How We Review & Test Money Transfer Providers

This is how we review and test every money transfer company we feature on MoneyTransfers.com.

Our Review Philosophy

At MoneyTransfers.com, we test every provider ourselves using real data, real transfers, and real-world scenarios.

Every review is hands-on, scored across 7 key categories, and backed by live data (not AI or automations).

We remain fully committed to our editorial standards and mission.

What We Look At

Each money transfer company, app, bank, challenger bank, currency broker, or anyone else gets reviewed using our developed scoring system.

Our scoring is based on 7 pillars:

Fees & Rates

Transfer Speed

Safety & Trust

Product Offering

Transfer Limits

Ease of Use

Customer Feedback

Each pillar is hand tested before assigning a score of 1-10.

Here’s a deeper look at what each of these means and includes.

Fees & Rates

Every money transfer provider company is different, especially when it comes to exchange rates and fee transparency.

Most modern money transfer companies, such as Wise, XE, and WorldRemit, share their exchange rates and fees with us using their API. This is the most reliable way and is always up-to-date.

For others, we collect the information manually or through close relationships (where this information is shared with us directly).

Finally, we go over each company's T&Cs and look for any hidden clauses that might change the rates. This is particularly important, as many companies will lower their rates for first-time transfers and increase them afterwards.

Transfer Speed

Safety & Trust

Product Offering

Transfer Limits

Ease of Use

Customer Feedback

How We Score Providers

Each company we review is scored from 1-10 points. The final score is a combination of 7 categories (explained above). So the maximum score a company can get is 70 while the minimum is 7.

Here’s how it looks:

Rating category | Score | Example score (ABCTransfers) |

|---|---|---|

Fees & Rates | 1-10 | 7.2 |

Transfer Speed | 1-10 | 8.9 |

Safety & Trust | 1-10 | 7 |

Product Offering | 1-10 | 5.5 |

Transfer Limits | 1-10 | 8 |

Ease of Use | 1-10 | 6 |

Customer Feedback | 1-10 | 8.2 |

Once we have all the scores, we apply the following formula:

(Total Score / Maximum Score * 100) / 10 = Final Score (rounded to 1 decimal place)

So, for the example above, it’s: (50.8 / 70 * 100) / 10 = 7.3/10

We regularly review the scores and change them based on any updates, changes, and additions to the website, so it’s always accurate and up to date.

How does our comparison engine work?

When you submit the form throughout the site, our comparison engine takes the following into consideration:

Where are you sending money from

Where are you sending money to

How much money are you sending

What currencies are you sending and receiving

Wherever you are sending or receiving money

The type of transfer (Personal or Business)

If business, what type of transfer are you making (one-off or payment platform)

As a result, you receive a tailored list of money transfer companies based on your needs.

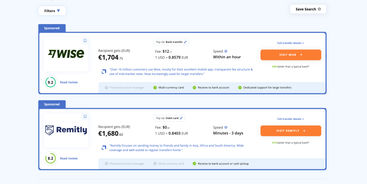

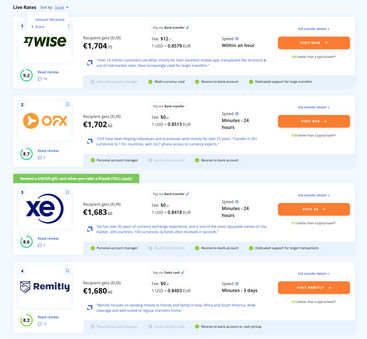

Our results are always sorted by the most amount of money received by default.

This means that the top option is always going to show you the cheapest way to send money.

Our sorting and ordering are never influenced by commercial deals, and will always default to the highest amount received.

However, for certain corridors, we do show companies that pay us to appear at the top, and these are clearly labeled as sponsored.

Beyond default sorting, you can sort the providers by our editorial rating, based on the process outlined above.

You can also use the filters for more granular control, to make the transfer even more tailored to your needs.

How do we know who is the best, fastest, and cheapest?

On our corridor-specific comparison guides, we clearly outline the overall best, fastest, cheapest, and other use case companies for that particular country and currency pair.

Below is a breakdown of each of the options and how it’s calculated.

Overall best provider

This is the company that received the highest score in our internal testing (based on the 7 categories) and supports transfers between the countries you’ve selected.

This option might not always be the fastest or cheapest, but the combination of all the factors makes it the overall best choice for the majority of our users.

Cheapest provider

The cheapest money transfer company is the one that offers the most amount of money received.

This is the exact number your receiver will get. Meaning it includes the exchange rate markup, the transfer fee, and any other associated fees.

By default, we assume that you will be using a bank transfer to make your transfer.

Fastest provider

The fastest money transfer company is the one that will deliver your money the quickest.

This does not include the sign-up time or transfer process. It only includes the transfer time, so from the moment you click send.

Best company for large transfers

For large transfers, we can automatically find the company that will offer the best exchange rate.

This is because even minor fluctuations in the rate can have a much bigger impact on the receiving amount.

Best for business payments

Best for business is based on our editorial scoring system because of all the nuances involved.

This company may not necessarily be the cheapest or fastest, but it offers the best combination of fees, speed, and features most businesses will need.

For a more detailed breakdown of companies, we recommend running a .

All the information in our country and corridor-specific guides is based on 7-day periods, meaning it updates every week. If you need the most up-to-date information, .

Our In-House Testing Process

Every provider we review and compare goes through a hands-on testing process, based on the 7 categories outlined at the start.

We don’t just copy what others say, we try it ourselves, step by step:

1. Sign Up & Onboard

2. Verify the Account

3. Fund the Account

4. Make a Real Transfer

5. Check the Details & Fine Print

6. Collect the rates and other data

7. Compare Real Rates to Mid-Market Rates

8. Spot Misleading Claims

9. Review External Feedback

10. Write & Fact-Check the Review

How Often Do We Update Reviews

We use dynamic data to power our reviews and comparisons, meaning all the key information, such as exchange rates, fees, exchange rate markup, and transfer speed, is updated automatically.

This ensures that the key parts of the reviews and comparisons are always up to date.

For everything else, we monitor all companies for changes and once enough accumulate, we update the pages. If there’s a significant change, we update the pages as soon as we can.

To make sure you are reading the latest version, look for the “last updated” date at the top of each review and comparison.

If you're still unsure or want to know more about our processes, check out the page linked below on why you can trust us.

Our Experts & Editorial Independence

At MoneyTransfers.com, every review, guide, and comparison is created by real people with real experience, not AI.

Each review is written, updated, and fact-checked by someone who’s actually used the platform, not just read about it.

We are fully committed to our editorial standards and transparency:

Affiliate partnerships do not influence our scores or rankings

Sponsored placements are always clearly labeled

We follow our editorial policy and the SPJ Code of Ethics

If you want to know more, you can learn more about our experts here.

Want to see our reviews and comparisons?

Contributors