Zing, a money transfer app brought by HSBC to rival Wise and Revolut is shutting down in May 2025.

What does this mean for you? It's simple: withdraw all your money by 22nd May 2025. Here are the key dates you need to remember:

Until 2nd April 2025: Your funds will remain safeguarded and untouched.

From 2nd April 2025: no more deposits (top-up or receiving money) will be available.

22nd May 2025: Zing will shut down all its services.

Here are a few options you have:

Get a Wise multi-currency card (check out our Wise review). They have lower fees on transfers of 1,000 USD or GBP or more per month, better exchange rates, but slightly lower ATM limits.

Get a Revolut card (check out our Revolut review and Wise vs Revolut comparison). Free Revolut account is cheaper than Wise or Zing for transfers under 1000 per month (GBP, USD, or EUR), but is more expensive beyond that.

Find another alternative. Check out our guide to the best money transfer apps to find the one that fits your needs.

Zing is a very young transfer provider based in the UK. It’s owned by well-known banking giant HSBC*, in an attempt to rival the big players in the remittance market. The app is easy to use and offers a lot of features, but availability to UK customers only hurts its wider strong performance.

Our analysis focuses on the positives and negatives of Zing, so you know whether it’s the best option for you in 2025. Check out our full review for details about cost, limits, safety, and ease of use.

£500 fee-free monthly currency conversion allowance until April 30 2025

Low fees (from 0.2%) once the currency conversion allowance is used up

Wide range of products offered including mobile banking, domestic transfers, and international transfers

Mid-market exchange rate offered

Only available to customers in the UK

Comparatively low transfer limits

As a new app, feedback from other users is limited

Fees and exchange rates

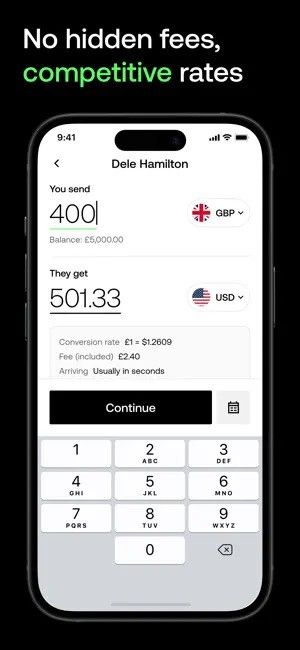

Zing highlights its many free features, including free access to a multi-currency account, a free debit card (with free delivery and one free delivery replacement card, unlike Revolut or Wise), and free domestic payments. However - these are also free with a lot of Zing’s competitors, so don’t be taken in by this alone. Zing also offers a £500 fee-free monthly conversion allowance for all members until Apr 30, 2025, and free international payments, which are not offered by many of it's competitors.

Transfer fees

The cost of using Zing comes from two main areas:

Conversion charge - a percentage charged when converting between currencies

Exchange rates - how good a rate you get on a pair of currencies

There are no transfer fees on outgoing international payments. Domestic transfers are also free.

Zing gives all members a £500 fee-free monthly conversion allowance until Apr 30, 2025. Once this is used, there's a conversion charge from 0.2% on currency conversions and with payments involving currency exchange.

They promote a calculator on their website and in-app that you can use to work out how much you’ll be charged for your transfers. This shows you the live exchange rates for your transfers.

There are no transfer fees for sending money out of your account, although currency conversion fees may apply if you’re making a currency exchange.

If you use your card to make a payment in a currency you don't have in your Zing multi-currency account, Zing will automatically cover the transaction from other currency wallets providing there are sufficient funds. Zing’s £500 fee-free monthly allowance will cover the fees unless this has been used up in which case there's a conversion fee of 0.2% charge, on top of the conversion rate. Domestic ATM withdrawals in GBP are free.

A word on Zing's exchange rates

Initial analysis of Zing exchange rates show them to be very competitive. They use the mid-market rate, which is great for consumers.

Unsure if Zing is for you?

.png)

There's a lot to like about Zing, but we've also put together these alternatives as well.

.png)

Transfer limits

If you need to move large amounts of money, you’re quite limited with Zing. They have fairly strict transfer limits of up to £40,000 per transaction, putting them on a lower score than some competitors like Wise and OFX. Minimum transfer limits vary by currency and users can check the calculator in the app.

Transfer speeds

We funded our Zing GBP wallet using the "Quick bank transfer" option. This allowed us to instantly move money from our traditional high street banking app into our Zing account. Very slick indeed.

Next we went about converting our GBP balance to EUR. The transfer details said the funds would arrive 'shortly'. To our pleasant surprise, the euro balance was available immediately.

Finally, we set up a payment to an external euro account. The speed was described as 'next day', although this was only a modest <100€ payment. One thing to note here is that most payments will arrive on the same day unless it's made later in the day.

Product offering

Zing’s product offering should be looked at in two different ways - the amount you can do with the app, and the availability of it.

What the app can do

The Zing app allows you to hold multiple currencies in one account, like Wise. In fact, it performs slightly better than Wise here as it allows you to store 20+ currencies at once, rather than Wise’s limit of 9, and it allows you to order your first Zing debit card for free, while Wise charges £7 (or $9) for your first, and any replacement cards.

Currencies available with Zing

Currencies you can hold include

Local payments to non-Zing accounts available in

Currencies you can make SWIFT payments in

Zing also lets you spend like a local for currencies you can hold in your wallets. The Zing debit card is accepted worldwide using either your physical or digital Zing card. However, you can only exchange up to around 30 currencies with Zing’s international transfers, giving it below the average amount of transfer corridors.

You can make domestic payments using your physical card or digital wallet for free, and local ATM transactions are also free. Your first international ATM withdrawal in a calendar month is free, with possible conversion rates applied where necessary. Any further withdrawals in a month cost £2, or currency equivalent.

The maximum wallet balance you can hold (per currency) is £40,000 or equivalent.

App availability

This is where Zing falls short. Currently, you can only access Zing if you’re a UK resident.

Ease of use

The app is easy to use, with sign-up completed in minutes. The overall interface of the app is very clear and easy to navigate, with your balance per currency clearly shown at the top of the home screen, and easy-to-find navigation buttons for adding money, sending money, and viewing your account details.

Customer service

The ‘Get Help’ section of the Zing website is clear and to the point, promoting that their customer service team (ZingCare) is available 24/7. The FAQs are brief, but cover all the main queries you may have when using the app, and the app includes its own chatbot feature.

If you’re struggling to access the Zing app, you can submit a request form on the Zing website and get help that way. You can also email the team directly. Unfortunately, there’s no option to phone customer service, but they can arrange callbacks if you request this via email.

Email: help@zing.me

Safety and trust

As a new app on the market, analyzing Zing’s trustworthiness can be complicated. But, they’re part of the well-known, highly respected banking group HSBC*, which gives you the peace of mind that they’re not new to the remittance market.

Zing is fully regulated by the Financial Conduct Authority (FCA), and legally allowed to supply financial services to UK customers. You can also enjoy multi-factor authentication with the Zing app, including email verification, mobile verification, and biometric security.

You should only ever use regulated providers to transfer money. If a provider is not regulated, it’s likely to be a scam.

Remember: We will only ever recommend regulated financial institutions.

Customer feedback

Zing has reviews over 4.5 on both the App Store and Google Play Store.

How to sign up for Zing

Download the app

Add your details

Verify your details

Confirm your ID

Confirm your starting currency accounts

The signup process for Zing is very quick and easier than a lot of other money transfer providers on the market.

Zing - new player, strong competitor

Zing is very new to the remittance market, but its owners HSBC* are not. You can tell this as you go through their app; they offer lots of services not covered by the wider remittance market, and they know what you need if you’re transferring money.

Zing offers amazing value for anyone looking to convert, spend, or send money overseas with its £500 fee-free monthly currency conversion allowance, no outbound transfer fees, and real-time rates.

Their overall product offering is very good, and their app is easy to use, but their limited availability to UK customers and transfer limits put them below some of their rivals like Wise and OFX.

*Zing is not a bank. Zing is an e-money institution (EMI) authorised by the Financial Conduct Authority. Find out more, including what this means to you in our FAQs.

Zing user feedback

Comments

Anonymous

I used Zing to pay at bars and restaurants in Portugal. I didnt bring the physical card with me, so relied on the Apple Pay integration.

It worked perfectly, with the exception of one time when the transfer was declined. However, the Zing app didn't notify it was declined until after I had left the restaurant. A bit of a pain, as I had to return later that day. I'm not sure the cause of this, as the card continued to work fine after. I contacted Zing's live chat support on the app, which was pretty fast to respond, however did not really give an adeqate explanation of why the transaction was declined or why I was not notified by the app about this.

That one instance aside, it worked fine for around 15 other transactions totalling over 1,000 EUR. The conversion process from GBP to EUR was very easy (the app is excellent btw).

It takes a bit of attention to figure out exactly how the fees work and how much you will be charged. Some of my conversions from GBP were done for a discount, as Zing does offer a certain amount of free conversions per month.

I converted £800 to EUR, which cost £0.60, and a further £250 which cost £0.50. Both conversions were done at mid market rate. Overall, it cost me £1.10 to convert £1,050 to euro, which is around 0.1%. Pretty happy with that, negligible costs on the conversion and a solid overall experience. I will probably use again next time.

.svg)

.jpg)