Our Review of Currencies Direct

Based in the UK but with a global customer base, Currencies Direct has established a loyal customer base. Offering services for both individuals and businesses, it’s a well-known brand with a strong reputation.

The remittance review team at MoneyTransfers.com has analyzed Currencies Direct’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback. We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture on how good Currencies Direct really is.

How MoneyTransfers.com rates Currencies Direct

Fees & Rates

With an absolutely fantastic fee structure offering a range of affordable transfers, Currencies Direct get our highest score ever for fees and exchange rates.

Service

Ease of Use

Safety & Trust

Customer Feedback

“Currencies Direct is a currency broker that specializes in large money transfers. Offering personalized guidance from account managers, as well as a 24/7 online platform with fee-free transfers, and a variety of other services, it’s a strong and flexible money transfer provider.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like Currencies Direct?

Pros

Cons

How much does it cost to send money with Currencies Direct?

Here's how we rated Currencies Direct based on its fees and exchange rates - it ranks as one of the best providers for the cost of making a transfer. Find the best rates for your specific transfer with our comparison tool.

Compare providers

Currencies Direct’s fee structure is simple - it doesn’t charge fees for personal customer transactions. It does however charge a slight markup on the mid-market exchange rate, which is how Currencies Direct makes money.

When sending money with Currencies Direct, the overall cost will depend on the currencies involved in the transaction, as this is how the exchange rate will be determined.

What are Currencies Direct’s transfer fees?

Currencies Direct is known for their fee-free structure, charging no fees at all to make a money transfer abroad. On its own this is great - we don’t have any complaints about the pricing so far. However as is always the case with money transfer providers that don’t charge a fee, it’s all about the exchange rates on offer.

What exchange rate does Currencies Direct charge for international transfers?

Currencies Direct offers very competitive exchange rates on all transfers we looked at, coming ahead of the competition with its rates for euro to US dollar transfers, euro to pound transfers, pound to US dollar transfers, and more. In fact, for every route we tested, Currencies Direct offered the best or second best rate of all providers.

Combined with its fee-free structure, it’s no mystery why we’ve rated Currencies Direct’s overall cost as 9.8 out of 10 - they are one of the most affordable providers on the market.

To put all these numbers into perspective, here's a real-time view of current exchange rates and fees charged by Currencies Direct for sending USD to different countries:

Currency pair | Exchange rate | Transfer fee | Exchange rate markup | Amount received |

|---|---|---|---|---|

USD / AUD | 1.4067 | $0 | 0.53 | $14,067 |

USD / CHF | 0.7683 | $0 | 0.51 | CHF 7,683 |

USD / EUR | 0.8414 | $0 | 0.51 | €8,414 |

USD / GBP | 0.7357 | $0 | 0.52 | £7,357 |

USD / INR | 90.1117 | $0 | 0.69 | ₹901,117 |

USD / MXN | 17.0569 | $0 | 0.59 | $170,569 |

USD / NZD | 1.6625 | $0 | 0.54 | $16,625 |

USD / PLN | 3.5515 | $0 | 0.59 | zł 35,515 |

USD / RON | 4.2776 | $0 | 0.75 | lei 42,776 |

USD / TRY | 43.5609 | $0 | 0.64 | ₺435,609 |

USD / ZAR | 15.9337 | $0 | 0.48 | R 159,337 |

“With a combination of no fees and competitive exchange rates, Currencies Direct is a very affordable option if you need to send significant sums abroad. However it can also be useful for smaller transfers, so be sure to compare deals with MoneyTransfers.com to see if it offers good rates for your needs.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is Currency Direct's money transfer service?

This is how we rated Currencies Direct based on the overall quality of service it offers. It ranks high on our list of top ten providers for their services, along with TorFX and other major providers.

Compare providers

Currencies Direct is a truly global money transfer provider with a network that stretches around the world. It also offers a strong money transfer service for its low cost - we’ve taken a closer look to see just how good its service is.

How fast are Currencies Direct’s transfers?

Currencies Direct says it'll usually take between 24 and 48 hours to complete your transfer. However, it also mentions that transfers to exotic destinations can take between three and five working days as a result of bank processing times.

This is not rapid by any means, but the majority of transfers should be done within two days, which is at least faster than most banks. However, if you’re looking for transfers to be carried out immediately, you might want to consider other providers like WorldRemit - just remember you’ll likely pay higher fees for the improved speed.

How much can I send with Currencies Direct?

Currencies Direct allow 24/7 transfers of up to £50,000 - if you want to send more, it’ll need to be within the company’s office hours as you’ll need to talk to an account manager.

What kind of transfers can I make with Currencies Direct?

When you send money with Currencies Direct, you’ll be able to pay for your transfer via the following methods:

Bank transfer: The most standard way to pay for a money transfer is to send payment from your bank account to Currencies Direct’s local bank account. They’ll send the same amount of money, minus exchange rate markups, from their account in the receiving country to the recipient’s bank account

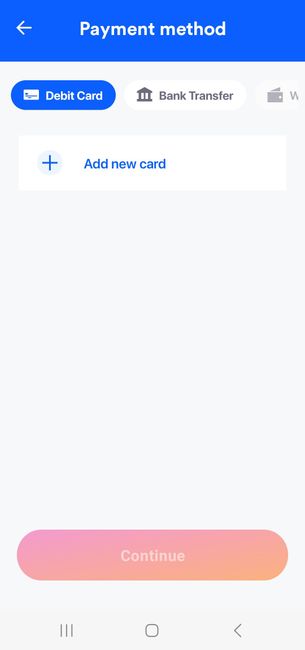

Debit card: Debit card payments are also accepted, and while these are often quicker to be processed than direct bank transfers, they’ll also come with a higher cost.

Currencies Direct are essentially a foreign exchange broker, and they specialize in large money transfers. As such, they offer certain money transfer products that can help you maximize the value of your transfer through targeting exchange rates:

Spot contract: A spot contract is an immediate money transfer, where you agree the exchange rate as it currently stands

Forward contract: A forward contract allows you to fix the current exchange rate for up to a year with Currencies Direct, it just requires a small deposit

Limit orders: A limit order lets you target a certain exchange rate, and Currencies Direct will transfer your money as soon as this rate is hit - good if you aren’t in a hurry to make the transfer and want to protect yourself against uncertainty

Where can I send money with Currencies Direct?

You can send money in over 40 currencies to 120 countries with Currencies Direct. This is a provider with a global reach, offering money transfers all over the world. While it falls slightly behind other providers like XE, WorldRemit and CurrencyFair, they still cater to almost all major currencies and countries, so you’re likely to find the transfer you need with Currencies Direct.

How good is Currencies Direct’s customer service?

Currencies Direct’s website says its UK customer support team is available 24/7 by phone, email, and live chat, but we couldn’t find a live chat option anywhere. In the USA you can reach them by phone or email, from 9am-5pm EST Monday to Friday.

Phone

Availability | Monday to Friday, 9am to 5pm EST |

|---|---|

Response time | 3 minutes |

Languages | English |

We spoke to our account manager at Currencies Direct, and found that they were very friendly and helpful, assuring us they were on hand for anything we needed. They answered all our questions promptly and offered to guide us through the process of making a transfer, especially if we wanted to use forward contracts or limit orders to target the best rates.

Availability | Monday to Friday, 9am to 5pm EST |

|---|---|

Response time | Under an hour |

Languages | English |

We also emailed our account manager for an inquiry about getting the best rates for a certain transfer we wanted to make. They answered within an hour and offered to guide us through a transfer over the phone.

What else can I do with Currencies Direct?

On top of their 24/7 money transfers up to £50,000 and bigger transfers within office hours, Currencies Direct offers a multi-currency card, which lets you:

Hold pounds, euros, US dollars and Australian dollars in your wallet

Spend in those currencies with no monthly fee

Withdraw from cash machines

Spend money in over 200 countries

Access smart banking features like instant notifications and controlling your card via the app

You can also use Currencies Direct’s rate alerts, currency charts and mid-market converter tool to see more current exchange rates.

“Offering a range of money transfer products designed to help customers get the best rates on large money transfers, Currencies Direct’s quality of service is excellent. We’d recommend them as a strong provider if you need to send a significant sum of money abroad, although their range of destination countries may not cater to your needs.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How easy is Currencies Direct to use?

Here's how we rated Currencies Direct based on how easy it is to open an account and send money. Currencies Direct came joint fourth in this ranking, level with TorFX (by which it is owned, so the process is similar), but behind providers like Wise, WorldRemit, and Atlantic Money.

Compare providers

We went through the process of signing up to and sending money with Currencies Direct - we’ve reviewed them in detail below.

Signing up with Currencies Direct

Here’s the process for signing up with Currencies Direct via its app:

Create account

We downloaded the app from our app store, opened it and clicked on ‘Create an account’

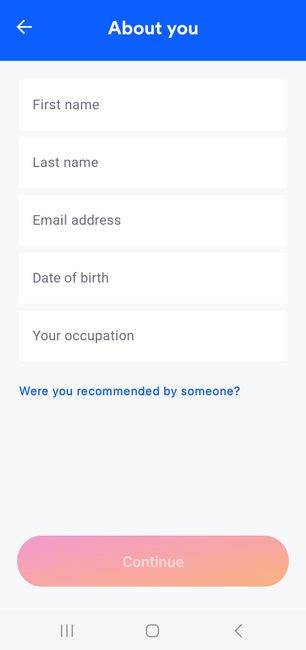

Add basic details

We gave our name, email, date of birth and occupation

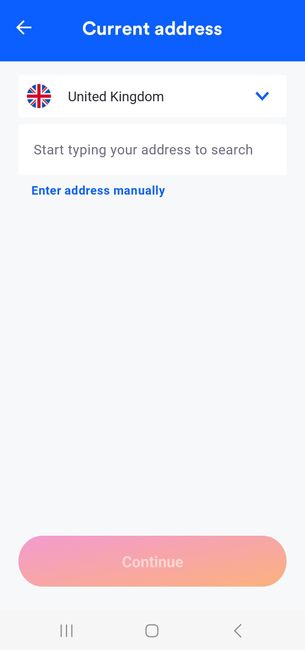

Add address

We added our home address

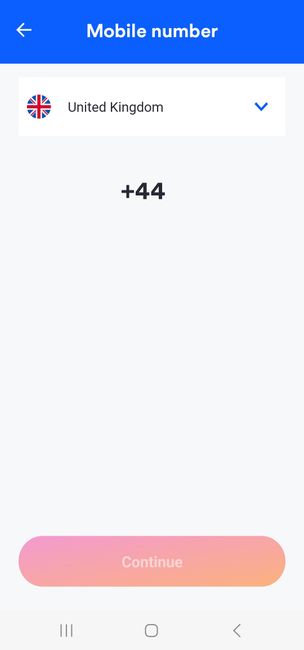

Add phone number

We gave our phone number

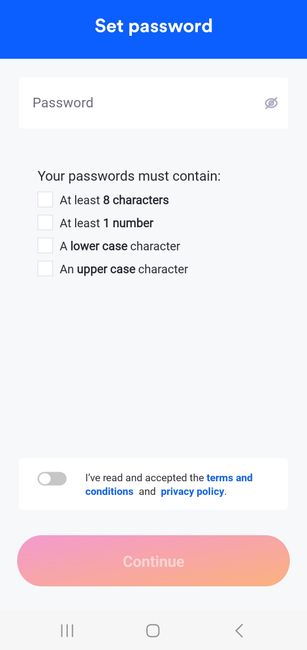

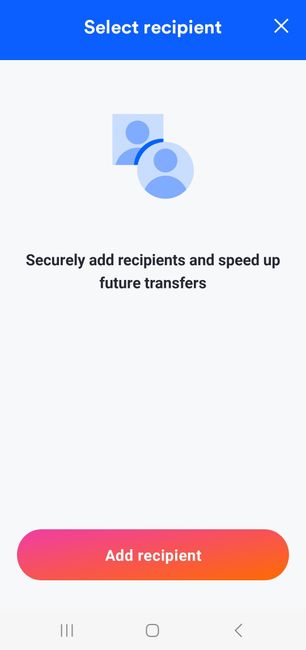

Set password

We set a password according to their guidelines

Answer security questions

Our account was ready to use, but we had to set two security questions to verify our our identity if we needed to call them

It was easy enough to sign up with Currencies Direct, taking only a few minutes to open an account.

Sending money with Currencies Direct

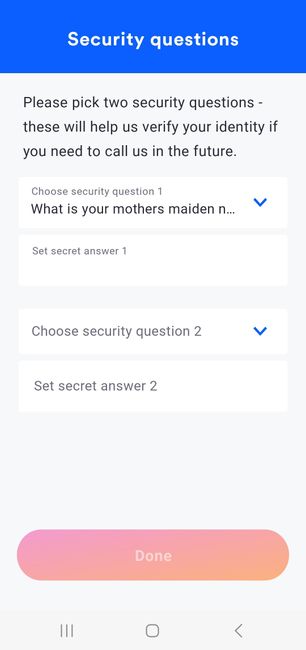

We used Currencies Direct to sent GBP to be converted to EUR - here’s how it went:

Enter transfer details

We entered the amount we wanted to send and the currencies involved in the transfer

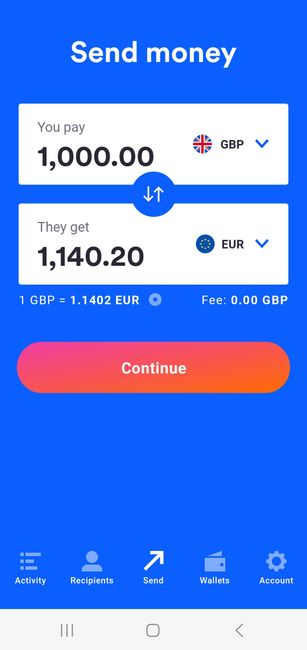

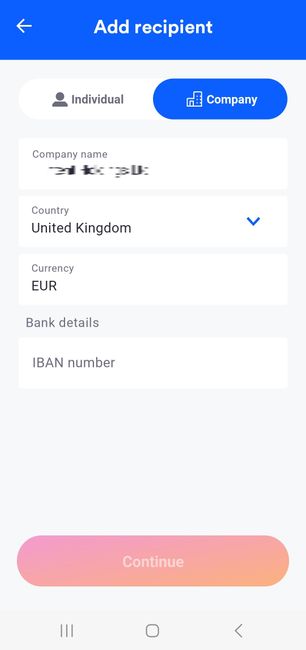

Add recipient

We chose the option to add our first recipient

Add recipient details

We specified that they were a company rather than an individual, and gave the company name, country, currency they’d be receiving in, and their IBAN

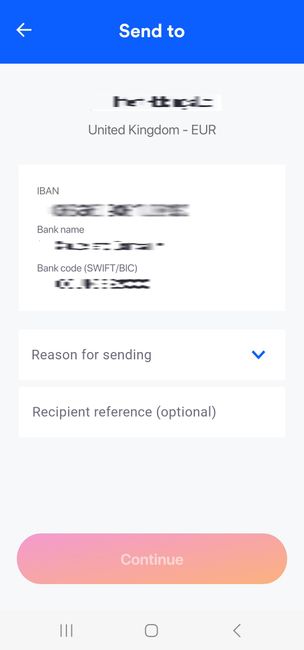

Select reason for transfer

We chose the reason for sending the money

Choose payment method

We added a new card as a payment method

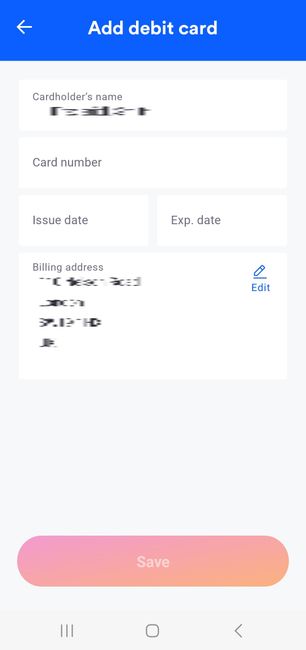

Add card details

We gave the cardholder name, card number, issue and expiry dates, and the billing address

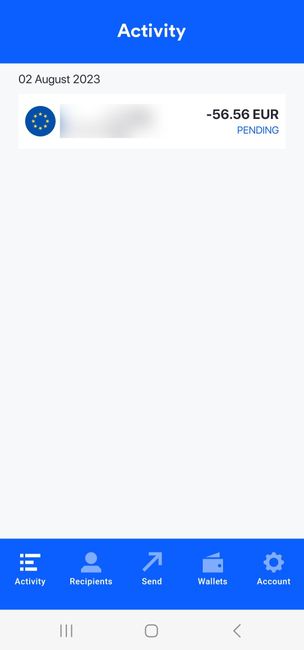

.jpg)

Review transfer

We reviewed the final details of the transfer

Confirm transfer

We confirmed the transfer, and once we hit send, we received a phone call from our designated account manager to ask about the transaction details and how often we were planning to send money. They also assured us they would be able to help us with anything we needed in the future

The process was simple and straightforward, and we appreciate the personal touch of receiving a phone call immediately. The money arrived with the recipient in just under 18 hours, which was pretty much as we expected - it’s not the fastest way to send money but anything under a day is still good in our books.

“Currencies Direct added a personal touch to the money transfer process, putting us at ease about our transfer and ensuring we knew they were there to help. It was straightforward without any real hiccups, and the money arrived in under a day, so all okay with us. However if you want faster transfers, you might be better off with another provider.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is Currencies Direct?

Here's how we rated Currencies Direct based on their safety, security, transparency and trustworthiness. They rank on our list of top ten providers for this category alongside TorFX, Wise, and OFX.

Compare providers

Currencies Direct have been moving money since 1996, and claim to have made over 600,000 payments in 2022, trading £10bn in various currencies. It’s a major provider in the industry with a positive reputation thanks to its low fees and competitive rates. It’s also authorized to provide money transfers in every region it operates in, just like all providers on the MoneyTransfers.com panel.

We took a deep dive into how Currencies Direct practices, who they’re regulated by, and what security features they use.

Is Currencies Direct authorized to provide money transfers?

Currencies Direct is regulated and authorized in all countries it operates in:

Currencies Direct is authorized by the Financial Conduct Authority as an Electronic Money Institution. Their reference number is 900669. It’s also regulated by the Prudential Regulation Authority

It’s also an authorized Financial Services Provider regulated by the Financial Sector Conduct Authority in South Africa (43493), and a Primary Accountable Institution with the Financial Intelligence Centre Act (AI/120106/00001)

Currencies Direct is registered with the Financial Transactions and Report Centre of Canada (MO8690900)

Currencies Direct is registered with the Commercial Registry of Almeria (BO4897930) in Spain for its EU services. It’s registered with the Bank of Spain under the number 6716

Currencies Direct is registered as a Money Service Business at a federal level with FinCEN, as well as specific state regulatory agencies in CA, FL, GA, IL, NJ, NC, PA, RI, SC, TX and WA.

Is Currencies Direct safe and secure?

Like all electronic money institutions, Currencies Direct practices Safeguarding to keep customers money safe in the event of insolvency. This means all customer funds are kept separately from business funds. It also employs standard security on its website and apps, ensuring your data is protected.

Is Currencies Direct transparent?

Currencies Direct is transparent with its fee-free structure, and it shows you what rate you get and how close it is to the mid-market rate. There are no hidden fees charged by Currencies Direct, so you know exactly what your money transfer will cost.

What do other customers think of Currencies Direct?

This is how we rated Currencies Direct based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It ranks high on our list of top ten providers for customer feedback alongside major names like TorFX and Wise.

Compare providers

With hundreds of thousands of transfers completed valued at billions, Currencies Direct seems to have a positive reputation among its customer base. We’ve looked into their ratings and reviews on Trustpilot as well as both major app stores to see what people have been saying.

What is Currencies Direct rated on Trustpilot?

Currencies Direct is rated as Excellent on Trustpilot, with a score of 4.9 from over 9,000 reviews when this article was written - 91% of all ratings are five stars. This is a fantastic score, but it’s important to note that while 9,000 reviews isn’t exactly a minor figure, it’s dwarfed by the number of reviews available for bigger providers - both XE and WorldRemit have over 50,000. When you consider that Currencies Direct have been around for a while, 9,000 starts to look smaller.

Many of the positive reviews cite specific account managers as particularly helpful, while there was also a lot of praise for how easy it was to use and the rates on offer. But the customer support is the main highlight by a distance here.

The few negative reviews reference lost money, some poor exchange rates, and a few issues with transactions not being canceled. However there are very few, and nearly all have a reply from the company. According to Trustpilot, Currencies Direct has replied to 89% of all negative reviews, getting their responses in under 24 hours.

What is Currencies Direct rated on the Apple App Store?

Currencies Direct is rated 3.3 stars out of 5 on the US Apple App Store, from only 12 ratings. It’s also rated 3.5 out of 5 on the UK App Store, from 86 ratings. From so few ratings, it’s better to look at the reviews in order to see how the provider is seen by its iOS users.

Positive reviews cite their efficiency, cheap transfers abroad due to their low fees and rates, and their customer support and account managers. However, negative reviews reference issues with the app, logging in, and some time ago, its availability in certain regions. If you are looking specifically for an app provider, our best money transfer apps comparison may be of help.

What is Currencies Direct rated on the Google Play Store?

The Currencies Direct app is rated 3.4 out of 5 on the Google Play Store, from over 450 reviews and 50,000 downloads.

Many of the positive reviews praise Currencies Direct’s service and customer support, but there is a lot of negative feedback surrounding the app’s functionality and not being able to log in. There are also some recent complains about rates not being as good as they used to be.

Our MoneyTransfers.com expert says…

“Currencies Direct’s offering isn’t quite the same as providers like WorldRemit or Wise - it’s more of a currency broker, designed to facilitate large money transfers at the best possible rates. We’d recommend giving them a try if you need to send over a few thousand dollars, and you can afford to wait for the best rates, but you might find more convenient transfers elsewhere.”Jonathan Merry, Founder, MoneyTransfers.comJonathan Merry

Our final verdict

Currencies Direct is one of our highest rated providers, and its fee and rate structure is what makes it stand out. It’s worth comparing their deals when making a big money transfer in particular, as you might find their rates to be among the most affordable.

Frequently asked questions about Currencies Direct

Do I need an account to receive money with Currencies Direct?

Do I need a bank account to join Currencies Direct?

Is Currencies Direct legal to use?

Who owns Currencies Direct?

Can I open a Currencies Direct account in any country?

Currencies Direct user feedback

Comments

Anonymous

I wanted to get a quote for sending CAD but web site only allows GBP

Anonymous

Good job 👍🏾

Roshan Firouz

Currencies Direct will be very friendly and efficient in TAKING your money, but when you ask for it to be transferred, they will shamelessly put every possible and impossible obstacle in your way in order to stop you from moving the money.