Find and Calculate SWIFT Codes

SWIFT codes are used to identify banks and financial institutions. These are used in 200+ countries for global money transfers.

Here you'll find a collection of our SWIFT guides. As well as, we'll explain what SWIFT is, how it works, how to find and check it, and when you will be needing it.

Find SWIFT/BIC codes

SWIFT codes are universal, 8-11 character codes used to identify banks and financial institutions (including the country, bank location, and branch number) when sending and receiving money.

SWIFT codes operate on a SWIFT network (The Society for Worldwide Interbank Financial Telecommunication Network) that provides a secure way for banks to communicate between themselves across the world.

What about BIC codes?

BIC code is used interchangeably with SWIFT code, as they are both doing the same thing.

BIC stands for Business Identifier Code - replaced from Bank Identifier Code in 2009 to reflect the growing number of non-bank financial services.

How the SWIFT network works

The SWIFT network is essentially a secure messaging system for banks to communicate with each other across the world.

Rather than being used to transfer money directly, the SWIFT network is used to communicate information between banks using SWIFT codes.

Isn't that the same as IBAN?

SWIFT codes identify the receiving bank that needs to be sent transfer instructions, while IBAN formats are used for an actual transfer of funds.

Here's a general overview of how the SWIFT network processes the transactions:

Customer Request

Transaction Details

SWIFT Message Format

Unique Identifier

Secure Network

Intermediary Banks

Recipient Bank

Verification

Nostro/Vostro Accounts

Central Banks/Clearing Houses

Credit to Recipient

Confirmation

Customer Notification

Who uses SWIFT codes?

The SWIFT network is used in over 200 countries and has gradually expanded over the years, with a reported 10 million messages sent via the SWIFT network in 1979, compared to more than 44.8 million in 2022.

Here's a list of all countries using the SWIFT network

Swift can sanction countries, preventing them from using the SWIFT network. Russia, Belarus, Iran, and Israel are a few examples of countries that were banned.

Here's a full list of countries baneed from the SWIFT network

In addition, the SWIFT network is utilized by more than 11,000 institutions of the following kind:

Commercial Banks: These are the most common users of the SWIFT network, facilitating international trade and payments. For example: JPMorgan Chase, Citibank, HSBC, Deutsche Bank, and Bank of America.

Central Banks: Central banks use SWIFT for interbank communications, foreign exchange, and monetary policy operations. For example, the Federal Reserve (USA), European Central Bank, Bank of England, and Bank of Japan.

Securities Dealers: These institutions use SWIFT for trading and clearing securities, including stocks and bonds. For example, Goldman Sachs, Morgan Stanley, and Barclays Investment Bank.

Clearing Houses: Organizations that facilitate the clearing and settlement of financial transactions use SWIFT for secure messaging. For example, Euroclear, Clearstream, and Depository Trust & Clearing Corporation (DTCC).

Asset Management Companies: They use SWIFT for fund administration, custody, and management services. For example, BlackRock, Vanguard, and Fidelity Investments.

Broker-Dealers: These firms use SWIFT to communicate with clients and other financial institutions for trade settlements. For example, Charles Schwab, E*TRADE, and TD Ameritrade.

Corporate Treasury Departments: Large corporations use SWIFT to manage liquidity, foreign exchange, and cross-border payments. For example, General Electric, Microsoft, and Toyota.

Foreign Exchange and Money Market Brokers: These brokers use SWIFT for transactions in the foreign exchange and money markets. For example, ICAP, Tullett Prebon, and BGC Partners.

Insurance Companies: They use SWIFT for transferring premiums and claims payments internationally. For example, AIG, Allianz, and AXA.

Custodian Banks: These banks hold securities on behalf of clients and use SWIFT to manage these assets. For example, BNY Mellon, State Street, and Northern Trust.

Payment Service Providers: They use SWIFT to facilitate international money transfers and payments. For example, PayPal, Western Union, and Wise.

Credit Unions: Some credit unions use SWIFT for international payments and member transactions. For example, Navy Federal Credit Union, and Alliant Credit Union.

Financial Market Infrastructures: Including stock exchanges and payment systems that use SWIFT for secure communication. For example, the New York Stock Exchange (NYSE), and the London Stock Exchange (LSE).

When would you need to use the SWIFT codes?

SWIFT/BIC codes are required almost any time money is transferred internationally to a bank account.

Of course, if you are sending money to be picked up as cash, mobile money, or via an alternative payment method, you may not need a SWIFT code for your recipient.

SWIFT/BIC codes are used by financial services outlined above to identify exactly where your money needs to be sent to when sending money internationally, so will generally be required any time you are transferring funds directly to your recipient’s bank account.

The SWIFT system, though secure and convenient for money transfers, can also be relatively slow to transfer funds.

For international transfers, you’re usually looking at a wait of 3 - 5 working days, which can work out as much longer if you are sending around a weekend or bank holiday.

Many money transfer providers bypass the SWIFT network which enables them to process international transfers within minutes, rather than days.

When is a SWIFT/BIC code required?

You may be asked for a SWIFT code from your bank or money transfer provider if you are sending money internationally.

For example, a SWIFT/BIC code will be used to process your transfer if you are making an international wire transfer or SEPA payment.

Finding your SWIFT code

If you’re sending or receiving an international payment, you’ll likely be asked for your SWIFT/BIC code, especially if you are using your bank to initiate the transfer.

You can find your SWIFT/BIC code by:

Find your SWIFT code by bank

Search the list below to quickly find the SWIFT code for your bank.

Use our SWIFT codes calculator

Simply fill in the details below and our SWIFT codes calculator will generate it for you based on your details.

Calculate an IBAN

Alternatively, you can find it in the following places:

Bank statement

Check your bank statement, as SWIFT codes are often listed there.

Online banking

Log in to your online banking profile. Navigate to the section for international transfers or account information where the SWIFT code might be listed.

Bank's website

Visit the official website of your bank. Look for sections related to international services, contact information, or frequently asked questions (FAQs). The SWIFT code is often listed there.

Contact your bank

Call your bank's customer service or visit a local branch. The bank staff can provide you with the SWIFT code.

Bank documents

Check any official documents provided by your bank, such as account opening documents, international transfer instructions, or welcome packs.

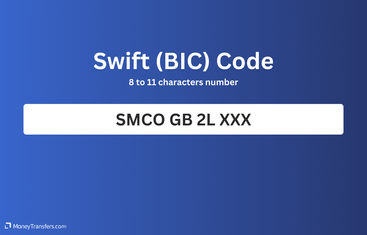

Here's an example of a SWIFT code, so you know what to look for:

Format of a SWIFT/BIC code

A SWIFT/BIC is an 8-11 character code that identifies your country, city, bank, and branch.

Bank code

A-Z4 letters representing the bank. It usually looks like a shortened version of that bank's name.

Country code

A-Z2 characters made up of letters or numbers. It says where that bank's head office is.

Location code

A-Z0-92 characters made up of letters or numbers. It says where that bank's head office is.

Branch code

A-Z0-93 digits specifying a particular branch. 'XXX' represents the bank’s head office.

Getting the right SWIFT code

You must double-check you have the correct SWIFT code before you start your transfer.

Providing the incorrect code could cause long delays to your transfer, make your payment bounce back to your account, or code even result in the transfer being deposited in the wrong account - which once completed, can be very difficult to reverse.

You can easily check your swift code using our SWIFT checker below:

Check your SWIFT code

Fees for using SWIFT codes

If you are using your bank to send an international transfer, you will likely be charged a fee for this service.

These fees will often be charged by both the sending and the receiving bank and can range from anywhere between $10 - $50 and upwards.

To save on fees, you can use a money transfer provider. Money transfer services will almost always offer more competitive exchange rates, have lower fees, and should be able to process your transfer almost instantly.

To get started, use the form below to get the best rates for your transfer.

Compare money transfer providers

A bit more on SWIFT codes

What are BIC codes?

Is there any difference between SWIFT and BIC codes?

Do I need a SWIFT code or IBAN to send money?

How does SWIFT make a profit?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More SWIFT/BIC transfer guides

Sources & further reading

Contributors