Airwallex international business offering

Features | Insight |

|---|---|

Monthly Fee | $0 |

Exchange rate | From 0.5% |

Transfer fees | $0 (from $10 for SWIFT) |

Multi-currency account | 12 local accounts |

Batch payments | ✅ Up to 1,000 |

Expense management and tracking | ✅ |

Pay invoices | ✅ |

Receive Payments | ✅ |

Marketplace integration | ✅ |

API options | ✅ |

Manage Payroll | ✅ |

ATM Access | ❌ |

Forward Contracts | ❌ |

Scoring Airwallex

When scoring Airwallex as an international business provider we factored in the product offering, speed of sending money, cost, safety measures in place and customer satisfaction.

Pros

Cons

Product offering

Airwallex offers one of the most comprehensive money transfer offerings for business.

Fees and rates

Transfer speed

Transfer limits

Ease of use

Safety and trust

Customer feedback

Online review software is unreliable because it averages out scoring across a company, for decades at a time. To give a clear view of how Airwallex is actually performing now, we analysed online review scores from a number of different sources, specifically for the business offering. This chart shows an average score out of 5, per month, since the start of 2023.

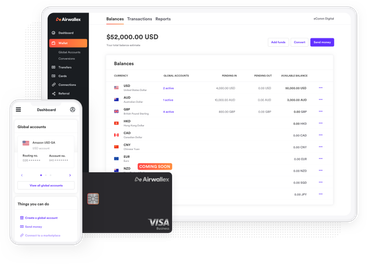

Airwallex multi-currency accounts

At the core of any international business transfer product is the ability to use local accounts for banking. Airwallex offers 12, the next nearest on the market would be the Wise business account with 10. This includes 130 supported payment currencies and global currency cards for spending and tracking expenses. All-in-all, it’s a well rounded option, built for international transactions.

Product offering

Supported currencies and countries

Local accounts with Airwallex

Airwallex covers the countries you would expect from a multi-currency account. Here is a breakdown of what you get per account.

Country | Account details |

|---|---|

Australia | Account number, BSB code |

Canada | Account number, Transit number, Bank number |

Denmark* | Account number, SWIFT code, IBAN |

Europe (SEPA) | IBAN, SWIFT Code |

Hong Kong SAR | Account number, Bank code, SWIFT code |

Indonesia | Account number |

Japan | Account number, Bank code |

New Zealand | Account number, Bank code, Branch code |

Poland | Account number, SWIFT code, IBAN |

Singapore | Account number, Bank Code, Swift Code |

United Kingdom | Account number, IBAN, Sort code |

United States | Account number, ACH routing number, Fedwire routing number, SWIFT code |

*Denmark also offers the same access (in Denmark) to the following currencies: CZK, CHF, GBP, HUF, MXN, NOK, PLN, RON, SEK, ZAR.

Offering these accounts means Airwallex has the strongest global currency account option on the market at the time of writing. In fact, they offer local accounts in North America, Europe, Asia, Africa and Oceania.

All in all, where the Euro covers a lot of ground, this offers customers the ability to operate in over 40 countries using local accounts.

Sokin offers access to 75 local currencies through accounts, but its offering does stop short of what Airwallex can provide a business at scale.

With these accounts the advantages include making batch payments, taking payments, setting up direct debits and managing exchange rates. More than any other provider, it feels like Airwallex offers multi-currency banking for businesses.

Additional currencies supported

As well as supporting a huge number of global accounts, there’s also options to hold, send and receive in around 130 currencies with Airwallex. Most notably these give access to African countries and currencies like the West African Franc and Nigerian Naira.

Whilst you will pay slightly higher exchange rates of 1% above the mid-market rate, and some transactions could take up to 5 days, this access is great for tapping into emerging markets.

Limits

The limits on processing currency transfers through Airwallex are nice and simple:

The maximum you can convert and send is $5 million per conversion.

The minimum is $10.

If as a business, there is a potential to need to go above or below this - then it’s possible to contact Airwallex customer service and amend these amounts.

Outside of this there are no limits on the amount you can deposit or collect within an Airwallex account. Again, there is no other provider offering this level of service within the international fintech space.

Cards and virtual cards

Airwallex offers access to multi-currency cards for individuals, or shared cards for multi-person use. These cards are then hooked up to your Airwallex system and can be managed, have funds added and even be blocked or re-issued as needed.

All cards are free at the point of issue and currency conversion rates apply if you spend outside of the account the card is issued from.

This being said, with a huge amount of local accounts available - effective planning essentially eradicates the issue.

Should you need to convert at the point of purchase, the exchange rate will be 0.5% above the mid-market rate for HKD, CNY, AUD, EUR, GBP, CAD, SGD, CHF, NZD and JPY.

All other currencies are charged at 1.0% above the mid-market rate.

At these prices, this is still a good deal.

Notably, Wise Business is a little cheaper at the mid-market rate with a 0.33% fee, but lacks in all areas compared to the Airwallex offering.

Spending in USD also offers 1.5% cashback in some places as well.

Expenses management

Expense management with Airwallex is offered in real time, and offers both ends of the spectrum depending on business needs.

On the one hand you have what we’ve mentioned above with the ability to issue cards and add transactions. These can be assigned in the account for review or approval and then linked to accounting software.

The other end is the ability to input and submit payments for review and eventual reimbursement of employees. These reimbursements can also come from local bank accounts to the employee and as such save on conversion costs.

Expenses on both ends of the scale can also be grouped for things like a total cost of a trip or ongoing ad spend in a specific country.

A nice touch is the ability to add multi-layered approvals for expenses - so line managers can hold one budget, and split this between their own team as appropriate.

Integrations

Type | Software |

|---|---|

Accounting | Xero, QuickBooks, Asperato, ApprovalMax, Odoo, Sage |

Website management | NetSuite, WooCommerce |

Marketplace | Amazon, Lazada, Magento, Shopee, Shopify, Shoplazza, Fnac |

Sending and receiving payments on Airwallex

Sending and receiving payments on Airwallex is at the heart of each part of its product offering. To strip it back, using a card in a store in another country is sending a payment to the company from your account.

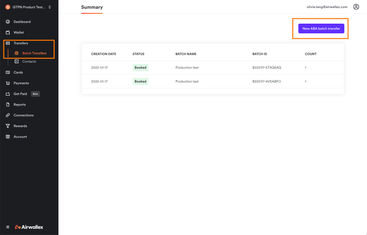

Making batch payments

Batch payment limit | 1,000 recipients |

|---|

Batch payments with Airwallex can be utilised in a way that allows you to template based on common themes in the business. This is worthwhile setting up for regular payments.

This can then be managed from a specific global account as needed. In essence, whilst you are sending an international transfer - you’ll actually be executing local transfers at an international level.

Sending money

Receiving money

Exchange rates and forward contracts

Exchange rates are competitive with Airwallex but there is no way to agree a forward contract. This is one of the downsides to using Airwallex and is similar to Payoneer in that it suggests using a multi-currency bank account is the best way to hedge against currency risk.

Whilst, using Airwallex will result in using multiple accounts in countries naturally, the addition of guaranteed rates (like Wise Business offers) wouldn’t go amiss.

Account levels

There are no subscription fees or levels of subscriptions with Airwallex. The products are split into three levels and it’s possible to access them all based on your needs.

The Business Account covers most of what we have here, it’s a way to manage international finance through an online account.

The next level is the Core API. This is where businesses can really begin to benefit from managing FX risk, embedded FX rates into their own systems.

Embedded Finance is where businesses can use Airwallex to launch global financial products. We’ve not covered this here too much as it’s not hugely applicable. However, as a fintech nerd, it’s a cool system.

Fees and rates when using Airwallex

Fees with Airwallex are pretty straightforward. There are generally no fees on sending, unless via SWIFT, and exchange rates re competitive at 0.5%.

Fees and rates

Airwallex fee breakdown

Essentially, with these fees and paired with how Airwalllex works, you are largely paying for conversions and fees on card payments.

For businesses looking for more custom or open banking services, there is likely to be some fees involved - although these will be bespoke to the needs of your business and as such we wouldn’t be able to report on them here.

Section | Type of Fee | Amount |

|---|---|---|

Global Accounts | Account Opening | $0 |

Multi-currency wallet | $0 | |

Incoming Payments | Domestic Cards | 2.80% + $0.30 |

International Cards | 4.30% + $0.30 | |

Local Payment Methods | $0.30 + Payment Method Fee | |

Transfers & FX | Transfers (SWIFT) | $15-$25 |

FX Conversions | 0.5% to 1% above interbank rate | |

Direct Debits | $0 | |

Cards & Expense Management | Company Cards Issue | $0 |

Employee Cards Issue | $0 | |

Card Transactions (Domestic) | $0 | |

Card Transactions (International) | $0 | |

Bill Pay | Payment via Local Transfer | $0 |

Payment via SWIFT | $10 per transaction | |

Software Integrations | Integration with Various Software | $0 |

Speed of transfers with Airwallex

Transfer speeds

Provider

Local account transfers arrive for the most part on the same day.

As with any batch transactions, setting up and arranging payments is likely to be the most work you’ll do here.

SWIFT and bank transfers can take a little longer to make their way through the network, as is the case when actually using a bank.

We did find that countries with less robust financial infrastructures may experience delays. For example, transfers to some African and South American countries might take up to 5 business days.

Other factors include banking holidays and time zone differences. Transactions initiated late in the day or during holidays in the recipient country may experience delays.

Using Airwallex

Provider

Airwallex offers ease of using some key areas - here they are in detail:

Ease of use

Invoicing

Integrations

Employees, roles and permissions

Multi-user access

Pay-in and Pay out methods

Signing up

Eligibility

Airwallex accepts businesses from a variety of industries, but not all. Eligibility is based on:

Business Eligibility: Airwallex is dedicated to serving registered businesses rather than individual consumers. To use Airwallex services, your business must be officially registered and have a physical address within the United States.

Prohibited Business Types: Airwallex does not support businesses involved in certain high-risk industries, including gambling and weapons manufacturing.

Age Requirement: You must be at least 18 years old or have reached the age of majority in your jurisdiction to use our services and be the key contact on the account.

KYC Requirements: You are required to complete a Know Your Customer (KYC) process. This involves providing identification and verification documentation for your business and its owners.

Safety and regulation

With any type of banking financial institution, naturally security is key. There are a few things Airwallex has in place to aid in helping businesses stay safe.

Provider

Regulation

In the USA Airwallex is liscensed as a money transmitter under the Nationwide Multistate Licensing System (NMLS).

The Airwallex NMLS ID number is #1928093.

Security measures in places

Identity Verification: To safeguard against identity theft, Airwallex requires a government-issued ID, such as a passport or US driving license, for registration.

Security Protocols: Airwallex implements stringent security measures. Each device must have a unique PIN for app access. Additionally, Airwallex supports biometric verification (fingerprint or facial recognition) to ensure secure logins. Passwords are mandatory for issuing company and employee cards, authorizing payments, and managing allowances.

Real-Time Card Management: In case of suspicious transactions on your company or employee cards, you have the immediate ability to freeze or cancel the cards through Airwallex.

Advanced Security Features:

Biometric Identification: Use biometric methods such as fingerprint or facial recognition for a secure login experience with Airwallex.

3D Secure: Enhance the security of your online transactions with Airwallex. Receive and approve transactions directly through in-app push notifications.

Virtual Cards: Increase your online payment security with a temporary virtual debit card from Airwallex, protecting your primary card information and maintaining your account's integrity.

Not keen on Airwallex?

If you are unsure of whether Airwallex is for you, here's how they stack up in the market.

User feedback

Customer feedback and user reviews are quite negative in places - giving them a TrustPilot score of 3.6 of 5. This is from just over 1300 reviews. In comparison, Payoneer has around 53,000 reviews, this does highlight the size of Airwallex and it’s recent entry into the market.

The reviews received differ from the negative being that overuse of bots for customer service, lack of contact on the verification and generally having just email support were the biggest problems. Users did also feel the card processing fees were a little high.

The flipside, is there are positive reviews for the help received and low cost of transfers. So it may depend on the needs of your business as to whether Airwallex is truly the right option.

Reviews for Airwallex across online platforms has been increasing in the last 18 months.

Airwallex user feedback

Comments

Anonymous

Airwallex's FX service has made my life so much easier. The transfers are super quick, happening in seconds because Airwallex uses its own local payment network, not SWIFT. I also love that I can easily open foreign currency accounts with local bank details. This means my clients from different countries can send local transfers to my account without any hassle. It's a great solution for anyone looking for fast, reliable international money transfers. Highly recommend!

Ejike

Unfortunately Airwallex would collect your information only to realize that they don't have presence in your business region. Sad!