Is A Place In The Sun Currency right for you?

A Place In The Sun Currency is good if… | Find an alternative if… |

|---|---|

|

|

Scoring A Place In The Sun Currency

The key areas of our A Place In The Sun Currency review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Below is a quick summary of A Place In The Sun Currency. Each area is covered in more detail below.

Exchange rates & fees

We haven’t collected enough data to give the exact exchange rates offered by A Place In The Sun Currency, however, based on the data we have it could range from 0.3% to 2% depending on the currencies and the amounts involved.

As for the fees, they charge £5 per transfer, which is waived on transfers over £30,000.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds with A Place In The Sun Currency, here’s a quick summary of the benefits and drawbacks.

Pros

Cons

A Place In The Sun Currency fees and exchange rates

Unlike online-only companies like Wise, currency brokers usually don’t charge a fee, but instead work the fee into the exchange rate markup.

Fees and rates

Exchange rates

We haven’t collected enough data yet to give you the exact exchange rates offered by A Place In The Sun Currency.

However, we can provide indicative rates and compare them to similar companies.

Based on a few examples they have provided, we’ve found A Place In The Sun Currency to add a markup between 0.3% - 2% on international transfers.

The examples we found were based on €150,000 transfer from GBP to EUR.

Based on our analysis and collected data, this is more or less in line with similar brokers:

Regency FX adds 0.30% markup

Key Currency adds 0.33% markup

TorFX adds 0.35% markup

Currencies Direct adds around 0.51% markup

For comparison, a UK bank would charge around 3-5% markup on international transfers.

However, just like with other currency brokers, exchange rates are tailored to your specific needs.

If you want to know more, we strongly suggest you contact their support on WhatsApp and check what rates you can get.

International transfer fees

Although most currency brokers don't charge a fee, A Place In The Sun Currency charges £5 per transfer, which is waived on transfers over £30,000.

According to their T&Cs, some currencies may incur a higher fee, which again, will be negotiated during the transfer, or can be requested with their “Pricing Policy”.

Finally, if you fail to make your payment on time, there is an additional charge of 4% on top of the base rate.

Just like with any international transfer to a bank account, there may be additional fees on the receiving end. Some banks will charge a receiving fee, or accumulate additional fees that are outside of anyone's control.

To put these numbers into perspective, let’s assume you’re making a £150,000 transfer from the UK to a bank via bank transfer to buy a property in Spain:

Transfer method | Exchange rate markup | Transfer fees | Lost in fees |

|---|---|---|---|

A Place In The Sun Currency fees | Agreed per transfer. Typically around 0.30%*. | £0.00 | £300.03 |

Regency FX | Agreed per transfer. Typically around 0.30%. | £0.00 | £300.03 |

Key Currency | Agreed per transfer. Typically around 0.33%. | £0.00 | £495.05 |

TorFX fees | Agreed per transfer. Typically around 0.35%. | £0.00 | £450.05 |

Currencies Direct | Agreed per transfer. Typically around 0.51%. | £0.00 | £765.08 |

HSBC fees | Around 3.5% markup. | £0.00 | £5249.39 |

*At the best rate

As you can see, you're losing a bit of money with each option, and this doesn't include all other combinations of currencies and amounts, this is why it is very important to compare.

Transfer speed

Transfer speed

According to A Place In The Sun Currency, maximum transfer times depend on the currency and timing of the payments:

Currency / Destination | Order Time | Allowed Timeframe |

|---|---|---|

Euro or sterling | Before 4 pm on a business day | Next business day |

Euro or sterling | After 4 pm on a business day or non‐business day | 2 business days |

Not in EUR or GBP to EEA | Before 4 pm on a business day | 4 business days |

Not in EUR or GBP to EEA | After 4 pm on a business day or non‐business day | 5 business days |

Outside EEA in any currency | Any time | Time can vary |

These are estimates and are usually faster depending on your specific transfer. You will be able to see the exact delivery time right before confirming the transfer.

Transfer limits

Transfer limits

A Place In The Sun Currency does not have any information on transfer limits, however, typically currency brokers have very high limits and some are unlimited.

With A Place In The Sun Currency, we can assume their limits are unlimited and can be discussed with your account manager at the time of the transfer.

Product offering

Features and offering

Supported currencies & destinations

A Place In The Sun Currency supports the following currencies:

GBP

EUR

USD

PLN

ZAR

HKD

INR

AED

SOK

NOK

DKK

THB

AUD

NZD

SAR

OMR

QAR

However, their main specialty is transfers from the UK to Europe (GBP to EUR).

This is a very light offering and not competitive.

Many other currency transfer brokers have more currencies available. For example, TorFX offers 42 currencies, Regency FX offers 50 currencies, and OFX offers over 170 currencies.

If you’re looking to make a more exotic transfer or plan on sending money in multiple currencies, I would recommend looking for an alternative.

Buying and selling property overseas

Buying and selling property abroad is their primary area of expertise.

All the tools and advice are built around property purchases abroad, and even online reviews suggest the majority of customers have used them for making house purchases in Spain.

A Place In The Sun Currency has an extensive range of very detailed guides for buying property abroad absolutely free, covering everything from local cuisine to taxes and pensions.

Here are a few examples:

Buying property in Spain

Buying property in Turkey

Buying property in Florida

Transfer types and payment options

All transfers on A Place In The Sun Currency are handled over the phone or email. They have no app and no online portal for making online transfers.

As for making actual transfers, you are limited to bank transfers.

A Place In The Sun Currency accepts bank transfers made online, over the phone, or by visiting your branch.

Risk management options

A Place In The Sun Currency currently offers two risk management options:

Spot contracts

With a spot contract, you essentially make a transfer on the spot at the current rate. With spot contracts, money can be sent to your account or a third party.

Forward contracts

You can lock in the rates for as little as 2 days, but this requires an up-front deposit and a final payment on the agreed date. They may require additional margin deposits if the market moves significantly.

This is a common and fairly light offering compared to other currency brokers. For example:

TorFX offers spot contracts, 12-month forward contracts, limit orders, and stop-loss orders

Currencies Direct offers 24-month forward contracts and spot contracts.

OFX offers 12-month forward contracts, spot contracts, and FX options.

Regency FX offers spot contracts, forward contracts, and limit orders.

If you are planning to make a large transfer in the future and want to protect yourself from currency fluctuations, we recommend comparing your options.

Ease of use

Ease of use

Platform options

A Place In The Sun Currency currently has no app or online portal, all transfers are handled over the phone or email, similar to Key Currency.

This is a good option if you want to deal with a real person and not rely on online portals.

However, if you prefer the latter, we recommend looking at TorFX and OFX. Both offer in-app transfers, online transfers, and over-the-phone transfers.

Alternatively, we have a guide on top money transfer apps in case you want something else.

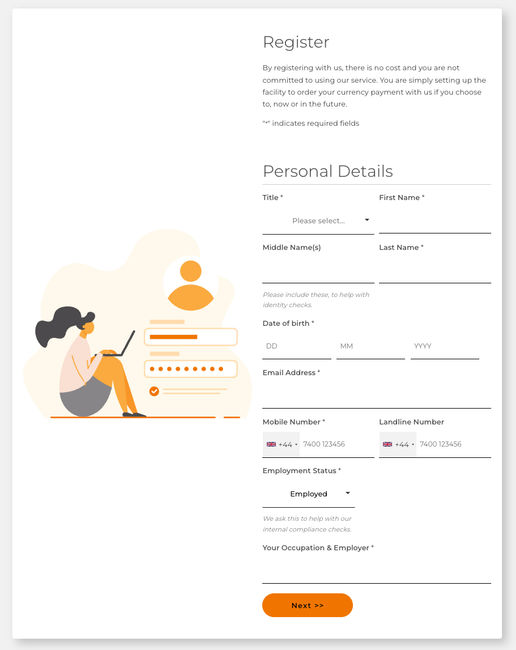

Signup process

I went through the signup process and it was a breeze. Took less than 5 minutes and only had 4 steps.

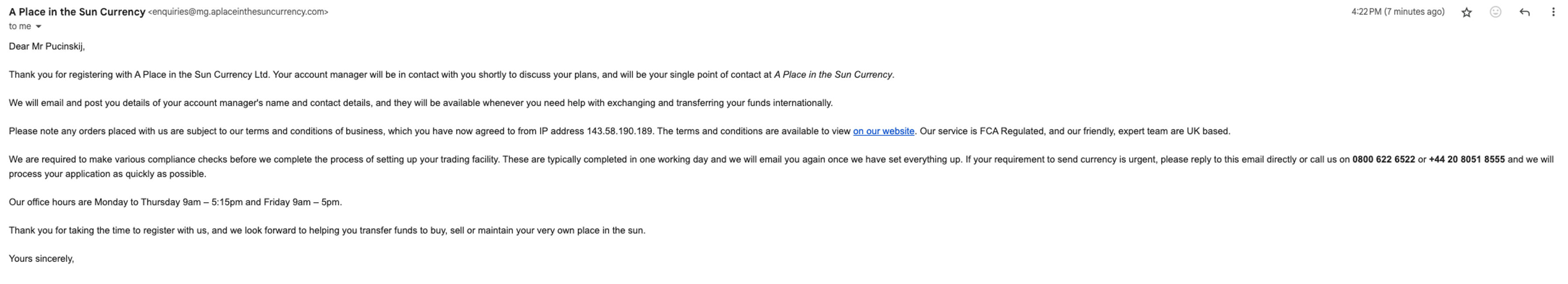

After registration, I received an email confirming my account and that someone will be in touch.

I think the process was a bit smoother and less confusing than when we tested Cambridge Currencies.

Customer support and account manager

Just like with other money transfer brokers, you will get a dedicated account manager to handle your transfer.

We’ve looked into their account managers on external review sites and overall, most users find them useful and helpful in dealing with transfers and handling issues.

As for the support, you can reach them:

Via the email at help@aplaceinthesuncurrency.com

Over the phone at 0800-622-6522 or 020-8051-8555

Over the post by sending mail to Unit 1 Hollybush House, 5a New Road, Croxley Green, Rickmansworth, WD3 3EJ

If you have a complaint, you can contact them via this email: complaints@aplaceinthesuncurrency.com

Safety and trust

Safety and legitimacy

A Place In The Sun Currency has been around since 2008. This is not as long as XE but more than Regency FX.

The company is authorized by FCA for payment services and by HMRC for AML compliance. If you’re unsure what this means, check out our directory of financial regulators.

Judging by the most recent online reviews, there are a lot of success stories and not too many complaints. If anyone complains, it’s usually due to mistakes or miscommunication.

On the positive side, many have made successful transfers and will be returning in the future.

I did find a few transparency issues with A Place In The Sun Currency, mostly around the fees and rates.

A lot of the small print such as the 4% late payment charge is buried in T&Cs and legal pages, the price list is hidden behind manual requests, and in general very little information on the exchange rates offered.

Looking into the T&Cs, there are also a few caveats on funds safeguarding.

Your funds are safeguarded only if it’s designated for a payment to a third party, while margin deposits, funds returned to your account, or funds used to fulfill a future foreign exchange are not safeguarded.

This means that safeguarded funds are separated from their accounts and are protected, while not safeguarded funds are not, which might be a bit risky if you’re not certain about your transfer.

Customer feedback

Customer feedback

Most reviews for A Place In The Sun Currency are on Reviews.io, there are over 2,000 reviews with a 4.9/5 rating.

ANALYSIS OF USER REVIEWS

After reviewing the past few months of customer feedback, it's clear that most people find A Place in the Sun Currency easy to use, secure, and highly efficient for transferring funds abroad.

Many leave positive feedback about the team’s knowledgeable and professional support, quick communication, and personalized guidance on complicated transfers.

While some complain about the occasional delays due to compliance checks (especially frustrating when transfers are urgent) others found it to be an additional security measure.

A few reviewers mention that they’d prefer even more competitive exchange rates, but overall, users report saving money compared to standard bank services.

Making international transfers with A Place In The Sun Currency

Getting started and making transfers with A Place In The Sun Currency is quick and easy. I was done in 4 steps when I tried signing up.

Click register or get a quote

Navigate to their website and click on the “Register Today” or “Request a quote” buttons.

From there, fill in your details such as name, D.O.B, contact details, and address.

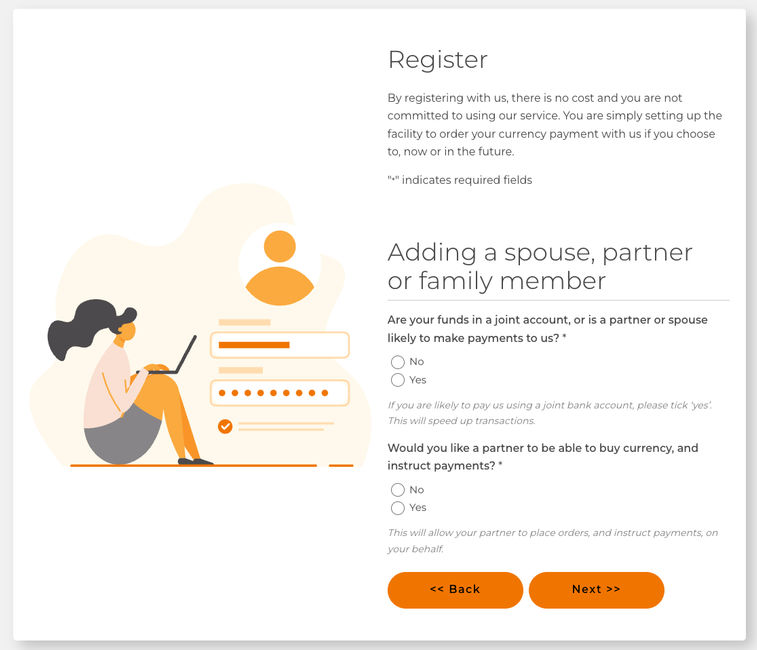

Add additional information

You will also need to answer a few questions about adding additional family members to the account, and marketing options (where you can opt-out).

Receive confirmation

Once completed, you will receive a confirmation email explaining the next steps. The next step will be your account manager contacting you to finalize your account and make a transfer.

Transfer money

Once you get contacted by your account manager, they will ask you about your needs, transfer details, and ask for any other information needed.

From there, they will give you a rate and you can either accept or find a few more options to compare.

Canceling transfer

You can cancel your transfer if it hasn’t been processed yet, usually, this is by the end of the business day it is due.

If you have money locked in a foreign contract, you can ask to terminate it, but you may be liable for any losses arising if the market has moved.

How A Place In The Sun Currency compares to other transfer services

If you’re not happy with the quoted rates or want to check other options, here are a few alternatives that might be better depending on your needs.

A Place In The Sun Currency: Is it good for transfers abroad?

Overall, A Place In The Sun Currency is a good service if you are from the UK and want to buy or sell property in the EU (for example in Spain).

They offer decent rates that are on par with similar providers and waive their fees on transfers over £30,000.

Most of the user reviews have been positive in recent months, and they are authorized by FCA as a payment service.

However, all money transfers are carried out over the phone or email, as they have no online portal or mobile app. If you need the latter, we recommend comparing your options using the button below.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More money transfer companies

.svg)