IBAN Transfer Guides

An IBAN is a unique identifier for your bank account, which helps banks identify each other.

It is often used for international money transfers, especially to Europe.

Here we've collected top resources on using IBANs for international transfers. As well as, we'll explain what an IBAN is, how to find and validate it, and where to find it.

IBAN explained

An IBAN (International Bank Account Number) is a code of up to 34 letters and numbers used as a unique identifier for your bank account.

IBANs are used by banks worldwide to process international payments, with this unique combination of characters providing a code that pinpoints your country, bank, and bank account when sending or receiving money.

When you will need an IBAN

IBAN codes are often required if you send money internationally directly to someone’s bank account.

Banks use them to identify the location, bank, and bank account a payment needs to be made to, by providing a set format of information.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

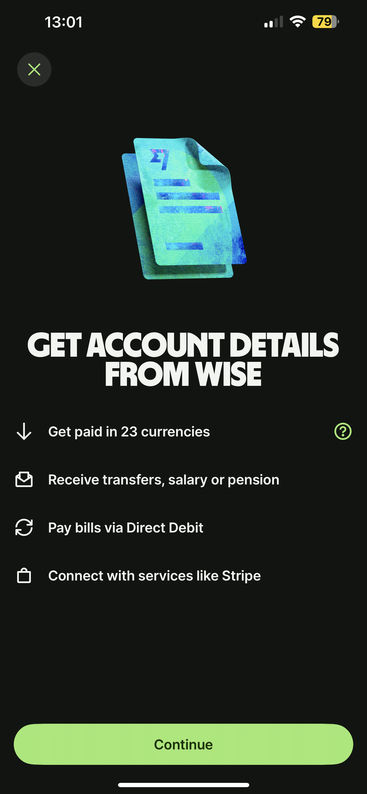

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

When would you need your IBAN code?

You will typically need to provide IBAN when making or receiving payment within the countries that use the IBAN system.

Here are a few common cases where you will need to provide it:

International bank transfers

If you're sending money to someone in a country that uses IBANs, you'll need the recipient's IBAN to ensure the funds are credited to the correct account.

SEPA payments (within EU/EEA)

IBAN is required for payments within the Single Euro Payments Area (SEPA), which includes most EU and EEA countries. This ensures seamless cross-border transactions within these regions.

Setting up direct debits

In some countries, IBANs are used for setting up direct debits or recurring payments. The IBAN ensures that payments are debited from the correct account.

Receiving payments from abroad

If you're receiving payments from abroad, providing your IBAN ensures that funds are deposited directly into your account without delays or errors.

Paying bills internationally

When paying bills or invoices to suppliers or service providers in countries that use IBANs, you may be required to provide your IBAN to facilitate the transaction.

IBANs are not always needed, however, some countries require the IBAN to be provided (it's mandatory).

List of countries that require the use of IBAN for intenratinoal wire transfers

IBAN formatting

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

Recognizing your bank details

Your IBAN will be in the same format as it is on your bank details, so it’s usually fairly easy to tell if you have the right IBAN for your account.

IBAN vs SWIFT: What’s the difference?

When dealing with international money transfers, you’ve probably come across the terms ‘IBAN’, ‘SWIFT’, and ‘BIC’, and wondered: what’s the difference?

In a nutshell:

An IBAN: an IBAN is used to identify the specific account to be used in an international transaction.

A SWIFT/BIC: a SWIFT code is used to identify a specific bank for an international transfer but not the account itself.

Here's a summary of the two:

IBAN | SWIFT/BIC | |

|---|---|---|

Short for | International Bank Account Number | Society for Worldwide Interbank Financial Telecommunication or Business Identification Code |

Characters | Letters and numbers | Letters and numbers |

Length | Up to 34 characters | 8 to 11 characters |

Purpose | Used to identify specific bank accounts around the world | Used to identify specific banks around the world |

Example | GB33BUKB20201512345678 | BUKBGB22 |

Both codes are therefore essential elements containing vital information for international payments but serve different purposes.

More on BIC/Swift codes

How IBANs work

IBAN codes are often required if you are sending money internationally directly to someone’s bank account.

If you are making an international payment where an IBAN is required, you should be able to organize your transfer via your online banking, app, or even by visiting your local bank branch.

If you are required to provide an IBAN for your recipient, you will probably also need to supply:

Your recipient’s name and address

The name and address of your recipient’s bank

Your recipient’s BIC/SWIFT code

The sum you need to transfer

The currency you want your international payment converted into

These details will all enable your bank to convey your transfer instructions to the recipient bank accurately and securely, with an international transfer usually completed within 3 - 5 working days.

Finding your IBAN

If you are receiving an international payment, you may be asked by the sender for your IBAN.

You can locate your IBAN in any one of the following ways:

Using our IBAN calculator

IBANs follow a set format in every country they are used in, so it’s possible to find your IBAN via an IBAN calculator if you don’t already have one.

An IBAN calculator will require your home country, bank account number, and sort code to generate your IBAN.

Calculate an IBAN

Alternatively... You can find it here:

Online banking

Your IBAN will be displayed under your account details in your online account.

Bank statement

Your IBAN will be printed on your bank statement, usually underneath your account number and sort code.

Your branch

The cashier at your local branch will be able to tell you your IBAN.

Getting the right IBAN code

If you are sending or receiving an international payment using the services of your bank, you must provide the correct IBAN.

Even one incorrect digit or character could cause your transfer to bounce back to your account, be severely delayed, or even be deposited in the wrong account - which is extremely difficult to reverse once completed.

Once you have generated the IBAN code, use our validator below to validate it:

Validate IBAN

Always double-check

You must double-check you have the right details when sending money, and have provided the correct details when receiving a payment.

Countries that use IBANs

If you are sending money to any country in any of the regions listed below, you will likely need to provide an IBAN code.

To make matters easier we have a full list of countries that use IBAN with examples:

Do IBANs look the same in every country?

IBAN format and structure differ from country to country (as you can see in the aforementioned examples above).

IBAN details for every region are described in the official IBAN registry.

Online resources such as the official IBAN Structure and Examples guide, provide a list of examples of how each country formats these codes.

The accuracy of an IBAN is crucial for anyone sending money overseas using an International Bank Account Number.

For this reason, IBAN checkers are an invaluable tool that can be used to verify banking information.

Fees for using IBAN's

If you are looking for an IBAN because you are sending money abroad, it’s worth considering all your options for international transfers and what overall charges you are facing.

While banks are a convenient way of sending money internationally, they are rarely the cheapest or most efficient option.

An international transfer can vary greatly in fees depending on what provider you use, but will almost always be cheaper compared to a bank.

The main fees to be aware of are transfer fees, hidden fees, and the exchange rates mark-up.

In general, banks are known to have less competitive exchange rates and higher transfer fees than most money transfer operators.

Additionally, with some transfer providers, you don’t need to go through the hassle of providing multiple details and bank codes for your recipient.

You also have the option of sending funds via cash or even paying into a mobile eWallet using P2P transfers (via the recipient’s phone number or email address).

Regardless of how you're planning to send money abroad, we always recommend comparing your options to get the best deal at the time of transfer.

Find out how much you could save on your money transfer today

A bit more about IBANs

Why do I need an IBAN?

Do I need IBAN and SWIFT code to send money interniatonally?

do you need IBAN to send money to the US?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources & further reading

Contributors