Companies for transfers from American Samoa to United Kingdom

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

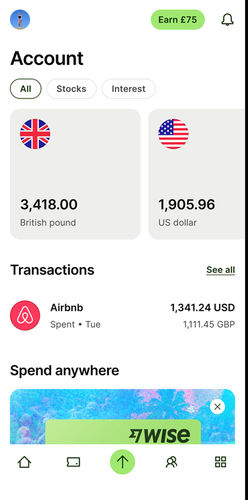

Overall best way: Wise

Wise scored the highest of the 1 money transfer companies supporting USD to GBP transfers.

In total, Wise appeared in 100% of American Samoa to United Kingdom searches.

For a great mix of cost, speed & features, we advise using Wise for your American Samoa to United Kingdom transfer.

How to compare companies offering money transfers from American Samoa to United Kingdom

Considerations for sending money from American Samoa to United Kingdom

Always compare ways to send money from American Samoa to the United Kingdom to get the best options for fees, speed, and reliability.

Our analysis included 1 providers that operate between American Samoa and United Kingdom.

Through this, you get a comprehensive view of all the options you have in American Samoa when you need to send money to the United Kingdom.

Cheapest way to transfer money to the United Kingdom from American Samoa: Wise

Data collected over the past six months shows that Wise is 0% cheaper than the second-best option.

Wise offers this through a combination of an average 30.03* USD fee per transfer and exchange rate between USD-GBP that is 0.01% different to the mid-market rate

If you want the cheapest way to send US Dollar to the United Kingdom, Wise is our recommended choice.

*The most common fee applied to USD-GBP by Wise, based on data from the past six months.

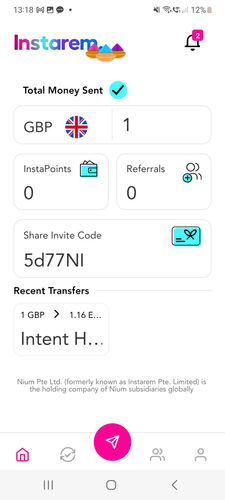

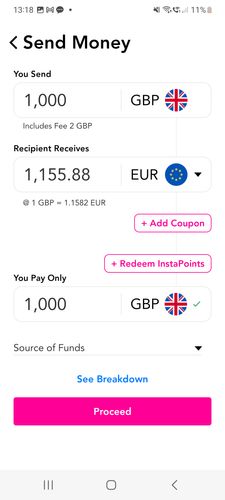

Fastest way to send money to the United Kingdom from American Samoa: Instarem.

In our comparison, we found Instarem to be the fastest way to send US Dollars to Pound Sterling in 100% of transfers. For quick transfers between USD and GBP, Instarem comes highly recommended.

Sending money from American Samoa to the United Kingdom through Instarem has an average fee of 0 USD.

To find the fastest company, we compared 1 money transfer providers for the overall speed of sending money from American Samoa to the United Kingdom. This was made up of depositing US Dollar to a money transfer account and transfer times to the United Kingdom.

When looking for the fastest money transfer, Instarem is our best choice for sending into United Kingdom from American Samoa.

Need to make a large transfer to the UK? Use Currencies Direct

Opt for a service proven with large transfers when size matters. For large payments to the UK, your top option is Currencies Direct.

While Currencies Direct may not always be the cheapest or fastest way to send USD to the UK, they will ensure your money is safe and give you peace of mind while your money moves to United Kingdom.

Understanding the cost of money transfers to United Kingdom from American Samoa

The total cost of sending money to United Kingdom from American Samoa is a mix of the mid-market, exchange rates and transfer fees.

The Mid-Market and Exchange Rates: The mid-market for USD-GBP is 0.7726 GBP per US Dollar.

Using a transfer company with an exchange rate as close to the mid-market rate as possible will result in being able to buy more Pound Sterling for your US Dollars.

The USD-GBP mid-market rate over the last three months has seen the US Dollar worth an average 0.7838 GBP. Within this there has been a high of 0.8215, and a low of 0.7451.

From 1 companies compared, Wise offers the strongest exchange rates.

The biggest factor in the overall cost of sending money is the exchange rate you receive on converting USD to GBP.

Fees: When sending money there may be additional fees. Wise offers the lowest fee of the 1 providers tested, averaging 30.03 USD per transfer over the last 6 months.

Amount Received: When comparing providers, the best measure is the amount of Pound Sterling eventually received in the United Kingdom.

This number should allow you to determine if you are getting a good deal. A higher amount of money received in the United Kingdom, means a better overall cost of sending money from American Samoa.

How to find the best exchange rate for US Dollar to Pound Sterling

Timing is essential for sending money between USD and GBP. The exchange rate you secure impacts how much GBP you get for your USD.

Let's dive into some interesting recent trends.

Over the past six months, the exchange rate from USD to GBP has seen some fluctuation. On average, it stood at 0.7838.

During this period, the highest value recorded was 0.8215, while the lowest was 0.7451.

Wise, which is our recommended service to send money online from American Samoa to United Kingdom offers an exchange rate that is only 0.01% above the mid-market rate.

Want to secure the best USD-Pound Sterling exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from American Samoa to United Kingdom!

How to pay for money transfers between American Samoa and United Kingdom

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between United Kingdom and American Samoa.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from American Samoa to United Kingdom.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send USD to GBP.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

.svg)