We've analyzed TorFX’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback.

We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture of how good TorFX really is.

Our video review of TorFX

TorFX review

Fees & Rates

Though TorFX doesn’t charge a transfer fee, its overall exchange rates are a little higher than other competitors, and only really provide value for large transfers.

Service

Ease of Use

Safety & Trust

Customer Feedback

“TorFX caters to a specific part of the remittance market, so it’s likely you’ll be more inclined to using it for certain types of transfers. It might not offer the best rates for everyday transactions, but being a currency broker it can come in useful when handling large amounts of money.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like TorFX?

No transfer fees: You won’t need to pay a transfer fee when sending money

Flexible transfers: You’ll have different options to help you get the best rate possible

Customer support: TorFX’s customer support team are attentive and helpful

High thresholds: You need to send a minimum of £500 for regular overseas payments or £100 for fee-free online payments

Unfavorable exchange rates for small amounts: The less you send via TorFX the higher its exchange rate markup will be

Only allows bank transfers: You won’t be able to send money to be received as a cash pickup or through a mobile

Fees and exchange rates

Here's how we rated TorFX based on their fees and exchange rates. Find the best rates for your specific transfer with our comparison tool.

Compare providers

TorFX has a pretty straightforward fee structure - there are no up front fees. TorFX makes its money by marking up the exchange rate instead, so it’s harder to see exactly how much your transfer will cost.

When sending money with TorFX, the overall cost will depend on:

How much you send: TorFX are geared towards providing large money transfers, so they offer better rates the more you send with them

The country and currency you use: Different money transfer routes will have different exchange rates - and unfortunately TorFX don’t let you see the rate up front

Transfer fees

TorFX does not charge any transfer fees up front - similar to other providers like XE and PassTo, it makes money through the markup it applies to the mid-market rate. This is potentially a big plus, assuming you’re able to get a desirable rate.

Exchange rates

We’ve compared TorFX’s transfers to other providers on the market, and interestingly we found that while their exchange rates are generally better for bigger transfers, TorFX does seem to still charge more than many other providers.

“It’s important to remember that TorFX isn’t the same kind of provider as Wise or WorldRemit. Its rates are friendlier for bigger transfers, but TorFX provides a more personalized level of service to go alongside this, which can be more appreciated when handling large sums of money.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is TorFX's money transfer service?

Here's how we rated TorFX based on the overall quality of service they offer. This puts them high on our list of top ten providers for their services, alongside Currencies Direct, XE and OFX.

Compare providers

TorFX is a popular provider for large money transfers, offering personalized support and an array of transfer types designed to maximize your return on the exchange rate. We’ve looked at their overall transfer service to determine how good it really is.

Speed of transfers

TorFX promises that their transfers should be in the receiving account on the same day as the transfer, and take no more than two business days. This is fairly standard for money transfer providers. If you need a faster transfer, there are some providers that can complete your transfer in minutes.

Transfer limits

TorFX does not have any maximum transfer limits when using money transfer service, which is to be expected from a company that caters more to bigger transfers.

With TorFX’s 24/7 online platform you can send a minimum of £100 and a maximum of £50,000 - but for higher amounts you’ll need to talk to an account manager. Its regular overseas payment service offers regular transfers of between £500 and £10,000.

The lower transfer limit does mean TorFX aren’t the provider you’re looking for if you need to make smaller transfers, but with no upper limit, they’re a good shout if you need to move large amounts of money.

Type of transfers available

When you send money with TorFX, you’ll only be able to pay by bank transfer, and your recipient will only be able to receive the money in their bank account. However, TorFX being essentially a currency broker means they offer more flexibility than most providers when it comes to the type of transfer you can make:

Spot contracts

Forward contracts

Limit order

Stop loss order

24/7 transfers

Where you can transfer money

TorFX states on their website that they support over 40 currencies, which is a relatively low number compared to other providers. For example, Wise supports transfers to over 80 countries around the world, while XE and WorldRemit both support over 130.

Customer service

Customer service is crucial to a money transfer provider’s overall image, and we went into this review knowing that TorFX has a positive reputation for their customer support. We tried out their contact options, of which there was a phone number and an option for emailing - as well as an FAQ help center. Unfortunately there is no live chat feature as is common with many providers.

Phone

Availability | Monday to Thursday, 8am to 7pm. Friday, 8am to 5pm. Saturday, 9am to 1pm. |

|---|---|

Response time | On hold for two minutes |

Languages | English |

We called TorFX customer support on a Tuesday at 3:45pm and they answered after two minutes of being on hold - already a plus. We decided to ask them to clarify a bit of information on their website surrounding supported currencies - they say they support over 40 but not all were visible on the app. They told us they’d be able to help us with any specific enquiries, but weren’t able to give us a more general picture of where you could send money.

We also asked if they could tell us a little more about their account managers and how they’d be able to help. They said the account manager was there for any kind of help we wanted, from using the online platform to going through the transfer process and finding the best possible rates.

They were friendly and keen to assist, and assured us they would be here to answer any questions we had.

Availability | Monday to Thursday, 8am to 7pm. Friday, 8am to 5pm. Saturday, 9am to 1pm. |

|---|---|

Response time | Under an hour |

Languages | English |

We were assigned an account manager once we’d signed up, but before we did, we emailed a general enquiry about the types of transfers TorFX offers. The account manager we were eventually assigned got back to us within an hour with a concise email answering the question, and an offer to call for any more information we needed. It’s evident that TorFX’s account managers are there to help and are happy to talk whenever required.

Help center FAQs

Availability | 24/7 |

|---|---|

Languages | English |

TorFX’s FAQ section isn’t as in depth as we’ve seen with other providers - there are only ten questions in total, but they’re pretty comprehensive, answering the main queries one might have. It does look as though they want to encourage more person-to-person contact, which aligns with their reputation and general practice.

Account manager

A key part of TorFX’s service is their personalized customer support by way of an account manager. Many of TorFX’s positive reviews praise their account managers and the tailored help they provide.

Additional services

TorFX also provides money transfer services for businesses, and you’ll get support from an expert guide to help you through the process of sending money.

“Being a currency broker means TorFX are geared towards providing an exceptional and personalized remittance service, which it does very well, if for a higher price than you’d pay with standard providers.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Ease of use

This is how we rated TorFX based on how easy it is to open an account and send money. TorFX perform reasonably well in this ranking, alongside its sister company Currencies Direct and other major providers like Wise and Atlantic Money in terms of simplicity.

Compare providers

We went through the process of signing up to TorFX on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

How to sign up to TorFX

Signing up with TorFX was straightforward by mobile - here’s how we did it:

Download the app

We downloaded the app, opened it and clicked ‘Create account’

Add your details

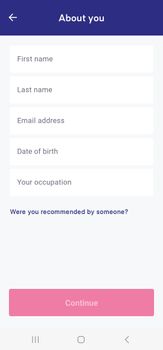

We added a name, email address, date of birth, and occupation

Add your address

Then we added a home address

Add your phone number

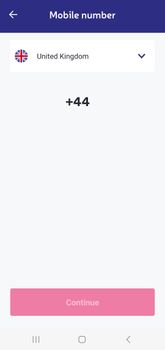

We gave a mobile phone number

Set a password

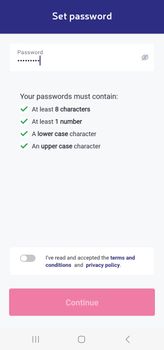

We were asked to set a password that adhered to certain criteria as a security measure

Sign up

After this, we had successfully signed up

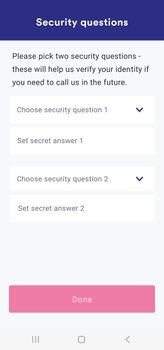

Verify security questions

Then we had to pick two security questions to verify our identity if we needed to call TorFX

How to send money with TorFX

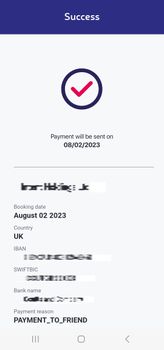

We used TorFX’s online platform to convert pounds to euros - this is how it went:

Enter transfer details

We entered how much we wanted to send and chose the receiving currency

Choose or add recipient

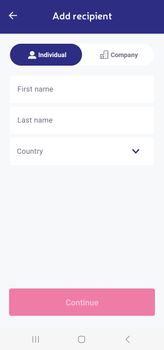

We selected the option to add a new recipient

Add recipient details

We chose between individual and a company, and added their name and country

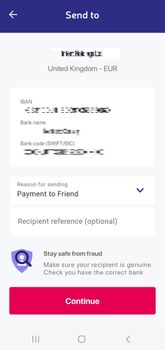

Add bank details

We added their bank details, including their IBAN, bank SWIFT code, and bank name as well as a reason for sending the money

Choose payment method

We chose debit card as our payment method, and added a new card

Add card details

We gave the cardholder’s name, card number, issue date, expiry date, and billing address

Confirm payment method

We confirmed the payment method and reviewed the transfer details

Finalize transfer

We finalized the payment and the transfer was confirmed to be sent on that day

Our transfer was originally blocked by TorFX as it wanted more information about the transaction, but was then released without us providing any details. The money arrived at its destination bank account in just over 17 hours, which is as fast as we expected, but not lightning quick.

“It was relatively straightforward sending money with TorFX’s online platform, and the funds arrived within a day which was ideal. The transfer was expensive however, and the process wasn’t much better than other providers who might offer better rates.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Is TorFX safe?

Here's how we rated TorFX based on their safety, security, transparency and trustworthiness. They rank highly in this respect, alongside its sister company Currencies Direct as well as others like Wise and XE.

Compare providers

TorFX claims to process over 10 billion pounds a year in foreign exchange and international payments, and they certainly are one of the biggest providers in the market. Like all providers we compare at MoneyTransfers.com, TorFX are fully credible and trustworthy, with all the relevant authorization and regulation.

We took a deep dive into how TorFX practices, who they’re regulated by, and what security features they use.

Is TorFX authorized to provide money transfers?

TorFX is fully authorized and regulated by all the relevant financial institutions and governing bodies in the regions in which it operates. They’re registered with the Financial Conduct Authority in the UK under Tor Currency Exchange - its FCA number is 900706. TorFX provides its services in Europe under Currencies Direct Spain, registered in the Commercial Registry of Almeria and authorized by the Bank of Spain - registration number 6716.

This is all just as you would expect with a money transfer provider, so no issues on our end.

Security

As a money transfer provider authorized by the Financial Conduct Authority, TorFX undergo a common practice known as safeguarding. This means all client money is held in a segregated bank account separate from any business funding, so it’s protected should the company become insolvent. Again this is a common practice for money transfer providers, and we are glad to see it confirmed on their website.

Additionally, TorFX also provides advice on security and fraud on its website, with guidance for passwords, emails, messages and more.

Fee transparency

TorFX is not entirely transparent when it comes to their exchange rates - you’ll need to sign in to their website or app to see what rates you’ll get. If you don’t want to sign up immediately, you will need to enter the currencies and amount you want to buy and sell, as well as your name and email address to get a free quote.

Customer feedback and user reviews

Here's how we rated TorFX based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It ranks very highly on our list of providers, alongside Wise and Currencies Direct and ahead of some of the biggest industry names in WorldRemit, XE and OFX.

Compare providers

Customer feedback should form a major component of a provider’s reputation as it's the best way to see what their customers think and how they interact with them. TorFX has a strong reputation for customer service, so we had a look into their reviews across the web to see how customers have fared with the provider.

Trustpilot

TorFX is rated as Excellent on Trustpilot, with a score of 4.9 from over 6,000 reviews when this article was written. This is an unusually good score, with 91% of all reviews being five stars, but it’s important to consider the relatively low number of reviews compared to other providers like Wise and XE.

However, 6,000 reviews isn’t nothing - so TorFX clearly has an appreciative customer base. Many of the reviews cite their account managers and the personalized service they receive - with some even mentioning account managers by name, showing that TorFX do really offer great support.

According to Trustpilot, TorFX replies to over 85% of negative reviews, generally in under 24 hours.

The App Store

TorFX is rated surprisingly poorly on the Apple App Store, with a score of 1.8 from only 6 ratings - which means you should probably take this with a large pinch of salt. The negative reviews are from 2018, 2019, 2022 and 2023, one in each year except for 2022, in which there were two. They cite the app being unusable, with them not being able to log in. I spoke to TorFX who cite older software and hardware issues as a potential reason.

The most recent review is, however, five stars - it doesn’t point out anything specific, just a general comment that they are wonderful.

It’s not really possible to get a clear picture from this - so if you’re wanting to use TorFX on iOS you should prepare to run into some potential issues.

Google Play

On the other hand, with over 200 reviews and 10,000 downloads, TorFX is rated as 4 out of 5 stars on the Google Play Store. This is a significant improvement over its Apple rating - but looking at some of the most recent negative reviews reveals some users have been struggling with opening the app and getting registered.

There are a handful of recent positive reviews, none really going into great detail but some citing their rates and simplicity of the app.

“TorFX is more of a currency broker than an ordinary money transfer provider in the vein of Wise or WorldRemit. It offers its customers a more hands-on, personalized approach to money transfers, more appropriate for those sending large sums who want a provider they can trust and get advice from.”Financial Content Specialist, MoneyTransfers.comArtiom Pucinskij

TorFX - Higher fees for a premium service

In the expert opinion of our analysts at MoneyTransfers.com, we recommend TorFX as a strong provider if you need to send large amounts of money abroad. It can offer great rates when sending significant sums, and the flexibility of transfer options as well as an account manager adds a personal touch that is welcome when handling significant sums.

A bit more about TorFX

Do I need an account to receive money with TorFX?

Do I need a bank account to join TorFX?

Is TorFX legal to use?

Who owns TorFX?

Can I open a TorFX account in any country?

TorFx user feedback

Comments

Arun

Misleading information

Anonymous

Can't transfer from India

.svg)