Use HELLORIA to get a promo rate on your first transfer!

This applies to transfers over £/$50 and can be used once per person.

Is Ria right for you?

Ria Money Transfer is best for when you need to make in-store transfers, or planning on making multiple recurring payments to hard-to-reach areas.

Ria is good if… | Find an alternative if… |

|---|---|

|

|

Scoring Ria

The key areas of our Ria review are focused on the fees & exchange rates, transfers limits & speed, product offering, ease of use, safety and customer feedback.

Below is a quick summary of Ria Money Transfer. Each area is covered in more detail below.

Exchange rates & fees

Ria fees range between $0.99 and $9 depending on the transfer location, deposit method, and delivery method. As for the exchange rate markup, Ria charges around 0.26% - 4.81% on the mid-market rate.

For instance, if you’re sending $100 to the UK from the US via debit card to a bank account, you will pay $5 + $3.48 (3.48% markup), which is $8.48.

For comparison, this same transfer with Wise would cost you $1.50 in total.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with Ria, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

Ria money transfer exchange rate & fees

Fees and rates

Exchange rates

When you send money with Ria Money Transfer, an exchange rate margin will be applied to the mid-market rate.

This means that for every unit of currency you send, you will pay an extra percentage on top of what it’s actually worth.

Ria Money Transfer offers an exchange rate markup of around 0.26% - 4.81%. This means that if you send the US to the UK, you will pay an extra 0.26% - 4.81% per every USD you send.

Here’s a summary of the Ria Money Transfer exchange rates, for transfers from the US:

Destination currency | Ria exchange rate | Mid-market rate | Ria markup |

|---|---|---|---|

MXN | 19.16 | 19.26754 | 0.56% |

BDT | 118.50 | 119.5352 | 0.87% |

COP | 4,088.32 | 4205.54 | 2.79% |

GHS | 15.4893 | 15.7 | 1.34% |

INR | 82.9948 | 83.77845 | 0.94% |

NGN | 1,635.15 | 1639.39 | 0.26% |

AFN | 66.6314 | 70 | 4.81% |

ALL | 86.92 | 89.75 | 3.15% |

DZD | 127.04 | 132.307 | 3.98% |

EUR | 0.8789 | 0.89924 | 2.26% |

AOA | 905.03 | 929.5 | 2.63% |

XCD | 2.66 | 2.70255 | 1.57% |

AMD | 375.168 | 387.61 | 3.21% |

AUD | 1.4528 | 1.480604 | 1.88% |

EUR | 0.8812 | 0.89924 | 2.01% |

CAD | 1.3242 | 1.35948 | 2.60% |

XAF | 574.47 | 589.2773 | 2.51% |

CNY | 7.0271 | 7.0935 | 0.94% |

XAF | 574.47 | 589.2773 | 2.51% |

GBP | 0.7334 | 0.759875 | 3.48% |

AED | 3.6401 | 3.673 | 0.90% |

NZD | 1.5956 | 1.617065 | 1.33% |

EUR | 0.8812 | 0.89924 | 2.01% |

*Exchange rates taken in September 2024. All rates are based on a 100 USD transfer.

As you can see, Rias exchange rates vary depending on the currency. For example, USD-MXN has 0.56% markup, whereas USD-GBP has a markup of 3.48%.

This is the reason why you should always compare your options for specific currency pairs.

If you were to send $100 to the UK, you are overpaying by $3.48, and this is without the fees. Whereas if you sent the same amount with Wise, you’d be saving yourself $3.48.

This might not seem like a lot, but if you’re making frequent or large transfers (or frequent large transfers), this will quickly add up.

However, it’s worth noting that Ria Money Transfer offers a discount on your first transfer with a better rate.

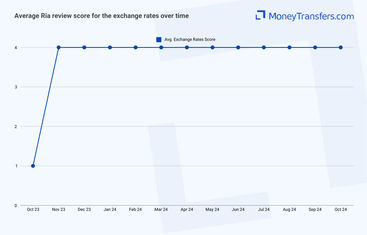

To ensure full coverage of Ria, we’ve looked at what other users have to say about their exchange rates, and plotted the results on the graph below.

International transfer fees

Similar to the exchange rates, Ria Money Transfer fees also vary and are a bit more confusing.

Ria Money Transfer fees vary based on the following factors:

Sending country

Receiving country

Amount sent

Payment method

Delivery method

Here are a few examples of the fees if you were to send $100:

Delivery method | Payment method | Fee (USD) |

Bank Account | Bank Account | $7.00 |

Bank Account | Cash Deposit | $9.00 |

Bank Account | Credit Card | $5.00 |

Bank Account | Debit Card | $9.00 |

Cash Pickup | Bank Account | $9.00 |

Cash Pickup | Cash Deposit | $9.00 |

Cash Pickup | Credit Card | $7.00 |

Cash Pickup | Debit Card | $5.00 |

*Fees taken in September 2024. All fees are based on USD transfers.

Delivery method | Payment method | Fee (USD) |

Bank Account | Bank Account | $3.00 |

Bank Account | Cash Deposit | $9.00 |

Bank Account | Credit Card | $7.00 |

Bank Account | Debit Card | $5.00 |

Cash Pickup | Bank Account | $3.00 |

Cash Pickup | Cash Deposit | $9.00 |

Cash Pickup | Credit Card | $7.00 |

Cash Pickup | Debit Card | $5.00 |

*Fees taken in September 2024. All fees are based on USD transfers.

Delivery method | Payment method | Fee (USD) |

Bank Account | Credit Card | $4.00 |

Bank Account | Debit Card | $1.00 |

Cash Pickup | Bank Account | $2.90 |

Cash Pickup | Cash Deposit | $7.00 |

Cash Pickup | Credit Card | $4.90 |

Cash Pickup | Debit Card | $3.90 |

UPI | Bank Account | $0.99 |

UPI | Cash Deposit | $4.00 |

UPI | Credit Card | $4.00 |

UPI | Debit Card | $1.00 |

*Fees taken in September 2024. All fees are based on USD transfers.

As you can see, fees vary depending on multiple factors.

For instance, if you’re sending $100 to the UK via cash deposit to a bank account, you will pay $9 + $3.4 (3.48% markup), which is $12.4.

In addition, if you are depositing money with your bank account, you may incur additional processing fees, as well as, cash advance fees may be charged when using a credit card.

The receiving bank can also charge further fees which are outside of your control.

This is why it’s important to check with both banks as well as compare your options when sending money abroad.

Now to put these numbers into perspective, let’s assume you’re making a $100 transfer from the US to a bank via bank transfer to a bank account in the following countries:

Country | Ria fees | Wise fees | Bank of America fees |

|---|---|---|---|

$3.00 + 3.48% ($6.48) | Total $1.50 | $45 + ~5.66% markup ($50.66) | |

$0.99 + 0.94% ($1.93) | Total $1.43 | Can’t transfer to India | |

$7.00 + 2.01% ($9.01) | Total $1.76 | $45 + ~5.45% markup ($50.45) |

Similar to the rates, we’ve looked at how other users have rated Ria in terms of their fees.

Transfer speed

Transfer speed

The transfer speed also depends on a few factors.

If you pay using a debit or credit card, the transfer is normally delivered within 15 minutes but sometimes can take up to 3 hours.

On the other hand, bank transfers can take up to 4 business days to appear in your recipient's account.

Mobile top up transfers are almost instant and cash delivery will also become available to the recipient within minutes.

If you need to send money urgently via Ria, it is best to send money using your debit card or by sending cash in the branch.

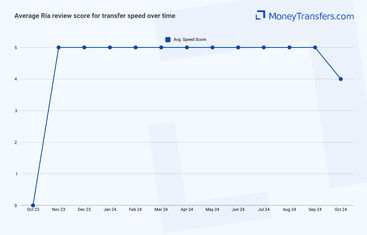

When it comes to user reviews, this is what it looks like when compared to Wise in terms of speed.

Transfer limits

Transfer limits

Ria Money transfer limits vary depending on the country you are sending money from.

Here’s a summary of Ria Money Transfer limits:

Country | Per Transfer Limit | Maximum Limit |

|---|---|---|

Denmark | 65,000 DKK | N/A |

UK | £4,999 | N/A |

Sweden | 100,000 SEK | N/A |

Switzerland | 1,000 CHF | 1,000 CHF every 30 days |

Norway | 100,000 NOK | N/A |

Supported EU countries* | 10,000 EUR | 25,000 EUR every 365 days |

USA | $495 (cash-funded transfers) | $14,999.99 every 30 days (other payment methods) if your account is verified. |

Australia | 20,000 AUD | N/A |

Malaysia | 50,000 RM | N/A |

Canada | 3,000 CAD | N/A |

Chile | 3,500,000 CLP | 10,000 USD per month |

*Supported EU countries include: Austria, Belgium, Finland, France, Germany,Ireland, Italy , Lithuania, Luxembourg, The Netherlands, Portugal, Spain

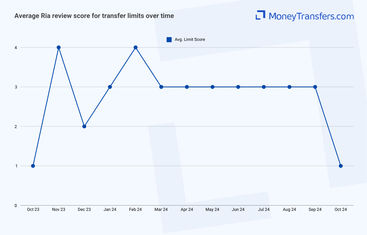

We’ve also looked at online user reviews for Ria Money Transfer limits and compared it to Wises limits.

Product offering

Product offering

Supported currencies & destinations

With Ria Money Transfer, you can send money from 32 countries.

However, Ria Money Transfer restricts the online portal to 13 locations, the rest will have to use the Ria Money Transfer app or send money using one of their branches.

Here is a summary of where you can send your money from, along with available deposit locations.

Country | Deposit Method |

|---|---|

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store | |

Online, app, and in-store |

Country | Deposit Method |

|---|---|

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store | |

App and in-store |

Country | Deposit Method |

|---|---|

In-store only | |

In-store only | |

In-store only | |

In-store only | |

In-store only | |

In-store only | |

In-store only | |

In-store only | |

In-store only |

When it comes to destinations, Ria Money Transfer has almost global coverage. Rias supports transfers to 180 countries with various deposit and withdrawal options.

Considering their coverage, instead of listing every country they cover, it is easier to list countries that are not covered by Ria Money Transfer:

Eswatini

Sao Tome and Principe

Comoros

Vanuatu

Malawi

French Guiana

New Caledonia

Falkland Islands

Montserrat

Tokelau

Niue

Pitcairn Islands

Saint Helena

Christmas Island

Need to send money to these locations?

Transfer types

Ria Money supports bank-to-bank transfers, cash transfers available via collection or delivery or mobile top up. These can be paid for via bank account, credit and debit card, or in cash.

With Ria Money Transfer you have a few transfer options available:

Online transfer

With online transfer, you can use Rias online portal to send money. However, this is limited to the 13 countries listed above.

App transfer

You can also use their mobile app to send money abroad. This option is available to 23 countries (10 exclusively via the app).

Transfer in person

Finally, you can send money in person by visiting the Ria branch. This option is available for all countries listed above.

Payment methods

When it comes to making deposits (where you are going to send money from), you have a few options.

Cash

With cash deposit, you essentially take the money to the store, hand it to the cashier, and they initiate the transfer. The receiver will be able to pick up the money within minutes (assuming you sent it as cash pickup). This method is perfect if you don’t have an account, don’t have access to the internet / app, or simply find it easier to do transactions in-person.

Credit card

You can use a credit card to fund your transfer, however, these will come at higher fees from Ria, as well as, your credit card company will likely charge you an additional fee, additional conversion fee, and cash advance fee.

Debit card

You can also use your debit card to fund your transfer. This option is much better than using a credit card. The fees are lower and transfer times are faster compared to other options.

Bank account

You can use your bank account to fund your transfer. This option is more secure, so is better for larger transfers, however it can take longer to process (on both ends of the transfer). Also, for first-time bank payments, Ria Money Transfer makes two micro-deposits that you have to verify to proceed with your transfer.

Don’t use credit cards for your transfer

If you have a choice, always pick another funding method. Credit card transfers come with multiple fees that are outside of your control. These could include additional conversion fees, and cash advance fees, and the general transfer fees are usually higher ($2-5 more compared to a debit card).

Receiving methods

As for receiving payments, the receiver can get the money in the following ways:

Cash pick-up

The receiver will need to visit one of the branches and provide the transfer details. They should be able to collect their money almost instantly. This method is perfect if the recipient needs money urgently, and if they prefer to deal with transactions in-person.

Bank account deposits

Transfer will land into the receiver's bank account. This can take up to 4 days depending on the deposit method you used. Although it’s longer, it is more secure to make transfers via the bank account compared to debit cards or eWallet transfers.

Ria eWallet (mobile wallet)

With this method the receiver will get their money deposited instantly into the Ria app (under the eWallet tab). From there, the receiver can either withdraw the balance or use it to send money abroad.

Home delivery

If you’re sending money from Armenia, Dominican Republic, Egypt, Hungary, Morocco, Philippines, or Vietnam, you can request a home delivery. The more will be delivered to the recipients home as soon as they become available. This option is a bit more expensive, but is perfect for those who are unable to make it to the store or don’t have an account or struggle to use online banking.

UPI

If you are sending money to India, you can receive money via UPI. This option doesn’t require the sender (you) to submit an IFSC number or account. This option is great if you don’t have all the details, or if the receiver doesn’t want to give all their details. Instead, you will need to supply MPIN and ensure the receiver has the UPI app from their bank.

Similar to deposit methods, RIas offering is good and in-line with other money transfer providers.

For example, Wise lets you receive money into their mobile app, multi-currency account, and to the receiver's bank.

Mobile app

Ria Money offers a free mobile app which is available to download from both Google Play and App Store.

On Google Play, the app has over 15,000 ratings, with an overall ranking of 4.7 out of 5. On the App Store, it has over 16,500 user reviews, with a score of 4.8 out of 5.

Ria Money Transfer app has lots of helpful features that enable customers to:

Send money instantly

eWallet option to receive money

Track transfers on the go

Locate nearby Ria Money agents

Secure login via fingerprint or facial recognition

Add new recipients

Manage all pending, complete and canceled transfers

Schedule repeat transfers

Share payment details through WhatsApp, Messenger, Gmail, Facebook, OneDrive and several other widely used mobile applications

It’s worth noting that the app is only available to a few countries that I’ve outlined above.

In terms of product offering, here’s what online reviews look like from other customers.

Ease of use

Ease of use

Overall, Ria is very simple and easy to use. Their online portal offers all the features you will need and most importantly, sending, receiving and tracking transfers is super simple and clear.

The registration process is well streamlined through both the website and the app.

The whole process took me less than 10 minutes on the web, and the test transfer I did similarly took me a couple minutes.

One aspect I really liked about their web platform is that you clearly can see the exchange rate, promo rate, and the fee before signing up.

This is important because you (and I) don’t want to lock with a provider that offers promo rates (or fees) without knowing subsequent transfer rates (and fees). So you can check it before making the decision to sign up.

One downside to their transfer process is the way payment and delivery methods are laid out. It’s a bit difficult to see the cheapest or fastest options, unless you click through each combination.

Similarly to other sections of this review, we’ve looked at what other had to say about the usability and plotted the results on the graph below.

Customer service

When it comes to support, you have a few options available:

Phone

Live chat

Help center

Ria offers slightly less options compared to the likes of XE or Wise.

If you do need to contact Ria, you can use the following details:

Method | Details |

|---|---|

Phone Support | 0800 085 5955 |

Live Chat* | Available Sunday to Friday, 12:00 AM - 11:59 PM PST, and Saturday, 6:00 AM - 8:00 PM PST. |

Help Center | Online help center with FAQs and troubleshooting resources. |

* You will need to have an account to be able to use the live chat.

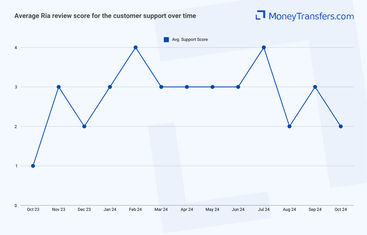

Customer support is usually the downside of many transfer companies. We’ve looked at what users had to say about Ria Money Transfer in terms of their support.

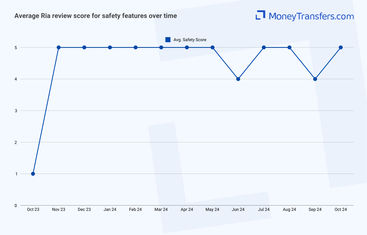

Safety and trust

Safety and trust

Legitimacy of Ria Money Transfer

Ria started out in the financial services and electronic funds transfer sector in 1987, launching in New York City, since, Ria has grown exponentially.

Between 1993 and 2006, the Ria Money network expanded into new markets across Europe, including Spain, UK, Italy, France, Switzerland, Austria, Belgium and Germany.

In November 2006, Ria Money was acquired by Euronet Worldwide, Inc. for $490 million.

The acquisition brought Ria Money into a huge family of sister companies like XE and ePay and in 2018, the group processed $115 billion in global payments, amounting to more than $2.5 billion in revenue.

In 2012, Ria launched its online money transfer platform, RiaMoneyTransfer.com, designed to help customers send money from the comfort of their homes and offices.

Regulatory compliance

Key industry partnerships

Protection of customer data

Industry awards

Similar to other areas of this review, we’ve analyzed what others had to say regarding Rias safety and compared it to Wise's reviews.

Customer feedback

User feedback

Ria Money has more than 22,258 customer reviews on Trustpilot: 74% of these reviews are rated as 5 stars, resulting in an overall rating of 4.3 out of 5.

ANALYSIS OF USER REVIEWS

We’ve looked at the past few months of user reviews, and found that most find it easy to use, convenient, and straightforward for sending money home.

Many mention quick transfer times, however, a few also talk about the delays due to compliance and requirements (of which many cause holds and rejections). It’s pretty frustrating, especially when you need to make an urgent transfer.

There are a lot of negative reviews around customer service. This is fairly typical for a large organization like Ria. Also, some find the fees to be high and exchange rates less favorable compared to other services.

Here's a summary of average user reviews.

Review Category | Apr 24 | May 24 | Jun 24 | Jul 24 | Aug 24 | Sep 24 |

|---|---|---|---|---|---|---|

International Transfers | 4 | 4 | 5 | 4 | 4 | 4 |

Fees | 4 | 4 | 4 | 4 | 4 | 3 |

Exchange Rates | 4 | 4 | 4 | 4 | 4 | 4 |

Speed | 5 | 5 | 5 | 5 | 5 | 5 |

Limit | 3 | 3 | 3 | 3 | 3 | 3 |

Features | 4 | 4 | 4 | 4 | 4 | 4 |

Ease of Use | 5 | 5 | 5 | 5 | 5 | 5 |

Safety | 5 | 5 | 4 | 5 | 5 | 4 |

Customer Support | 3 | 3 | 3 | 4 | 2 | 3 |

Opening an account with Ria

To open an account with Ria Money Transfer, you will need the following:

Be located in the supported country (discussed above).

A personal phone number

An email address

Once you have these details, follow the steps below to open an account:

Register

Navigate to Ria MOney Transfer using any of the orange buttons on this page.

Click on Register at the top right corner.

Create an account

Select your country from the list provided, give your number for verification, and set a strong password.

Add your personal information

Enter your name, date of birth, occupation, email and address.

That is it, now you can make a transfer using the Ria Money Transfer online portal.

Register using the app

You can also register via the mobile app. For full steps, refer to the guide provided by Ria Money Transfer.

Making international transfers

To send money with Ria Money Transfer, you will need the following:

Ria account: You must be logged in to your Ria account.

Transfer amount: Specify how much you want to send.

Payment method: Credit card, debit card, or other available methods.

Recipient's details: Provide recipient’s name and bank/mobile wallet details.

Delivery method: Choose from bank transfer, cash pickup, or mobile wallet.

Government ID: For in-person transfers.

MPIN: For UPI transfer you will need to provide an MPIN.

If you are sending money to the bank account outside of the EU, you will also need to provide a SWIFT code.

Sending money abroad

Once you have all the details ready, you can send money with Ria Money Transfer by following the steps below.

Log in to your Ria account

Go to Ria Money Transfer, sign in using your account credentials, and click on "Send Money"

Fill in the details

Choose the country where you want to send the money and add the amount you want to send in your home currency or the amount the receipient will receive.

Select the payment & delivery methods

Choose between credit card, debit card, or bank account as your payment method.

And select whether the money will be delivered to a bank account, via cash pickup, or to a mobile wallet.

Provide recipient’s details

Enter your recipient’s full name and their bank account, mobile wallet, or cash pickup details.

Carefully check all details, including exchange rates and fees, then confirm and send your transfer.

Canceling transfer

You can log in to your online account and cancel your transaction under the recent orders.

Transfers that have already been paid out to the recipient cannot be canceled.

Depending on your payment method, it takes anywhere between 2-10 business days to get your refund following a successful cancellation.

Cash and mobile transfers are carried out too quickly making cancellations almost impossible.

Receive international transfers

There are four ways your beneficiary can receive money with Ria Money.

The funds can be deposited in their bank account, mobile money wallet, delivered at home, or collected in cash from a cash pickup point.

As I’ve already mentioned above, there are a few ways for the receiver to get the money; cash pick-up, bank account, eWallet, home delivery, and UPI in India.

Bank deposits and eWallet transfers do not require the recipient to do anything.

For home deliveries and cash pick-ups, the receiver will need to provide the following information:

The PIN provided to you when initiating the transfer

A valid ID (the same as that used in the transfer)

Now, to receive the transfer, the process is very straightforward.

Provide your details to the sender

Make sure your full name matches your government-issued ID, and give the sender your country of residence and preferred receiving method, such as cash pickup, bank deposit, or mobile wallet.

Choose a receiving method

Decide whether you want to receive your money via cash pickup at a Ria location, a bank account deposit, or a mobile wallet transfer.

Sender initiates the transfer

The sender will initiate the transfer and share the PIN / Order Number with you.

Collect your funds

For cash pickup, visit a Ria location with your ID and the PIN (or order number). For bank deposits and mobile wallets, the money will be transferred directly.

Does the recipient need an account with Ria?

No, the recipient does not need a Ria Money Transfer account if they have a bank account.

How Ria compares to other transfer services

Generally, high-street money transfer services tend to be a bit more expensive than online-only companies. Here's a list of a few alternatives you might want to consider for your transfer.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Ria Money Transfer: Is it good for transfers abroad?

All in all, Ria Money Transfer is a good money transfer provider for those who want to make small transfers or transact in person.

They offer more transfer options than many other alternatives but are a bit more expensive compared to the likes of Wise or WorldRemit.

We’d suggest finding an alternative if you want to make large or recurring international transfers.

Find the best rates for your transfer

A bit more about Ria

Can I track transfers with Ria?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services

Ria Money Transfer user feedback

Comments

Anonymous

good service with least charges

Anonymous

Can't send money from india to Nigeria

Arnaldo Negron

You did not send money to Cuba. Sad.

Anonymous

iraq isn't even included

Anonymous

You cannot create an account from India.