The first transfer under $5,000 is free and with a promo rate!

This applies to first transfer transfers below $5000.

Is MoneyGram right for you?

MoneyGram is best for when you need to make in-store transfers, or planning on making multiple recurring payments to hard-to-reach areas.

MoneyGram is good if… | Find an alternative if… |

|---|---|

|

|

Scoring MoneyGram

The key areas of our MoneyGram review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Below is a quick summary of MoneyGram. Each area is covered in more detail below.

Exchange rates & fees

MoneyGram charges no fee on transfers up to $5,000 in USD, as well as, you get a promotional rate (better than the mid-market rate). However, this only applies to your first transfer.

On subsequent transfers, there is a fee of $ 1.99 to most destinations, and on transfers above $5,000, you are looking to pay more than $128.02 (and this does not include the markup).

MoneyGram adds a markup of 1.33% on average, with some currencies going as high as 7.59%.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with MoneyGram, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

MoneyGram fees and exchange rates

Fees and rates

MoneyGram charges both exchange rate margins and transfer fees when processing transactions.

They show all the fees upfront before signing up, which I found really useful and convenient.

Exchange rates

MoneyGram exchange rates are different depending on where you send the money from.

We took a sample of 107 USD pairs and analyzed the exchange rate markup.

We found that on average, MoneyGram adds a markup of 1.33% on top of the “real” exchange rate.

This means you will pay 1.33% more for every unit of currency you are sending.

Considering that you can send money from 37 locations, we’ve looked at the rates specifically from the US (in USD).

Here’s a table summarizing MoneyGram exchange rates for sending USD to other currencies.

Destination currency | MoneyGram rate | Mid-market rate | MoneyGram markup |

|---|---|---|---|

AFN | 63.704 | 68.53943 | 7.59% |

COP | 4056.476 | 4223.03 | 4.11% |

GBP | 0.7253 | 0.75438 | 4.01% |

JMD | 152.4998 | 157.16388 | 3.06% |

BRL | 5.3362 | 5.4323 | 1.80% |

PLN | 3.7356 | 3.893262 | 4.22% |

MXN | 19.1502 | 19.44263 | 1.53% |

EUR | 0.8765 | 0.906075 | 3.37% |

CAD | 1.3183 | 1.348595 | 2.30% |

NZD | 1.5565 | 1.59628 | 2.56% |

PHP | 55.16 | 56.202 | 1.89% |

AUD | 1.4325 | 1.453372 | 1.46% |

INR | 82.8333 | 83.96865 | 1.37% |

AED | 3.6464 | 3.673 | 0.73% |

HNL | 24.8307 | 24.956793 | 0.51% |

*Rates collected in October 2024. Each conversion is based on USD. Also, MoneyGram limits some countries to USD, EUR, GBP, and AUD transfers only, hence we’ve removed the duplicates.

To ensure full coverage of MoneyGram, we’ve looked at what other users have to say about their exchange rates and plotted the results on the graph below.

International transfer fees

MoneyGram charges no transfer fees on transfers up to $5,000 to most countries; there are a few exceptions such as Hong Kong, however.

Considering the promotion, we wanted to know the fees for larger transfers, so we’ve looked at sending $5,001 to various countries.

We found that on average MoneyGram charges a fee of $129.23 for transfers over $5,000.

This is not ideal, considering similar services like Ria Money Transfers would only charge around $4 - $9 for transfers over $5000.

Similar to the exchange rates, we took a sample of the fees for different destinations when sending $5,001 - this is what it looks like.

Destination | Currency | Fee |

|---|---|---|

United Arab Emirates | AED | $130.02 |

Afghanistan | AFN | $130.02 |

Australia | AUD | $128.02 |

Brazil | BRL | $128.02 |

Canada | CAD | $128.02 |

Colombia | COP | $130.02 |

Spain | EUR | $128.02 |

UK | GBP | $128.02 |

Honduras | HNL | $128.02 |

India | INR | $130.02 |

Jamaica | JMD | $130.02 |

Mexico | MXN | $128.02 |

New Zealand | NZD | $128.02 |

Philippines | PHP | $128.02 |

Poland | PLN | $128.02 |

Argentina | USD | $130.02 |

*Fees collected in October 2024. Each is based on transfers from the US in USD. Fees for EUR, AUD, GBP, and USD are the same regardless of the destination country, hence was removed from the table.

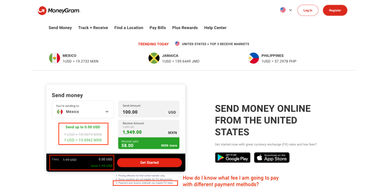

Also, transfer fees and rates can be affected by the payment method you use.

Depending on the payment method you choose, there could be third-party fees that MoneyGram doesn't factor in.

For instance, paying via credit card may attract a cash advance fee in addition to interest fees on the amount advanced.

Deposit with your bank to get the lowest fees

We recommend paying via bank and have the transfer deposited directly into the recipient's bank account to get the lowest fees.

To put these numbers into perspective, let’s assume you’re making a $1000 transfer from the US to a bank via bank transfer to a bank account in the following countries:

Country | MoneyGram fees | Wise fees | Wells Fargo fees | |||

$1,000* | $5,001 | $1,000 | $5,001 | $1,000 | $5,001 | |

$1.99 + 2.23% ($24.29) | $128.02 + 2.23% ($239.54) | Total: $9.46 | Total: $42.07 | $30 + 6.55% ($95.50) | $30 + 6.55% ($357.57) | |

$1.99 + 0.82% ($10.19) | $128.02 + 0.82% ($169.03) | Total: $9.07 | Total: $41.31 | $30 + 9.72% ($127.20) | $30 + 9.72% ($516.10) | |

$1.99 + 3.12% ($33.19) | $128.02 + 3.12% ($284.04) | Total: $6.26 | Total: $27.78 | $30 + 6.60% ($96.00) | $30 + 6.60% ($360.06) | |

*Without promotional rates and fees from MoneyGram

Similar to the rates, we’ve looked at how other users have rated MoneyGram in terms of their fees.

Transfer speed

Transfer speed

When sending with MoneyGram, transfer speed depends on a few factors:

Destination: harder to reach areas might take slightly longer to reach the recipient.

Transfer method: different methods will have different transfer times.

Here’s a quick summary of transfer times by transfer method.

Transfer method | Fastest | Slowest |

|---|---|---|

Cash Pickup | A Few Minutes | A Few Minutes |

Cash pickup at Canada Post | A Few Minutes | A Few Minutes |

Cash Pickup at Partner Locations | A Few Minutes | A Few Minutes |

Cash Pickup at Polish Post | A Few Minutes | A Few Minutes |

Cash Pickup at UK Post | A Few Minutes | A Few Minutes |

Direct to Bank Account | 0-1 Business Days | 0-10 Business Days |

Mobile Wallet | A Few Hours | 0-1 Business Days |

As for the destinations, this will vary heavily based on your specific transfer details. Here are a few examples to illustrate the difference.

When sending directly to the bank account:

0-1 Business Days: ARS, AUD, CNY, MXN, PHP, PLN, USD

0-2 Business Days: BRL, CAD

A Few Hours: COP

0-3 Business Days: EUR, NZD

0-4 Business Days: GBP, HNL

0-10 Business Days: JMD

While making transfers to mobile wallets looks like this:

For cash transfers, the money will be available instantly, regardless of the destination.

When it comes to user reviews, this is what it looks like in terms of speed.

Transfer limits

Transfer limits

MoneyGram’s transfer limits vary based on the payment method, your country, your destination country, and the receiving method.

Most online and in-app transfers from the US to pretty much all the destinations are limited to $10,000 per transfer. In some locations, the limit is $10,000 per 30 days.

In-store transfers are higher (especially at Walmart locations), but might require extra information about the transfer, such as source of funds.

We’ve also looked at online user reviews for MoneyGram limits.

Product offering

Product offering

MoneyGram offers consumer and business money transfers.

Here’s a quick overview of what these offer:

Consumers

For personal transfers, you can:

Online money transfers

Bill Payment such as rent, car, and phone bills.

Tuition fee payments

Businesses

For business transfers, you can:

Make international business transfers

Access cryptocurrency market

Allow customers to pay directly into bank accounts and wallets

Process and manage payments

Access to “MoneyGram Access” (partnered with Stellar)

Make in-store payments

Supported currencies & destinations

With MoneyGram, you can send money from 37 locations to 41 destinations.

Send money from

You can make transfers from the following locations:

Australia | Austria | Belgium |

Brazil | Bulgaria | Canada |

Chile | Croatia | Czech Republic |

Denmark | Estonia | Finland |

France | Germany | Greece |

Hong Kong | Hungary | Iceland |

Ireland | Italy | Latvia |

Lithuania | Luxembourg | Malta |

Netherlands | New Zealand | Norway |

Poland | Portugal | Romania |

Singapore | Slovakia | Spain |

Sweden | Switzerland | The UK |

United States |

Destinations

It’s worth noting that for some destinations, you have the option to send different currencies:

Australia, Tuvalu

Switzerland, Liechtenstein

Albania, Austria, Belgium, Saint Barthélemy, Cyprus, Spain, Finland, France, Guadeloupe, Greece, French Guiana, Ireland, Italy, Lithuania, Luxembourg, Saint Martin (French Part), Moldova, Macedonia, Malta, Montenegro, Martinique, Mayotte, Netherlands, Portugal, Reunion, Slovakia, Slovenia, Ukraine, Kosovo, Germany

UK, Gibraltar

Hong Kong, Macau

Ecuador, Anguilla, Argentina, Armenia, American Samoa, Bonaire - St. Eustatius - Saba (Bes), Belarus, Bolivia, China, Congo, Democratic Republic (Kinshasa), Costa Rica, Cayman Islands, Egypt, Estonia, Ethiopia, Micronesia, Georgia, Guam, Iraq, Israel, Jordan, Kazakhstan, Kyrgyzstan, Cambodia, Korea, South, Laos, Lebanon, Liberia, Libya, Lesotho, Latvia, Marshall Islands, Mongolia, Namibia, Nigeria, Nicaragua, Panama, Peru, Puerto Rico, Palestinian Territory, Occupied, Russia, Sudan, El Salvador, South Sudan, Suriname, Sint Maarten (Dutch Side), Turks And Caicos Islands, Tajikistan, Turkmenistan, Timor-Leste, Taiwan, Uruguay, United States, Uzbekistan, Venezuela, Virgin Islands, British, Virgin Islands, U. S., Vietnam, Somaliland, Yemen, Zimbabwe

Central African Republic, Cameroon, Congo, Republic (Brazzaville), Gabon, Equatorial Guinea, Chad

Antigua And Barbuda, Dominica, Grenada, Saint Kitts And Nevis, Saint Lucia, Montserrat, Saint Vincent And The Grenadines

Benin, Burkina Faso, Côte d'Ivoire (Ivory Coast), Guinea-Bissau, Mali, Niger, Senegal, Togo

New Caledonia, French Polynesia

Transfer types

MoneyGram makes it a bit confusing when it comes to transfer types you can make.

This is because their online platform and the app have different naming conventions for each.

In general, you can send money in four different ways.

Online

You will be sending money through their website.

Through their website, you can send money directly to your bank account or mobile wallet.

App

You can send money using the MoneyGram app.

With the app, you can make transfers from your bank account, mobile payment services such as Apple Pay or Google Pay, or from your debit or credit card.

When sending with the app, you can have the money sent directly to the recipient's bank account or mobile wallet.

In-person (Cash)

You can send money through any of the MoneyGram branches.

Money can either be delivered to the receipts door (only in certain locations), or the recipient can pick it up in any nearby branch.

Money order

You can also send a money order through the post office.

This is similar to cash transfers, but instead, you will visit the post office and fill in the money order form.

From there, a money order will be delivered to your recipient and they can deposit it to their bank account or get the cash value at any post office.

Payment methods

MoneyGram lets you pay for your transfer with cash, credit or debit cards, mobile wallets, or mobile payment services such as Apple Pay and Google Pay.

Deposit cash at the location

To deposit with cash, you will need to visit one of the MoneyGram agents. The process is simple, you fill in the form, hand the money, and the recipient picks it up. You can also start the transfer online, and pay for it in the store.

Deposit with your mobile

This works online, in-store, and using their app. You will fund your account (or pay in the store) using your phone's mobile wallet such as Apple Pay.

Deposit with your bank

You can fund your transfer using your bank account details. This method only works in the app or online. You will need to add your bank account to your account and use it to fund your transfer.

Deposit with a debit card

You can use your Visa or MasterCard debit card to pay for the transfer. Similar to other ways, this can be used to pay for any kind of transfer.

Deposit with a credit card

This is the same as the debit card, but using your credit card balance. You can use any major card issuer including Visa, MasterCard, Discover Credit Card, Diners Club International, and Union Pay.

This is the most expensive way to pay for the transfer. The fees are usually higher, but there will also be a cash advance fee from your credit card company.

SOFORT

If you’re in Austria, Belgium, Germany, Netherlands, or Spain, you can use SOFORT to pay for the transfer. SOFORT is a real-time payment system that facilitates payments instantly. Similar to FPS in the UK and POLi in New Zealand.

Don’t use credit cards for your transfer

We strongly suggest against using your credit card to fund your transfer.

Credit cards have higher fees, and worse rates, and come with cash advance fees. If you have a choice, use your bank account to make the transfers (it is usually the cheapest way).

Receiving methods

You can receive money in many ways when using MoneyGram.

Direct to bank account

Money will be deposited directly into the receiver's bank account. This process is usually automated and there is nothing they need to do.

Mobile wallet

Money will be deposited directly to the mobile wallet. Some of the popular wallet options include Weixin / 微信 / WeChat, AliPay, GCash, and Mpesa.

Similar to the bank account, the process is automated so there is nothing they need to do.

Cash pickup

The receiver will need to go to the nearest MoneyGram branch or partner location and pick up the cash. When sending cash, money will be available for pickup within minutes. They will need to bring their transfer ID and their government ID.

Post office pickup

This is similar to cash pickup, however, money will need to be picked up at the post office. MoneyGram is partnered with multiple post offices including Canada Post, Polish Post, Royal Mail, and many more. You can use their branch finder to find the nearest post office.

Home delivery

Finally, you can get your money delivered to the recipient's door. They will need to show the transfer ID and their government ID to be able to claim the money. Although funds will be available instantly, they will need to wait for the courier to deliver it.

This option is great if you have no nearby agents, can’t get to one, or don’t have a bank account.

Mobile app

MoneyGram has a mobile app available as a free download on both Android and iOS platforms.

Through the app, you can do the following:

Send money 24/7 to 200+ countries and territories

Check exchange rates and fee estimates

Start your transaction on the app and complete it at a store

Pay bills such as mortgage, utilities, and car payments

Track incoming and outgoing transfers

Check transfer history

Find nearby agent locations

The app has a rating of 4.5/5.0 on Google Play, with over 68,000 reviews. On the App Store, it has a rating of 4.8/5.0 and a total of 52,536 reviews.

In terms of product offering, here’s what online reviews look like from other customers.

Ease of use

Ease of use

A few quirks aside, MoneyGram is very easy to navigate, sign up for, and most importantly use to send money.

MoneyGram makes it really clear what fees and rates you will get for your transfer before you even sign up.

That is a win, as you don’t want to sign up first, just to find that the fees are way higher than what you expected.

On the downside, the fees shown are estimates, without giving you an option to check the delivery method.

This is bad because this is what leads to the hidden fees (you won’t know how much debit transfer or cash transfer costs unless you sign up).

One of the quirks I found is that when you use their online form, you can’t pick the currency. This is resolved once you’re in the account, but again, you can check the fees and rates before signing up.

As for online reviews, this is what the average rating looks like from other users regarding the MoneyGrams usability.

Customer service

There are a few ways you can get help from MoneyGram.

FAQs

Contact form

Email

Phone

Live chat

If you need to contact them, you can use the following details:

Support method | Details |

|---|---|

Phone | 1-800-926-9400 (you can also contact your closes branch directly) |

Contact form | Use the form on the website here. |

FAQs | Here’s the link to the most common questions. |

Live chat | Live chat is available in your account and the app. |

Transfer cancellation form | Use this form to find your transfer and cancel it. |

Customer support is usually the downside of many transfer companies. We’ve looked at what users had to say about MoneyGram in terms of their customer support.

Safety and trust

Safety and trust

Legitimacy of MoneyGram

MoneyGram operates in over 200 countries and territories with approximately 350,000 agent locations.

The company is registered with the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and adheres to international anti-money laundering and counter-terrorism financing regulations.

In the US, MoneyGram is licensed in all 50 States including the District of Columbia.

In the United Kingdom and EEA, MoneyGram International Limited is regulated by the FCA and HMRC as an Authorized Payment Institution.

While it has faced regulatory actions in the past concerning fraud prevention, MoneyGram has improved its compliance programs and settled issues with authorities like the Federal Trade Commission (FTC).

Key industry partnerships

Protection of customer data

Industry awards

Similar to other areas of this review, we’ve analyzed what others had to say regarding MoneyGram's safety.

Customer feedback

User feedback

On Trustpilot, MoneyGram International has over 43,000 reviews. They are rated 4.4 out of 5, with over 70% of reviews as 5*.

ANALYSIS OF USER REVIEWS

We’ve analyzed online reviews and found that speed and convenience are the key positives according to online reviews.

However, the app functionality, customer support, and communication could be better.

Many say that the app is easy to use with useful features (like notifications and enhanced tracking), and transactions are quick and on time (often within minutes).

Fees and rates are also often mentioned, many call it a “cost-effective” option.

On the downside, many report multiple bugs with the app (e.g. errors preventing transfers and random account restrictions.

Just like with many other companies, users blame customer service for being slow and unresponsive.

In addition, a few users mention high fees for larger transfers and low limits on annual transfer amounts.

Here's a summary of average user reviews.

Review Category | Apr 24 | May 24 | Jun 24 | Jul 24 | Aug 24 | Sep 24 |

|---|---|---|---|---|---|---|

International Transfers | 5 | 4 | 1 | 5 | 4 | 4 |

Fees | 4 | 5 | 3 | 4 | 4 | 3 |

Exchange Rates | 4 | 5 | 3 | 4 | 4 | 2 |

Speed | 5 | 5 | 5 | 5 | 5 | 5 |

Limit | 3 | 4 | 2 | 2 | 3 | 1 |

Features | 5 | 4 | 2 | 4 | 4 | 2 |

Ease of Use | 5 | 5 | 4 | 5 | 5 | 5 |

Safety | 5 | 5 | 0 | 5 | 5 | 5 |

Customer Support | 4 | 3 | 1 | 3 | 4 | 1 |

Opening an account with MoneyGram

To open an account with MoneyGram, you will need the following:

Valid email address

Active phone number

Proof of address such as the most recent bill

Government-issued ID such as passport or drivers license

A payment method to pay for your transfer

You can open the account using the app or online, the process is the same for both.

Visit the MoneyGram website

Go to the MoneyGram website and click "Register" to start creating your account.

To use the app, download it from your app store. Then open and click “Register”.

Enter your details

Fill out the registration form with your full name, email address, residential address, and phone number.

Verify your identity

Confirm your email address through the verification link sent to you, provide a government-issued ID for identity verification, and create login credentials with a strong password.

Add your payment details

Select your preferred payment method, read and agree to the T&Cs, and optionally set up 2FA.

That is it, now you can send money with MoneyGram.

Making international transfers

To make a transfer with MoneyGram, you will need the following:

A verified MoneyGram account

A mobile app (for mobile transfers)

Transfer details, including the transfer amount and the currency

Payment method to pay for the transfer

Recipient's details, including recipient’s name and bank/ wallet details.

Government-issued ID (for in-person transfers) such as driving license or passport

If you are sending money to a bank account outside of the EU, you will also need to provide a SWIFT code.

Sending money with the app or online

Once you have all the details ready, you can send money with MoneyGram by following the steps below.

Log in to your MoneyGram account

Login to your account either online or using the app (you can get the app at the App Store or the Play Store). From there, select Send Money and select the destination.

Enter recipient details

Provide the necessary information about the receiver and enter how much you want to send.

Select payment method

Select how you want to pay for the transfer (credit, debit card, cash at a location, etc…).

Confirm and send

Double-check all the information and details. If all is looking good, click send.

Sending money in-person

For in-person transfer, you will need to visit the branch.

Visit a MoneyGram agent

Use the store locator to find the nearest MoneyGram agent. This can be a MoneyGram branch, post office, or one of their partner locations.

Fill in the details

At the counter, fill in the money transfer details giving the recipient details and the amount you want to send.

Provide your ID

Provide your government ID which can be your national ID, passport, driving license, or any other government-issued document in your country.

Pass the details

For your recipient to be able to collect the money, you will need to give them the transaction number.

The transaction number will be given to you at the branch (you will get an SMS with the code). Pass this code to the receiver so they can pick up the cash (they will also need to bring an ID).

Canceling transfer

You can cancel the transfer as long as it hasn't been paid out to the recipient.

There are a few ways to do it

App or online account: log in to your account, find the transfer you want to cancel, and there will be an option to cancel it.

Support: contact their support team and provide your transfer details (reference number, your details, and receiver details). From there they will cancel your transfer.

Use “Find a Transfer”: you can use MoneyGrams online transfer finder tool, and cancel it from there.

The whole refund process can take between 3-10 business days and will be refunded to your payment method.

Receive international transfers

For transfers to a mobile wallet or a bank account, there is nothing the receiver needs to do, money will be deposited to their account directly.

When receiving money in-store, the recipient will need to have the following:

Transaction/reference number: the code you will get as a sender. You need to give it to the receiver.

Government-issued ID: Any government ID will work, such as a driving license or a passport.

For cash pickup, the recipient will need to visit one of the MoneyGram agents, and provide them with the reference number and the ID. From there, if all checks out they will get their cash.

Similarly, for home deliveries, the recipient will need to show the reference number and the ID to the courier.

Does the recipient need an account with MoneyGram?

No, the recipient doesn’t need a MoneyGram account to receive their money regardless of how it was sent.

How MoneyGram compares to other transfer services

Just like other high-street exchange stores, MoneyGram comes with slightly higher fees beyond the first transfer. If you're looking to make recurring or large transfers, we'd suggest these alternatives.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

MoneyGram: Is it good for transfers abroad?

MoneyGram is a good option if you have an agent nearby, want to send money to one of their supported destinations, and want to send up to $10,000.

But even then, the fees are really high compared to what you could get with other high-street services such as Ria Money Transfers and Western Union.

If you want to make an online transfer, the promo rate and no-fee deal are good. You could make use of it to make one transfer and then switch to another service such as Wise.

Without the promo rate, if you sent $1000 to Mexico, they would get 19,032 MXN, while with Wise they would receive 19,273.98 MXN.

But as with any service, I’d suggest comparing your options with our form below, because the best money transfer service for your specific need will depend on many factors.

Find the best rates for your transfer

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services

MoneyGram user feedback

Comments

Anonymous

If you forget your password have amagnifying glass handy because you cant even read the messages they send

Anonymous

Best in industry. Well respected.