Receiving business payments from abroad

Sending and receiving business payments often go hand-in-hand. With businesses receiving money from abroad in potentially large amounts, and at regular intervals, the cost of receiving money should be part of managing currency risk.

The best way to receive business payments will be into a multi-currency account like Airwallex or Wise Business. These offer lower conversion rates (from 0.33%) than banks and no incoming transfer fees. You can also access local account details and expense management options.

As a business it is easy to get a bad deal on incoming transfer fees when the money is going into a bank account. The sender is in control of sending the money, but as the recipient it is possible to improve control and reduce the cost of receiving money.

Broadly speaking, a money transfer company offering a multi-currency account for regular payments, or a managed service for one off large payments, are the best options.

The reason for this is simple - the incoming cost of the transfer through each is largely eradicated.

Here’s some detail on this:

Receive method | ✅ Best for | ❌ Not great for | 👉 Offered by |

|---|---|---|---|

Receive to regular bank account | Incoming international payments in same currency | Incoming international payments in different currency | Your regular bank |

Receive to multi-currency account | Most incoming transfers, connected services to marketplaces (like Amazon Marketplace) | Very large incoming transfers | |

Receive through a managed service | Companies with a strong need for currency risk management, large transfers | Small, regular payments |

The type of international payment received

The type of international payment being received plays a huge part in which type of provider to choose. This will largely depend on the business.

Regular international transfers

Regular incoming transfers are best served using a multi-currency business account. This allows businesses to manage income in local accounts in different markets and receive local payments.

Example 1: Receiving to a standard business bank account

.png)

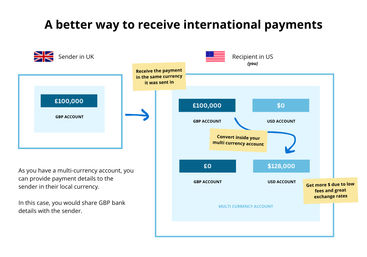

Example 2: Receiving to a business multi-currency account

What to look for

Companies with local accounts within the market/s you operate

Companies offering to receiving fees on local and international payments

Companies offering the accounting software integration that matches a business

For the most part, these also allow for sending invoices and will be sync with accounting software in real time.

In essence, this is international business transfers, managed alongside everyday finance.

Whilst not necessarily for receiving payments, being able to sync accounts with expenses and outgoing payments is also hugely beneficial.

Enterprise, SME and large incoming transfers

This type of transfer can result in the biggest cost for the receiving business. Banks will often charge a receiving fee and will charge for the conversion of funds. For example, if a USD account receives in EUR.

What to look for

Companies offering account management

Companies offering currency risk strategy services

For these types of transfers working with a company offering risk management and hands on account management will be a huge benefit.

Incoming payments as a freelancer

There are some overlaps with what regular transfers and international freelancers will need in terms of receiving money. However, not all standard business accounts (Revolut Business for example) are available to freelancers. There are also certain accounts that have more marketplace and freelancer platform integrations than others.

For example, Payoneer offers an Upwork option.

What to look for

Companies with local accounts within the market/s you operate

Companies that allow you to create invoices and send in relevant countries

Companies offering flexibility with integrations

Companies offering interest on balances

Outside of these points, opting for a company that makes sending money a little easier is key. The world of the digital nomad is well and truly established, and finding the right provider that offers freedom in use, in the same way the lifestyle offers freedom of work is key.

Regular marketplace income

Marketplace income, such as through Amazon Marketplace, is the lifeblood of many businesses. Having the ability to sell globally, as opposed to just one location can change everything.

Different companies provide different levels of integration and many will work with Amazon Marketplace, Shopfiy setup and WooCommerce. Effectively, this allows plugin and lower conversion or cost on incoming card payments than going directly into a bank account.

What to look for

Companies with local accounts within the market/s you operate

Companies that integrate with the software used

Companies offering low international card payment fees

Ecommerce businesses may find a need to show more proof of income, particularly if newer businesses. This being said, in the setup phase most companies will work alongside businesses ensure all KYC can be met.

Focus on where the money is coming from

In the end, managing currency risk can be simple if you focus on where the money is coming from - this could be clients, invoices, marketplaces and should be paired with the country and currency.

Opt for a provider that offers local accounts in the markets your business operates.

Opt for a provider that offers risk management solutions where your incoming funds can be particularly large.

Work with customers where possible to ensure incoming payments are suited to your business needs.

Sources and further reading

Related Content

Contributors

.svg)