N26 is no longer available in the US

In 2022, N26 closed its US bank accounts to focus on its European business. If you had money in an N26 account at this time, a paper check for the account total was sent to your home address.

N26's transparent approach is applied to all their products; the website and mobile application are jam-packed and full of company information, how-to guides, and topical blog posts, making it a helpful resource for new and existing customers.

As a challenger bank conducting business solely online, N26 primarily focuses on developing intuitive, user-friendly features for a digital customer base, having created a modern mobile banking app and a desktop version.

It has quickly become one of the best challenger banks in the EU, offering the same or better services than the likes of Revolut or Monzo.

Scoring N26

While N26 may sound like it ticks all the boxes, we wanted to learn more about the international banking features, fees, limits, and support, and take a closer look at the finer details of how money transfers are arranged with this challenger bank.

Pros

Cons

N26 fees and exchange rates

Fees and rates

Challenger banks are known for presenting cutting-edge alternatives to traditional banking fixtures: but is this applicable to N26? We will look closely at how these exchange rates and transfer fees fare, comparing them to the competition.

Exchange rates

According to N26, the bank does not charge exchange mark-ups for their Foreign Currency Transfers, instead using the “real” exchange rate provided by Mastercard.

Upon closer look, we discovered that while Mastercard does base all foreign exchange rates on the mid-market rate, the currency conversion may be marginally higher - albeit by only 1 - 2 %.

This markup will depend on factors such as destination country, transfer size, and availability of the foreign currency.

Here's a summary of user reviews with N26 exchange rates.

Transfer fees

To charge customers “as little as possible” N26 offers low to zero fees.

Transfers & Debits Transfers received from or within EEA states and Switzerland in Euro are free.

Valid refusal of direct debit due to insufficient funds will result in a fee of €3.00 per refusal.

How Do N26 Transfer Fees Compare to Using a Money Transfer Provider?

In line with their goal to provide more transparent, low-cost services than the average bank, N26 offers very competitive transfer fees.

Due to the integration of money transfer providers, Wise, N26 can offer customers bank-quality security standards alongside the low fees offered by money transfer providers.

Customers can gauge how N26 fees compare to other banks and financial service providers by using our comparison tool to see the prices of other money transfers displayed side by side.

Here's how users review N26 fees online.

Transfer speed

N26 transfer speed

The transfer speed depends on the transfer type, destination country, and currency used.

Recipient banks that support instant credit transfers will receive SEPA credit transfers within minutes: SEPA banking regulations will apply.

Standard SEPA transfers should arrive within a maximum of 2 working days.

When setting up a money transfer N26 recommends 2 - 3 business days for most transactions.

Due to the transparent nature of N26 services, the estimated arrival date of your transfer will be displayed throughout the process.

Transfer limits

N26 transfer limits

There are some transfer limits on money transfers with N26.

Transfer limitations apply to the following types of transactions:

Domestic transfers between N26 customers: €1,000 daily limit

Incoming/outgoing SEPA transfers: No daily limit

Here's what users have to say about transfer limits on N26.

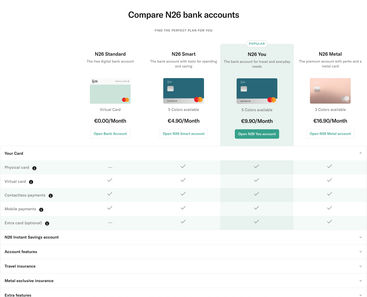

Product offering

N26 product offering

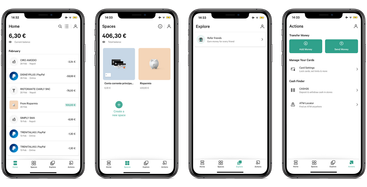

You can arrange international bank transfers thanks to N26's partnership with money transfer provider, Wise.

Wise is directly integrated with the N26 app which means customers can arrange international bank transfers using their mobile phone, with 38 different currencies to choose from.

In addition, we've looked at how online users review product features of N26, here's a summary.

Ease of use

N26 ease of use

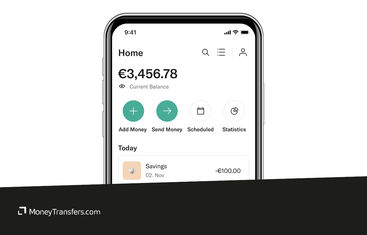

N26 offers simple to use mobile app which is free to download from the Google Play Store or App Store.

At the time of writing 92,484 reviews have been left by Android users, who have collectively rated the N26 app 3.9 out of 5.

Over on the App Store, 14,700 reviews have rated the iOS version of the app 4.7 out of 5 stars. The vast majority of reviews are complimentary.

Here's how users review N26 usability.

As for customer support, users can reach the N26 customer service team via live chat; available 7 days a week.

There is also an email address for customer queries and support. All services are available in English, Spanish, German, Italian and French.

Here's how users view customer support over time based on online reviews (averaged per month).

Safety and trust

N26 safety & trust

Here's how users review N26 safety.

Customer feedback

N26 customer reviews

ANALYSIS OF USER REVIEWS

The reviews for N26 are generally positive, with users frequently highlighting the ease of use and efficiency of the banking service.

Many customers appreciate the straightforward setup and management of accounts, as well as the convenience of the N26 app.

Users also like N26 for its great customer support, fast access to funds, and the utility of the card.

However, several users have reported problems with customer support, describing it as inadequate or slow to respond.

Specific issues mentioned include difficulties with accessing accounts, poor handling of disputes, and dissatisfaction with the resolution of problems.

Additionally, some users expressed frustration with card-related issues, including acceptance problems and transaction failures.

Overall, while many users find N26 convenient and efficient, there are notable concerns about customer service and support reliability.

Here's a summary of average user reviews for N26 in 2024.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Ease of Use | 1 | 4 | 3 | 4 | 3 | 5 | 3 |

Exchange Rates | 0 | 0 | 1 | 5 | 0 | 1 | 0 |

Features | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Fees | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

International Transfers | 4 | 5 | 5 | 5 | 1 | 0 | 0 |

Limit | 5 | 5 | 4 | 4 | 5 | 4 | 0 |

Safety | 4 | 5 | 1 | 3 | 2 | 4 | 1 |

Speed | 3 | 2 | 2 | 2 | 2 | 3 | 1 |

*0s represent no reviews for the given month.

How to sign up for N26?

To begin transacting with N26, customers must first sign up for an online account.

Here's a step-by-step guide on how to open an account and send money using the N26 Foreign Currency Transfer service.

Sign up

Download the N26 app for mobile or desktop, open it up, and begin the signup process by entering your personal information: this will include full name, date of birth, and contact details

Verify your email

To proceed with the signup process you will need to confirm your email address by entering the verification code sent to you. Once this has been entered, you can choose your desired account type from the available Membership Plans

Verify your identity

In addition to verifying your email address, you will also be contacted by an N26 agent, who will verify your identity via video call. The video call typically takes less than 10 minutes and as a 24/7 service, the call can be made outside of business hours, speeding up the verification process.

Deposit funds

Once your identity has been verified by an N26 agent, you will be able to add funds to your account and set up a money transfer. You will also be able to pair your mobile device with the app, setting up two-factor authentication for added security

Select Send Money

Overseas transfers can be set up by first selecting Send Money on the home screen, and then tapping Foreign Currency Transfer.

Add the transfer details

Choose the desired currency from the dropdown options, enter the amount you want to send in € and the app will automatically convert it into the foreign currency of choice

Add receipients details

Next, you will need to enter your recipient’s details; full name, contact information, and address.

Review & send

Review the transaction in full before entering your security information and submitting the payment

What if there's no currency I need to send?

If your required currency does not appear in the Foreign Currency Transfer dropdown options, you will need to make your transfer using Wise.

We would recommend checking out our in-depth guide to Wise services by reading our full review here.

International transfer requirements & details

To make an international transfer with N26, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with N26 and their app.

N26's SWIFT code is NTSBDEB1.

N26 alternatives

N26 is a great digital bank for transfers from or within EEA and Switzerland with a transparent fee structure. However, it is not available available in the US and UK and doesn't offer as many features as some other digital banks.

Here's a breakdown of top money transfer alternatives that might be better for you.

N26 - More than just a bank

A growing number of challenger banks have been set up over the last decade, designed to shake up the traditional banking standards by empowering customers and granting them total access: N26 does exactly this.

The app is easy to use and makes moving money between banks or other N26 users stress-free and straightforward.

Generally speaking, there are more pros than cons when it comes to setting up an N26 bank account.

The bank also offers a variety of reputable money transfer services along with favorable exchange rates and minimal fees.

Unfortunately, N26 is no longer available for customers in the UK and the US; customers will instead have to explore other challenger banks such as Monzo, Revolut, or Starling.

If you are sending or receiving Euro transfers, this challenger bank is a great option.

A bit more about N26

Can I open an N26 account in any country?

Can I use a N26 debit card when travelling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks

N26 user feedback

Comments

Anonymous

You dont leave a review of n26!? N26 seem to have an allergic reaction to stating what they charge for money going into an n26 account! Its all about sending, sending....

Is it 3% of the transfer amount? You as a reviewer fail to say. Commission?