Send money using a debit card

Sending money from a debit card to an international recipient is best done through a money transfer company.

It’s always , but Wise is generally the cheapest and quickest option for a debit card transfer.

Search Now & Save On Your Transfer

International debit card transfers simply mean using your debit card as a funding method to send money abroad.

There is no such thing as a “card transfer”, instead, your card is a way to connect with another service (be it a bank, a money transfer company, or Apple Pay) and is charged when you make a transfer.

Sending money from a debit card with a money transfer company is usually the cheapest, easiest, and fastest option when it comes to card transfers.

Debit card transfers are best used for smaller, urgent transactions, or where a bank transfer is not possible.

Opting to send money online with a debit card is usually good for:

Convenience

It can be quicker to autofill existing debit card details than it can to hook up a bank account to a money transfer company.

When in a rush, sending using a debit card may be the best option.

Speed

In many cases, debit card transfers are instant, especially when sending small amounts via P2P. On average, debit card transfers can take up to a few hours vs 3-10 days via a bank transfer for larger amounts.

Access

Not everyone has access to a bank account. Using a mobile money account with a debit card, or a prepaid debit card, is a common way to transfer money.

Security

Money transfer companies are regulated and have several safety measures in place. This being said people may simply not want to use a bank account to make a transfer. Debit cards, which use the same funds, become the next best option by default.

So, to make things simpler, here’s a quick overview of when it makes sense to send money with a debit card:

Deposit with a debit card if... | Find an alternative if... |

|---|---|

|

|

Ways to send money using a debit card

As I’ve mentioned above, card transfer is a funding method.

In all cases, your money will be transferred from your bank account through the card to the service where your card is added, like so:

Here are the most common ways to send money abroad with a debit card.

Money transfer company

With money transfer companies, you add your debit card to the account and fund your transfer with card details. This is usually the quickest and the cheapest way to send money abroad with a debit card.

Card-to-card transfers

A card-to-card transfer is essentially moving funds from your card to another card linked to a bank account. This is slightly different from the bank account transfer, as you don’t need the bank account details to send money, only the debit card details.

P2P transfers

Companies like Revolut, Venmo, Cash App, and many others offer transfers between accounts, known as P2P transfers. You will have to link your debit card to the account (sometimes you will get a card with the provider) and it will be charged when you make a transfer.

In-store transfers

If you need to send money in-person, you will need to visit your local branch (be it a bank or a money transfer provider like Western Union). Once you provide all the details, you will need to pay for it via your debit card. There are a few other payment methods available, but usually, debit cards are preferred.

Mobile payments

These are the apps you have on your phone such as Apple Pay, Google Pay, AliPay, PayPal, Mercado Pago, BBVA, and similar. Similar to other methods, you need to link your card to the app to fund your transfers.

Money transfer companies

To get the best deal using a debit card, you need to pick the correct provider as well. We’ve compiled a list based on data accumulated over the last 6 months.

Methodology

Providers offering debit card deposits are limited. Here’s a breakdown of money transfer companies that let you transfer money online using a debit card.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

Wise comes with the title of one the best money transfer companies on the market. Part of what makes Wise a great choice is its product offering and the transparency in fees.

Fees: from 0.33%

Exchange rate: No markup

Debit card limits: 2,000 USD per transfer

For debit card payments this is the same. Wise charges around 0.21% more for debit cards, than bank payments. It charges this to account for the fees they need to pay to the card processor.

As well as having the option, and charging a little more than for a bank transfer, Wise is the cheapest way to send a debit card to debit card transfer and one of the cheapest money transfer options on the market.

Debit card transfers with Wise are instant for major currencies, and can be made in the same way as bank transfers, so you will not get access to cash pickup should it be needed.

Remitly offers debit card money transfers with the added benefit of cash pickup for the recipient. Generally, Remitly is used for lower transaction amounts and is popular for regular transfers into Asia, South America, and Africa.

Fees: No fees

Exchange rate: Around 1.5%

Debit card limits: Limits apply but will vary with currencies involved

Remitly offers no fees on some transfers, and most first-time transfers will see fees waived.

With Remitly you can send debit to debit card transfer, cash pickup, mobile money, home delivery, or transfer money from debit card to bank account.

Using Remitly means you will likely wait a little longer for a debit card transfer to arrive. This can be up to 3 days in some instances. Then, exchange rates are around 1.5% above the mid-market rate.

Compared to Wise, with fees from 0.33% and no cost on the markup, it does make them about 1.18% more expensive as a starting point.

However, when you dig into Wise fees, you’ll find some harder-to-reach locations start to hit 1% or 2%, so it is possible to get a better deal with Remitly in some instances.

This is why we always recommend comparing your specific transfer.

WorldRemit offers debit card payments for money transfers, which can be sent to several pickup methods. These methods include airtime and mobile money apps.

Fees: from $1.99

Exchange rate: Around 1.17%

Debit card limits: $5,000 per transaction or $9,000 in 24 hours.

Sending with WorldRemit is a little more expensive than Wise or Remitly, but essentially it is access to alternative pickup methods that make it a viable option.

Transfer times are usually up to 2 days, so somewhere in between the speed of Wise and the potential 3-day wait when using Remitly.

If transfer speed is your priority, we recommend using Wise with their instant transfers.

WorldRemit is popular for transfers into harder-to-reach locations, with cash pickup. In particular, it is one of the top choices for transfers into Africa.

WesternUnion is a well-established money transfer company, primarily offering cash transfers from physical locations. It’s possible to use a debit card at a physical store, or online.

Fees: from $0.00

Exchange rate: Around 0.62%

Card transfer limits: $5,000 per transaction

Fees and limits are competitive on initial send but do creep up once introductory offers have expired. Transfer times can be longer as well, particularly in hard-to-reach locations. In some cases, these can be up to 3 days.

A little like Remitly or WorldRemit, WesternUnion is convenient for sending money using a debit card if it’s needed, but won’t be the best option overall. In particular, however, if you want to visit a physical store to send money, using a debit card or cash, it is a great choice.

How to send money online using a debit card

Select the company

Pick a provider that supports debit card transactions as a way of payment. Providers can be filtered using our comparison tool. Then sign up.

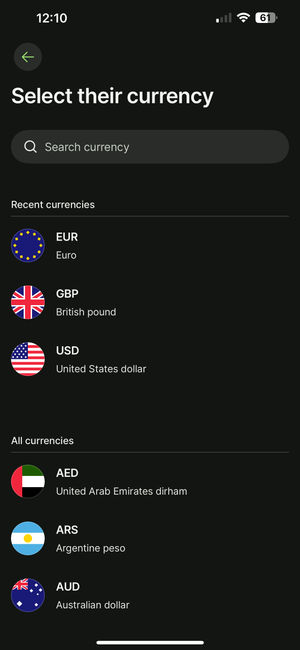

Add transfer details

Choose the amount you want to send and the currencies involved.

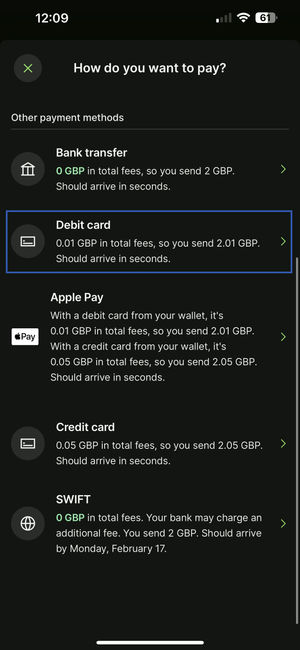

Select debit card deposit method

Fund the transfer using a debit card. This may change the quote slightly if you’ve not picked the payment method upfront.

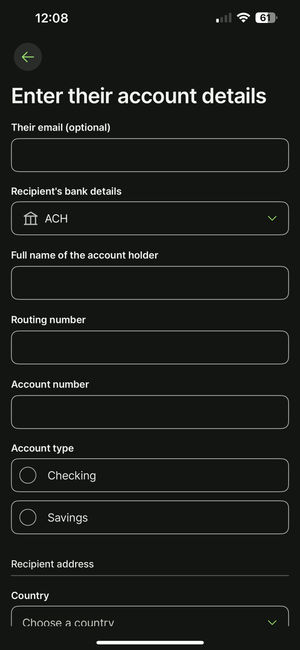

Add details

Card details and verification might be needed depending on which bank account, or card you are using. This can normally be confirmed through the app.

Confirm and send

Confirm details and send the transfer.

While some money transfer providers will take payment from a debit card at the point you send the money, others will need you to fund your balance with a debit card ahead of time.

Essentially, this switches steps 2 and 3 around, but the rest of the process will be the same.

What about receiving money using a debit card?

When sending a card-to-card transfer (even via a money transfer company) the recipient doesn’t need to do anything in most cases. Money will be deposited directly to their debit card.

If you’re sending a large amount of money, the recipient bank might hold the transaction to confirm the recipient's details.

Card-to-card transfers

Card-to-card transfers are convenient because all you need is the debit card details, rather than the bank account number, swift code, IBAN, etc…

Card-to-card transfers are supported by Visa and Mastercard and are fairly straightforward to do.

This process can be done in many ways, the most popular way is through the ATM. You will need to insert your card, select the transfer option, fill in the receiving card details, and make the transfer.

Other card-to-card transfer options are:

Sending money from a pre-paid debit card to another card

Using your bank account to make a transfer (only a few selected banks support it)

Using mobile payment apps

And using P2P transfer (more on P2Ps below)

P2P Transfers

P2P transfers are primarily used for domestic transfers through apps like Venmo and Cash App. However, with the increase in popularity of multi-currency accounts, you can now make P2P transfers with companies like Revolut, Wise, PayPal, and similar.

P2P payments are the fastest way to send money with a debit card, as most transfers will be instant, regardless of whether you are making a domestic payment or international.

For popular domestic apps like Cash App and Venmo, you will need to link your debit card to the account for funding (similar to other methods).

While with multi-currency accounts you will receive a new debit card that is already linked to the account that you can use to send money.

If you want to know more about P2P payments, we have a full guide on making P2P transfers.

In-store money transfers

If you are using a physical service such as MoneyGram, Western Union, or Ria Money Transfer, for an over-the-counter transfer you will likely need to pay using a debit card.

Be aware of the transaction in question here, as the cost of sending money in person can be higher, as well as, will heavily depend on the receiving method; cash pickup or delivery, airtime, or a bank account deposit.

If this transaction is being sent for cash pickup or cash delivery, you will be paying more in fees than you would for an online money transfer with a debit card.

Simply speaking, you’re paying for infrastructure as well.

Prices for sending over-the-counter transfers, funded by debit cards will differ, but here’s a breakdown of what you can expect from major retailers.

First transfer | Often free |

Second transfers | Sometimes free, sometimes offered at a reduced rate (like 50%) |

Usual price | Fees for sending to cash usually start from $1.99 but can reach upwards of $10. |

While convenience plays a part here, we would recommend and sending using a debit card through an app or online portal.

Mobile wallets

Making a card transfer using a mobile payment option like Apple Pay or Google Pay is funded by a debit card, but isn’t quite the same, because mobile wallets are also a method of funding.

For example, you can send money via Apple Cash, which is linked to your Apple Pay, which is linked to your debit card.

Many money transfer companies, such as WorldRemit, will let you fund your transfer via mobile payments and wallets.

Again, fees and limits will be very different than using a bank transfer and in some cases an actual debit card payment.

Alternatives to debit card transfers

Debit card cost vs bank transfer

If you are wondering whether sending money online with a debit card is the cheapest option, the simple answer is no.

Bank transfers through money transfer companies are more commonly the cheapest way to send money.

Using a debit card however is still much cheaper than sending money through PayPal, or using your bank account to send directly.

Here’s the difference in the cost of sending $1,000 from the USA.

Both fees are from a money transfer service such as a Wise, where both sending with a debit card and through a bank transfer are available.

With Wise, transfers are offered at the mid-market rate. We would always recommend carrying out a live search of the amount you want to send to ensure you get the best deal.

Country | Fee - Debit Card | Debit card (Amount received) | Fee - Bank transfer | Bank transfers (Amount received) |

|---|---|---|---|---|

To the UK | $17.09 | £780.64 | $10.30 | £786.04 |

To the Euro | $16.67 | €945.62 | $9.87 | €952.16 |

To Canada | $16.95 | $1,421.08 CAD | $10.15 | $1,411.32 CAD |

To Australia | $16.91 | $1,570.93 AUD | $10.11 | $1,581.79 AUD |

To Mexico | $19.46 | 20,025.86 MXN | $12.67 | 20,164.54 MXN |

PayPal vs debit card transfers

For reference, here are the same transfers with the cost based on sending money directly using a bank account and PayPal as well.

Again, this average amount received for a $1,000 transfer using a debit card online.

Country | Money transfer company | Bank account | PayPal |

|---|---|---|---|

To the UK | £780.64 | £762.26 | £761.46 |

To the Euro | €945.62 | €1,379.40 | €1,377.96 |

To Canada | $1,421.08 CAD | $1,377.69 CAD | $1,377.96 CAD |

To Australia | $1,570.93 AUD | $1,533.94 AUD | $1,519.12 AUD |

To Mexico | 20,025.86 MXN | 19,499.83 MXN | 19,523.75 MXN |

Prepaid debit cards as a payment method

While making a money transfer using a debit card associated with a bank account can come from convenience, it can also be a result of necessity in some cases.

Unbanked populations are biggest in the following countries and using a prepaid debit card can be a popular way to fund a transaction.

Country | Unbanked Population (%) | Cash Transactions (%) | Card Transactions (%) | ATMs per 100,000 Adults | Internet Penetration (%) |

|---|---|---|---|---|---|

Morocco | 71 | 41 | 27 | 28.6 | 62 |

Vietnam | 69 | 26 | 35 | 25.9 | 66 |

Egypt | 67 | 55 | 27 | 20.1 | 45 |

Philippines | 66 | 37 | 22 | 29 | 60 |

Mexico | 63 | 21 | 44 | 61.5 | 66 |

Nigeria | 60 | 24 | 27 | 16.9 | 70 |

Peru | 57 | 22 | 62 | 126.7 | 49 |

Colombia | 54 | 15 | 55 | 41.3 | 62 |

Indonesia | 51 | 13 | 34 | 53.3 | 55 |

Argentina | 51 | 18 | 45 | 60.9 | 76 |

Data taken from the Global Finance.

Keep in mind that depending on the card you use, it may not be accepted as a payment method by all transfer methods, including money transfer companies.

If you want to know more, we have a full guide on making money transfers to someone without a bank account.

Paying using a credit card

Yes, credit card transfers are similar, but it will cost you more in the long run if the balance isn’t paid.

We would recommend sending money using a credit card ONLY when there are no other options available. This could be in the form of an emergency.

In essence, you will be taking a cash advance in the same way you would when withdrawing money at an ATM using a credit card.

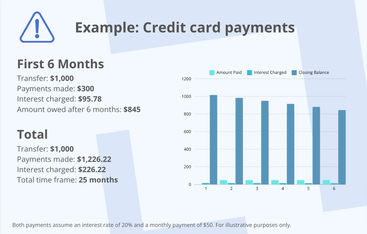

For example, a $1,000 transfer using a credit card as a payment method would cost an additional $226 based on an interest rate of 20%, and a monthly minimum payment of $50 being made.

Avoid using debit card transfers if…

While using a debit card can be convenient, there are times when it is not the most appropriate payment method for sending money.

...You want to make large transfers

Large money transfers should not (and in most cases cannot) be funded using a debit card.

If you try to send a lot, and we mean $50,000+, either your bank or transfer method will stop the transaction if you’re trying to send too much.

The best alternative to online debit card transfers for a large money transfer is to use a currency broker like Regency FX or TorFX.

These companies provide things like forward contracts and account management. They are a very different service to the likes of Wise, where everything is self-managed.

Depending on the reason for sending money, there may be different options available.

...You want to make regular payments abroad

Should you be sending money with a debit card?

Card transfers, specifically online debit card transfers are a great option to fund your international transfer.

You have multiple options from money transfer companies to apps to mobile wallets that let you fund your transfer with a debit card.

It is a convenient, almost instant, and widely accepted way of making transfers abroad, as long as you keep the transfer amount small, and don’t do it too often.

However, if you are looking to make a large transfer abroad, or need to set up a recurring payment, we recommend finding an alternative.

Also, you need to consider the transfer method, the currencies involved, and the amount you want to send. These three points will directly impact the fees and the number of options you have.

As always, we recommend doing a quick search below to find the best service for your needs that accepts debit card transfers.

Compare rates now

Related Content

Contributors