City National Bank for international wire transfers

Despite the bank’s presence in multiple states, City National Bank lacks the same reach as other, larger high-street banks like Chase, Wells Fargo, or Bank of America.

You can make international wire transfers with City National Bank, but the fees are higher compared to money transfer services, as well as, it will take longer for your money to reach its destination.

Here’s an overview of how City National Bank compares to an average money transfer provider.

Transfer type | City National Bank | Money Transfer Companies |

|---|---|---|

Sending fees | $12 - $55 + ($5 - $35 / month) + $25 (if sending under $250) | $0 - $20 |

Receiving fees | $25 | $0 |

Exchange Markup | ~4%-6% | 0% - 2% |

Transfer Times | 3-5 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring City National Bank

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

City National Bank fees and exchange rates

Fees and rates

Exchange rates

City National Bank supports more than 90 different currencies but does not disclose its exchange rates on its website. Instead, the bank simply states that rates are competitive.

From our research and testing, traditional banks are known to charge anywhere between 4 - 6% above the mid-market rate for transfers that require currency conversion.

This means you will need to initiate the transfer or call your local branch to get the latest exchange rate.

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

International transfer fees

Wire transfer fees range from $12 to $55, depending on the transfer type (domestic or international) and if you’re making it online or in person.

In addition, you will need to pay a $25 fee, if your transfer is below the minimum threshold of $250.

There is also City National’s monthly service charge, although this can be avoided by maintaining a minimum balance and transaction volume.

Other bank fees to consider include:

Monthly Account Maintenance Fees: ranging from 5 to 35 USD per month, depending on account type.

Overdraft Fees: start at 37 USD, with a maximum of 185 USD per day

Withdrawals from out-of-network ATMs: 2.50 USD, depending on the account type

To put these numbers in perspective, let’s assume you’re making a $1000 transfer from the US to a bank via wire transfer to an account in the following countries:

Country | City National Bank fees | Wells Fargo fees | Wise fees |

|---|---|---|---|

$55 + ~6% markup | $30 + ~6% markup | $10.79 + 0% markup | |

$55 + ~6% markup | $30 + ~6% markup | $13.16 + 0% markup | |

$55 + ~6% markup | $30 + ~6% markup | $10.36 + 0% markup |

Transfer speed

Transfer speed

On average, City National Bank takes 3-5 business days to deposit funds in the beneficiary’s account.

If you’re looking to exchange currencies before making a transfer, you can get it the next business day if you convert before 2 PM.

Transfer limits

Transfer limits

City National Bank has a transfer limit of $25,000 per day and $5,000 per transfer, with a maximum of five transfers allowed per day.

These rates may change over time. The bank may also impose limits on dollar amounts or the number of wire transfers at its discretion.

Product offering

Product offering

Foreign Currency Accounts

CNB offers foreign currency bank accounts designed specifically for international transactions.

These accounts allow you to hold and manage funds in multiple foreign currencies, reducing the need for frequent currency conversions and providing flexibility in international markets.

You get access to foreign currency CDs, demand deposit accounts, and the ability to hedge against currency fluctuations.

Currency Exchange

City National Bank offers currency exchange services that allow individuals and businesses to buy and sell foreign currencies.

These services are ideal if you’re traveling abroad, engaging in international business, or need to convert and hold foreign currency.

However, you can only do it at the local branch and you will be limited to $2,500 per day.

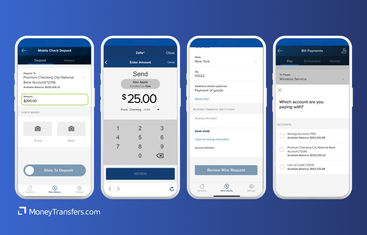

Mobile App

The City National Bank App® is available for free download on Apple and Android devices.

You can check account balances, transfer money between accounts, send money with Zelle, pay bills, and much more.

The app has a rating of 2.7 on the Google Play Store, and 3.5 on the App Store.

Ease of use

Ease of use

Customer service

CNB offers multiple contact options including:

Phone

Email

Mail

Branch Locator

Secure Message

Live Chat

If you have any questions or concerns, you can reach CNB via the following:

Contact Method | Details |

|---|---|

Phone | (888) 309-5139 for international banking and (800) 773-7100 for customer service. More phone options available here. |

Available through a secure online form. | |

City National Bank, P.O. Box 60938, Los Angeles, CA 90060-0938. | |

Branch Locator | Use the online tool to find a nearby branch. |

Secure Message | Send via online banking after logging into your account. |

Live Chat | Available on the website during business hours. |

Safety and trust

Safety and trust

Just like any other reputable high street bank, CNB comes with multiple security features, including:

ACH positive pay: Allows businesses to review and approve ACH debits before they are paid, ensuring unauthorized transactions are blocked.

Check positive pay: Matches checks presented for payment against a list of checks issued by the business, identifying potentially fraudulent checks.

Reverse positive pay: Provides a list of checks presented for payment, allowing businesses to approve or reject each item.

ACH debit block: Blocks all unauthorized ACH debit transactions from being processed.

ACH filter: Automatically reviews and filters ACH transactions, allowing only those that meet predefined criteria to be processed.

Card management tools: Enables businesses to manage card usage, set transaction limits, and monitor activity to prevent unauthorized use.

Fraud alerts: Sends real-time alerts for suspicious transactions or activity on business accounts.

Two-factor authentication (2FA): Requires an additional verification step, such as a code sent to a mobile device, to access accounts.

Encryption: Uses advanced encryption methods to protect data transmitted between clients and the bank.

Automatic logoff: Logs users out of online banking after a period of inactivity to prevent unauthorized access.

Dedicated fraud team: A specialized team is available to assist clients in identifying and responding to fraud.

Suspicious activity monitoring: Monitors client accounts for unusual transactions or patterns indicative of fraud.

24/7 fraud monitoring: Continuous monitoring of transactions to identify and prevent fraudulent activity.

Immediate fraud notifications: Notifies clients immediately upon detecting suspicious transactions.

For more information, check CNB resources here.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

Overall, there aren’t many user reviews for CNB.

However, based on the available ones, City National Bank (CNB) customers are not happy with CNB banking services, especially after the merger.

Many complain about poor customer service, deceptive practices, and operational mistakes. Common complaints are around difficulties reaching support, unresolved disputes, misleading credit score assessments, undisclosed personal liabilities on business loans, and transaction errors leading to fees.

Some describe their experience with CNB as unprofessional, with abrupt terminations from the bank's advisory board.

However, there are a few positives, particularly with specific branches and staff members, where users have found the service to be good with friendly staff and efficient handling of business loans.

Opening an account with City National Bank

To open an account with CNB, you will need the following details:

Social Security number

Driver’s license or state ID

Home address

A debit card or account information for funding

With these details, you can open an account by following these steps:

Choose your account type

Gather required documents

Open your account

Enroll in online banking

Verify and start using

Making international transfers

To send money abroad with CNB, you will need the following details:

Beneficiary’s full name and address

Beneficiary’s bank name and address

Beneficiary’s bank SWIFT/BIC code

Beneficiary’s bank account number (or IBAN)

Currency and amount to be transferred

Purpose of payment

Your CNB account details

City National Bank’s SWIFT code is CINAUS6L

Sending international wire

Once you have all the details ready, follow these steps to make the transfer:

Sign in

Access wire transfers

Enter beneficiary details

Specify transfer details

Review and submit

Use Wise to send money from your City National Bank account

It may be simpler to fund your transfer with your CNB account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your CNB account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 122016066.

For international wire transfers, you’ll need to supply your SWIFT code or BIC: CINAUS6L.

The bank name and address

Depending on the type of transfer, the CNB address is City National Bank, Los Angeles, CA.

Your account number, name, and address

You’ll need to supply your complete CNB account number, the name on your account, and the complete address of your account as it appears on your bank account.

How City National Bank compares to money transfer services

CNB is a good option for high earners and businesses making large transactions.

However, CNB is extremely expensive compared to the likes of Wise Business, XE, and Airwallex.

If you already have a bank account with CNB, you can use it to fund your transfer as well.

Here’s a list of services that can offer money transfers abroad with higher limits, lower fees, and better exchange rates.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

City National Bank: Is it good for transfers abroad?

City National Bank lets customers send and receive money domestically or internationally in person, via online banking, or mobile app.

However, due to the fees, daily transfer limits, lack of payment options, and unclear exchange rates, this bank is not the best money transfer option.

We recommend comparing your options to get the best exchange rates for your needs using our form below. You can use your existing bank account to deposit the funds to any of the recommended providers and save on transfer fees.

Find the best rates for your transfer

A bit more about City National Bank

Can I open a City National Bank account in any country?

Can I use a City National Bank debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks