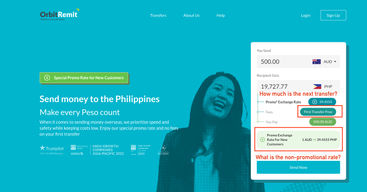

Limited-time offer - Special promo rate for new customers!

The promo rate applies to new customers only and one per customer. The promotional rate applies for the first $500.00 transfer.

Scoring OrbitRemit

The key areas of our OrbitRemit review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Before you choose whether to transfer funds overseas with OrbitRemit, here’s a quick summary of the benefits and drawbacks.

- Fees range between 0 AU$ / NZ$ - 6 AU$ / NZ$. Free transfers are available when sending money to Bangladesh, China, Samoa, and the UK (via bank transfer) from the AU or NZ, as well as to India from the AU only.

- OrbitRemit also offers a promo rate for the first transfer at a very good rate. If you need to make one large transfer from Australia or New Zealand, it might be a good option for you.

- Direct to Government Departments payments make OrbitRemit a good option for day-to-day use within New Zealand. Makes it easier to keep all your domestic and international transfers in one place.

- It lacks geographical reach, as you can only make transfers from AUD and NZD. Also, OrbitRemit only supports 25 destinations from AU and 23 destinations from NZ. To compare, Wise offers over 50 destinations from AU and NZ.

- OrbitRemit adds a markup of 1.45% on average. For transfers from AUD, the markup is 1.71%, while for NZD it’s 1.18%. This is higher than usual, for example, Wise adds no markup on top of the “real” exchange rate.

- It only offers cash pick-up options in the Philippines, Vietnam, and Nepal. If that’s what you need, you might be better off using Western Union or MoneyGram.

OrbitRemit fees and exchange rates

Fees and rates

OrbitRemit adds a percentage on top of the mid-market exchange rate (the “real” rate) and charges nominal fees on transfers.

Exchange rates

The markup added on top of the “real” exchange rate depends on the currency pair, and wherever it’s your first transfer.

In general, OrbitRemit adds 1.45% on top of the mid-market rate. This means you pay 1.45% more per unit of currency you send.

There is a slight variation in the rates depending on where you send the money from:

Australia: If you’re sending AUD the average markup is around 1.71%

New Zealand: If you’re sending NZD the average markup is 1.18%

Here’s a more detailed breakdown of the exchange rates.

AUD exchange rates

Payout | OrbitRemit Rate* | Mid-Market Rate* | OrbitRemit Markup |

|---|---|---|---|

LKR | 204.6147 | 205.3899472 | 0.38% |

KRW | 906.8968 | 911.4391 | 0.50% |

THB | 22.2956 | 22.51727 | 0.98% |

NZD | 1.0822 | 1.09367 | 1.05% |

HKD | 5.2958 | 5.366265 | 1.31% |

CNY | 4.786 | 4.851001 | 1.34% |

USD | 0.6806 | 0.690105 | 1.38% |

PHP | 38.19 | 38.76972 | 1.50% |

VND | 16728 | 16983.48405 | 1.50% |

SGD | 0.8747 | 0.888728 | 1.58% |

IDR | 10318.1711 | 10491.27 | 1.65% |

INR | 56.8485 | 57.84881074 | 1.73% |

MYR | 2.8231 | 2.873942272 | 1.77% |

NPR | 91.0355 | 92.6982161 | 1.79% |

GBP | 0.5088 | 0.51795 | 1.77% |

DKK | 4.5566 | 4.64066628 | 1.81% |

EUR | 0.6112 | 0.622415 | 1.80% |

CAD | 0.9164 | 0.9335291871 | 1.83% |

ZAR | 11.7137 | 11.94114 | 1.90% |

SEK | 6.906 | 7.044881 | 1.97% |

BDT | 81.0355 | 82.84889952 | 2.19% |

PLN | 2.607 | 2.669269551 | 2.33% |

FJD | 1.4733 | 1.509466666 | 2.40% |

NOK | 7.1066 | 7.309757785 | 2.78% |

WST | 1.7977 | 1.8583578 | 3.26% |

*Rates taken in September 2024. Rates are based on sending 1,000 AUD and receiving money into the bank account.

NZD exchange rates

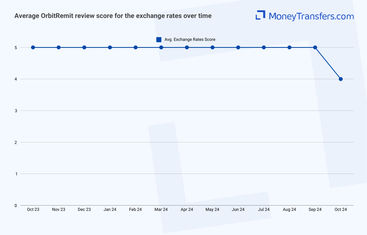

To ensure full coverage of the OrbitRemit, we’ve looked at what other users have to say about their exchange rates and plotted the results on the graph below.

International transfer fees

OrbitRemit has fairly low fees and is fixed. In a way, this is better than those services that offer percentage-based fees such as Wise (0.33%), especially for large transfers.

OrbitRemit fees range between 0 and 6 AUD / NZD, depending on the currencies you exchange.

The fees you pay are paid by you (as the sender) in the same currency you are sending from. So, if you send AUD, you will pay in AUD.

Here’s a breakdown of the fees:

Sending money from Australia

Free transfers - BDT, CNY, GBP

4 AUD - CAD, DKK, EUR, FJD, IDR, KRW, LKR, MYR, NOK, NPR, NZD, PHP, PLN, SEK, SGD, THB, USD, VND, ZAR

6 AUD - HKD

Sending money from New Zealand

Depending on your bank, you may be charged an extra fee to facilitate your bank transfer or POLi payment to OrbitRemit.

As well as, if there are any intermediaries involved or the receiver bank charges a fee, the receiver will need to cover these.

Now to put these numbers into perspective, let’s assume you’re sending 1000 NZD transfer from New Zealand to a bank via bank transfer to a bank account in the following countries:

Country | OrbitRemit fees | Wise fees | Bank of America fees |

|---|---|---|---|

$NZ 0.00 + 1.36% (13.60 NZD) | Total 3.66 NZD | $45 + ~5.66% markup ($50.66) | |

$NZ 4.00 + 2.27% (26.72 NZD) | Total 4.07 NZD | Can’t transfer to Norway | |

$4.00 + 1.34% (17.40 NZD) | Total 3.21 NZD | $45 + ~5.45% markup ($50.45) |

So double-check with the receiver about these, and send them our guide on receiving money from abroad.

Similar to the rates, we’ve looked at how other users have rated OrbitRemit in terms of their fees.

Transfer speed

Transfer speed

OrbitRemit transfer speed depends on the transfer method you use and the currencies you exchange.

Deposits to bank accounts, Alipay transfers, cash pickup, and payments to government departments will arrive on the same day.

OrbitRemit does mention in their T&Cs that any transfer involving a bank can have a few-day delays due to intermediaries and networks used. But these are fairly rare.

Mobile transfers (such as GCash and M-PAiSA) will arrive within minutes.

Here’s a breakdown of the transfer times.

Transfer method | Expected delivery timeframe |

|---|---|

Direct to the bank account | Same day |

Direct to bank account over 50,000 PHP | 1 - 2 business days |

Direct to Alipay account | Same day |

Cash pick-up | Same day |

GCash | Few Minutes |

M-PAiSA Vodafone money transfer | Few Minutes |

Direct to government departments | Same day |

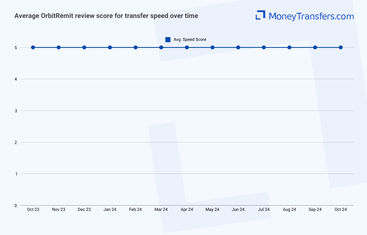

When it comes to user reviews, this is what it looks like in terms of speed.

Transfer limits

Transfer limits

Similar to everything else, transfer limits heavily depend on the destination, and the transfer type.

OrbitRemit splits the limits by the following transfer types: personal transfers, business transfers, transfers to charity accounts, transfers to trust accounts and cash pickups.

In general, transfers to South Africa, Denmark, Europe (Euro), Norway, the United Kingdom, the United States, Australia, and New Zealand have no limits to personal accounts.

Others will have daily transfer limits. Here’s an overview of transfer limits by transfer type. As a note, I’m not including destinations where the transfer is not available, so if it’s not on the list, it’s not available.

Personal accounts

Country | Transfer limits |

|---|---|

South Africa | No limit |

Bangladesh | 1,500,000 BDT |

China | 30,000 CNY |

Hong Kong | 500,000 HKD |

India | 20,000,000 INR |

Indonesia | 100,000,000 IDR |

Malaysia | 50,000 MYR |

Nepal | 999,000 NPR |

Philippines | 5,000,000 PHP |

Singapore | 200,000 SGD |

South Korea | 5,000,000 KRW |

Sri Lanka | 10,000,000 LKR |

Thailand | 49,999.99 THB |

Vietnam | 499,999,999 VND |

Denmark | No limit |

Europe (Euro) | No limit |

Norway | No limit |

Poland | 150,000 PLN |

United Kingdom | No limit |

Canada | 100,000 CAD |

United States | No limit |

Australia | No limit |

Fiji | 10,000 FJD |

New Zealand | No limit |

Samoa | 10,000 WST |

Business accounts

Charity accounts

Trust accounts

Cash pickup

We’ve also looked at online user reviews for OrbitRemit limits.

Product offering

Product offering

Supported currencies & destinations

OrbitRemit supports transfers only from Australia and New Zealand.

As it stands, there is no information or evidence that you can send money from the UK at this moment.

The service used to be offered in the UK, and OrbitRemit is registered in HMRC, however, it doesn’t look like they offer the services as of the time this review was updated.

You can send money to the following destinations / in the following currencies from both, Australia and New Zealand:

Bangladesh (BDT)

Canada (CAD)

China (CNY)

Denmark (DKK)

Europe (EUR)

Fiji (FJD)

Hong Kong (HKD)

India (INR)

Indonesia (IDR)

Malaysia (MYR)

Norway (NOK)

Poland (PLN)

Singapore (SGD)

South Africa (ZAR)

South Korea (KRW)

Sri Lanka (LKR)

Sweden (SEK)

Thailand (THB)

The Philippines (PHP)

The UK (GBP)

The USA (USD)

Vietnam (VND)

In addition, you can also send money to the following destinations, only from Australia:

Nepal (NPR)

New Zealand (NZD)

Samoa (Samoa)

Also, you can only send money to Australia (AUD) from New Zealand.

Transfer types

OrbitRemit offers a few transfer types, which also depend on the destination. Here’s a quick summary:

Australia

Transfer type | Countries |

|---|---|

Cash pick-up | Nepal, The Philippines, Vietnam |

Direct to Alipay account | China |

Direct to the bank account | Bangladesh, Canada, Denmark, Europe, Hong Kong, India, Indonesia, Malaysia, Nepal, New Zealand, Norway, Poland, Singapore, South Africa, South Korea, Sri Lanka, Sweden, Thailand, The Philippines, The UK, The USA |

Direct to government departments | New Zealand |

Direct to GCash | Nepal |

Direct to M-PAiSA | Fiji, Samoa |

New Zealand

Bank account transfers

This method allows you to send money directly to the recipient's bank account. Money will arrive directly and there’s nothing they need to do.

Bank transfers should arrive on the same day but can take up to 3 days with OrbitRemit.

Cash transfers

This is where you send money and the receiver will need to come to the pickup location to collect it. The transfer will be instantly available for pickup by the recipient.

This option is limited to certain countries (check the table above).

Transfer to mobile wallets

Mobile transfers let you send money directly to available wallets. In the case of OrbitRemit, these are GCash, M-PAiSA, and Alipay.

Funds should arrive instantly, and there’s nothing the receiver needs to do. Similarly, these transfers are limited to certain destinations (see above).

Government departments transfer

Finally, in New Zealand, OrbitRemit offers an option to send money to IRD for tax, loans, and support payments, to MSD for work and income payments, and to MOJ for any fines.

Similar to other sections, transfers will take up to a day, usually instant, and there’s nothing the receiver (in this case departments) needs to do.

Payment methods

You can fund your transfer on OrbitRemit using the following options.

Bank transfer

With bank transfer, you use your bank to fund the transfer. This can be done on the web and using the app.

Debit card (only AU)

In Australia, you can fund your transfer via your Australian debit card.

This feature is only available on the mobile app.

The card needs to be either Visa or Mastercard and there might be extra fees depending on the bank.

PayID

This is an Australian payment method where your payments are made via mobile number, email, ABN, or organization ID. It is similar to FPS in the UK.

Your bank will need to support PayID to be able to use this transfer. Use the official PayID website to check if your bank is supported. Here is the link.

POLi

POLi is only available in New Zealand. It’s an online payment service that allows for direct deposits from your bank without the “middleman” such as Visa or Mastercard.

It is only available with a few select banks (which you can find here).

If your bank is supported, I’d suggest using it as you won’t be charged any fees for card usage.

Receiving methods

OrbitRemit transfers can be delivered in the following ways.

Direct to the bank account

Money will arrive directly in the recipient's bank account. There’s nothing the receiver needs to do, it is all automated.

Via mobile wallet

Given the receiver has the supported mobile wallet (explained above), money will be delivered straight to it. There’s nothing they need to do, it is fully automated.

Cash pickup

The receiver will need to come to one of the branches (in over 5,000 locations). They will need to provide government-issued ID and the transfer number to be able to collect.

Mobile app

OrbitRemit has a mobile money transfer app available as a free download on both Android and iOS.

Using the app, you can:

Make transfers to bank accounts and cash pickup locations.

Manage recipients by adding, deleting, or modifying their details.

Check exchange rates and transfer fees.

Access 24-hour customer support.

On Play Store, the app has 7,095 reviews and an overall rating of 3.9/5. On the App Store, it has a 4.7/5 rating and a total of 121 reviews.

Based on these numbers alone, it is clear that they need to improve their app performance.

In terms of product offering, here’s what online reviews look like from other customers.

Ease of use

Ease of use

Overall, OrbitRemit is very easy to use and is very straightforward.

The signup process only takes a few minutes, and making a transfer is fairly quick and simple (given you have all the recipient details on hand).

One thing that I didn’t like about them is the lack of transparency in fees.

It is fairly common amongst money transfer companies to get you to sign up before you see the fees, but many (including Wise for example) will show you all the info upfront.

What I mean by this, is that unless you sign up, when you use the form you will get the bubble saying “First Transfer Free” and will only see the “Promo Exchange Rate”.

Ideally, I’d like to see the promo rate, actual rate, promo fees, and actual fees. This way, I’m not locked down to the provider that offers a worse rate and higher fees after the first transfer.

Similarly to other sections of this review, we’ve looked at what others had to say about the usability and plotted the results on the graph below.

Customer service

If you run into issues or have questions, you have the following support options:

Phone

Email

Live chat

Extensive guides

To contact them, use the following details:

Contact Method | Details |

|---|---|

Phone support | +64 4 831 8780 in New Zealand and +61 2 8188 3735 in Australia. You can leave a voicemail and get a callback if no one picks up. |

support@orbitremit.com. You should hear back from them within 1 business day. | |

Live Chat | Available on OrbitRemit app (Monday - Friday, 9 am - 5 pm NZST). |

Guides and FAQs | All are located on the OrbitRemit website here. |

Customer support is usually the downside of many transfer companies. We’ve looked at what users had to say about OrbitRemit in terms of their support.

Safety and trust

Safety and trust

Regulatory compliance

OrbitRemit Limited is registered in:

New Zealand (company number 2174112)

Australia (company number 69601986038)

The UK (company number 06731488)

And is regulated in the same countries:

United Kingdom: The company is authorized and regulated by the Financial Conduct Authority (FCA) to provide money remittance and payment services. It is also registered by the HM Revenue and Customs (HMRC) company number 12480317.

Australia: OrbitRemit is licensed by the Australian Securities and Investments Commission and the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a money remitter.

New Zealand: The company is registered and regulated by the Financial Markets Authority (FMA) and operates as a Financial Services Provider-FSP7721. It is also supervised by the Department of Internal Affairs (DIA).

Industry awards

Similar to other areas of this review, we’ve analyzed what others had to say regarding OrbitRemit safety.

Customer feedback

Customer feedback

On Trustpilot, OrbitRemit has over 31,000 reviews with a rating of 4.9, where 85% of users gave it 5 / 5 stars.

Overall, OrbitRemit users find it efficient, affordable, and reliable when it comes to international money transfers.

The most positive comments are about the speed, ease of use, good fees, and timely transfers. There aren’t any complaints about the transfer fees or exchange rates, although a few do mention that long-term customers should be getting better deals.

Many comment on the use of the app, saying it’s easy and convenient to use, but does have some bugs and minor usability issues.

Interestingly, customer service is frequently described as responsive and helpful, resolving issues promptly when they arise. This is unusual for an online-only company.

Here's a summary of average user reviews.

Review Category | Apr 24 | May 24 | Jun 24 | Jul 24 | Aug 24 | Sep 24 |

|---|---|---|---|---|---|---|

International Transfers | 5 | 5 | 5 | 5 | 5 | 5 |

Fees | 5 | 5 | 5 | 5 | 5 | 5 |

Exchange Rates | 5 | 5 | 5 | 5 | 5 | 5 |

Speed | 5 | 5 | 5 | 5 | 5 | 5 |

Limit | 0 | 0 | 5 | 5 | 0 | 5 |

Features | 5 | 5 | 5 | 5 | 5 | 5 |

Ease of Use | 5 | 5 | 5 | 5 | 5 | 5 |

Safety | 5 | 5 | 5 | 5 | 5 | 5 |

Customer Support | 5 | 5 | 5 | 5 | 5 | 5 |

Opening an account with OrbitRemit

To open an account with OrbitRemit, you will need the following:

Email address

Password

Business confirmation if opening a business account.

Government-issued ID

Confirmation of the address

Once you have these details, follow the steps below to open an account:

Start the signup

Navigate to the site (using any of the orange buttons on this page) and click Sign Up.

Fill in the details

Add your email address and create a strong password.

Verify your email address

Once done, you will receive a verification link in your email. Click on it to verify the account.

Fill in your profile

Finally, go to your profile and fill in your personal details. This is where you will need to submit your ID, and proof of address, and add your personal details. This will save you time on future transfers.

Making international transfers

To send money with OrbitRemit, you will need the following:

Recipient details

Verified account (in the steps above)

Transfer details

Payment method to fund your transfer

If you are sending money to a bank account outside of the EU, you will also need to provide a SWIFT code.

Use the search box below to find your recipient’s SWIFT code.

Find a SWIFT Code

Sending money abroad

Once you have all the details ready, you can send money with OrbitRemit by following the steps below.

Start your transfer

Go straight to the calculator and key in the amount you want to send to check the fees, rates, and the amount the recipient will get. When making your first transfer, you will first need to choose your account type (individual or business).

Add the recipient details

Add the bank account details and name of your recipient. These details can then be saved so it’s easy for you to select the same payee again in the future.

Verify your information

You then need to complete the ‘About You’ section (unless already done during the registration). This involves providing proof of ID and proof of address documents.

Review your transfer

Check that all your transfer details are correct and add some reference information for your recipient if you want.

If it’s your first transfer you can redeem it at this point by simply checking the ‘You have free transfer(s) available’ box.

Pay for your transfer

Select one of the available payment methods. OrbitRemit will display the relevant details once you confirm your payment method.

Monitor your transfer

Check the status of your transfer as it progresses to completion right from your OrbitRemit dashboard.

When sending over 500,000 PHP, you will also be required to provide the following:

Filled in and signed the remittance information form

Passport or driving license if the ID on file has expired

Recipient ID

Proof of payment

A document showing the source of funds

If you are sending more than 300 million Vietnamese Dongs, you will also be required to fill in and sign a remittance information form.

Yes, you can get in touch with customer support to have your transfer canceled if it is ‘Awaiting Payment’ or ‘Awaiting Update’. Completed transfers cannot be canceled.

Receive international transfers

OrbitRemit deposits the funds directly into your beneficiary’s bank account once you have arranged and funded the transfer.

In addition to bank transfers, recipients in the Philippines, Nepal, and Vietnam can also get their funds from cash pickup locations.

They only need their government-issued ID cards and the reference number of the transfer to collect the money.

How OrbitRemit compares to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

OrbitRemit: Is it good for transfers abroad?

Overall OrbitRemit offers great services for those living in Australia and New Zealand.

If they support the destination country of your transfer and the currency you need, it’s a good service to sign up to and benefit from the promo on the first transfer.

Considering its fixed fees, it’s a good option for large transfers (however consider the limit). In addition, you will be losing out on the exchange rate a bit.

If you want to save as much as possible, I’d encourage you to compare your options using the form below. This way you are guaranteed to find the provider that supports your transfer needs, as well as get the best rate available right now.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

.svg)