The remittance review team at MoneyTransfers.com has analyzed Atlantic Money’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback.

We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture on how good Atlantic Money really is.

Our Video Review of Atlantic Money

How MoneyTransfers.com rates Atlantic Money

Fees & Rates

With a low flat fee and mid-market exchange rates, Atlantic Money is a fantastically affordable option for the service it provides

Service

Ease of Use

Safety & Trust

Customer Feedback

“Atlantic Money might be new on the scene but they show a lot of promise, with a desirable fee structure and a really easy-to-use app. Signing up and sending money was simple, and if Atlantic Money caters to a transfer you need to make then it’s unlikely you’ll find a better fee.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like Atlantic Money?

Pros

Cons

How much does it cost to send money with Atlantic Money?

Here's how we rated Atlantic Money based on their fees and exchange rates, putting them high up on our top ten list of money transfer providers in terms of overall cost. Find the best rates for your specific transfer with our comparison tool.

Compare providers

Atlantic Money charges a single flat fee for all money transfers, and there is absolutely no markup on the mid market exchange rate. While many providers will vary your fee depending on how much you send, which currency you’re sending, and how you pay for your transfer, you can look forward to consistent pricing with Atlantic Money.

The only time you’ll pay more is if you opt for an express transfer, which means you get a faster money transfer for the extra cost. This is an excellent pricing structure, offering more affordable money transfer rates than many of its competitors.

What are Atlantic Money’s transfer fees?

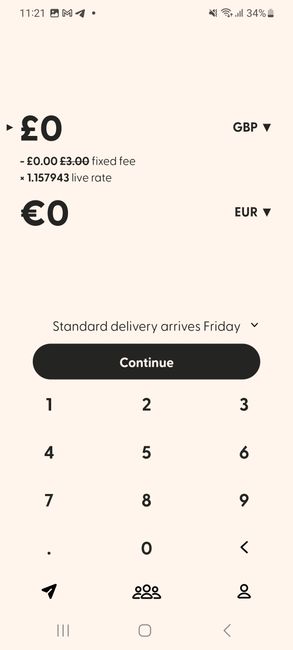

Atlantic Money charges a flat £3/€3 for all standard international money transfers, regardless of how much you’re sending or where it’s going. If you choose an Express money transfer you’ll pay the same fee plus an extra charge of 0.1% of the total amount being sent.

A flat fee structure is often much easier to grasp as you’ll always know how much you’re sending, and while it might be less than ideal for small amounts, it often represents better value overall.

What exchange rate does Atlantic Money charge for international transfers?

Atlantic Money always offers the live exchange rate for your transfer, meaning there is no percentage markup for the provider to make extra money - so there are no hidden fees or charges.

However it’s worth noting that if you make a transfer during the weekend or on a public holiday, you’ll be offered two exchange rates:

Last known: If you pick the last known rate, you'll see the exchange rate as it was at the close of business on the previous working day. This will come with a 0.1% fee as you get a degree of certainty with it

Next available: The other option is to go with the next available, which is a little more risky as you won’t know what the rate is when you make the transfer - it’s determined the next working day

Once again, it’s easy to see why Atlantic Money has a high score for their transfer fees and rates - these are amongst the cheapest deals available for money transfers. The pricing is so good that you might be wondering what the catch is - let’s dig further into Atlantic Money’s transfer service to see if it’s too good to be true.

“It’s fair to say Atlantic Money is on the affordable side when it comes to money transfers. We can only hope these rates last as the company grows and its service becomes stronger - and therefore more expensive to maintain. If Atlantic Money caters to a route you need, it would be wise to take advantage.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is Atlantic Money's money transfer service?

This is how our experts scored Atlantic Money based on the overall quality of service it offers. It ranks outside of our top ten list of providers for their overall quality of service.

Compare providers

As a relatively new money transfer provider, it’s not a huge surprise that Atlantic Money doesn't currently offer the same level of service as some of the bigger companies. But as is the case with all providers, it can depend on what you need from them.

So we’ve taken a deep dive into Atlantic Money, analyzing their transfer speeds, currency support, and customer service to see how good they are.

How fast are Atlantic Money’s transfers?

Atlantic Money offer two transfer types, Standard and Express, while it also has specific delivery times for different currencies:

Currency | Standard Delivery Time | Express Delivery Time |

Australian Dollar | Up to four business days | Up to two business days |

British Pound | Up to two business days | Instant, 24/7 |

Canadian Dollar | Up to three business days | One business day |

Danish Krone | Up to three business days | One business day |

Euro | Up to two business days | Instant, 24/7 if possible, otherwise within one business day |

Norwegian Krone | Up to three business days | One business day |

Polish Zloty | Up to three business days | One business day |

Swedish Króna | Up to three business days | One business day |

US Dollar | Up to three business days | One business day |

Atlantic Money’s ‘Standard’ transfers often require two business days for currency conversion, on top of the standard transfer time seen under ‘Express’ transfers.

Atlantic Money’s cutoff time is 8:30 pm on weekdays. Any transfers made after this time won’t be processed until the next business day, so aim to fund your transfer before this time. Transfers funded on weekends won’t be processed until Monday unless instant delivery is supported and an Express transfer is chosen.

These transfer speeds are quite slow, compared to many other providers who can move money often within the same day. However, if you’re happy to pay an extra 0.1% fee for instant transfers for pounds or euros (where applicable), Atlantic Money may still be a good option.

How much can I send with Atlantic Money?

Atlantic Money have maximum transfer limits for certain currencies, laid out in the table below:

Currency | Pay out limit | Pay in limit |

Australian Dollar | None | None |

British Pound | None | £1 million |

Canadian Dollar | CAD$1 million | None |

Danish Krone | None | None |

Euro | None | €1 million |

Norwegian Krone | None | None |

Polish Zloty | 1 million PLN | None |

Swedish Króna | None | None |

US Dollar | $1 million | None |

However, you won’t have access to these upper limits until you’ve passed Atlantic Money’s verification processes. The providers has verification tiers that you can progress through:

When you sign up: You’ll be able to send £/€850 per 30 day rolling period, or £/€2,500 per 180 day rolling period

The next tier: When you take a selfie to confirm your ID and answer some questions about you and your account, the limits increase to £/€30,000 per 30 day rolling period, and £/€80,000 per 180 day rolling period

Advanced tier: If you choose to submit documents to prove the source of your funds, and give a reason for sending money, Atlantic Money will then give you a customized transfer limit

This might be bothersome to those looking for a quick signup and transfer, but verification processes are standard and a good way to ensure your money stays safe.

What kind of transfers can I make with Atlantic Money?

When you send money with Atlantic Money, you’ll only be able to pay by bank transfer - you won't have the option of paying by debit or credit card. While this keeps things relatively cheap, it does mean your transfers with Atlantic Money won’t usually be that fast.

Where can I send money with Atlantic Money?

Atlantic Money is available in the following countries:

Andorra | Czech Republic | Iceland | Norway |

Austria | Denmark | Ireland | Poland |

Azores | Estonia | Italy | Portugal |

Belgium | Finland | Latvia | Romania |

Bulgaria | France | Lithuania | Slovakia |

Canary Islands | Germany | Luxembourg | Slovenia |

Croatia | Greece | Madeira | Spain |

Cyprus | Hungary | Netherlands | Sweden |

United Kingdom |

You’ll be able to send euros or British pounds to be converted into:

Australian dollars

British pounds

Canadian dollars

Danish krone

Euros

Norwegian krone

Polish zloty

Swedish krona

US dollars

Atlantic Money, being new and relatively small compared to other providers, has a small range of countries and currencies it supports. While this is a significant limitation, as you can only send money from the UK and countries in Europe, Atlantic Money still offers transfers to some of the biggest mainstream destinations like Canada and Australia.

If you’re looking for a more global service you’ll be better off with providers like WorldRemit (130+ countries), XE (130+ countries), or OFX (190 countries).

How good is Atlantic Money’s customer service?

Atlantic Money’s customer support is, as you might expect, not as developed as the bigger providers. It doesn’t offer a live chat feature, but does have a WhatsApp message service as well as email support - and a useful FAQ help center where you can find answers.

SMS

If you’re logged into the app you can contact them via SMS on WhatsApp. We messaged to ask for help with using their app, and they replied in seven minutes. We had a short text conversation in which they answered all of our questions, with virtually no delay between answers.

Availability | 9:00am to 5:30pm |

Response time | Minutes |

Languages | English, French, Spanish and German |

We sent an email to Atlantic Money’s customer support team with a few questions, but after 48 hours we received no response.

Availability | 9:00am to 5:30pm |

Response time | Within 48 hours |

Languages | English, French, Spanish and German |

Help center FAQs

Atlantic Money’s help center is very helpful, providing clear and useful information about its fee structures, rates, transfer times, limits and more at the click of a button. You can also search for your question and see related articles - all in all a solid information base.

Availability | 24/7 |

Languages | English, French, German, Italian, Spanish |

What else can I do with Atlantic Money?

Atlantic Money does not currently offer any other services aside from sending money abroad.

“We weren’t too happy about the lack of response by email, so points are being docked here. However their SMS support team is very helpful and fairly quick to reply - so this might be the best way to get a response if you need one.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How easy is Atlantic Money to use?

Here's is our score for how easy it is to open an account and send money with Atlantic Money. It ranks highly, alongside providers like Wise and WorldRemit - showing its service is as polished and easy-to-use as the biggest providers.

Compare providers

We went through the process of signing up to Atlantic Money on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

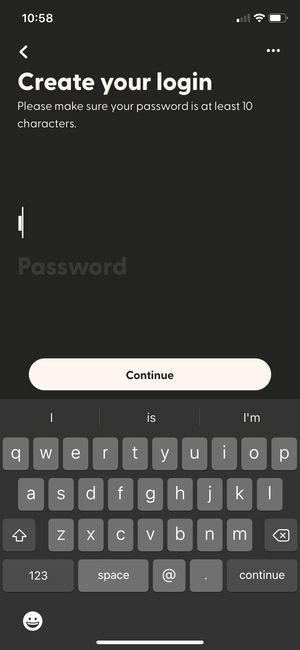

Signing up with Atlantic Money

We signed up to Atlantic Money using an iPhone:

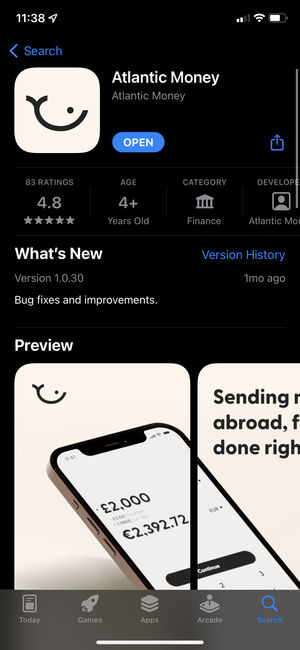

Download the app

You can find the Atlantic Money app on both the Apple App Store and the Google Play Store

Set your location

Choose your location from the list shown

Create your login

Add your email address and a secure password of at least 10 characters

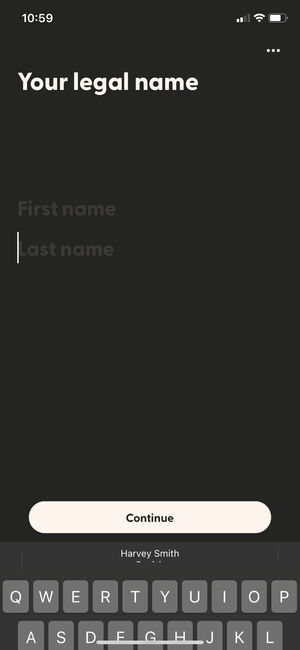

Add details

You’ll need to give your legal full name and mobile number and you’ll be signed up

It was as easy as anything to sign up, a plus for those who want a very straightforward, no-frills experience.

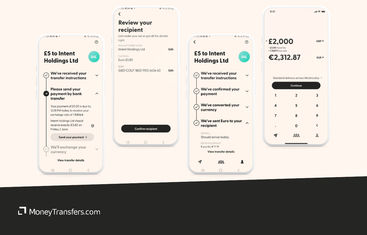

Sending money with Atlantic Money

We sent money with Atlantic Money using their Standard and Express transfers - here’s how it went:

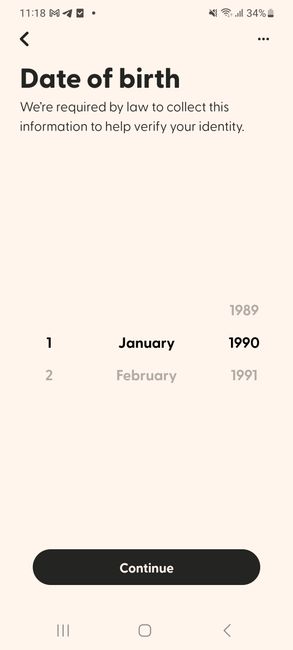

Verify identity

Before we could send money, we had to verify our identity with our date of birth and full home address

Input transfer details

We chose the amount we wanted to send, and selected a Standard transfer first time round, and Express the second time

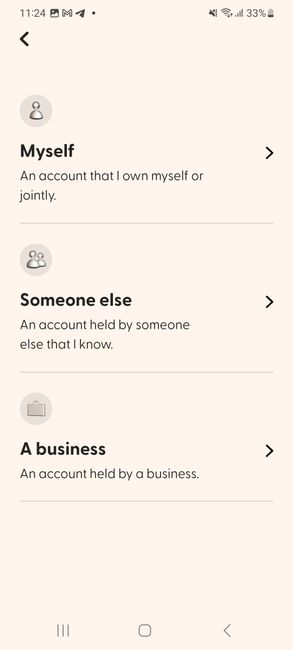

Select recipient

We were asked to add our recipient - the options were ourselves, someone else, or a business

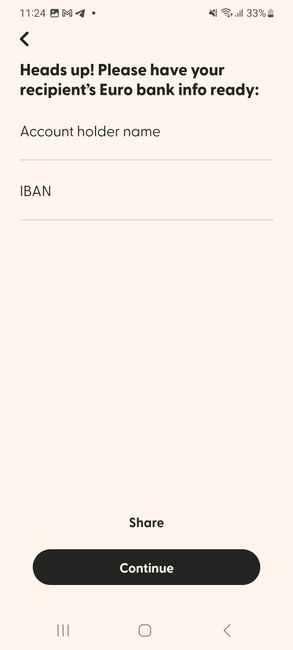

Add their details

We added their account holder name and IBAN. Once they were added we could choose them for the transfer

Review transfer

We reviewed the details of our transfer, and confirmed when ready

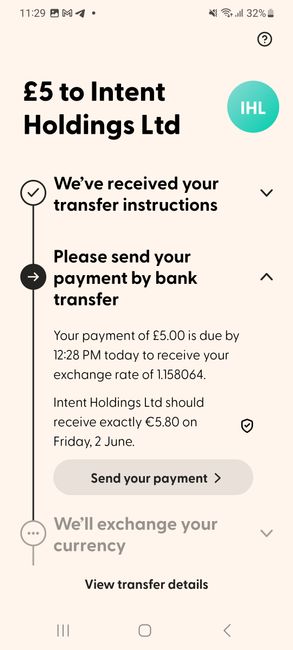

Pay by bank transfer

Once Atlantic Money confirmed they had received our instructions, they requested payment by a set time to receive the shown exchange rate. We were given the name, sort code and account number to make payment to

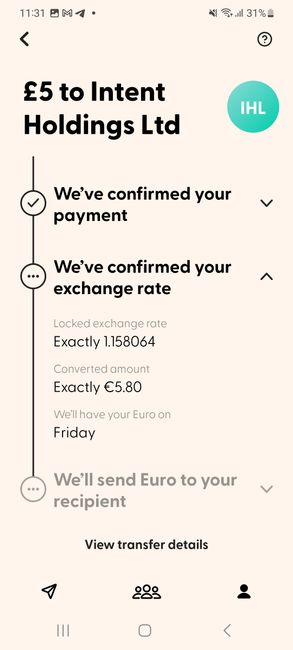

Confirm payment and exchange rate

Atlantic Money confirmed they had received our payment, as well as the exchange rate we got

Money sent

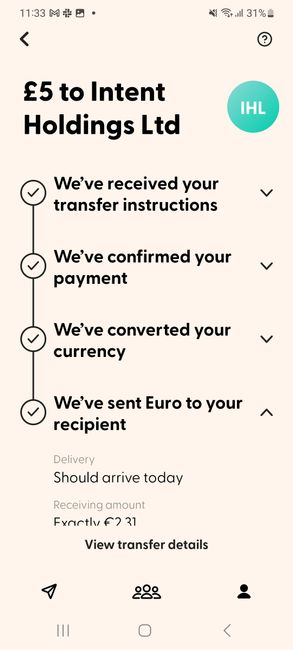

Atlantic Money then confirmed later that they had sent the euros to our recipient, with an email confirmation alongside

Once again, this was a very straightforward and guided process, with no real hiccups. We found the interface to be a little confusing in terms of what to click, but other than that it was easy.

For the Standard transfer we send the money at 11:33am on a Wednesday, and it was received at 1:30pm on Thursday. It took one day and just under two hours, vs the expectation of two days.

The express transfer was also sent at 11:33am on a Wednesday, and was received at 1:27pm on the same day. It took just under two hours, vs the expectation of an instant transfer.

The standard transfer was a pleasant surprise, taking just over a day, but the promise of an instant transfer did not live up to expectations.

“Signing up and sending money was as simple as it could’ve been. The Atlantic Money app is incredibly easy to use, and setting up a transfer was straightforward. However, the instant transfer was disappointingly slow - so if speed is a priority Atlantic Money may not be the best option.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is Atlantic Money?

This is how we rated Atlantic Money based on its safety, security, transparency and trustworthiness. They score well here, ranking in our top ten for safety, with only behemoths of the industry like Wise, XE and Remitly placing higher.

Compare providers

Atlantic Money’s infant status in the industry certainly stands against them. But they’re fully authorized and regulated, with advanced protection measures on their app and website - the same as every other provider you’ll see on MoneyTransfers.com. They’re also fully transparent with their fees and rates, so you know exactly what you’re getting.

We took a deep dive into how Atlantic Money practices, who they’re regulated by, and what security features they use.

Is Atlantic Money authorized to provide money transfers?

Atlantic Money is authorized to provide money transfers in the UK and the EEA. They’re authorized by the Financial Conduct Authority in the UK (FRN 947491) and by the National Bank of Belgium in the EEA (ID number 0783.476.423).

Is Atlantic Money safe and secure?

Atlantic Money follows a practice called safeguarding, which ensures your funds are kept secure even if something were to happen to the provider, such as becoming insolvent.

When you pay for your transfer, the money is received into a designated customer safeguarding bank account, where it is protected until it’s converted into the receiving currency. In case of any delays in the process, your money is kept in this account until it’s successfully paid out.

Atlantic Money also outlines extra steps to minimize the risk of anything happening to your money:

It takes due diligence on the creditworthiness and reliability of its partner providers for banking, payment and anything else

It maintains a minimum amount of capital on balance sheets

It maintains strict control over access to bank accounts belonging to the company

It keeps track of all transactions undertaken and secures those records

It authorizes periodic independent audits

It’s worth noting that safeguarding is different to FSCS and other guarantee schemes. Your money won’t be covered by any of these schemes - instead, in the rare occurrence of insolvency, an insolvency practitioner would be involved in ensuring customer funds are returned.

This is fairly standard for money transfer providers, and Atlantic Money, being authorized by the FCA, fully adheres to all required regulations.

Is Atlantic Money transparent?

Atlantic Money is entirely transparent with all their fees, and does not charge any hidden fees in markups on the exchange rate. You know exactly what your transfer will cost, so Atlantic Money scores high in this respect.

What do other customers think of Atlantic Money?

This is how we rated Atlantic Money based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It ranks highly with a few other providers like Instarem, OFX and PassTo.

Compare providers

There are only so many times we can mention that Atlantic Money is a new company, but it gives context to their rating when relatively few people have used and reviewed the service. We’ve looked at their ratings and the reviews people have left on each respective app store and on Trustpilot to see what people think of Atlantic Money.

What is Atlantic Money rated on Trustpilot?

Atlantic Money is rated as ‘Average’ on Trustpilot, with a score of 3.6 from over 80 reviews when this article was written. This is not an amazing score - only 50% of ratings are five stars, and almost a quarter are one star.

However, looking closer into why this is the case reveals that most of the recent one star ratings are down to a referral scheme. Many users have complained that the scheme is a scam, but Atlantic Money have replied to all reviews either referencing the use of a ‘link that was created to abuse their referral programme’ or guiding users through the verification process.

There are a high number of positive reviews that praise Atlantic Money’s fees, the app’s simplicity, and the customer service live chat. According to Trustpilot, Atlantic Money replies to 100% of negative reviews, always in under two days.

What is Atlantic Money rated on the Apple App Store?

Atlantic Money is only available in the UK and Europe for now, so it only has a presence on one App Store. However it’s rated 4.8 out of 5 from 83 ratings - an excellent score. Many of the reviews cite their easy-to-use app, fees, and rates, as well as their fast SMS customer service.

There is only one negative review visible, and it criticizes the long verification process and the fact that their bank thought the transfer was a fraudulent transaction.

What is Atlantic Money rated on the Google Play Store?

Atlantic Money have recently launched an Android app after previously being only available on iOS. Their app is rated 4.9 out of 5 from 86 ratings, with over 5,000 downloads. This is another excellent score - with many reviews praising their rates, fees, and service. Some of the criticism revolves around the limitations of the app, including how few currencies it supports and how long transfers take, as well as mentions of the referral programme.

If you want to use a money transfer app with more history and a higher number of reviews, you can check out our best money transfer apps comparison.

“While Atlantic Money might be new on the scene, they’re quickly gaining a following thanks to its affordable fees, mid-market rates and easy-to-use app. We certainly found it straightforward to use Atlantic Money - but the limitations of its few currencies and supported destinations mean it’s not for everyone. We can only hope that if they do grow their network, their fees and rates stay as affordable as they are now.”Financial Content Specialist, MoneyTransfes.comArtiom Pucinskij

Our final verdict

The team of experts at MoneyTransfers.com rates Atlantic Money very highly, despite it being a relatively small provider at the moment. It has its drawbacks, largely in its limited range of supported countries and currencies, but many of the biggest are covered - and its low fees and mid-market rates are a huge plus. We’d recommend Atlantic Money if they cover a route you’re sending money on.

Frequently asked questions about Atlantic Money

Do I need an account to receive money with Atlantic Money?

Do I need a bank account to join Atlantic Money?

Is Atlantic Money legal to use?

Who owns Atlantic Money?

Can I open an Atlantic Money account in any country?

Compare Atlantic Money with other providers

Atlantic Money user feedback

Comments

Anonymous

Surprising how cheap this works out for large transfers. Blows Wise and others out of the water, but I worry about whether it's sustainable? it's almost TOO cheap