How to Get British Pounds in the USA

If you’re planning to get away to Britain, you’ll need to exchange your US dollars for pounds. Avoid the fees by planning ahead and avoiding emergency exchanges at the airport. Find the best, cheapest way to get pounds in the US.

- Over 16 million customers

- Multi-currency account available

- No hidden fees

Wise is the fastest and cheapest way to get GBP in the US.

To get British pounds in the US, options include multi-currency accounts (Wise or Revolut) which allow you to exchange and store GBP at low fees, and prepaid travel cards for convenience. Avoid costly exchanges at airports or tourist areas.

Best places to get pounds in the USA

Before you buy your pounds, you should make sure you’re getting the best deal. To save money, consider using cheaper ways to exchange currencies, such as opening a multi-currency account.

Best way to save on fees - Wise and Revolut multi-currency accounts

Best alternative - Prepaid travel cards

Most overrated - Local banks and credit unions

Best for emergencies - Banks and ATMs abroad

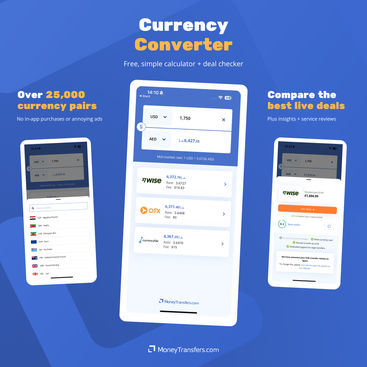

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Open a multi-currency account

The best and cheapest way to exchange your dollars for British pounds is through multi-currency accounts. With the right service, you can open an account, purchase the amount of pounds you need, and store them in your account.

Wise and Revolut offer the best multi-currency accounts in 2026. You can open an account online. Exchange the pounds you need and save them for your vacation.

The Wise multi-currency account lets you purchase pounds and hold them ready to spend. You’re charged the mid-market exchange rate with a fixed fee, and you can order the Wise payment card for a one-time fee of $9.

If you have enough pounds in your account, you can use the card to make payments in the UK without paying any fees for foreign transactions. You can also download the card to send money through Google Wallet or Apple Pay for easy mobile payments.

Revolut can store up to 28 different currencies in an account at once. Exchange the amount of pounds you’ll need for your holiday and they’ll be ready to spend when you arrive. Revolut also has a free card allowing you to spend like a local in the UK, provided you gave enough pounds in your account.

Tip: Exchange money with Revolut during the week for the best deal, as they add a 1% markup to the exchange rate at weekends.

Get a travel money card

Travel money cards are a good way to exchange dollars for pounds, although they can be more expensive than multi-currency accounts. Some cards, like Currensea, link directly to your bank account and deduct payments as you make them. Multi-currency accounts are usually cheaper for money transfers and conversions because they cost less than making multiple exchanges before your holiday.

Alternatively, prepaid travel cards are available, which you can preload with the amount of pounds you’ll need before you travel. Companies like Mastercard offer prepaid travel money cards so you can save on exchange fees by making a single payment.

Use local banks and credit unions

Local banks are often used to exchange money, but they don’t offer the best exchange rate. You’ll find a better deal from multi-currency accounts. Many banks and credit unions claim ‘fee free’ exchanges, but they're often still costly due to higher exchange rates.

Use a foreign currency exchange

Foreign currency exchanges are popular for exchanging money, but they usually charge higher rates than banks. As we explained earlier, a cheaper way of getting pounds is through a multi-currency account.

Tip: Check the exchange rate before you buy

A good way to make sure you’re getting a good deal is to check the current exchange rate before making the purchase. If the current exchange rate is much lower than the one being offered by your bank, you’ll probably find cheaper options elsewhere.

| USD | GBP Price |

|---|---|

| 1 USD | 0.75 |

| 5 USD | 3.74 |

| 10 USD | 7.47 |

| 20 USD | 14.95 |

| 1000 USD | 747.29 |

| 2000 USD | 1494.58 |

| GBP | USD Price |

|---|---|

| 1 GBP | 1.34 |

| 5 GBP | 6.69 |

| 10 GBP | 13.38 |

| 20 GBP | 26.76 |

| 1000 GBP | 1338.17 |

| 2000 GBP | 2676.34 |

Places to avoid when buying British pounds

It’s always better to plan ahead and exchange your money before you travel. Last minute exchanges at the airport or in tourist hotspots are very expensive. Here are some of the places to avoid when buying British pounds.

Currency Exchange at the Airport

Airports have a high exchange rate, so they're not ideal for converting dollars to pounds. Condé Nast Traveler says airport currency exchanges charge fees of $5 to $15, and the exchange rate is usually 7% to 15% higher than the mid-market rate.

Airport exchanges for free? Not quite!

Airports may advertise free currency exchanges, but these don't include the huge markups they add to their exchanges. Most airport exchange rates are between 7% and 15% higher than the usual bank rate.

Foreign currency exchanges in tourist-dense areas

Lots of tourists that don’t prepare in advance find they need to exchange money quickly. This is why currency exchanges in tourist dense areas can charge high fees and high markups on exchange rates. If you need pounds, try to exchange your money before you travel to avoid getting caught by high fees.

Visiting banks abroad

Foreign banks can exchange currency for you, but they usually charge a fee and have high exchange rates. Some banks may also charge for helping non-account holders, so it’s best to avoid this wherever possible.

Exchanging US dollars for British pounds - better deals are out there for those that plan

When you go to the UK, you’ll need to have some British pounds in the bank. If you open a multi-currency account before you travel, you can exchange the money for a low fee and spend without worries when you get to the UK.

Explore more topics

FAQs

What’s the best place to get British pounds before traveling?

What’s the best place to get British pounds after traveling?

Should I buy British pounds when I get to the airport?

What else do I need to travel to the UK?

Can you get British pounds at the US Post Office?

Can you get British pounds from US banks?

How far in advance should I buy British pounds for my trip?

What is the best way to pay when I'm in the UK?

How much cash in British pounds should I take?

Should I keep receipts for currency exchanges in the UK?

Are there fees for using my card in the UK?

How do I check the exchange rate I'm getting for USD/GBP?

What's the best way to exchange any leftover British pounds?

Related Content

Contributors

.jpg)