first direct bank offers transparent fees and exchange fees.

The app is rich in features and it offers overall good service for international transfers.

Scoring first direct bank

Using our unique scoring system, we’ve reviewed their fees and rates, transfer speed and limits, product offerings, and user feedback to see how they compare to other services. Here's a quick summary of how it looks.

- There is a 50,000 GBP daily limit for transactions, but there are no transfer fees for transfers in GBP within EEA.

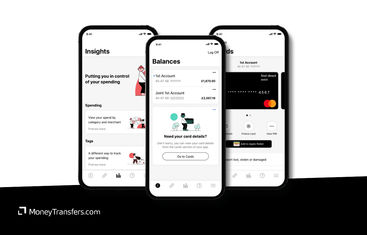

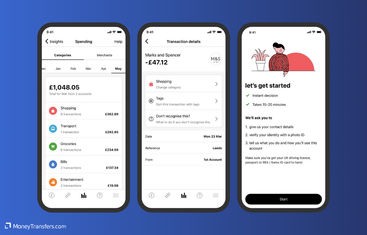

- You can view your transactions, balances, and make transfers within their app.

- In cases of inquiry or need for assistance, First Direct can be reached online or through telephone 24 hours a day, 7 days a week. They guarantee that an available agent can address your concerns.

- First Direct accounts can only be opened from the UK despite their full remote setup.

- Money transfers outside EEA countries can take up to 4 days or more to arrive and cost £4. Other money transfer services can do this almost instantly.

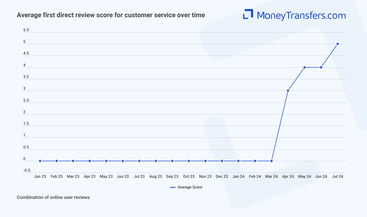

We've also looked at the online user reviews for first direct to see how users are rating international transfers.

Most are fairly happy with the service giving it 5 stars on average, however the number of reviews in general reduced at the start of 2024. This is likely due to new services such as Zing entering the UK market and offering better international transfer services.

first direct fees and exchange rates

first direct fees and rates

first direct Bank is transparent with its exchange rate and fee policies as seen in their terms and conditions.

Exchange Rate

Unfortunately, the first direct Bank does not publicly show its own exchange rates.

They advise consulting with them for exchange rates, especially if not in GBP or USD currencies.

If you've already decided to use first direct Bank for an international money transfer, first direct will show their updated exchange rates right before confirmation of a transaction.

In terms of online reviews, here's how users rate first direct exchange rates.

Transfer Fees

All of the first direct transfers made within EEA and in GBP are free when done online.

The only other option is to send funds through their telephone service.

Transactions outside of EEA or to other currencies incur a 4.00 GBP transfer fee.

No other money transfer provider offers free transfer fees similar to first direct.

For example:

Wise calculates their transfer fees based on your total amount, a fixed fee based on your preferred transfer method, and the market exchange rate.

WorldRemit considers the same factors, which results in large fees.

Currencies Direct offers no transfer fees, but it presents lower market rates to gain revenue from cutting the transfer rates.

CurrencyFair incurs a flat rate of 3 EUR per transaction added with a 0.45% margin to the total amount.

Additional costs

While no figures were given, first direct explicitly states additional fees may come from the beneficiary or intermediary bank fees.

No other additional costs or fees were stated in their terms and conditions.

Here's how users rated first direct fees over the past year (on average).

Transfer speed

first direct transfer speed

The processing time for transfers depends on the country of the recipient account.

Recipients living within the European Economic Area (EEA) take a working day of processing time before the receipt of the money transfer.

Recipients living outside EEA will have to wait longer as it takes 4 working days to reach them.

It must be noted that other destination countries might take more than 4 working days.

Additional security checks will sometimes cause further delays as part of the first direct Bank’s efforts to mitigate fraud.

Here's how users rated first direct transfer speed since last year.

Transfer limits

first direct transfer limits

For online transfers, there will be a 50,000 GBP limit imposed per day.

If the transfer would be in a different currency, the limit will still be based on the equivalent of 50,000 GBP.

For telephone transfers, there will be no transfer limits.

Here's how users rated first direct transfer limits.

Product offering

first direct product offering

first direct also offers the following services in addition to regular online banking:

Overdraft

An extra 500 GBP can be availed for clients with insufficient funds who need to make transactions within the month.

If eligible for this product, first direct sets no interest on the first 250 GBP borrowed and applies a 39.9% equivalent annual rate (EAR) variable for the succeeding amounts borrowed.

A bigger overdraft can only happen if you arrange for it in advance.

Travel money

Savings accounts

Loans

Credit cards

Insurances

Here's how users rate first direct's features.

Ease of use

Ease of use

Here's how users rated first direct's ease of use.

And here's how users rated first direct's customer support.

Safety and trust

first direct security & trust

Here's how users rated the security of first direct bank.

Customer feedback

User feedback

The online user reviews for first direct Bank are largely positive, with users frequently mentioning the ease of use and reliability of the banking app.

Users appreciate the excellent customer service and find the app straightforward to navigate for managing their accounts. Many users highlighted the bank's effective security measures and the convenience of online banking.

However, there are occasional mentions of poor service experiences, such as issues with phone support.

Here's a summary of online reviews for first direct bank.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 0 | 2 | 0 | 1 | 0 | 0 | 0 |

Ease of Use | 4 | 3 | 2 | 0 | 5 | 0 | 0 |

Exchange Rates | 4 | 4 | 5 | 4 | 4 | 5 | 0 |

Features | 5 | 5 | 0 | 0 | 0 | 0 | 0 |

Fees | 1 | 5 | 5 | 1 | 0 | 0 | 0 |

International Transfers | 4 | 3 | 4 | 4 | 2 | 2 | 0 |

Limit | 0 | 0 | 0 | 0 | 5 | 5 | 5 |

Safety | 5 | 3 | 4 | 3 | 3 | 4 | 4 |

Speed | 0 | 0 | 0 | 3 | 4 | 4 | 5 |

*0s represent no reviews for the given month.

How to sign up with the first direct

Download the app

Navigate to the App Store or Google Store and search for the first direct app.

Once you find it, download the app.

Add and confirm your details

Open the app, and click "‘New to Digital Banking" to start the process.

Fill in the application form and add your details. These will include your name, email, and address.

In addition, you will need to submit one of the government-issued IDs such as a passport or driving license.

Start sending

That's it! Once your account gets verified, you will be able to send and receive money (domestically or internationally).

International transfer requirements & details

To make an international transfer with first direct, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with first direct and their app.

first direct alternatives

It might seem like first direct is the best option for your needs, but it's worth knowing that the service they offer is a norm among the top providers.

If you're after a general account to send money domestically, make a few international transfers here and there, manage your finances, and keep track of costs, then it might be for you.

However, if you're looking to send international transfers more than once a month, or planning to make a large transfer, we'd suggest looking at these alternatives.

first direct Bank - More than just a bank

first direct shows promising remote banking services done online (first direct app) and through the telephone.

While the initial account opening can only be done in the UK, their services extend worldwide.

Their products ease the overall banking life and day-to-day financial needs of a UK resident or citizen.

High ratings and good reviews continue to praise their performance through the years. Comparison with other challenger banks and online services showcases them as the cream of the crop.

Their app can be used anytime and anywhere for their usual services as long as an account has been made.

General inquiries, frequently asked questions, and other services can all be seen on the first direct website.

If deemed insufficient, a 24/7 representative can accommodate specific concerns regarding their products and services.

A bit more about first direct Bank

Can I use first direct bank for international bank transfers?

Can I use a first direct debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks

first direct user feedback

Comments

Anonymous

Hve been with them for over 20 years and have used a lot of their products. Great for online banking.

.svg)