How to send money to Nigeria from the USA at the best USD-NGN exchange rate

The best way to send USD to Nigeria is with Wise using a bank transfer deposit.

We’ve compared 8 money transfer companies, banks, apps, and wallets to find the cheapest, fastest, and overall best way to transfer money to NGN from the US.

Read on to find the best USD-NGN exchange deals, expert information, and tips on hassle-free transfers to Nigeria.

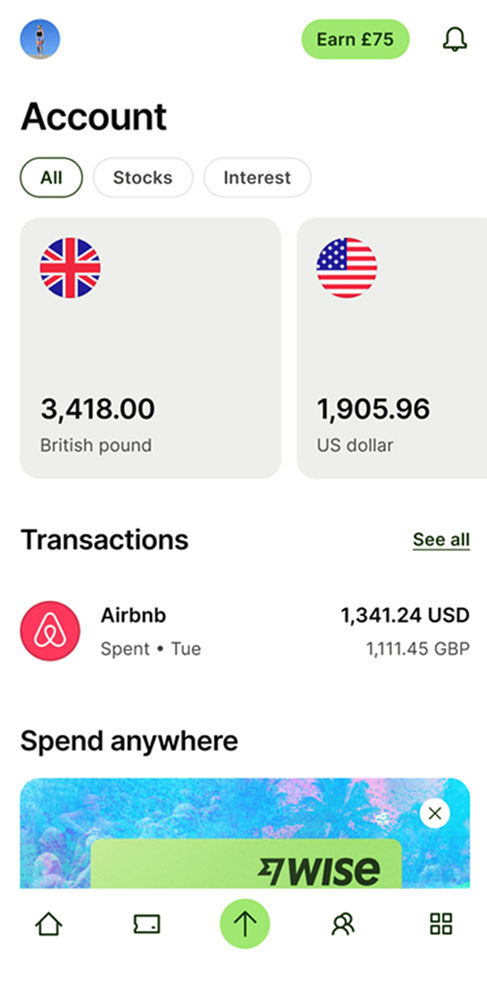

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

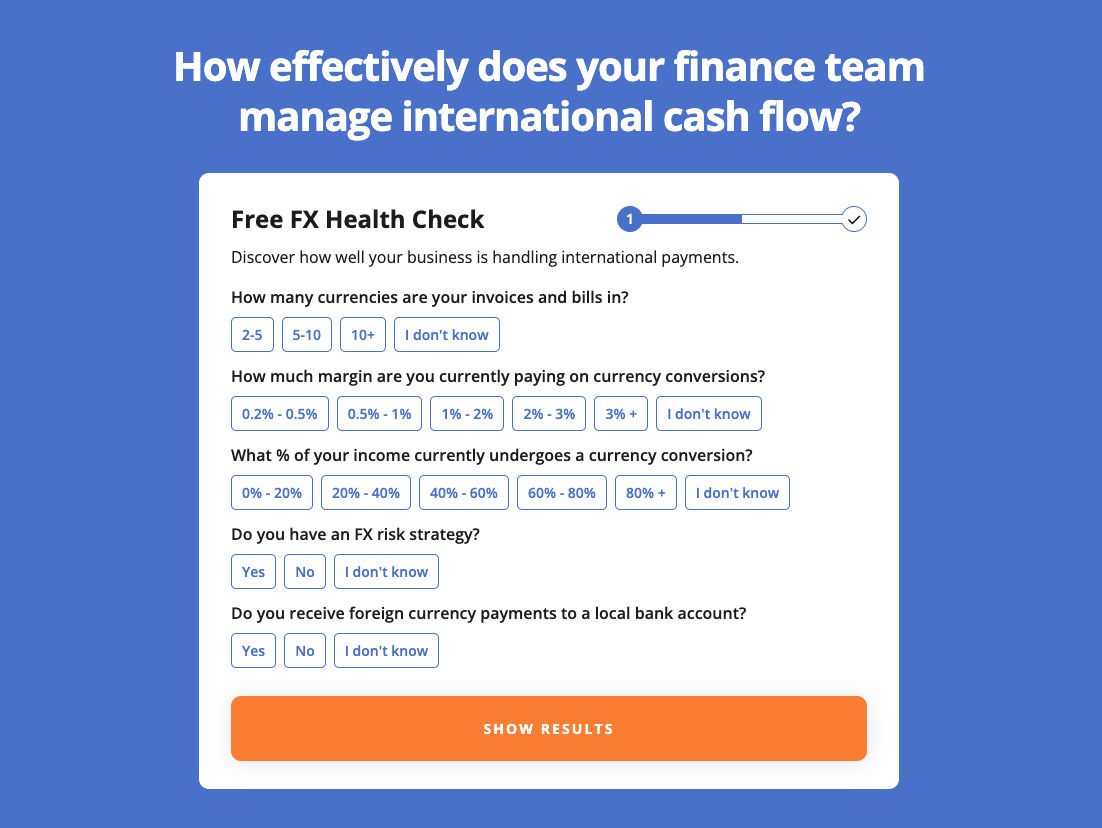

Managing business payments between USD and NGN?

In our experience, there are always efficiencies to be made in how businesses manage international payments between Nigeria and the US.

Why not take our free FX health check test to see how effective your business is in managing these? It only takes a couple of minutes.

Compare today's USD to NGN (US Dollar to Nigerian Naira) exchange rates

The mid-market rate is the value of NGN against USD, and since it constantly fluctuates, it will affect how much NGN your recipient will receive. Sending Naira from Nigeria to the USA when NGN reaches the highest value will result in more NGN for your recipient.

Over the last 7 days, here’s what we’ve seen:

The USD-NGN exchange rate average at 1,362.0254 Nigerian Dollars per USD.

The highest value recorded was 1,377.0398 NGN/USD, while the lowest was 1,347.9904 NGN per USD.

There are currently 8 providers offering transfers between the USA and Nigeria close to this rate.

Want to secure the best USD-Naira deals?

Sign up for our rate alerts and we'll tell you when it's the best time to buy Nigerian Dollar (Naira)

Latest USD to NGN Conversion Rates

Here are the latest USD-NGN (US Dollar to Nigerian Naira) exchange rates for popular conversion amounts. These are the ‘real’ exchange rates, the actual payout will vary depending on the money transfer company used.

| USD | NGN Price |

|---|---|

| 1 USD | 1379.09 |

| 5 USD | 6895.45 |

| 20 USD | 27581.79 |

| 100 USD | 137908.97 |

| 1000 USD | 1379089.71 |

| 10000 USD | 13790897.09 |

| NGN | USD Price |

|---|---|

| 1 NGN | 0.00 |

| 5 NGN | 0.00 |

| 20 NGN | 0.01 |

| 100 NGN | 0.07 |

| 1000 NGN | 0.72 |

| 10000 NGN | 7.25 |

The costs of sending USD to Nigeria

The cost of USD to NGN transfers is made up of a few fees, mainly the transfer fees and the exchange rate markup on the USD-NGN mid-market rate.

Exchange rate markup

The exchange rate markup is the percentage added to the mid-market rate (the "real" NGN rate) by the service provider.

Finding the company that offers the best exchange rate will result in more NGN received.

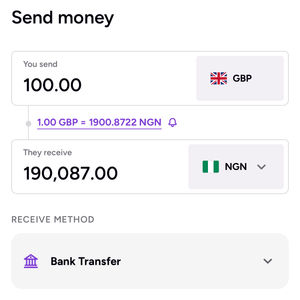

Some companies such as Wise will offer to send money at the mid-market rate, meaning you will receive 1,379.0897 NGN per US dollar. However, they compensate with slightly higher transfer fees.

Transfer fees

Transfer fees between the US and Nigeria can be fixed, percentage-based, or a combination of both.

The transfer fees largely depend on how many dollars you are sending, the transfer and delivery methods you use, and the specific provider fees.

Companies like WorldRemit, Remitly, or Instarem will let you make your first transfer for free (depending on the amount of USD you send). However, they will add a higher markup to the ‘real’ exchange rate.

Deposit and delivery methods

The way you fund your NGN transfers can significantly affect the cost.

A bank transfer is the overall cheapest deposit option based on our analysis of 8 money transfer companies servicing Nigeria.

While depositing and receiving cash are the most expensive methods in Nigeria, so expect to pay premium fees.

You need to consider all three fees to get the best option, but we’ve done this for you.

We’ve analyzed 8 companies supporting USD-NGN transfers and found that Revolut offers the lowest fees and best exchange rates for transfers to Nigeria from the US.

With Revolut, your recipient will get the most NGN from the US.

Sending and receiving money in Nigeria

Delivery and withdrawal methods can significantly affect the speed and the cost of the transfer to Nigeria from the US.

Money transfer companies

Money transfer companies such as Wise or WorldRemit are the best, cheapest, and fastest way to send money to Nigeria from the US.

These companies use local accounts in Nigeria to move your USD without crossing the borders, minimizing the fees and the time.

All you need to do is sign up with Wise, connect your bank account, and make the transfer.

Apps & mobile wallets

Money transfer apps such as Lemfi, M-PESA, Chipper Cash, and sendApp let you send money from your phone to another mobile wallet, similar to how P2P transfers work.

Apps are convenient for transfers to Nigeria, as most of them implement USSG allowing you to pay for bills, send money locally, check your account balance, and more, however, they offer worse exchange rates compared to money transfer companies.

It’s worth noting that money transfer companies also offer apps that are just as convenient but are cheaper and let you send money from the USA to a Nigeria bank account.

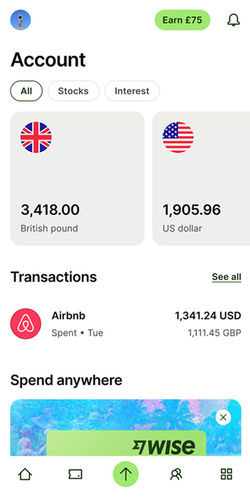

Multi-currency account

Multi-currency accounts like Wise are becoming increasingly popular in the US.

These let you convert USD to NGN and later send it to the Nigerian bank account in NGN.

This method is great for small transfers and can be used to send money to a debit card, bank account, and mobile wallet.

In-person & cash transfer

Cash transfers are a good way to send money if your recipient doesn’t have a bank account, or can’t access the internet.

Cash transfers are usually instant and you can initiate the transfer online or in the store and have your recipient pick up the cash in the branch or have it delivered to their door.

The best company for this is Western Union, however, it might cost a bit more than an online transfer.

Wire transfers

Finally, you can use your bank to wire money Naira to Nigeria, however, this option is the most expensive and should be avoided.

This is because your transfer will go through multiple banks, each taking a small fee, resulting in much less NGN at the end.

Instead, we recommend signing up with a money transfer company such as Wise and sending money to a Nigerian bank account through it.

Bank account

The money will be added directly to the Nigerian bank account without needing to do anything. This is the most popular option and can be paired with money transfer companies.

Domicile bank accounts

Banks like FNB and GTBank let you open bank accounts where you can store currencies other than Naira. This is similar to the multi-currency accounts but is offered by high-street banks in Nigeria.

Pre-paid cards

Similarly, you can receive money on a pre-paid card (such as the one from FNB bank). NGN will arrive directly onto the card without needing to do anything.

Cash pickup

The recipient will need to visit the physical store (depending on which company you use). They will need to have the reference number, transfer details, and their passport to collect. This is by far the fastest way to receive money but is a bit more expensive.

Home delivery

Cash will be delivered directly to the recipient's home but takes around 2-4 days. Just like with cash pickup, the recipient will need the reference number, transfer details, and an ID such as a passport or NIN.

Airtime and mobile top-ups

Airtime top-up is a way to add credit to your recipient's prepaid mobile phone plan. This is a popular option in Nigeria as you can use the credit to pay for things you need. However, the money can’t be withdrawn into cash.

We found WorldRemit to be the best option for airtime top-ups in Nigeria.

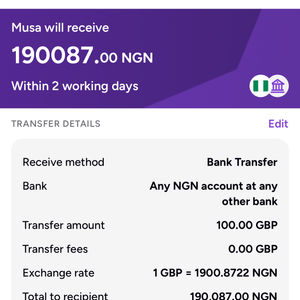

The best way to send USD to Nigeria is Wise via bank transfer

Wise is consistently scores highly in our comparison for NGN transfers and was rated the best option among the 8 providers that support NGN transfers.

Wise offers quick transfers, adds a -0.03% markup on NGN transfers, and costs $744,001.53 in fees.

This makes it the best option for a mix of cost, speed & features for NGN transfers.

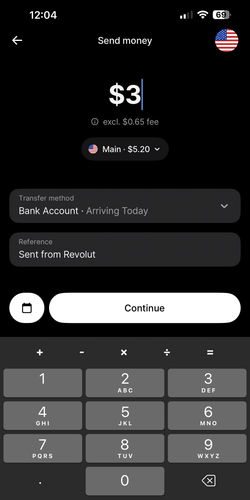

The cheapest way to send money to Nigeria from the USA is with Revolut via the bank transfer

Revolut consistently offers the cheapest money transfers to Nigeria.

Revolut appeared as the cheapest option 1 times in our comparisons out of 8 providers we’ve tested.

They charge $0 per USD-NGN transfer, with a 0.2% markup on the USD-NGN exchange rate.

To get the most out of your transfer to Nigeria, use a bank transfer deposit to maximize the amount of NGN received.

The fastest way to send USD to Nigeria is with Wise

If you need to send money to Nigeria from the USA instantly, we recommend using Wise online or sending cash with Western Union.

We found Wise to offer the quickest USD transfers to Naira. It consistently appears as the fastest provider for transfes to Nigeria, with a fee of 744,001.53 USD.

This speed test included depositing US Dollars to an account and the average timeframe for sending money to Nigeria.

The easiest way to send money to Nigeria from the US is with Wise

Wise is the quickest and the easiest money transfer company to use.

By “easiest”, we mean that they are easy to get started with, are fully transparent, and offer a good balance of low cost and speed.

The signup process took us under 5 minutes including the verification. We’ve also had no issues with depositing and transferring NGN to another Nigerian account.

How to send money from the USA to Nigeria online

Sending money to Nigeria is simple. Here are the steps using WorldRemit as an example:

Download the app & sign up

Download the WorldRemit app from your app store and add your details

Add amount & details

Click “Send Now” and fill in your recipient's details

Confirms & send money

Confirm the information and click Send Now. You may be asked to verify your account

Payment methods for transfers to Nigeria from the USA

Bank transfers

Bank transfer is the default method for sending money to Nigeria from the US, and WorldRemit is the best company to use for this.

With WorldRemit, you can send USD to Naira via a bank transfer (ACH) from the US while benefiting from lower fees and better exchange rates.

WorldRemit is free for your first NGN transfer and adds a small markup of 0.94% on top of the USD-NGN exchange rate.

Debit and prepaid cards

Sending money to Nigeria with a debit or prepaid card is very simple with Paysend.

Paysend is a leader in debit card payments to Nigeria, competing among a total of 8 active money transfer companies.

Credit cards

When it comes to sending NGN via credit card, we .

However, credit card transfers are very expensive and come with higher fees.

Fee alert

Wsing a credit card for transfers to Nigeria often results in a cash advance fee being charged by your card issuer. That's why we recommend a bank transfer or debit card instead.

Considerations for sending money from the USA to Nigeria

There is no legal cap on how much you can send from the US to Nigeria.

However, the limits will depend on the money transfer company you use, for example:

Western Union will cap the transfer at $10,000

Wise will cap the receiving amount at 95,000,000 NGN (around 63000 USD)

WorldRemit is limited to $5000.00 per transfer

XE has no limit but you may be required to contact them directly instead of using the online portal

We recommend using Wise for medium-sized transfers as they are the cheapest, XE for large transfers as they have no limits, and Western Union for small cash transfers.

For exceptionally large transfers, make sure to let your bank know about it in advance, to avoid blocking or delaying your transaction.

In addition, any money transfers from the US over $10,000 must be reported to the Financial Crimes Enforcement Network (FinCEN). Splitting up the transactions with the sole purpose of avoiding the checks can result in more checks and be considered as structuring.

Sending over $20,000 to Nigeria?

For transfers over $20,000, we recommend using XE.

Of the 8 companies servicing USD to NGN transfers, XE is the only company with no transfer limits, exceptional customer service, and tailored fees for your specific needs.

We strongly recommend getting in touch with XE when it comes to large transfers.

Keep your money safe

The Central Bank of Nigeria (CBN) is the primary regulator in Nigeria. It is responsible for financial standards and issuing licenses to banks and other financial institutions.

Always choose providers regulated by financial authorities and only send money to those you know and trust.

If you want to know more about the regulatory bodies and money transfer regulations, please refer to our directory of financial regulators.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Nigeria and United States.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from United States to Nigeria.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send USD to NGN.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Popular transfer destinations to and from Nigeria

Send money from Nigeria

Send money from South Africa

Send money from Kenya

Send money from Ghana

Send money from Uganda

Send money from Morocco

Send money from Ethiopia

Send money from Cameroon

Send money from Gambia

Contributors