into the thousands, or even tens of thousands, each month.

With this, recipients can also be added in bulk and tagged appropriately as well.

These bulk payments can also be multi-currency.

All-in-all, Sokin’s workflow for bulk payments is easy to use and great to master.

Sending through an integration

Receiving money

Incoming business transfers into a Sokin account can happen in a couple of ways.

Into an account

Any of the multi-currency business accounts on offer can receive money into them.

If this is one of the currencies that can be held it will remain in the account. If this is one of the currencies which needs to be converted, this will happen upon receipt.

Via a payment gateway

Specific to those selling products, Sokin offers a payment solution. This is similar to something like Stripe and falls into the realm of cross border payments more than money transfers.

Because of the eradication of international card fees, the cost for vendors is 1.2% per transaction. For comparison, the Airwallex fee for international card transactions is 3.15% + $0.20.

This gateway can be added to a site and payments in all receiving options offered by Sokin can be accepted. These funds are then transferred to the accessible multi-currency accounts.

This gateway is supported by Open Banking.

Interest on balances

Standard interest on balances with Sokin is 1% in USD, EUR, and GBP accounts. This is anything Sokin users put into a Premium Wallet.

For 60 day periods on these accounts customers can increase this to 3%. This can be renewed every 60 days. This is anything users put into a Boost Wallet.

The difference here is the difference between a standard wallet or boost wallet. The Premium Wallet can be accessed any time, anything in a Boost Wallet only becomes available once the 60 days are up.

As such, businesses should be careful to not lock finances into a Boost Wallet that may be needed.

Account options

Within Sokin there are not any account options. There are no setup fees and no monthly costs either.

Sokin will make its money through exchange rates on top of a transfer.

The simplicity of the offering is a decent feature. The biggest difference is the Premium Wallet and Boost Wallet. The former offers 1% interest and the latter 3% for 60 days.

Feature | Business |

|---|---|

Access to 100+ currencies | ✅ |

Access to local accounts | ✅ |

Earn interest on balances | ✅ |

Multiple user logins | ✅ |

Make batch payments | ✅ |

Receive payments from marketplaces | ✅ |

API access | ✅ |

Accounting software integration | ✅ |

Setup fees | None |

Compare Business Multi-Currency Business Accounts

Selecting a multi-currency account for business can feel a little tricky with different options, local accounts and features. We've broken down the top accounts across the industry at the moment.

Fees and rates when using Sokin

Sokin is fee-free for most things, and uses the exchange rate offered as its core financial income.

Provider

Interestingly, the terms and conditions for Sokin are missing the link for fees - I have contacted them about updating this for users. :

https://sokin.com/wp-content/uploads/2024/05/Plata-Capital-Terms-and-Conditions.pdf

4.1 You agree to pay the Fees as detailed in the Fee Addendum in addition to any

applicable supplementary Fees as detailed on the Sokin website which can be found

at [Link].

Service | Sokin |

|---|---|

Domestic Transfers | Fee free |

International Transfers | Fee free |

Currency Conversion Fee | From 0.3% |

Receiving Fee | 1.2% |

Holding currencies | $0 |

Card Payments | Not possible |

Monthly Fee | $0 |

Setup Fee | $0 |

Payment Tracking | $0 |

Mass Payout | $0 (currency conversion applies) |

Accounting Integrations | $0 |

Additional Fees | Not applicable |

Transfer speeds with Sokin

Provider

Sokin service and account management

Customer service options

Support with Sokin feels lacking in comparison to other providers and the site is very much driven to attract new customers only.

There’s not a huge amount of help for things like rates or queries ahead of sign ups. With this, there are no phone numbers and no email addresses either.

The only support options widely available on the site is a contact form.

Phone support

Availability | Not available |

|---|---|

Response time | N/A |

Languages | N/A |

Whilst there isn’t a clear email support option, it is possible to contact Sokin through a form and have them come back to you. We tested this with a few queries on opening accounts.

Availability | 24/7 |

|---|---|

Response time | 2 days |

Using Sokin

Using Sokin

We testing the following for ease of use

Invoicing

Integrations

Adding multi-user access for employees, roles and permissions

Paying-in and withdrawing funds

For each option the process was simple and easy to follow, Wise is very much a platform where you can see within one or two actions, how to achieve what you need to achieve.

Eligibility and sign up

The sign process for Sokin doesn’t throw up any unexpected hurdles, but you need to expect to have to provide details for KYC and await verification on the account.

Initially, just register to sign up on the site.

Determine local accounts

Wait for verification

Safety and regulation

Provider

Sokin is the trading name of Plata Capital Ltd.

Its registered office is at Plata Capital Limited c/o Mishcon De Reya, Africa House, 70 Kingsway, London, United Kingdom, WC2B 6AH. Registered Number 10958599.

The company is registered with the Financial Crimes Enforcement Network (FinCEN) Department of the Treasury as a Money Service Business (MSB) with the registration number 31000186536142.

There are also different types of regulated in place in Europe, the UK, Canada, Australia, Singapore, India, Brazil and Mexico.

Safety measures

Sokin has some security measures in place, notably around fraud prevention. These include regular audits of accounts and looking for changing trends and patterns on accounts.

Not keen on Sokin?

If you are unsure of whether Sokin is for you, here's some alternatives.

User feedback of Sokin

Provider

Customer feedback and user reviews

Sokin is one of the newer providers of business transfer services on the market and the number of TrustPilot reviews available highlight this (17 in total). This being said, these are largely positive.

Sokin user feedback

Comments

Anonymous

Still a charge for international transfer of money.