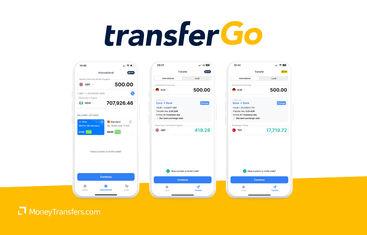

The remittance review team at MoneyTransfers.com has analyzed TransferGo’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback.

We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture of how good TransferGo really is.

Is TransferGo right for you?

TransferGo is good if… | Find an alternative if… |

|---|---|

|

|

Our video review of TransferGo

How we rate TransferGo

Fees & Rates

TransferGo’s fee structure, exchange rates, and overall price compared to other providers is commendable, offering a consistent and affordable price for bank to bank transfers to most destinations.

They claim to add a small markup on top of the exchnage rate, which is true. Their exchange rates are slightly above the "real-rate" at just 0.66% on average. This is still higher than Wise for example, but it is ofset by lower fees on many transfers.

TransferGo's fees range between $0 and $36.30 depending on the countries, speed option, and deposit / withdrawal options. We found most expensive transfers to be within same region (domestic transfers), while international transfers are cheaper costing under $1 on average.

Service

Ease of Use

Safety & Trust

Customer Feedback

“TransferGo offers a strong money transfer service, and while they might not be the biggest provider on the market, they certainly put on a good showing. With affordable fees and fast transfers, if TransferGo offers your required route it’s worth checking them out.”Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why we like TransferGo

Pros

Cons

TransferGo fees and exchange rates

Based on our analysis of 300+ transfers, TransferGo's rates are much better compared to other companies.

On average, they add 0.66% markup and charge between $0 and $36 per transfer in extreme cases. Combining the two, puts their fees in a much better position compared to other services.

For example, if you were to send a €1,000 from Spain to the US, you'd pay €5.11 in fees vs €6.21 with Wise. This is not the case for all routes, in many they can easily compete.

This is why it's important to compare, use to get the most of your transfer.

Provider

TransferGo charges a small markup on the mid-market exchange rate (around 0.66% on average), like many other providers.

It also has a basic tiered pricing structure listed on its homepage, and TransferGo sets your fee based on the speed of your transfer.

However, there are some variations to the fee structure that depend on different factors:

How you pay

TransferGo allows you to pay for your transfer by debit card, credit card or bank transfer - but, as with many providers, their fees are higher for card payments.

Card payments also incur a different exchange rate, as well as a percentage fee on top of the fixed fee, which leads us to the next point

How much you send

With card payments, as a result of the percentage fee, larger transfers will cost more.

TransferGo recommends themselves that you use bank-to-bank transfers for larger sums, and use the more expensive card payments to send small amounts fast

The country and currency you use

Lastly, your fees will also depend on the transfer route you’ve chosen - and not all tiers are available for every destination country.

TransferGo’s transfer fees

The tiered pricing structure on their website is as follows:

Speed | Fee |

|---|---|

Within 30 minutes | £2.99 |

Today | £1.99 |

Tomorrow | £0.99 |

However, it’s important to note that these fees apply for most but not all countries, and not all tiers are available for all destinations.

This is why we’ve looked at over 300 unique country combinations to see how true this is.

Based on our analysis, same-pair transfers (meaning domestic) are much more expensive compared to international transfers, especially for EUR transfers which average $17.00 per transfer.

Here’s a list of the top 20 most expensive currency pairs we’ve tested:

This is why we do not recommend using TransferGo for domestic transfers.

We’ve also looked at the fees based on currencies to and from.

Based on this, sending GBP is more expensive on average, although it only costs $0.28 per transfer, followed by EUR ($0.09), and DKK ($0.07).

While the highest fee is for sending PLN, RON, and DKK.

Here’s a breakdown of the fees based on the country you are sending money from:

On the other hand, there wasn’t much variation in the fees based on the destination country.

Transfers to Poland cost the most ($0.24 / transfer), followed by RON and EUR. However, USD has the highest fee ($3.12), meaning it can get very expensive to send money to the USA.

Here’s a summary of the fees based on the destination:

TransferGo exchange rates and markup

TransferGo charges a small markup on the mid-market exchange rate, like many other providers - and it shows you the rate you’ll get before making your transfer.

On the TransferGo website, they give their conversion rate as being within 0-2.2%.

Based on our testing and analysis, we found that on average the exchange rate markup is 0.66%, but heavily depends on the currencies involved.

The exchange rate markup can go as high as 7.72% and -2.72% (meaning better than the mid-market rate).

For example, sending money from the UK to Nigeria will result in better exchange rates than the mid-market rate (-2.73%), while transfers to Ukraine can have a markup of up to 7.71%.

Here’s a summary of the exchange rates based on where you are sending money from (as of December 2024):

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

KZT | 531.27117 | 545.77 | 2.73% |

UAH | 42.80293 | 43.9338 | 2.64% |

PHP | 60.63041 | 61.942 | 2.16% |

MAD | 10.36797 | 10.5674 | 1.92% |

UGX | 3844.36148 | 3898 | 1.40% |

MDL | 19.09561 | 19.33 | 1.23% |

TRY | 36.20098 | 36.6495 | 1.24% |

KES | 135.41176 | 137.05 | 1.21% |

RON | 4.94881 | 4.9774 | 0.58% |

USD | 1.05066 | 1.05619 | 0.53% |

PLN | 4.27699 | 4.29546 | 0.43% |

GBP | 0.82896 | 0.83245 | 0.42% |

XOF | 652.16904 | 652.73607 | 0.09% |

NGN | 1802.71152 | 1777.6 | -1.39% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

KES | 11.38243 | 11.73036 | 3.06% |

UAH | 3.66418 | 3.75971 | 2.61% |

KZT | 45.76529 | 46.71541 | 2.08% |

MAD | 0.88586 | 0.90365 | 2.01% |

UGX | 328.9985 | 333.61971 | 1.40% |

MDL | 1.63287 | 1.65375 | 1.28% |

XOF | 55.74784 | 56.15125 | 0.72% |

USD | 0.08973 | 0.09033 | 0.67% |

PHP | 5.27 | 5.29666 | 0.51% |

EUR | 0.08543 | 0.08553 | 0.12% |

GBP | 0.07114 | 0.0712 | 0.09% |

GHS | 1.39284 | 1.38749 | -0.38% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

UAH | 0.09911 | 0.10672 | 7.67% |

KZT | 1.26629 | 1.32582 | 4.70% |

KES | 0.3236 | 0.33286 | 2.86% |

MDL | 0.0464 | 0.04694 | 1.16% |

USD | 0.00255 | 0.00256 | 0.55% |

PHP | 0.15 | 0.15034 | 0.23% |

GBP | 0.00202 | 0.00202 | 0.04% |

EUR | 0.00243 | 0.00243 | -0.10% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

KES | 26.70967 | 27.55064 | 3.15% |

UGX | 763.74398 | 783.55994 | 2.59% |

KZT | 107.06369 | 109.71872 | 2.48% |

GBP | 0.16398 | 0.16724 | 1.99% |

MAD | 2.08304 | 2.12238 | 1.89% |

MDL | 3.82128 | 3.88505 | 1.67% |

UAH | 8.72909 | 8.83249 | 1.18% |

USD | 0.20977 | 0.21221 | 1.16% |

XOF | 130.47795 | 131.88032 | 1.07% |

PLN | 0.85459 | 0.863 | 0.98% |

PHP | 12.39 | 12.44317 | 0.43% |

EUR | 0.20016 | 0.20091 | 0.37% |

GHS | 3.27517 | 3.25954 | -0.48% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

UAH | 0.29396 | 0.30174 | 2.64% |

KZT | 3.67971 | 3.74821 | 1.86% |

PHP | 0.42 | 0.42508 | 1.21% |

MDL | 0.13134 | 0.13272 | 1.05% |

KES | 0.93199 | 0.94118 | 0.99% |

GBP | 0.00567 | 0.00571 | 0.76% |

UGX | 26.56697 | 26.76794 | 0.76% |

XOF | 4.47361 | 4.50529 | 0.71% |

USD | 0.00721 | 0.00725 | 0.55% |

EUR | 0.00685 | 0.00686 | 0.20% |

GHS | 0.11184 | 0.11135 | -0.44% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

GHS | 2.18593 | 2.17532 | -0.49% |

GBP | 0.11158 | 0.11162 | 0.04% |

XOF | 87.95727 | 88.0212 | 0.07% |

PHP | 8.27 | 8.30429 | 0.41% |

USD | 0.14061 | 0.14162 | 0.72% |

MDL | 2.56053 | 2.59277 | 1.26% |

UGX | 515.73346 | 522.6637 | 1.34% |

MAD | 1.39027 | 1.41654 | 1.89% |

KZT | 71.74033 | 73.22983 | 2.08% |

UAH | 5.74356 | 5.89092 | 2.57% |

KES | 17.87636 | 18.37654 | 2.80% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

UAH | 9.86025 | 10.23423 | 3.79% |

KZT | 123.47577 | 127.13662 | 2.96% |

KES | 31.16651 | 31.89973 | 2.35% |

MAD | 2.41142 | 2.45931 | 1.99% |

UGX | 895.81657 | 907.95048 | 1.35% |

MDL | 4.44336 | 4.50162 | 1.31% |

GBP | 0.19231 | 0.1938 | 0.77% |

XOF | 151.74829 | 152.81639 | 0.70% |

RON | 1.15111 | 1.1587 | 0.66% |

USD | 0.24434 | 0.24587 | 0.63% |

PHP | 14.33 | 14.41793 | 0.61% |

EUR | 0.23259 | 0.23281 | 0.09% |

GHS | 3.79149 | 3.77684 | -0.39% |

NGN | 421.4056 | 414.10163 | -1.73% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

GHS | 0.64501 | 0.64199 | -0.47% |

KES | 5.41054 | 5.42709 | 0.31% |

PHP | 2.44 | 2.45075 | 0.44% |

USD | 0.04157 | 0.0418 | 0.54% |

XOF | 25.8247 | 25.97858 | 0.60% |

EUR | 0.03927 | 0.03957 | 0.77% |

GBP | 0.03263 | 0.03294 | 0.95% |

UGX | 152.88984 | 154.35037 | 0.96% |

MAD | 0.41023 | 0.41808 | 1.91% |

KZT | 21.18614 | 21.61306 | 2.02% |

MDL | 0.74104 | 0.76518 | 3.26% |

UAH | 1.68471 | 1.73961 | 3.26% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

NGN | 2196.85821 | 2136.252 | -2.76% |

QAR | 4.62206 | 4.56436 | -1.25% |

PKR | 351.99461 | 348.3021 | -1.05% |

UGX | 4735.5737 | 4687.209 | -1.02% |

NOK | 14.05543 | 14.0449 | -0.07% |

ILS | 4.621 | 4.61499 | -0.13% |

SEK | 13.84569 | 13.8373 | -0.06% |

NZD | 2.14721 | 2.14626 | -0.04% |

HKD | 9.88014 | 9.8752 | -0.05% |

CAD | 1.77741 | 1.77922 | 0.10% |

LKR | 368.60204 | 369.1568 | 0.15% |

JPY | 190.25551 | 190.416 | 0.08% |

ZAR | 22.89538 | 22.93012 | 0.15% |

NPR | 171.33925 | 171.9046 | 0.33% |

PLN | 5.13739 | 5.16013 | 0.44% |

SGD | 1.69286 | 1.70065 | 0.46% |

AUD | 1.94211 | 1.9514 | 0.48% |

CZK | 30.20543 | 30.35735 | 0.50% |

BHD | 0.47615 | 0.47871 | 0.54% |

CHF | 1.11224 | 1.11835 | 0.55% |

THB | 43.28641 | 43.51143 | 0.52% |

BGN | 2.3383 | 2.34987 | 0.49% |

XOF | 784.18315 | 788.7654 | 0.58% |

USD | 1.26163 | 1.26879 | 0.57% |

PHP | 73.97462 | 74.40645 | 0.58% |

KWD | 0.38788 | 0.39038 | 0.64% |

EUR | 1.19235 | 1.2013 | 0.75% |

AOA | 1146.93932 | 1155.8485 | 0.78% |

MXN | 25.68989 | 25.91035 | 0.86% |

BDT | 150.43982 | 151.7834 | 0.89% |

PEN | 4.7118 | 4.7554 | 0.93% |

AED | 4.61673 | 4.6609 | 0.96% |

VND | 31848.77148 | 32159.49 | 0.98% |

KZT | 649.57991 | 656.2536 | 1.03% |

HUF | 489.85983 | 495.195 | 1.09% |

SAR | 4.72208 | 4.77084 | 1.03% |

RON | 5.91839 | 5.9794 | 1.03% |

DZD | 167.70008 | 169.2551 | 0.93% |

AZN | 2.13379 | 2.15722 | 1.10% |

TRY | 43.52267 | 44.01722 | 1.14% |

KES | 162.82695 | 164.7978 | 1.21% |

ALL | 116.73177 | 118.1705 | 1.23% |

MDL | 22.95254 | 23.24449 | 1.27% |

MYR | 5.57145 | 5.64409 | 1.30% |

DOP | 75.68144 | 76.66075 | 1.29% |

JMD | 197.37804 | 200.1251 | 1.39% |

CLP | 1223.73524 | 1240.743 | 1.39% |

XCD | 3.37928 | 3.42898 | 1.47% |

HNL | 31.61308 | 32.13468 | 1.65% |

BOB | 8.62449 | 8.77706 | 1.77% |

MAD | 12.45762 | 12.70693 | 2.00% |

COP | 5428.9899 | 5567.835 | 2.56% |

ETB | 155.35963 | 160.5352 | 3.33% |

UAH | 50.22381 | 52.83172 | 5.19% |

AMD | 475.80047 | 503.0063 | 5.72% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

NGN | 156.97439 | 154.43445 | -1.62% |

GHS | 1.41459 | 1.40841 | -0.44% |

EUR | 0.0868 | 0.08679 | -0.01% |

GBP | 0.07222 | 0.07227 | 0.07% |

PHP | 5.36 | 5.37722 | 0.32% |

USD | 0.09117 | 0.09169 | 0.57% |

XOF | 56.64615 | 56.99112 | 0.61% |

MDL | 1.65788 | 1.67869 | 1.26% |

UGX | 334.04047 | 338.371 | 1.30% |

MAD | 0.89969 | 0.91717 | 1.94% |

KZT | 46.44476 | 47.41414 | 2.09% |

UAH | 3.7177 | 3.8169 | 2.67% |

KES | 11.55517 | 11.89691 | 2.96% |

To Currency | TransferGo Rate | Mid-market Rate | Markup |

|---|---|---|---|

GBP | 0.0225 | 0.02272 | 0.96% |

UAH | 1.18566 | 1.19975 | 1.19% |

EUR | 0.02652 | 0.02729 | 2.88% |

PHP | 1.59685 | 1.69019 | 5.85% |

To put all these numbers into context, let’s imagine you’re making a €1,000 transfer from Germany via a one-day transfer transfer to the following countries:

Country | Method | TransferGo total fee | Wise total fee |

|---|---|---|---|

The UK (GBP) | Bank to bank | €3.98 | 5.75 EUR |

Kazakhstan (KZT) | Bank to card | €25.85 | Not Available |

Morocco (MAD) | Bank to bank | €18.20 | 24.37 EUR |

The US (USD) | Bank to card | €5.11 | 6.21 EUR |

The Philippines (PHP) | Bank to bank | €20.46 | 8.50 EUR |

Poland (PLN) | Bank to bank | €4.36 | 6.21 EUR |

Ukraine (UAH) | Bank to bank | €25.01 | 13.80 EUR* |

*At the time of writing you couldn’t send more than €700 to Ukraine.

TransferGo’s rates are far better than banks, and they’re competitive against other providers too - so we think it’s always worth checking them out when looking to send money.

“With flat fees hitting their ceiling at £2.99, TransferGo is definitely on the affordable side - particularly as there are no limits to how much you can send if paying by bank transfer. It’s worth a look, especially if you can take advantage of their under-30-minute transfers.”Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

TransferGo's money transfer service

With TransferGo, you can send money from 42 countries to 87 countries (in multiple currencies). This is much higher than the likes of Wise (from 27 countries to 51 countries) but is less than XE for example.

On the other hand, TransferGo misses on additional services such as multi-currency accounts.

Overall, this puts them high up on our top services list but is not a perfect 10.

Provider

TransferGo offers a fast and affordable money transfer service used by millions worldwide.

Our expert team has taken a close look at its service, looking at its functionality and usability to determine just how good it really is.

TransferGo speed

TransferGo has different tiers of money transfers, depending on how much you’re willing to pay in fees.

We’ve looked at the transfer times of 300+ transfer corridors and found that sending money to the phone number where the receiver collects the money is the most expensive option, followed by a day transfer and instant transfer.

Here’s a summary of the fees based on the transfer speed:

Delivery Estimate | Avg. Fee (USD) | High Fee (USD) | Low Fee (USD) |

|---|---|---|---|

After Receiver Collects | 4.20 | 36.12 | 0 |

One Business Day | 2.14 | 34.22 | 0 |

Instant | 1.97 | 36.34 | 0 |

Two Business Days | 0.00 | 0.00 | 0 |

30 Minutes | 0.00 | 0.00 | 0 |

Most of their standard transfers are usually completed within one working day, while their fast transfers are instant most of the time.

These are varied and affordable options - if you need a fast transfer you’ll likely have it for a comparatively low cost compared to some other providers.

However, you should .

TransferGo limits

TransferGo does not state any explicit limits on how much you can send by bank transfer - but there may be limits with your bank so check this beforehand.

TransferGo does have a limit of £10,000 per transaction if paying by card, but you can place an unlimited number of transfers, so in effect there is no limit so long as you’re happy to pay the fees for card payment.

There’s also a limit if sending money to a debit or credit card - the maximum is $2500 per transaction.

This makes TransferGo an appealing prospect if you’re depositing money into the recipient’s bank, with essentially no limits on how much you can send.

However, it is worth noting that these limits will be slightly different depending on where you send money from, but generally expect them to be very high.

TransferGo transfer types, deposits, and withdrawals

When you send money with TransferGo, you’ll be able to pay for your transfer via the following methods:

Bank transfer

The standard method for paying for international money transfers, this is when you send money to TransferGo’s local bank account in your country.

TransferGo will send the same amount from their bank account in the receiving country, minus fees and exchange rate markups, to the recipient.

The money never crosses international borders, so it doesn’t need to go through the expensive and time-consuming SWIFT process. Bank transfer payments usually work out the cheapest too.

Debit or credit card

You can also pay using a debit or credit card, but keep in mind you’ll get a different exchange rate and will likely face higher fees - especially for bigger transfers.

Credit and debit card payments are usually much faster than bank transfers, but their associated fees make them better for smaller transactions.

Card-to-card transfers

It’s worth noting that TransferGo also offers card-to-card transfers, meaning you’ll be able to use TransferGo’s money transfer service to send money directly to the recipient’s debit or credit card.

It offers the benefit of not needing the recipient’s full bank/IBAN details - you’ll just need their 16-digit card number and expiry date.

According to TransferGo, this method means you’ll avoid a host of bank charges too. Card-to-card transfers go through Mastercard or Visa Direct, Visa’s real-time push payments platform, so transfers are completed in minutes.

You can send money to debit and credit cards in 32 countries, including Ukraine, Turkey, Romania, Spain, Germany, and Poland.

Local payment methods and apps

TransferGo also lets you deposit money using local methods and apps such as Sofort, FPS, BLIK, etc...

These are priced slightly higher, but almost always faster and more convenient than other methods.

Other methods

TransferGo also offers cash pickup or delivery options and mobile money in certain countries including Nigeria and Morocco, while you can also send money to Nigeria with just the recipient’s phone number.

While bank transfers are one of the most common ways of sending money abroad, the limited other payout options may make TransferGo less appealing for those who don’t rely so much on banks. If you prefer cash pickups or apps to send money, other providers offer more flexibility.

As for payout methods, you have the following options depending on where you are sending money:

Phone number

Bank Account (via SWIFT, BBAN code, ABA number, Sort code, PrivatBank)

Debit cards (Visa or Mastercard)

Cash pickup

Mobile wallet

Based on our analysis, we found that there the fees vary significantly depending on the deposit and withdrawal methods.

Sofort is the most expensive deposit method (as it’s more niche) averaging at around $14.18 per transfer, followed by card deposits at $2.83 / transfer.

Here’s a summary of the fees by the deposit method:

As for withdrawals, transfers to a phone number, bank transfers, and card transfers are the most expensive, costing $4.20, $2.79, and $2.69 respectively.

Here’s a summary of the fees by withdrawal method:

TransferGo reach and supported countries

TransferGo operates in over 60 countries, allowing transfers from over 42 and payouts to over 87 countries - they’re listed below:

Send from these countries with TransferGo

Send to these countries with TransferGo

This is definitely on the higher end of global coverage compared to many other services. However, most of these are located within the EU.

For example, with Wise, you can send money to 51 countries from 27, and with MoneyGram from 37 locations to 41 destinations.

However, if they support your specific route(s) and the fees are affordable, then TransferGo can still be a reliable option for you.

TransferGo’s customer service

TransferGo’s customer support options include a phone line, a live chat, and an email helpline available 5 days a week, as well as an FAQ help center. We tried them all out below:

Phone

Availability | Monday to Friday, 7am to 6pm GMT |

|---|---|

Response time | Instantly |

Languages | English, Lithuanian, Romanian, Ukrainian, Russian, Polish, German, Turkish |

We called TransferGo’s customer support team at ten past twelve on a Friday afternoon, and they answered the phone immediately.

The agent was very helpful, answering all questions we had to clarify their pricing structure and transfer times, and more specific enquiries about why our bank card was blocked.

Live chat

Help center FAQs

“With very affordable rates, fast transfers and the rare ability to make transfers directly to someone’s bank card, TransferGo’s service stands out. The customer support team was very helpful too.”Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

TransferGo ease of use

We went through the signup process and were ready to send money in just a few minutes. Aside from a little issue with linking the card, the process was easy and straightforward.

The actual transfer process was also easy to follow and the fees we paid matched what was offered.

We went through the process of signing up to TransferGo on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

Provider

Signing up with TransferGo

Signing up with TransferGo was fairly straightforward - here’s how you do it:

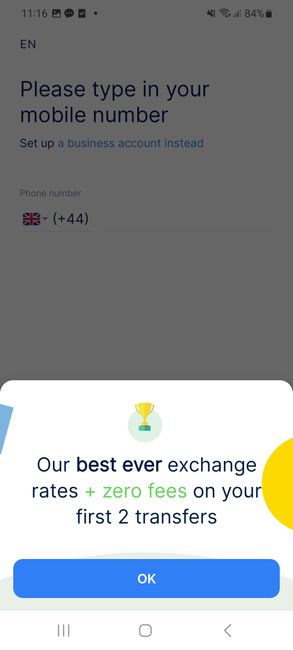

Enter phone number

The first step was to enter our phone number, and then enter the six-digit authentication code

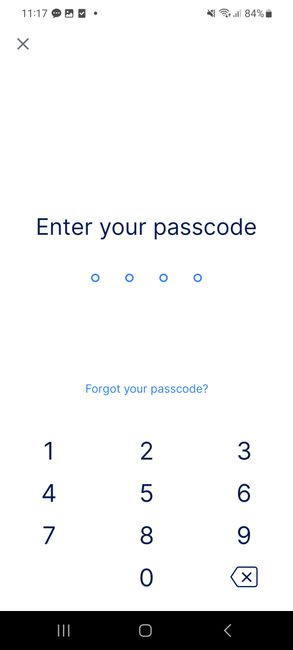

Create a passcode

Then we had to create and enter a four-digit passcode to log in

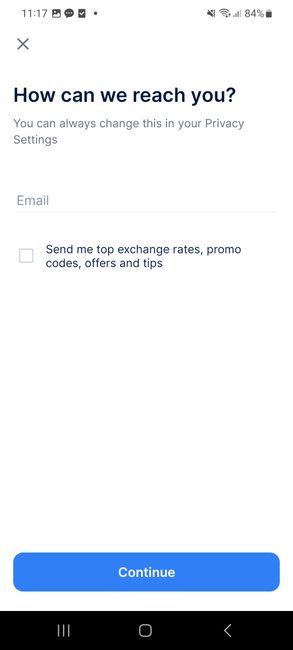

Add email

The next step was to add our email address and choose whether we wanted to receive promotional messages

Personal details

After this it was time to add our personal information, including name, date of birth and citizenship, plus where we’d be sending money from - then we were signed up and ready to go

This process was fast and straightforward - just how we like it.

Sending money with TransferGo

We tried sending money with TransferGo - here’s how we did it:

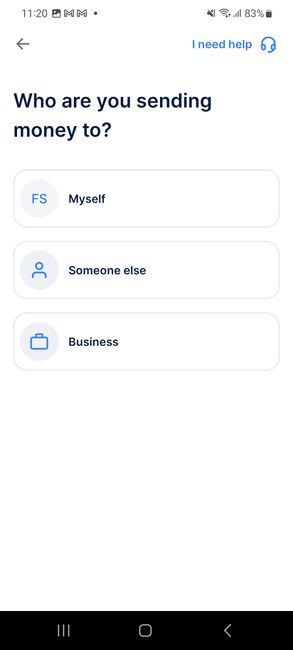

Choose recipient type

We had to say whether we were sending money to ourselves, someone else, or a business

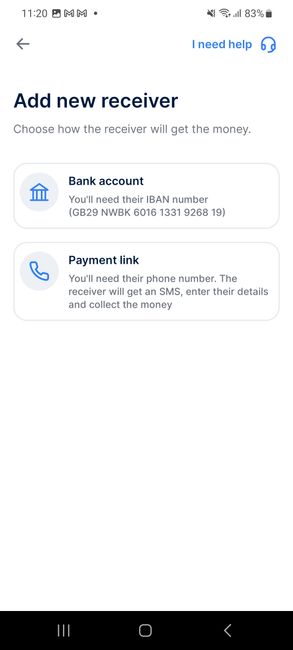

Add receiver

We were given the option of either sending money to their bank account or sending them an SMS with a link to enter details and collect their money.

We chose to send it to their bank account

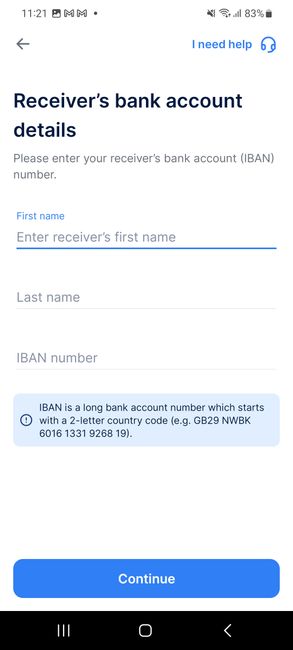

Add bank account details

We gave their first and last name, and their IBAN

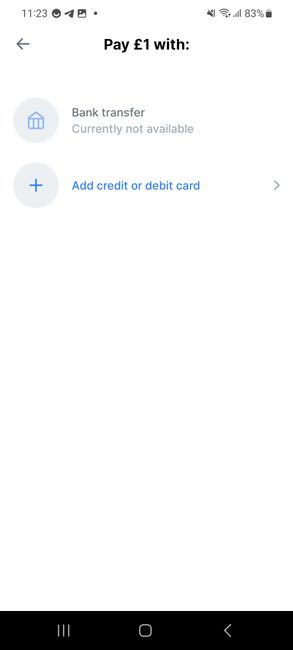

Choose payment method

Bank transfers weren’t available so we paid by card

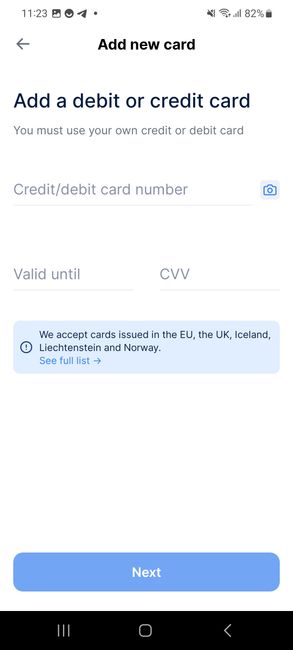

Add card

We gave our card number, expiry date and CVV

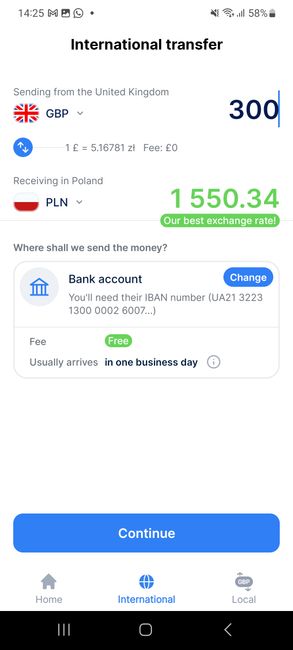

Confirm details

We confirmed the amount to send, the bank account, the delivery option and speed

Review

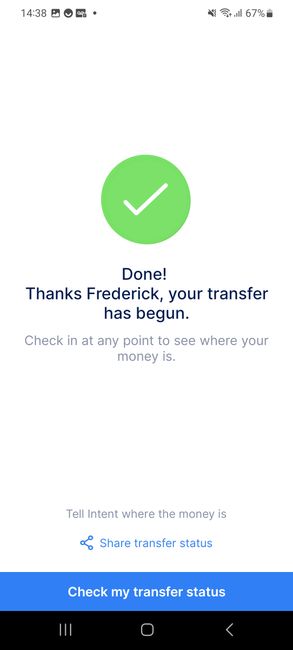

We reviewed the details of the transfer and paid, and our transfer was confirmed

“We found TransferGo’s quality of service to be quite high, and it was very straightforward signing up and sending money. Customer support was helpful in resolving the card issue, and at the speed and prices it offers, we definitely found it to be a slick operation.”Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

TransferGo safety and legitimacy

TransferGo reached its 5 million customer milestone, growing as a money transfer provider and building its credibility in the industry. Like all money transfer providers we compare on MoneyTransfers.com, TransferGo is fully licensed and reputable.

Provider

We took a deep dive into how TransferGo practices, who they’re regulated by, and what security features they use.

Is TransferGo authorized to transfer money?

TransferGo is fully regulated and authorized to provide money transfers in every region it operates in.

It is supervised by the HMRC under Money Laundering Regulations (12667079), and regulated by the FCA (600886).

It’s also authorized and regulated by the Bank of Lithuania, registration number 304871705, FI code 32400.

TransferGo safety and security

TransferGo transparency

User feedback on TransferGo services

TransferGo’s growth has seen its customer base grow to over five million in the last few years, and seeing what those customers think directly is always a useful way to find out more about a provider.

In general, most reviews are positive commenting on transparent fees, and good service in general. On the downside, they seem to have technical issues with transfer delays, clocked cards, and money getting lost.

This knocks it down a few points in our rating but is generally inline with other companies.

Provider

We’ve looked at their score on Trustpilot as well as their app reviews for both Android and iOS - here’s what we found.

TransferGo is rated as Excellent on Trustpilot, with a score of 4.7 from over 37,000 reviews when this article was written - and 91% of all ratings are 5 stars.

This is an excellent score, especially considering the high number of reviews, showing that TransferGo is an extremely trustworthy company with a great reputation among its customers.

Negative reviews, of which there are very few, cite blocked or delayed transfers, and money going missing - as well as some issues with larger transfers and less than stellar reviews on their customer service.

However, many positive reviews call out their fast transfers, low fees, and favorable exchange rates.

According to Trustpilot, TransferGo replies to 98% of negative reviews, usually within a week.

Region | Number of reviews | Score |

|---|---|---|

US | 130+ | 4.7 |

UK | 2,000+ | 4.9 |

DE | 900+ | 4.8 |

FR | 400+ | 4.9 |

ES | 90+ | 4.5 |

TransferGo’s ratings across multiple iOS App Stores are very high, and in the store, with the most downloads - the UK - it’s rated 4.9 out of 5, while in the US it’s rated 4.7 out of 5.

Many of the positive reviews praise the app’s functionality, the overall transfer service including its speed, and the ease with which they can send money.

However negative reviews cite lost money and delays in the transfer process.

TransferGo is rated very highly on the Google Play Store, and its Android app has 4.9 stars from over 28,000 reviews and one million plus downloads.

Many of the positive reviews comment on their fast transfers, and easy-to-use money transfer app - however negative reviews again cite delays, bugs, missing money, and poor customer service.

These are common themes across all review platforms, which tells us that TransferGo is, for the most, a trustworthy and reliable company.

However, the common themes of missing money or delayed transfers aren’t ideal - remember to always be careful and accurate when inputting details and providing verifying documentation.

“TransferGo may not be the biggest provider on MoneyTransfers.com, but they offer a solid money transfer service, with plenty of flexibility and choice. We found the overall experience with TransferGo to be positive, and would recommend them as a provider if they offer the best rate for your transfer.”Financial content specialist, MoneyTransfers.comArtiom Pucinskij

Compare TransferGo with other providers

A bit more about TransferGo

Do I need an account to receive money with TransferGo?

Do I need a bank account to join TransferGo?

Is TransferGo legal to use?

Who owns TransferGo?

Can I open a TransferGo account in any country?

Our final verdict

We rate TransferGo as a strong money transfer provider, joint third on our list of top ten providers on the market, and would recommend it if it covers your needs.

With consistently high scores across the board and a particularly strong showing for its service quality, they’re worth considering - especially for transfers within the EU.

TransferGo user feedback

Comments

Piotr W

Used it for couple of years, unfortunately recently the level of their services went down the drain. Transfers are extremely delayed without giving any info. Of course while chatting with them (they cancelled their phone line) it's always someone else's fault, system, bank etc. Definitely I won't be using it ever again.

Anonymous

The exchange rate goes to astonishingly bad as soon as you have generated an account… My advise: STAY WELL CLEAR!

Symeon

The amount shown on the main page is only for new users and for the first 2 transactions.

Anonymous

so many hoops to get started