International Money Orders

International money orders are a way to send money to someone in another country.

You buy a money order at a post office or bank, pay a fee, and send it to the recipient. The recipient can then cash it or deposit it into their account.

It's a great and secure alternative when wire transfers or online providers are not available.

Here we'll look at what money order is, how it works, and when you should use it. We'll also explain the costs, safety, and speed and answer all pressing questions.

Search Now & Save On Your Transfer

International money orders offer a secure way to send small amounts of money internationally. Available from banks, post offices, and transfer services, they involve prepaid funds that the recipient can cash or deposit. While safe and convenient, they can have higher fees and slower delivery compared to money transfer companies.

What is an international money order?

An international money order is a document that works as a safe and secure way of sending small amounts of money overseas.

Fun fact, money orders were established in the UK in 1972 and were known as postal orders.

How do international money orders work?

International money orders work similarly to checks, but you won’t need a bank account to receive the money.

The sender pre-pays an amount and the document is sent to the recipient, who can exchange it for cash or deposit it to their bank account.

Who offers international money orders?

Post office

Pretty much every major postal service or post office will offer a money order.

Banks

Similarly, most banks offer postal order services.

Money transfer providers

Online services such as Western Union or MoneyGram also offer the option to send international money orders.

Buying international money orders

You should be able to purchase an international money order from your local postal service, a range of banking institutions, and some money transfer providers.

🇺🇸 International money order in the US

If you’re in the US you should be able to purchase an international money order from the USPS to a range of countries.

Your transfer limit is generally around $700, but it will depend on where and how you send the money.

However in the US, you won’t be able to send money via an international money order to certain countries - instead, you’ll need to use a service called ‘Sure Money’ or ‘DineroSeguro’.

Aside from the USPS, you can also buy an international money order from various banks or even your local Walmart.

🇨🇦 International money order in Canada

🇬🇧 International money order in the UK

Are internatinoal money orders safe?

International money orders are completely safe and private, with no risk of losing money if the order is misplaced or stolen as it needs to be signed by the named recipient to be cashed.

Sending international postal orders

Sending an international money order is relatively straightforward - just follow these steps:

Buy a money-order certificate

Buy a money-order certificate from a third-party provider, such as your local postal service (Post Office, USPS, etc), bank, or money transfer branch.

You’ll normally be able to pay using cash or a card.

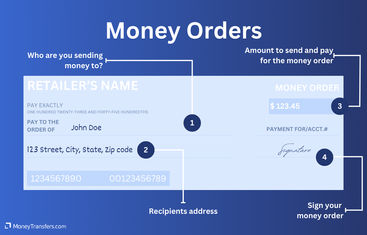

Fill out the money order form

Fill out the money order form with the required information, including your name, address, and contact details, the recipient’s name, and the sum of money you’re sending.

Send it

Send your international money order certificate to your recipient, usually via international mail

Cashing an international money order

When you receive an international money order, you’ll be able to cash it at a local bank, post office, or even some shops. You will need to:

Sign it

Sign the money order just before you give it to the cashier so they can see you do it

Show your ID

Provide identification, usually either a passport or driving license

Pay the fee

Pay any required fees as part of the transaction

Confirm the amount

Ensure the amount of money is correct before leaving the location

How fast can you cash an international money order?

It depends on the specific country and financial institution.

It could take anywhere from a few days to several weeks.

In some cases, the recipient may also need to go through a verification process before they can receive the funds.

To ensure faster processing, it is best to consult with both the issuing and receiving financial institutions beforehand.

The cost of international money orders

International money orders vary in price and generally cost upwards of $10. Here's a quick roundup of the starting fees based on the biggest money order services:

UK Post Office: capped at £12.50

USPS: set at $10.25

Sure Money: purchases lower than $750 will cost $14.55

Sure Money: purchases between $750 and $1,500 will cost $20.75

However, these are not all. Total costs are usually associated with the processing fee and the currency exchange rate.

Practical example with USPS

For example, an international money order from USPS will include an issuing fee of $49.65 and the processing fee based on country.

There is a limit of $700 for international money orders if using this route, but you can purchase several money orders of $700 denomination if you intend to send a higher amount.

This means that, for instance, sending money orders worth $7000 through USPS would cost more than $100 in fees.

Another cost associated with international money transfers is the currency conversion fee when the recipient cashes the money order or deposits it in their local account.

Again, the exchange rate margin will vary on a variety of factors including:

The provider you use

The country you’re sending to

The currencies involved

However, it is typical to see margins associated with international money orders being higher than with online transfers.

International money order transfer limits

You will likely find that international money orders come with limits for how much you can send abroad, depending on the provider you use and the country you send to.

However, the average value of a postal order in the US is around $315 which is about $78 million moved around the US per day.

For example, USPS has a maximum limit of $700 per international money order and allows the sending of multiple money orders up to a maximum limit of $10000.

Generally, most providers would have a limit of around $1000 per money order, meaning that if you are planning to send large amounts overseas, international money orders might not be your best option.

The speed of money orders

The total time an international money order takes can vary from a few days to a few weeks long depending on where the mail is being sent.

This means it is rarely the fastest option for transferring money, and this is because there are a variety of steps involved.

Normally, it takes no more than a few minutes for you to get your money order made.

Once you fill up the form and pay for the money order, the issuer will take only a few minutes to process the request and provide you with the money order.

However, once you have made and paid for your order, it will then take more time to be physically sent to your recipient before they can get it paid out.

To ensure faster processing, it is best to consult with both the issuing and receiving financial institutions beforehand.

Benefits and drawbacks of using money orders

Pros

Cons

Best alternatives for international money orders

International money orders have their upsides and their downsides, but it’s up to you to decide whether it’s the best way to send money abroad.

You may want to consider the following alternatives:

Money transfer operators

Using a money transfer operator is the quickest, easiest, and often the cheapest way to send money abroad.

You can use a money transfer operator to send funds via bank transfers, money pickups and deliveries, and mobile wallet apps.

Wire transfer

Find a better alternative to postal orders

A bit more on money orders

Can I cancel an international money order?

What is the difference between a money order and a money transfer?

Can you send money orders online?

How do you check if a money order has been cashed?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: What are money orders?

If you want a guaranteed prepaid way of delivering money overseas, then international money orders might be for you, but by looking into the various online money transfer providers around today, you will probably be able to find a quicker and cheaper way to transfer your funds abroad.

Find a better alternative to money orders

Resources & further reading

Related Content

Contributors

Mehdi Punjwani