Wise vs Payoneer

Wise Business wins in our comparison against Payoneer.

Payoneer does offer access to some harder to reach locations and marketplace support. So might still be the right option for your business.

Wise Business and Payoneer both offer a range of products for international businesses. These include money transfers, multi-currency business accounts and marketplace integrations.

An overview of Wise Business vs Payoneer

Wise Business wins in our comparison against Payoneer. It is cheaper and simpler to use.

The total cost of sending money or making an international payment with Wise Business will be from 0.33%. This is made up of exchanging at the mid-market rate and fees from 0.33%.

The cost of sending, and spending, through Payoneer is much higher and less consistent, potentially as high as 5%. Exchange rates can be up to 2% and fees up to 3%, depending on the combination of the countries and currencies involved in the transaction.

Wise Business is best for… | Payoneer is best for… |

|

|

Features | Wise | Payoneer |

|---|---|---|

Monthly Fee | $0 | None ($29.99 annual fee for unused accounts) |

Exchange rate | Matches the mid-market rate | 2% |

Transfer fees | From 0.33% | Up to 3% for international payments, $1.50 for USD to USD payments |

Multi-currency account | 10 local accounts (US registered companies), 19 (Europe registered companies) | Supports 9 local accounts, 190 countries and 70 currencies |

Batch payments | ✅ Up to 1,000 per transaction with guaranteed rates | ✅ Up to 1,000 per transaction |

Expense management and tracking | ✅ (although, cards not currently being issued in the US) | ✅ |

Pay invoices | ✅ | ✅ |

Receive Payments | ✅ | ✅ |

Marketplace integration | ✅ Amazon, Upwork, Etsy + more | ✅ Amazon, Upwork, Etsy + more |

API options | ✅ Automated payments, regular payments | ✅ Automated payments, regular payments |

Manage Payroll | ✅ | ✅ |

ATM Access | ✅ | ✅ |

Forward Contracts | ❌ | ❌ |

This page was updated in October 2024. The changes reflect how each company has changed since the original 2021 publication.

Customer feedback

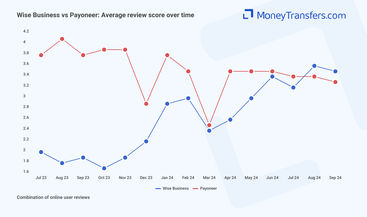

We looked at how customer reviews of Wise Business and Payoneer have changed over time. We found that Wise Business was on a constant upward trend, particularly in the last 12 months.

Payoneer on the other hand seems to be losing customer satisfaction. This seems to have steadied slighly in the last 5 months, but is noticeable vs July 2024.

It can be said that people only leave bad reviews. But, trends do show customer satisfaction for Wise Business improving, with Payoneer declining.

Our scoring

Here’s how each of the companies have scored within our core categories.

In the page, we’ll go into more detail of each of them and explain how we reached each of the scores.

Product offering

Payoneer has a wider selection of supported currencies, over 100, Wise has around 40

Marketplace integrations mean Payoneer can be used as a payment method, whereas Wise Business will be added as a bank account

Payoneer comes with an account management option for larger spends

Wise and Payoneer give access to a similar number of multi-currency accounts. 10 for Wise, 9 for Payoneer

Batch payments, APIs and card issuing is similar for both

Wise Business and Payoneer offer similar product options. At the heart of both is a multi-currency business account and platform.

Payoneer is more of an all-round business platform, whereas Wise Business offers multi-currency business accounts and transfers.

Here’s how they compare to each other.

Multi-currency accounts

Wise Business offers 10 local accounts, and Payoneer offers 9. While some accounts are the same, some are different. For making a choice on who is the better, it is best to compare what a business needs.

For example, if you need local NZD accounts Payoneer isn’t the right choice. If you need a UAE account, opt for Payoneer over Wise Business.

Payoneer and Wise both score highly for business multi-currency account offering, they are two companies with the widest scope. For local accounts, only Airwallex (with 12 options) offer more than either of these options. Sokin also offers 4 local accounts, but access to a huge amount of IBAN accounts as well.

Currency | Wise Business | Payoneer |

|---|---|---|

British Pound | Account number / Sort Code | UK sort code, account number, and IBAN |

Euro | SWIFT / BIC and IBAN | IBAN account |

US Dollar | ACH and wire routing number / Account number | Routing number and account number |

Australian Dollar | BSB code | BSB code and account number |

New Zealand Dollar | Account number | Not available |

Singapore Dollar | Account number | IBAN account |

Romanian Lieu* | SWIFT / BIC and IBAN | Not available |

Canadian Dollar | Institution number / Transit number / Account number | Institution number / Transit number / Account number |

Hungarian Forint | Account number | Not available |

Turkish Lira* | Bank name / IBAN | Not available |

Japanese Yen | Not available | IBAN account |

Hong Kong Dollar | Not available | Routing number and account number |

UAE Dirham | Not available | Bank name, IBAN |

*these accounts are offered but can only receive payments in local currency, so businesses will need one of the other local accounts offered by Wise Business as well

Compare Business Multi-Currency Business Accounts

Selecting a multi-currency account for business can feel a little tricky with different options, local accounts and features. We've broken down the top accounts across the industry at the moment.

Supported currencies

Outside of local accounts, the amount of supported currencies are important. Wise Business and Payoneer offer a variety. Of the two, Payoneer offers the most access.

Access to currencies will make things easier for international business. Staff payments, supplier payments and the ability to receive business payments all benefit.

We’ve listed the currencies and whether they are supported by Wise Business or Payoneer.

Payoneer has a much wider range of supported currencies.

Wise Business covers most of the key markets people could need to access.

We have only included currencies where at least one of Payoneer or Wise Business offers it.

Africa

Europe

North America

South America

Asia

Oceania

Virtual and physical cards

Cards are not currently on offer to US businesses from Wise Business, however we expect this to change.

If this is essential to a business offering it may make Wise Business the wrong option.

On the other hand, Payoneer is available for US business. Support outside of this is just for CAD, EUR and GBP. For Wise Business, cards can be accessed for each local account.

With Payoneer, you will pay up to 3.5% to exchange at the point of transaction. For Wise Business, converting at the point of payment costs 0.33%. This makes the lack of supported countries a downside to using Payoneer.

On spending, with Wise Business you'll also get 0.5% cashback.

Neither business offers particularly good options for withdrawing cash. Unfortunately, this is the norm across business multi-currency accounts.

Cards | Wise Business | Payoneer |

|---|---|---|

Offered | Yes | Yes |

Annual fee | $0 | $29.99 |

Initial card fee | $7 (physical, virtual cards are $0) | $0 |

Additional card fee | $7 (physical, virtual cards are $0) | $0 |

Replacement card fee | $4 (physical, virtual cards are $0) | $12.95 |

Spending (no conversion) | No cost | No cost |

Spending (with conversion) | from 0.33% | Up to 3.5% |

Spending limits (daily) | $50 million | $200,000 daily |

ATM fees | 2% + $1.50 - over $100 per day | $3.15 / €2.50 / £1.95 |

Expense management | Yes, sync different cards to specific people | Yes, sync different cards to specific people |

Restrictions | Cards not issued in the US at the moment | Cards only issued in USD, CAD, EUR and GBP |

Interest rates

Companies with a significant balance in EUR, USD or GBP can benefit from interest rates with Wise Business, but not with Payoneer.

Currency | Wise Business | Payoneer |

|---|---|---|

USD | 4.85% | 0% |

EUR | 2.12% | 0% |

GBP | 3.22% | 0% |

Revolut Business and Sokin do both offer interest rates as well, should this be needed.

These rates are correct as of 30th October 2024, but do change based on central bank rates in each applicable country.

For regular transfers, the cost of using Wise Business is cheaper than using Payoneer.

The wider selection of options you can send to from Payoneer could make them the better option.

Batch payments

Both companies offer batch payments, and there’s no difference in what you’ll get between them. It’s a thousand payments each. The biggest difference will of course be in the cost.

As outlined in the overview, Wise Business is significantly cheaper.

If you sent 10 payments of $100 on Wise, it would cost you $3.30 ($0.33 x 10). At the worst end of Payoneer it would be $50 (2% exchange rate and 3% fees).

Wise Business | Payoneer | |

|---|---|---|

Batch payment limit | 1,000 | 1,000 |

Integrations

The benefit you’ll get from integrations could be a defining factor as to whether you opt for Wise or Payoneer.

Payoneer partners with a lot of ecommerce, and freelance marketplaces. So it is possible to use a Payoneer account to be directly paid into. With Wise Business, you ‘withdraw’ to a local account.

This is because in some cases you can set up Payoneer as a payment method. Whereas Wise Business works in the same way as a bank account hooked up to a marketplace would. This means freelancers in particular can benefit from being paid from platforms like Fiverr and Upwork, directly into a their Payoneer dashboard.

This being said, Wise Business has more support for accounting software plugins. So it’s possible to sync the account to things like Xero or Intuit Quickbooks.

In short, both will accept payments into local accounts though. So it’s possible to use both things like Fiverr, eBay, Etsy, Upwork and many more.

APIs

Both offer API access to build and customise offerings into your every day business.

This can include automated payments and syncing of accounting software which isn’t natively supported. However, neither can be used to provide white labelled products to clients. We’d recommend Airwallex for that.

Fees and rates

Some international transfers with Wise Business could be over 4.5% cheaper than using Payoneer

Card transactions are 0.67% cheaper on Wise than they are with Payoneer

Neither Wise Business or Payoneer offer currency risk solutions

Sending and receiving payments

At heart, both companies are international money transfer companies. The Wise personal offering is actually listed as one of the best money transfer providers in the market at the moment.

For this reason, both companies do offer a pretty decent transfer service. Although Payoneer is more expensive.

Money transfer | Wise Business | Payoneer |

|---|---|---|

Exchange rate | 0% | 2% |

Fees | from 0.33% | Up to 3% for international payments |

For receiving money, you can do so into local accounts.

Receiving payments | Wise Business | Payoneer |

|---|---|---|

Into multi-currency account | $0 | $0 |

Into a supported currency | 0% + 0.33% if you need to convert | 1% |

Into a non-supported currency | from 0.33% into the base account | 1% |

Using the Payoneer payment gateway will cost you as well, 3% for each transaction (3.99% for credit cards).

It’s not possible to use Wise Business at this time as a payment gateway.

Guaranteed rates and forward contracts

For international currency risk, Wise Business or Payoneer are not the right option.

Wise Business offers guaranteed rates on some transfers for up to 2 days. However, there’s no forward contracts, or limit orders.

Providers like Moneycorp or OFX Business are best for this.

Currency risk offering | Wise Business | Payoneer |

|---|---|---|

Forward contracts | Not offered | Not offered |

Limit orders | Not offered | Not offered |

Guaranteed rates | 2 days (on some transfers) | Not offered |

Currency risk strategy | Not offered | Not offered |

The reasoning for this goes back to the nature of these services. They’re very much ‘self-serve’ options. Currency brokers, or more hands-on options, allow you to negotiate and agree rates ahead of big international business transactions.

Transfer Speed

Wise Business has better customer feedback on the speed of transfers

On paper, both providers settle transfers within a couple of days, but different transfer routes may impact this

Sending money through both Payoneer or Wise is relatively fast.

Payment types | Wise Business | Payoneer |

|---|---|---|

Money transfers | 0-2 business days | 0-2 business days |

P2P payments | Instant | Instant |

Incoming payments | Instantly released (marketplaces and platforms may have their own timeframes) | Instantly released (marketplaces and platforms may have their own timeframes) |

Ease of use

Wise Business has an intuitive app that syncs nicely with desktop use

Wise Business has a simple to use user setup which can be extended to specific cards and features within the account

The accounting integrations with Wise Business against the options with Payoneer make syncing to every day accounts much simpler

App and interface

Both Payoneer and Wise Business come with app access. Across Google Play and the App Store, the feed back is pretty consistent. Wise Business simpler to use, with a couple of bugs. Payoneer often has login problems and is slow to resolve issues.

Apple App Store

Measure | Wise Business | Payoneer |

|---|---|---|

Average Rating | 4.7 stars | 4.3 stars |

General Sentiment | Highly Positive | Mixed to Positive |

Common Positive Feedback |

|

|

Common Negative Feedback |

|

|

Google Play Store

Aspect | Wise Business | Payoneer |

|---|---|---|

Average Rating | 4.5 stars | 4.1 stars |

General Sentiment | Generally Positive | Mixed to Positive |

Common Positive Feedback |

|

|

Common Negative Feedback |

|

|

Customer service

The level of service you have access to from both is similar. It is possible to get an account manager for higher ongoing spend with Payoneer, the rest is very much like-for-like:

Feature | Wise Business | Payoneer |

|---|---|---|

Dedicated account manager | No | Yes (available for high spend levels) |

Help center | Yes (24/7) | Yes (24/7, multilingual) |

Live chat | Yes | Yes (24/7, multilingual) |

Yes | Yes | |

Phone support | No | Yes |

Wise Business offers straightforward, efficient support with a focus on self-service. While lacking phone support, it’s pretty easy to navigate. For email support, responses are generally received within a day.

Payoneer provides more comprehensive support, including a dedicated account manager for high-spending customers. This being said, response times are slow once you need to escalate an issue, which will be off-putting for many.

Regulation

Wise Business holds regulations in 14 different countries, Payoneer is regulated in 8

Both Payoneer and Wise Business have a wave of regulation in place. Here’s how they compare against each other.

This offers protection for customers operating in different markets.

Country/Region | Regulators | Wise Business | Payoneer |

|---|---|---|---|

Australia | ASIC, APRA, AUSTRAC | Yes | Yes |

Brazil | Central Bank of Brazil | Yes | No |

Canada | FINTRAC, Revenu Québec | Yes | Yes |

European Economic Area (EEA) | National Bank of Belgium, Estonian Financial Supervision Authority | Yes | Yes |

Hong Kong | Customs and Excise Department (CCE) | Yes | Yes |

India | Reserve Bank of India (RBI) | Yes | No |

Indonesia | Bank Indonesia, Financial Services Authority (OJK) | Yes | No |

Japan | Kanto Local Financial Bureau | Yes | Yes |

Malaysia | Central Bank of Malaysia (Bank Negara) | Yes | No |

New Zealand | Financial Markets Authority | Yes | No |

Singapore | Monetary Authority of Singapore (MAS) | Yes | Yes |

Switzerland | FINMA | Yes | No |

United Kingdom | Financial Conduct Authority (FCA) | Yes | Yes |

United States | Financial Crimes Enforcement Network (FinCEN), various states | Yes | Yes |

Not keen on either?

If neither Wise Business or Payoneer feel like the right option for your business, we'd recommend checking out one of our other providers.

More comparisons

Contributors

.png)