Top 8 Zelle Alternatives for International Payments & Money Transfers

Zelle is great if you’re sending money across the street. But when it comes to international transfers, it hits a wall. You can’t send money abroad, you need a US bank account to use it, and there’s no support for foreign currencies or global delivery methods.

We’ve first hand tested and reviewed the best Zelle alternatives for international transfers, whether you’re sending to family, paying friends, or managing global expenses.

Each one of the listed apps like Zelle work well for personal use, is available in the US (and in some cases the UK too), and offers better international reach, speed, and pricing than Zelle ever could.

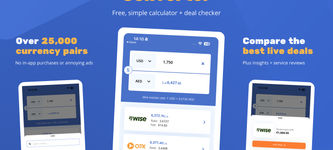

Search Now & Save On Your Transfer

Zelle doesn't support international transfers

Zelle is only available in the US and is used for domestic transfers (within the US). It does not support international money transfers.

Top Zelle alternatives at a glance

Here are the top alternatives for sending money internationally, and when they might be a better fit:

Wise - Best for personal international transfers with mid-market exchange rates, transparent fees, and instant delivery to 70+ countries.

WorldRemit - Ideal if your recipient needs cash pickup, mobile wallet, or airtime top-up options, especially in Africa or Asia.

Revolut - Good for UK and EU users who want banking and transfers in one app, with extras like budgeting tools and travel perks.

Paysend - Great for simple, low-cost card-to-card transfers. Super fast and user-friendly.

Instarem - Strong choice for Asia-focused transfers, often fee-free with competitive rates and a clean mobile app.

CurrencyFair - Best for bank-to-bank transfers with a flat fee and the option to exchange currencies with other users for better rates.

MoneyGram - Reliable for cash pickup or in-person transfers, with a massive global network. Good for one-off or unbanked recipients.

Monzo - A solid pick for UK-based users, thanks to its integration with Wise and smooth mobile banking experience.

Why You Might Need an Alternative to Zelle

Zelle is fast, free, and easy as long as you’re sending money within the US But the moment you try to send funds internationally, well, you can’t.

And it’s not just that, here are a few more reasons why there’s a need for an alternative:

No international transfers - Zelle only works with US banks and US phone numbers. You can’t use it to send money abroad, even to Canada or Mexico.

No currency conversion - Zelle doesn’t support foreign currencies or international bank accounts. Everything stays in US dollars and within US borders.

No cash pickup or wallet support - If your recipient doesn’t have a US bank account, you’re out of luck. Zelle doesn’t support cash pickups, mobile wallets, or alternative delivery methods.

Limited to eligible US banks - Both you and your recipient need a participating US bank. No workarounds, no exceptions.

If you’re sending money to friends or family overseas, or just need more flexibility, switching to an international-friendly provider is the way to go.

Here’s a quick roundup of top Zelle alternatives before we go into each in more detail:

Provider | Availability | Payout Methods | Exchange Rate | Fees | Speed |

|---|---|---|---|---|---|

Wise | 70+ countries (US + UK) | Bank transfer, Wise app | Real mid-market rate | Low + transparent | Instant–1 day |

WorldRemit | 130+ countries | Cash, mobile, bank | Markup applied | Low to moderate | Minutes–1 day |

Revolut | 35+ countries | Bank accounts, Revolut wallets | Mid-market (tiered) | Free up to limits | Instant–3 days |

PaySend | 170+ countries | Cards, bank accounts | Small markup | Flat (~$2) | Minutes–1 day |

Instarem | 50+ countries | Bank account | Small markup (<1%) | Often free | Same-day–2 days |

CurrencyFair | 150+ countries | Bank account only | Mid-market or better | Flat (~€3) | 1–2 days |

MoneyGram | 200+ countries | Cash pickup, mobile, bank | 1–4% markup avg | Low (<$5K) / High | Minutes–1 day |

Monzo | UK only | Bank transfer via Wise | Real mid-market rate | Low (via Wise) | 1–2 days |

Wise

Wise is the best overall alternative to Zelle if you want to send money internationally.

It’s just as easy to use, works in both the US and UK, and offers far better value than traditional banks or PayPal.

No cash pickup or wallets here, but for most Zelle users, that’s not a dealbreaker.

If you care about getting the best rate and knowing exactly what you’ll pay, Wise should be your first stop.

Wise is the closest thing to a like-for-like Zelle replacement when you need to send money abroad. It’s fast, intuitive, and cheap, with no hidden exchange rate markups and full price transparency before you hit send.

Unlike Zelle, you can send internationally to 70+ countries, and unlike PayPal or Xoom, the fees won’t catch you off guard.

You don’t get cash pickup or mobile wallets here since Wise is strictly bank-to-bank or card-to-bank, but that’s all most Zelle users need anyway.

Transfers are typically completed same-day or faster, and the app experience is one of the best on the market.

Why choose Wise instead of Zelle?

Sends money internationally at the real exchange rate with no markup

Transparent pricing with no surprises

Same-day or instant transfers in many popular corridors

Rated 4.5+ on both app stores with 10 M+ downloads

Works well from both the US and the UK

Quick summary

Feature | Wise |

|---|---|

Availability | 70+ countries |

Exchange Rate | Real mid-market rate |

Fees | Low, transparent fees |

Payout Methods | Bank account |

Typical Speed | Instant to 1 day |

Best For | Transparent, low-cost global P2P |

To learn more, read our Wise review or watch our video review:

WorldRemit

If your recipient doesn’t use a bank, WorldRemit is a better Zelle alternative, simple, global, and flexible.

If you’re sending money to someone who doesn’t have a bank account, or you need flexible delivery options like airtime top-up or mobile wallet, WorldRemit is a top Zelle alternative.

You can send from the US or the UK to 130+ countries, and the recipient can choose how they want to get the funds.

Fees and exchange rates vary by country and method, so it’s worth checking before you confirm.

But for remittances, especially to Africa, Asia, and Latin America, WorldRemit is one of the easiest options around.

Why choose WorldRemit instead of Zelle?

Send to 130+ countries, even if the recipient is unbanked

Supports cash pickup, mobile wallets, bank transfers, and more

Great app experience for personal use

Transparent pricing before you send

Quick summary

Feature | WorldRemit |

|---|---|

Availability | 130+ countries |

Exchange Rate | Markup applied |

Fees | Low to moderate (varies by route) |

Payout Methods | Cash pickup, mobile, bank |

Typical Speed | Minutes to 1 day |

Best For | Sending to unbanked recipients |

To learn more, read our WorldRemit review or watch our video review:

Revolut

Revolut is ideal if you want more than just transfers, a solid Zelle alternative with perks.

Revolut is more than just a transfer app, it’s a full banking alternative that also handles international transfers well.

You can send money globally at near mid-market rates, and it’s especially handy if both sender and recipient use Revolut (transfers are instant and free).

Just note that fee-free limits apply based on your account tier, and it’s a better experience for users in the UK and EU than in the US.

Why choose Revolut instead of Zelle?

Instant free transfers between Revolut users

Great for travel + spending abroad

Can hold dozens of currencies in one app

Works as a full banking app replacement

Quick summary

Feature | Revolut |

|---|---|

Availability | 35+ countries |

Exchange Rate | Mid-market with some limitations |

Fees | Free up to limits, then 0.5–1% |

Payout Methods | Bank accounts, Revolut accounts |

Typical Speed | Instant (Revolut), 1–3 days (bank) |

Best For | Every day use + travel transfers |

Paysend

Paysend is perfect if you want fast, card-based transfers with no setup stress.

Paysend is a great Zelle alternative if you want to send money fast using just a card.

It’s available in 170+ countries, and you can send directly from your debit or credit card to someone else’s card or bank account, no lengthy setup needed.

It’s one of the cheapest options for small transfers, especially across borders, and the flat $2-ish fee is hard to beat.

Why choose Paysend instead of Zelle?

Send to a card, not just bank accounts

Flat low fee (often $2 or less)

Super simple, you can almost literally send money in seconds

Available in 170+ countries

Quick summary

Feature | Paysend |

|---|---|

Availability | 170+ countries |

Exchange Rate | Small markup |

Fees | Flat low fee (~$2) |

Payout Methods | Bank accounts, cards |

Typical Speed | Minutes to 1 day |

Best For | Quick card-to-card transfers |

Instarem

Instarem is a hidden gem if you’re sending to Asia or want super low fees.

Instarem flies under the radar, but it’s a strong Zelle alternative for sending money to Asia or Latin America.

Fees are often $0, and exchange rate markups are typically lower than big-name players.

The app is clean and easy to use, though some routes (like to Africa) are limited.

Just note that some US users may face slightly clunky onboarding compared to Wise or Revolut.

Why choose Instarem instead of Zelle?

Zero or low fees on most transfers

Very competitive exchange rates

Great for sending to India, Philippines, etc.

Reliable mobile app

Quick summary

Feature | Instarem |

|---|---|

Availability | 50+ countries |

Exchange Rate | Small markup (often <1%) |

Fees | Often $0, varies by route |

Payout Methods | Bank account |

Typical Speed | Same-day or 1–2 days |

Best For | Asia-focused transfers |

CurrencyFair

CurrencyFair is a strong Zelle replacement for global bank transfers, especially if you care about getting a better rate.

CurrencyFair is ideal if you’re sending money internationally from your bank account to another, especially for Europe, the UK, Australia, and a few other major markets.

It uses a peer-to-peer model to offer better-than-bank exchange rates, plus a flat transfer fee of around €3.

There’s no flashy app design here, but the value makes up for it.

It’s not great for instant payments or mobile wallets, but if you’re moving money between accounts, it’s a solid Zelle alternative.

Why choose CurrencyFair instead of Zelle?

Excellent rates via peer-to-peer currency exchange

Flat, transparent fees (around €3 or equivalent)

No limits on transfer amount

Great for Europe, UK, Australia

Quick summary

Feature | CurrencyFair |

|---|---|

Availability | 150+ countries |

Exchange Rate | Mid-market or better |

Fees | Flat (~€3), low FX markup |

Payout Methods | Bank account only |

Typical Speed | 1–2 business days |

Best For | Cost-effective bank transfers |

To learn more, read our CurrencyFair review or watch our video review:

MoneyGram

Not the cheapest, but good for urgent or in-person transfers where cash is key.

If your recipient needs to pick up cash or doesn’t have a bank account, MoneyGram is a practical Zelle alternative.

You can send online or in person, and the recipient can collect the funds at 200,000+ global locations.

That said, fees are high on transfers over $5,000, and the digital experience isn’t as smooth as modern apps.

But for one-off or emergency remittances, especially in-person, it’s reliable.

Why choose MoneyGram instead of Zelle?

Cash pickup and in-person service in 200+ countries

Fast, same-day availability for many transfers

Works well even if the recipient is unbanked

Multiple ways to send (online, app, agent)

Quick summary

Feature | MoneyGram |

|---|---|

Availability | 200+ countries |

Exchange Rate | 1–4% markup |

Fees | Low under $5K, high above |

Payout Methods | Bank, cash pickup, mobile |

Typical Speed | Minutes to 1 day |

Best For | Cash pickup & unbanked recipients |

Monzo

Mainly for the UK users, but if that’s you, Monzo + Wise is the best combo for Zelle alternative.

Monzo is one of the top digital banks in the UK, and while it's not available in the US, it’s a great Zelle alternative for Brits sending money abroad.

Thanks to its integration with Wise, you get great exchange rates and low fees right from the Monzo app.

It’s smooth, modern, and packed with features, perfect if you're already using Monzo for your day-to-day banking.

Why choose Monzo instead of Zelle?

Integrated with Wise for great rates on transfers

Excellent mobile banking app (UK-only)

Ideal for UK residents sending abroad

Transparent fees and real-time notifications

Quick summary

Feature | Monzo |

|---|---|

Availability | UK only |

Exchange Rate | Mid-market (via Wise) |

Fees | Low, Wise-based |

Payout Methods | Bank accounts (via Wise) |

Typical Speed | 1–2 business days |

Best For | UK users sending abroad |

We strongly recommend running a quick search using the form below to get the latest exchange rates for your needs.

Check live rates now

If you're still unsure of what to pick, have a look at our guides below. These are the best money transfer apps and challenger banks that let you send money internationally and domestically, completely removing the need for Zelle.

A bit more about Zelle alternatives

Can you use Zelle internationally with a VPN or workaround?

Is Wise or Revolut better than Zelle for personal use?

What’s the best option if my recipient doesn’t have a bank account?

Do I need to verify my identity to send money abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Related Content

Contributors