How to Get Canadian Dollars in the US with the Lowest Fees

Get your travel plans off to the best start by exchanging your Canadian dollars before you leave and avoiding the high fees of the airport. Find the best, cheapest way to get Canadian dollars in the US.

- Over 16 million customers

- Multi-currency account available

- No hidden fees

Wise is the fastest and cheapest way to get CAD in the US.

Best places to get Canadian dollars in the USA in 2023

Before exchanging your American dollars for Canadian dollars, you should make sure you’re getting the best deal. Exchanging dollars using traditional methods can be costly. But using online multi-currency accounts is easier and cheaper for spending money abroad.

Best way to save on fees - Wise and Revolut multi-currency accounts

Best alternative - Prepaid travel cards

Most overrated - Local banks and credit unions

Best for emergencies - Banks and ATMs in Canada

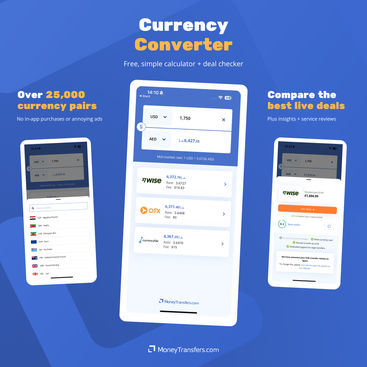

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Open a multi-currency account

Multi-currency accounts are the best, cheapest way to buy the Canadian dollar. With a multi-currency account, you can buy as many Canadian dollars as you need and keep them stored in your account, ready for your holiday.

Wise and Revolut are well ahead of their nearest competitors. You can open an account online, exchange your dollars as needed, and store them in your account, ready for your trip.

The best way to get Canadian dollars in the US is through a Wise multi-currency account. It allows you to purchase Canadian dollars and hold them in your Wise account, ready to spend.

Opening a Wise account is easy, you just download their app and follow the instructions. You can then order a Wise card for a one-time fee of $9, and use it to make payments from your account. You can use your card in Canada with no foreign transaction or exchange fees, provided you have enough Canadian dollars in your account. If you don’t have enough of the local currency in your account when you make the payment, you’ll be charged a conversion fee to exchange the currency.

You can also use a digital version of the card via Google Wallet or Apple Pay, which can help with contactless payments.

Revolut

Revolut also offers a great multi-currency account. A Revolut account is able to store up to 28 different currencies at once. Exchange the amount of Canadian dollars you need, and they’ll be saved to your account.

Note: Exchanging money with Revolut is more expensive at the weekend, when a 1% markup is added to the exchange rate. For a better deal, always exchange on a business day.

Revolut offers a free card. You can use it abroad without extra fees, if you have enough Canadian dollars to pay for your purchases.

Want to know more about Wise and Revolut?

We run a side-by-side comparison of the two services to help you decide which is better for you: Wise or Revolut?

Get a travel money card

Travel money cards are a popular choice for exchanging Canadian currency in the US, despite being more expensive than multi-currency accounts. Some cards, like Currensea, link directly to your bank account and deduct payments as you make them. As the card exchanges the money at point of sale, the exchange rate is what makes this more expensive.

You can also get prepaid travel cards, which need to have the correct amount of travel money loaded onto them before they can be used. Lots of global companies like Mastercard offer prepaid currency cards, and you’ll get a lower total markup as you’re only exchanging the money once.

You can use travel money cards to exchange dollars for Canadian dollars. However, the rates are often higher compared to multi-currency accounts. Overall, Revolut and Wise offer more value for money.

Use local banks and credit unions

It’s more expensive, but local banks and credit unions will also be able to exchange money. You’ll be able to get the Canadian dollar at your local bank at a higher exchange rate, so you’ll be better off opening a multi-currency account.

Use a foreign currency exchange

Exchanging money at foreign currency exchanges is popular, but it's usually more expensive than banks due to high rates. If you’re looking for a cheap way to exchange your dollars for Canadian dollars, you’ll be better off with a multi-currency account.

Tip: Check the exchange rate before you buy

A good way to make sure you’re getting a good deal is to check the current exchange rate before making the purchase. If the current exchange rate is much lower than the one being offered by your bank, you’ll probably find cheaper options elsewhere.

Places to avoid when buying Canadian dollars

Generally, the more traditional methods of exchanging money are the most expensive, and still the most popular. To get a good deal, you need to shop around and find the best exchange rate. Prepare ahead of time - don’t wait until you’re at the airport.

Here are some of the places you should avoid when buying Canadian dollars.

Currency Exchange at the Airport

Last minute attempts to buy Canadian dollars at the airport exchange offices are very expensive. Condé Nast Traveler says airport currency exchanges charge fees of $5 to $15. The exchange rate is usually 7% to 15% higher than the mid-market rate.

Exchange foreign currency for free at the airport? I don't think so!

Even if airports don't apply a 'fee' to their exchanges, they add huge markups to their exchange rates, usually between 7% and 15% higher than the standard bank rate.

Foreign currency exchanges in tourist-dense areas

Tourist-dense areas are full of people that are looking for the local currency. As a result, currency exchanges in such locations can charge excessive fees and rates.

If you need Canadian dollars, make sure you’re not caught out by high fees in last-minute emergencies.

Visiting banks abroad

You can always visit a bank while you’re on holiday, but it’s expensive, and not the kind of thing you want to be thinking about while you’re away. Some banks may also charge for helping non-account holders, so it’s best to avoid this wherever possible.

Exchanging US dollars for Canadian dollars - plan ahead to get more for your money

Exchanging your money is one of the first things to consider when you’re planning your holiday. The best deals on your Canadian dollars are easy to find if you plan ahead, last minute exchanges can leave you out of pocket.

We recommend opening a multi-currency account in advance of your trip. With the right provider, you’ll get lower exchange rates with no added fees.

Explore more topics

FAQs

What’s the best place to get Canadian dollars before traveling?

What’s the best place to get Canadian dollars after traveling?

Should I buy Canadian dollars when I get to the airport?

What else do I need to travel to Canada?

Can you get Canadian dollars at the US Post Office?

Can you get Canadian dollars from US banks?

How far in advance should I buy Canadian dollars for my trip?

What is the best way to pay when I'm in Canada?

How much cash in Canadian dollars should I take?

Should I keep receipts for currency exchanges in Canada?

Are there fees for using my card in Canada?

How do I check the exchange rate I'm getting for USD/CAD?

What's the best way to exchange any leftover Canadian dollars?

Related Content

Contributors

.jpg)