Founded in 2015, Revolut has been supplying online banking and transfer services to customers across the globe for years.

Scoring Revolut

Using our unique scoring system, we’ve reviewed Revolut based on cost, speed, transfer limits, and more. Here's a quick overview of Revolut's pros and cons.

Pros

Cons

We've also looked at the online reviews to see what users are saying about Revoluts international transfers.

Revolut fees and exchange rates

Fees and rates

Revolut transfers are cheaper than most of its competitors, but its fee structure is quite complicated. Here’s a full summary.

Exchange rates

Revolut usually offers the mid-market rate on its transfers, but some conditions exist.

If you exchange outside the foreign exchange market hours, a 1% markup is added to the rate.

Foreign exchange market hours are all hours except 5 pm on Friday to 6 pm on Sunday, Eastern Time.

To keep things cheaper, it’s better to transfer on a weekday.

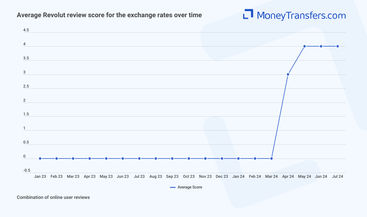

Here's how users reviewed Revolut exchange rates in the past year.

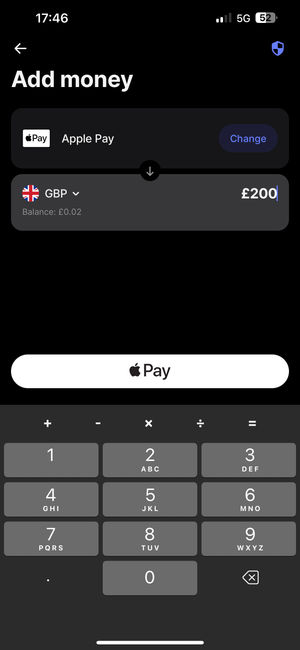

Transfer fees

Transfers between Revolut accounts are free, while transfers to other bank accounts are charged a variable fee.

For transfers of $200 or more, there’s a fee of up to 5% of the transaction total. For amounts of less than $200, the fee is up to $10, depending on the amount of the transfer.

Luckily, you can work out exactly how much your transfer will cost using Revolut’s in-app calculator before you make the transfer.

Wire transfers are also available with Revolut, but these are $10 per transfer, regardless of the amount.

Things get a bit more complicated when you add the Revolut tier system.

If you’re on the Standard plan, you can exchange up to $1,000 per month at the rates mentioned above. Any more than this, and you’ll be charged an additional 0.5% fair usage fee.

The free limit for Premium plan members is $10,000.

Metal account holders have no upper limit.

Seem a bit complicated?

If you like to keep things simple, you may find it easier to use a provider like Wise.

They offer the mid-market rate on all international transfers, regardless of when they’re made.

You can also calculate the exact cost of your transfer before you send any money.

See how Revolut compares with Wise in our full comparison.

Here's how users review Revolut fees online.

Transfer speed

Transfer speed

This is much simpler. Transfers from one Revolut account to another are usually instant, no matter where the other account is located.

Transfers to external bank accounts vary, with most domestic transfers within the US taking around one business day.

Wire transfers also take around a day to complete, while other international transfers take around one to five business days, depending on your payment method.

Here's how users rated Revolut transfer speed on average.

Transfer limits

Transfer limits

There are no limits on the amount of money you can transfer with Revolut, but the fees due will vary depending on how much you send and which plan you’re on.

Check the fees section for more details.

Users are also neutral about the transfer limits on Revolut. This is probably due to the norm in the industry. Most challenger banks don't have any fixed limits on money transfers. There are a few spikes in the average rating of user reviews when it comes to transfer limits, this is likely due to the updates and demand.

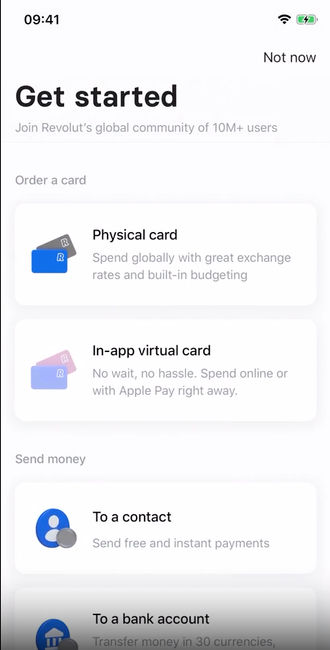

Product offering

Product offering

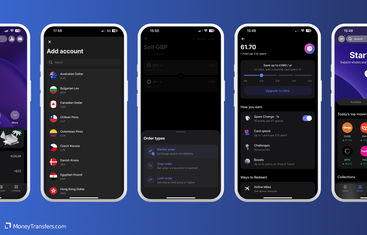

For transfers, Revolut actually has a fairly limited product offering.

It’s available in just over 35 countries, much fewer than a lot of other providers like Wise and Currencies Direct.

They can only exchange around 36 currencies too, which is also much less than the majority of the market.

You can make payments with Revolut in two ways; directly to another Revolut account, or to another bank account.

Transfers to other Revolut accounts are free, while transfers to other banks come with a fee.

Revolut’s transfer offering is less comprehensive than that of some other providers, but they do offer other services aside from just transfers.

If you’re after more than just a transfer provider, you may be interested in some of Revolut’s additional features.

This year, users commented and rated many recently introduced features.

Ease of use

Ease of use

Despite a very complicated fee structure, Revolut is actually fairly easy to use.

The app is clear and simple, with the latest update drastically improving navigation.

The tier system makes some parts of the app more difficult for standard plan holders, but the process of transferring is still quick and easy to manage.

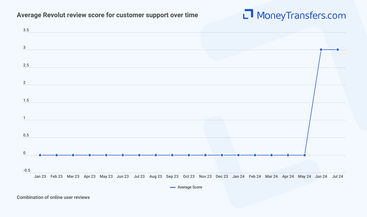

There are not many Revolut reviews regarding their support. Here's a summary of how average user reviews look over time.

Customer service

This is a mixed bag.

The Revolut in-app live chat is quite useful, but you’ll need to go through a few FAQs and a virtual assistant before you get connected to a real agent.

You can also email Revolut via their customer support email address.

You can only phone customer service if you’re on the Ultra Revolut plan.

You can access the number through the Revolut app when you become an Ultra member. Unfortunately, Ultra is only available to UK and European-based members.

Otherwise, you’re limited to an automated contact number, which is listed below.

Method | Revolut contact details |

|---|---|

Phone | 1-844-744-3512 (automated only) |

As for customer service, here's how user reviews look over time.

Safety and trust

Safety and trust

Revolut is completely legit. It’s registered with the FDIC and has to comply with US financial regulations.

The complex fee structure marks Revolut down a little on simple transparency, and the tiered system makes it harder for Standard plan customers to trust they’re getting the best deals available.

The Revolut app also uses encryption to protect your money when you store it with Revolout or make a transfer.

You can also set up multi-factor authentication, to add an extra layer of security to your account.

Check your provider is regulated

You should only ever use regulated providers to transfer money. If a provider is not regulated, it’s likely to be a scam.

Remember: We will only ever recommend regulated financial institutions.

Here's how users rated Revolut's support over time.

Customer feedback

Customer feedback

Revolut has been widely reviewed on Trustpilot, the App Store, and Google Play.

Trustpilot | App Store | Google Play | |

|---|---|---|---|

Revolut | 4.2 | 4.5 | 4.4 |

Analysis of user reviews

Users like Revolut's low fees, impressive security features, and user-friendly interface.

Especially the flexibility in handling various currencies, as well as the convenience of managing money on the go.

However, many users express frustration with hidden fees in currency exchanges, and the inconsistency of exchange rates.

As well as some find the frequent changes to the interface confusing. While others criticize the support and accessibility.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 4 | 3 | 3 | 5 | 4 | 4 | 0 |

Fees | 0 | 0 | 0 | 3 | 3 | 3 | 4 |

Exchange Rates | 0 | 0 | 0 | 3 | 4 | 4 | 4 |

Speed | 5 | 4 | 5 | 4 | 5 | 5 | 0 |

Limit | 3 | 3 | 3 | 5 | 2 | 0 | 0 |

Features | 4 | 5 | 4 | 4 | 4 | 4 | 5 |

Ease of Use | 0 | 0 | 0 | 0 | 0 | 5 | 5 |

Safety | 0 | 0 | 2 | 3 | 3 | 3 | 4 |

Customer Support | 0 | 0 | 0 | 0 | 0 | 3 | 3 |

*0 means there are no reviews for a given category in the given month.

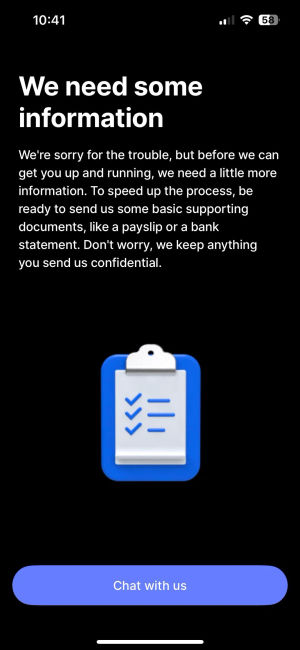

How to sign up for Revolut

Register

Click the button below (or any orange link on this page) and register for a Revolut account.

Enter your details

Enter your name, address, and contact information as requested.

Verify your identity

You’ll need to send a photo of your ID so Revolut can verify you.

Choose a plan

Choose which plan you’d like. You can choose Standard, Premium, or Metal.

All plans above standard charge a monthly membership fee.

Fund your account

Fund your Revolut account from your bank account and you’re ready to go.

International transfer requirements & details

To make an international transfer with Revolut, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with Revolut and their app.

Revolut's SWIFT code is REVOGB2L.

Additional features

Revolut isn’t just a transfer provider.

They also offer banking services, a multi-currency account, and a platform for businesses.

If you’re after more than international transfers, here are some of the benefits you could enjoy with Revolut.

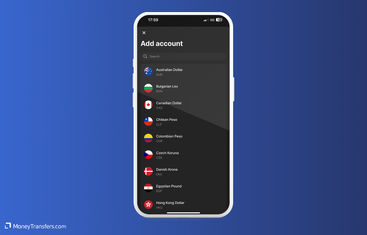

Multi-currency account

Revolut offers a multi-currency account, allowing you to hold up to 30 currencies at once.

To open an account in a new currency, just press the ‘+’ icon in the Revolut app and choose the currency you want.

Each currency you choose will give you a local account in that currency.

If you need to receive money to this account, you can provide people with these bank details and if they live in the country the bank account is held in, they can make the transfer locally.

Multi-currency debit card

With Revolut, you can order a free debit card (plus postage).

With this, you can make purchases overseas without paying any fees.

And, as long as you have the currency you need to spend in your Revolut account, you won’t have to pay any currency exchange fees either.

There are some limits on ATM withdrawals, though. The monthly limits are different depending on your membership tier.

These are:

$400 with standard

$800 with Premium

$1,200 with Metal

If you go over these limits in a month, you’ll be charged a 2% ‘fair usage’ fee.

You may also find you’re charged a fee for using an out-of-network ATM, but Revolut has over 55,000 ‘in-network’ ATMs that are fee-free.

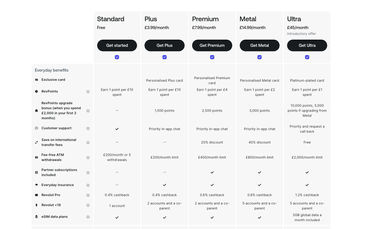

Tiered membership

Revolut’s tiered membership system allows you to access more features for a monthly subscription.

For example, with a Premium or Metal account, you can access a range of travel benefits.

These include primary accidental medical insurance, trip delay expense coverage, trip cancellation and interruption protection, and selection of baggage protection.

We’ve included a summary of some of the key differences between the tiers below.

Standard (Free) | Premium ($9.99 per month} | Metal ($16.99 per month) | |

|---|---|---|---|

Interest on savings | 3.25% APY | 4.25% APY | 4.25% APY |

Mid-market exchange rate limit | $1,000/m limit | $10,000/m limit | Unlimited |

Discounted international transfers | No | 20% discount | 40% discount |

Revolut for business

If you’re a business owner, Revolut offers a great business account too.

Like the personal account, you can hold and exchange over 25 currencies, make both domestic and international transfers, and enjoy the mid-market exchange rate on transfers within market hours.

As well as this, the business account lets you issue physical debit cards to your team, and freeze the cards if you need to in the Revolut app.

You can also accept payments to your business online and in-store, and integrate seamlessly with accounting software like Xero and Quickbooks.

These are the four tiers available to businesses:

Business Tier | Price |

|---|---|

Basic | Free |

Grow | From $30/month |

Scale | From $119/month |

Enterprise | Custom pricing. For larger businesses. |

Revolut alternatives

Although Revolut is a great neobank, it has flaws, especially in its complex fee structure.

Here are a few alternatives to Revolut.

Revolut - More than just a transfer provider

Revolut isn’t just a transfer provider. Their additional features are wide-ranging, meaning there’s something for everyone in a Revolut account.

With banking features, the ability to earn interest, and an option for business, Revolut offers some of the most diverse services of all the providers we recommend.

However, if you’re only looking for money transfers, you may find their fee structure more complex than necessary.

Simpler transfers are available from the likes of Wise and XE.

A bit more about Revolut

What is Revolut?

Is Revolut legit?

Can Americans use Revolut?

Where is the Revolut headquarters in the US?

What do I need to open a Revolut account?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks

Revolut user feedback

Comments

Anonymous

Family purpose

Anonymous

Our family and in-laws use revolut for when they come to the UK, when we're in Germany, France or Portugal to pay each other back for holiday expenses for our families such as shopping, meals, petrol, gifts etc. It's great.

Anonymous

not competitive

Anonymous

Yes i recommend

Malek

Does not support transactions for people resident in algeria