Best Currency Brokers Compared & Reviewed

Currency brokers are the easiest way to send large amounts of money abroad.

They ensure you save money and secure the best possible deal while talking to a real human.

If you just want to get started, the best currency brokers are TorFX and RegencyFX.

TorFX offers a better online platform, while RegencyFX focuses on customer experience.

Otherwise, keep reading. We will explain all the key elements to consider before choosing a currency broker, as well as, go over the top currency brokers in the industry.

Search Now & Save On Your Transfer

Currency brokers are ideal for businesses and individuals needing to exchange large amounts of money, often providing personalized service.

Top currency brokers are:

All currency brokers listed on this page are FCA-regulated and many will offer access to online portals, currency risk options (such as forward contracts or limit orders), and all will have a dedicated account manager.

Who should be using a currency broker

Before diving deeper into the exchange brokers, here’s a quick overview of who will benefit from using a currency broker.

Use a currency broker if you… | Find an alternative if you… |

|---|---|

|

|

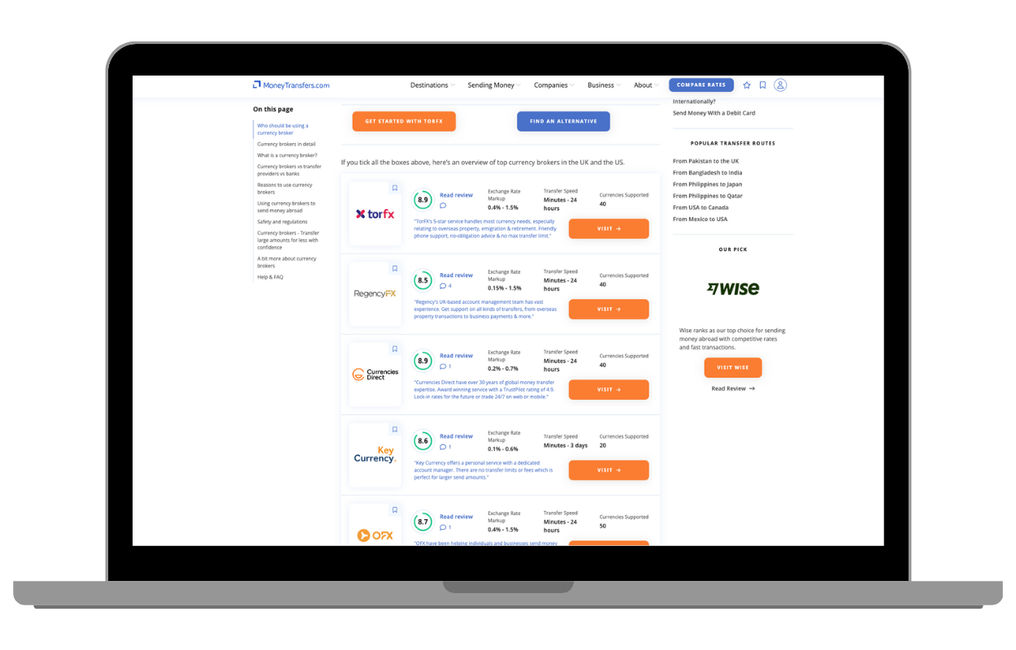

If you tick all the boxes above, here’s an overview of top currency brokers in the UK and the US.

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

Are all currency brokers the same?

Not necessarily.

While some foreign currency brokers excel at keeping transfer costs low, others charge a premium to offer lightning-fast transfer times, more hedging tools, or better customer service.

For example, TorFX offers multiple hedging options and the most user-friendly interface, while RegencyFX offers a more tailored approach and superior service without many bells and whistles.

We've conducted a thorough review of the leading figures in the currency brokerage industry. We've done this to bring you the best in the business.

Our goal? To give you an insider's look into the world of the best currency brokers in the UK and the US.

Understanding the difference between the services listed on this page is key.

It will help you find the best solution for your transfer.

Currency brokers in detail

We found TorFX to have the best business offering and the most user-friendly interface available.

Like Currencies Direct, TorFX is owned by Redpin Holdings Limited, giving them just under 50 years in the money transfer market.

They charge no fees and add a markup to their exchange rates, but their ease of use and currency hedging tools are what make them unique.

Based on our analysis, if you were to send £100,000 from the UK to the US, you can expect to pay a 0.25% markup.

With TorFX you get access to live exchange rates, rate alerts, spot contracts, forward contracts, limit orders, stop-loss orders, and access to 24/7 transfers through the app (up to $25,000).

Making it ideal for businesses and commercial clients wanting to offset currency fluctuation risks, while making medium and large transactions at the best exchange rate.

The one thing to keep in mind is that smaller transfers with TorFX might get you a less favorable exchange rate compared to brokers like Currencies Direct.

For example, sending £100,000 will have a 0.25% markup vs % for a £2,000 transfer.

You can use TorFX in the way that suits you - either by signing up via their website or their app.

When you register, TorFX will assign you a dedicated account manager to help you process your transfers.

They will help you with your transfer requirements, getting a deal on the exchange rates, or navigating the app.

Transfer limits online are quite low for a currency broker, at only $25,000. Once again, you can transfer more - but you’ll need to have the transfer authorized by your account manager first.

You can only make payments by bank transfer or debit card.

When you should use TorFX

TorFX is great for… | Find an alternative if you… |

|---|---|

|

|

Regency FX is a great broker for large transfers and superior customer service.

Regency FX has no fees and only adds a markup to the exchange rate. They usually offer better exchange rates for transfers over $5,000 and have no maximum transfer limits.

For example, sending $100,000 to the USA from the UK would cost you 0.20% in markup, while sending £2,000 would result in a %.

With Regency FX, you can send money to 150 countries in 50 currencies. Slightly less than OFX, but with a more tailored customer experience.

You can make transfers over the phone or using their online portal, but there is no mobile app.

This is better than Key Currency which only offers transfers over the phone, but slightly worse than TorFX and OFX if you need to send money on the go.

Just like with other exchange brokers, you will get assigned an account manager who will take care of all your needs, negotiate better exchange rates, help you execute the transfers, and suggest on the best course of action.

Considering this London-based broker is relatively new, there aren’t many online reviews, however, we’ve had multiple users from MoneyTransfers recommending the service (click User Comments below to read them).

If you’re sending money from the UK, you can use bank transfer, credit card as well as debit card deposits, otherwise, you are limited to bank and wire transfers.

When you should use RegencyFX

RegencyFX is great for… | Find an alternative if you… |

|---|---|

|

|

Currencies Direct is the best US currency broker for smaller transfers.

They offer a low minimum online transfer of just £10 and fee-free transfers at fairly low exchange rates.

However, just like with other brokers, the markup will depend on the amount and the currencies involved.

For example, if you were to send £100,000 to the US, you can expect to pay 0.53% on average.

They service over 120 countries and manage the exchange of over 40 currencies, as well as, they offer a multi-currency account with a debit card.

This makes them a good option for all-rounded financial needs.

Their low minimums and low cost do come at the expense of some other features.

You still get access to 24-month forward contracts and market orders, but lose on FX options, stop/loss orders, and rate alerts that you get with TorFX and OFX.

For a currency exchange broker, their transfer limits are not the highest, capped at $50,000 online or in-app.

To send more, you will have to contact the Currencies Direct customer service team and request a one-time authorization.

Currencies Direct only accepts bank transfers and card payments, making them less versatile than some competitors in terms of payment options.

As a well-established currency brokerage service set up in 1996, Currencies Direct is highly respected in the currency brokerage industry and frequently receives positive reviews on Trustpilot and the App Store.

Make sure all your recipient’s details are correct before pushing send, as Currencies Direct has no cancellation policy.

When you should use Currencies Direct

Currencies Direct is great for… | Find an alternative if you… |

|---|---|

|

|

Key Currency is a classic currency broker, focusing on fast transfers and customer satisfaction.

They’re a relatively new currencies brokerage firm based in the UK, focusing on payments between the UK, Europe, Australia, and the US through a partnership with Currencycloud.

However, as a UK-based company, it can be more complicated to process payments from the US, and they service fewer countries than other currency brokers on the list.

They charge no fees, but like others add a markup to the exchange rate.

If you were to send £100,000 with Key Currency from the UK to the US, you can expect to pay a 0.15% markup.

They have no online portal or app for making transfers. They operate only over the phone and only accept bank transfer deposits.

This is a good option for those wanting to send money the traditional way with reassurance in mind, otherwise, consider using TorFX or Currencies Direct.

Like with other foreign currency exchange brokers, Key Currency has no upper limits on money transfers, but they do offer faster transfer times for large transfers on average.

You can expect most transfers to arrive within 1-3 days, but some may take up to 5 due to receiver bank delays.

It’s worth noting that money transfer companies specializing in smaller, regular payments such as Currencies Direct or Wise will often be faster.

Key Currency reviews focus on the friendly customer service department and how easy it is to speak to a team member.

When you should use Key Currency

Key Currency is great for… | Find an alternative if you… |

|---|---|

|

|

We found OFX to offer the most currencies including more ‘exotic’ ones.

OFX is available in over 170 countries (including the UK and the US) and lets you move large amounts of more exotic currencies such as ZAR, KWD, MAD, VND, or 50 others.

As a currency broker, OFX specializes in high-value transfers with no upper limits.

This means their minimum transfer limits are slightly higher:

In the USA it is $1,000

In the UK it is £100

In Canada and Australia, it is $250 (CAD or AUD).

They charge no fees on their transfers and add a small markup to the exchange rate.

For example, if you’re sending £100,000 to the US, you can expect to pay a 0.50% markup on the exchange rates.

Like TorFX, you can use OFX to monitor live exchange rates via their app, set alerts, use spot and forward contracts (although limited to 12 months vs 24 with TorFX), as well as FX options.

When you should use OFX

OFX is great for… | Find an alternative if you… |

|---|---|

|

|

What is a currency broker?

Unlike online-only money transfer apps and companies, you can contact a broker directly via phone and speak to your account manager to process your transfers whenever you need to.

Account managers will help you with any questions you have, find you the best deal, and process your payment giving you a much more tailored experience compared to online-only companies like Wise.

Currency brokers are slightly slower than other online-only services, but they’re great when you need a more tailored and direct experience delivered personally.

This makes currency brokers more useful for sending large amounts of money.

But how do currency brokers save you money?

There are two main reasons why currency brokers can save you money; tailored rates and no fees.

Firstly, most currency brokers charge no fees on the transfer, but instead, they work it into their exchange rate markup.

Secondly, their personalized approach means each transfer is handled individually, and the exchange rates are tailored to your needs, and the amount you are sending.

Here are a few examples of how much you would receive by using a currency broker vs online-only service.

Transfer amount | TorFX (currency broker) | Wise (online-first service) |

|---|---|---|

100,000 GBP to USD | $125,147.35 | $125,098.39 |

10,000 GBP to USD | $12,509.72 | $12,498.65 |

2,000 GBP to USD | $2,501.85 | $2,498.64 |

200 GBP to USD | Under the minimum limit | $248.65 |

100 GBP to USD | Under the minimum limit | $123.66 |

Figures are based on the data from our comparison engine.

Currency brokers vs transfer providers vs banks

To better understand which service you need, here’s a closer look at what each service has to offer.

Currency brokers are best to transfer large sums of money internationally. They offer specialist account managers you can contact by phone to manage your transfer for you.

These companies give you greater control over your transfers; brokers will personalize their service to your specific needs, so you’re less likely to miss out on a potential deal.

However, when using self-managed (online-only) money transfer companies such as Wise or Remitly, you will handle the transfer yourself.

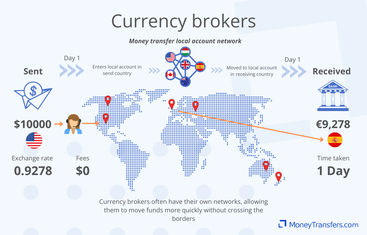

Currency brokers utilize local accounts and expertise to offer better exchange rates by volume. This means your money never actually crosses the borders.

It is also worth noting that some currency brokers will also process small transfers, but these are often more expensive than using online-only money transfer providers.

All currency brokers are money transfer providers, but not all transfer providers are currency brokers.

While currency brokers specialize in personalized approaches via account managers, other money transfer companies have different specialties.

Providers like Wise and Revolut aim to keep their costs low for small, day-to-day transfers over the app and offer better multi-currency accounts for travelers.

Remitly and WorldRemit on the other hand focus on deliverability and payout options for harder-to-reach areas.

While Western Union and Ria Money have the largest global reach and are better suited for in-store transfers.

Similar to currency brokers, online money transfer companies use local accounts where the money goes into one account, and the recipient takes it out in another, without crossing the borders.

Most banks will allow you to make transfers abroad, but they’ll often have very high fees and exchange rate markups compared to currency brokers and other money transfer providers.

On average, banks will add 4% - 7% exchange rate markup, charge $30 – $50 in fees, and have a deposit fee.

Currency brokers on the other hand will only add a markup of around 0.3% - 2% with many charging no fees.

This is because most international bank transfers will go through multiple intermediary banks across the borders, each taking a small cut of your transfer in fees.

Then how do currency brokers make money?

Most currency brokers will make money through the exchange rate markup.

Meaning they will add a percentage on top of the ‘real exchange rate’ and take the difference.

Some currency brokers will also add a fee (which can be flat or percentage, just like other providers), but this is rare compared to online-only services.

Ultimately, this will heavily depend on the amount you are sending and the currencies involved.

For example, for a large transfer ($10,000 and up), a flat fee with a markup would be better, compared to a small transfer where a flat fee will be worse.

This is why it is so important to compare your options.

Reasons to use currency brokers

We’ve already touched on a few reasons when and why you should be using a currency brokerage service over banks and other money transfer companies, but here’s a bit more detail.

Customer service and support

The biggest gripe in the money transfer industry is customer support.

We’ve had a few of our users contact us and complain about the support and help offered by the online-only services.

Currency brokers solve this problem.

The key benefit of currency brokers is the support and tailored experience you get.

Once you sign up to a broker, you will get a dedicated account manager to handle your transfers for you.

These account managers are qualified currency specialists who will guide you through your transfer, give tips on timings, provide guidance on the exchange rates, and help you navigate the space.

In addition, currency brokers offer a wider range of customer support options than other transfer providers.

In addition to the account managers, most currency brokers will have a customer support team you can contact by phone, email, or live chat in some cases.

With this, you will know exactly what is happening with your money, with 100% reassurance that it will arrive safely in the receiving bank account.

Exchange rates

Currency brokers not only offer tools to manage currency fluctuations, but they also have control to tailor the exchange rate markup to your needs.

This is usually the case for larger transfers. The more you send, the more likely you will get a better exchange rate.

Why? Because the larger the amount, the smaller the markup they need to apply to generate profit.

With other money transfer apps, the fee and the rate are usually globally applied to every customer, meaning there is no room for negotiation.

Again, this is why we recommend comparing your options and signing up with multiple brokers.

If you’re quoted an exchange rate that is over 0.5% of the mid-market rate, you may not be getting a fair value for what you are paying.

It is also worth noting that currency brokers usually offer fewer currencies compared to other money transfer services, but this will be clearly visible upfront when getting a quote.

Expertise

Currency brokers are able to help you based on your specific needs, be it for home purchases abroad, handling taxes, paying for education, or sending pensions to another country.

Considering they mostly deal with large transfers, their account managers are trained to provide the expertise for various use cases.

For example, Key Currency has a strong presence in Spain, giving them the ability to support on large transfers to Spain (for example buying a summer home in Spain).

While TorFX has been focusing on building its robust online platform and app as well as offering currency hedging tools.

This makes them leaders in business transfers, where account managers can discuss ways of mitigating risks of currency fluctuations.

Also, currency brokers have been around for much longer than other online companies.

For example, TorFX has been around since 2004 while Currencies Direct launched in 1996, both are owned by Redpin Holdings Limited, giving them a combined experience of almost 50 years in the industry.

In comparison, Wise came about in 2011 giving them just over 13 years in the industry.

This gives you the reassurance that currency brokers know what they are dealing with.

Currency risk management

Most currency brokers offer different currency hedging options and tools to mitigate currency risks to help guarantee your exchange rates.

As rates change daily, it’s often a good idea to set up a contract to lock in favorable exchange rates and avoid missing out.

Here are some of the most commonly used currency contracts available.

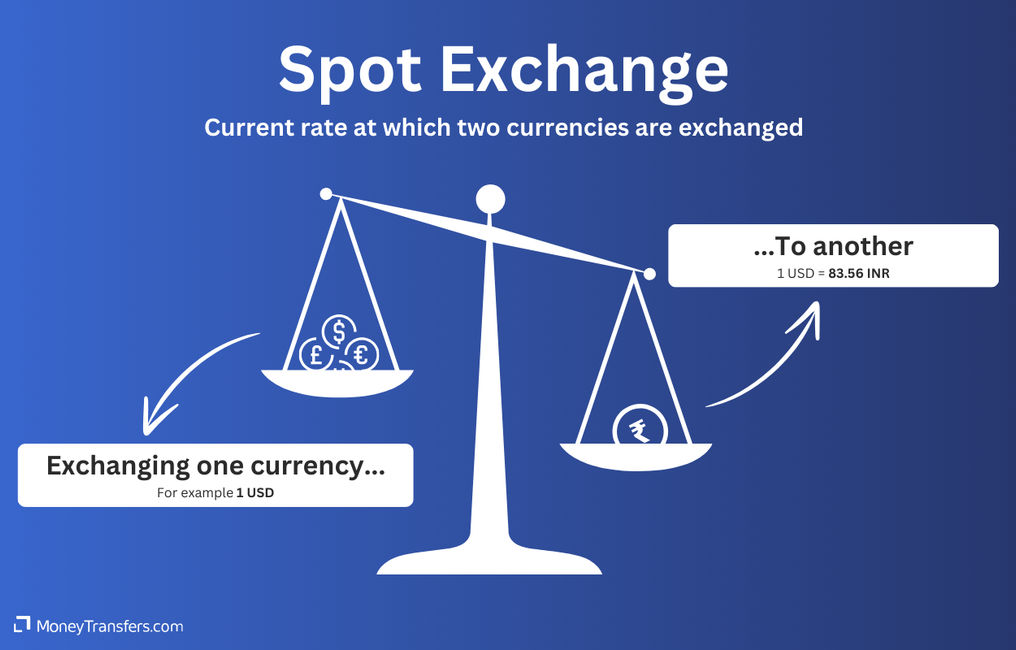

Spot contracts

These are the most common.

When you want to make a transfer, you can fix the current exchange rate so you don’t lose out if rates get worse while your transfer is being processed.

The standard timeframe for a spot contract is two business days.

Forward contracts

A forward contract is booked to be settled in the future.

If you book a transfer to be completed in several months, and the exchange rate has improved today, you can lock it in.

If the exchange rate gets worse when your transfer is completed, you won’t lose out.

However, you also won’t benefit if the exchange rate is better when your transfer is processed.

The usual lock period is up to 12 months, but some brokers like TorFX and Currencies Direct will offer 24 months.

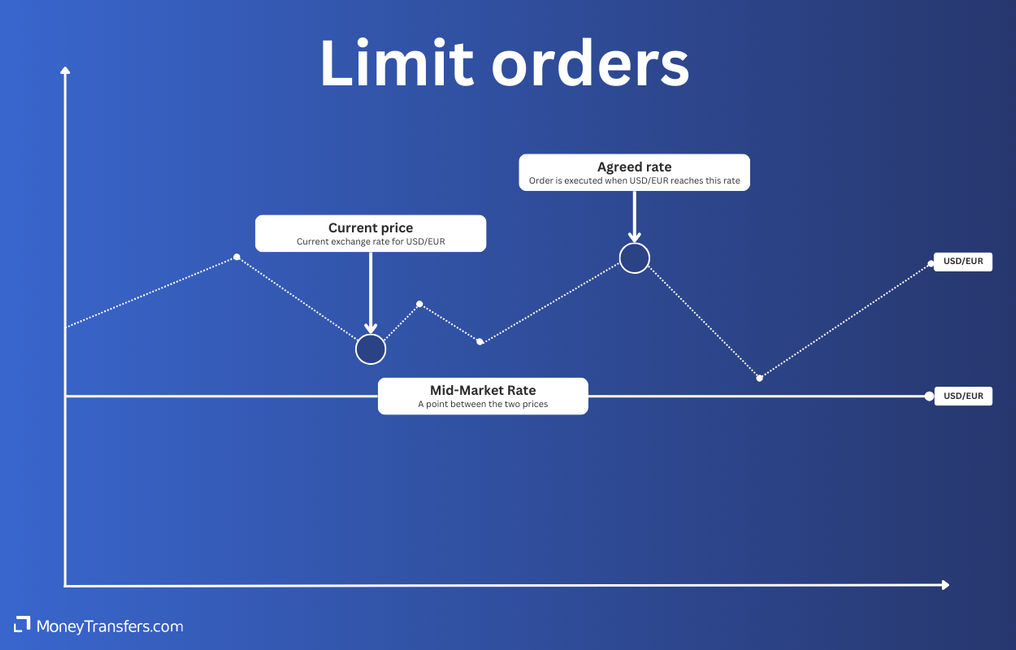

Limit order

Limit orders can be set to book a transfer when the market reaches a specific rate.

Your broker will buy your desired currency as soon as the exchange rate reaches your target.

These are also commonly used by forex traders to make money on large exchanges.

Limit orders allow you to avoid missing out, but can delay your transfer.

Stop loss

Stop losses are the opposite of limit orders.

Through a stop loss, exchanges are booked to be made as soon as the exchange rate falls to a certain figure.

Like limit orders, these are also often used by forex traders to capitalize on large exchanges.

Stop losses protects you from losing too much money if the exchange rates fall. They can only be used alongside limit orders.

Foreign exchange rates risks

When making large transfers, there is a chance of receiving less than you expect, due to currency fluctuations.

This is known as foreign exchange risk (or simply FX risk).

To better understand these risks and learn how to avoid them, have a look at our guide below.

Business

Businesses are prime clients for currency brokers, not only because of high-value transfers, but because businesses are likely to make the most use of currency hedging tools discussed above, and save time by offloading their needs to the account managers.

For businesses moving large amounts of money abroad frequently, currency brokers can take this load from their internal teams and manage it all through the account managers.

This is particularly useful when businesses require the expertise and someone who knows how to make the most of the money sent.

Want to know about money transfers for business?

Although many companies will service both business and personal money transfers, there are a lot of differences to consider.

We've created multiple money transfer guides for business, diving deeper into top companies, considerations, and what they have to offer.

Using currency brokers to send money abroad

Using currency brokers is simple and similar to any other platform.

The biggest difference in the process is that you will receive a quote for your transfer, instead of initiating it yourself.

Here’s how it works.

Choose your broker

We’ve provided a breakdown of the best and most trusted currency brokers in our summary above.

If you want a more detailed summary of your transfer corridor, you can use our currency brokers comparison tool via the button below to search for the best live rates offered by brokers and transfer providers available in your country.

Get a quote

Once you’ve picked a broker, you will need to request a quote. Usually, this involves providing the amount and currencies, as well as your email and phone number.

This step also makes it easier to request quotes from multiple brokers at the same time.

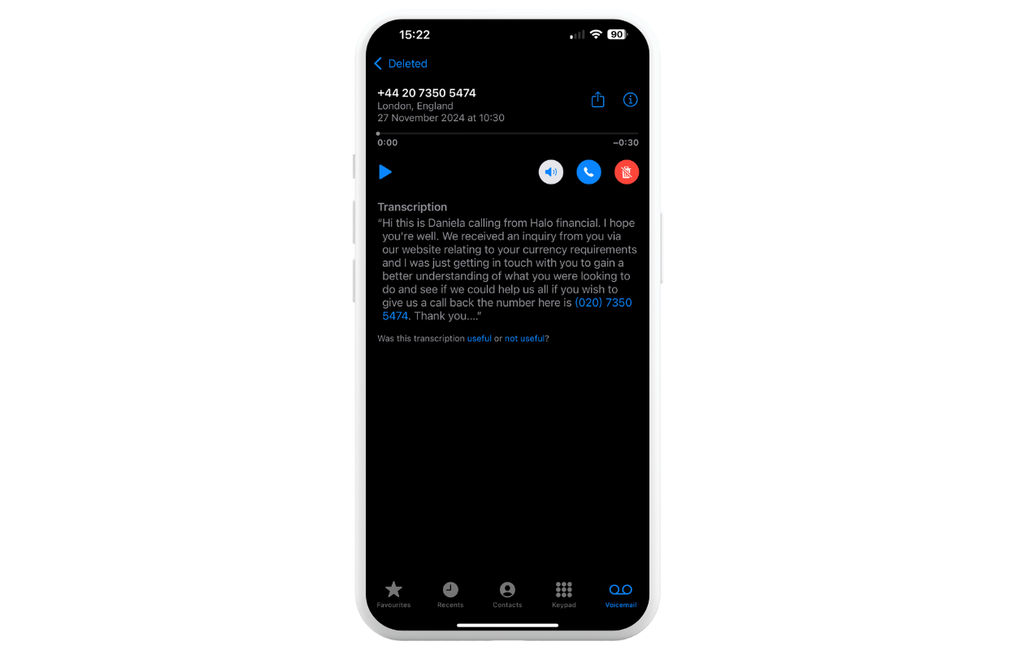

Wait for callback

Once you request a quote, the broker will either email or call you with their offer.

From there, you will get an account manager assigned who will take you through the process.

You can negotiate the rates, lock in the rates, wait for other quotes, or proceed with your transfer.

Make a transfer

Once you have the desired quote, you can make a transfer.

This will be different for each broker, but most of the time your account manager will handle the rest and may require you to provide more information and transfer details.

Depending on the broker, this will be done either online or over the phone.

Safety and regulations

Currency brokers are regulated by the Commodity Futures Trading Commission (CFTC) in the US.

They have primary responsibility for overseeing commodities markets in the US, which includes foreign currency transfers and exchanges.

The CFTC regularly investigates cases of foreign currency trading fraud and ensures companies processing currency exchanges are legitimate. All legitimate currency exchange brokers will be fully regulated.

All UK currency brokers are regulated by the Financial Conduct Authority (FCA).

Only use regulated currency brokers

You should only ever use regulated providers to transfer money. If a provider is not regulated, it’s likely to be a scam.

We will only ever recommend regulated financial institutions.

Use our regulators directory to learn more about it.

Making transfers with legitimate currency brokers is safe, provided you take reasonable precautions.

Never reveal personal information like your passwords or PIN over the phone, and don’t share your account details with anyone.

Currency brokers - Transfer large amounts for less with confidence

Currency brokers can help you transfer larger amounts of money through their personal approach and get you more money out of the transfer via the tools provided.

You can also lock in rates before transferring, but they tend to offer fewer currencies and can be slower than online transfer companies used for smaller transactions.

A bit more about currency brokers

Are currency brokers and forex brokers the same thing?

Can I use currency brokers for both personal and business transactions?

How do currency brokers ensure the security of my transactions?

How quickly can currency brokers process international transfers?

Can I schedule regular transfers with a currency broker, and how does this work?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Contributors

.svg)

.svg)