How to send money to Nigeria from Italy with the best EUR-NGN rate

Find money transfer deals for sending money from Italy to Nigeria. Compare the cheapest, fastest, and most reliable providers with the best EUR to NGN exchange rates.

Read on for the best deals, expert information, and easiest ways to send money to Nigeria from Italy.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Card-to-card transfers can be received in just two minutes."

"Card-to-card transfers can be received in just two minutes."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"Sendwave is trusted by over 1 million users across the US, UK, Canada and EU. 24/7 support is available online and via the app."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

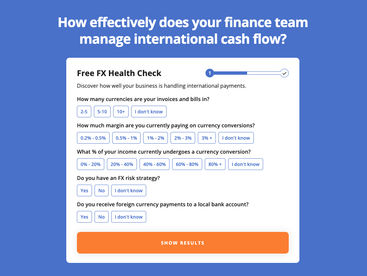

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

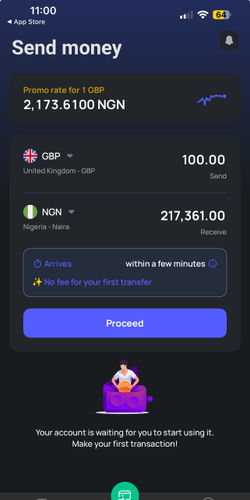

Overall best way: Wise

We tested & reviewed 8 transfer providers, and Wise scored highly.

Sending 7,000 EUR to NGN will cost you €46.96 in fees, and you will receive 11,107,481.4 NGN. The delivery time is within minutes, but it depends on the day you make the transfer.

So for a great mix of cost, speed & features, make your Italy to Nigeria transfer using Wise.

How to get the best deal on sending money from Italy to Nigeria

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates to send money from Italy to Nigeria.

Choose a provider

Select the provider that offers you the best value on buying NGN & service for your needs.

Click, sign up & send

Follow the steps & make your transfer. Your funds will soon be on their way to your chosen country & currency.

Understanding Italy to Nigeria money transfers

Comparing providers when sending money from Italy to Nigeria is the easiest way to make a transfer at the best price.

We’ve compared 8 providers for sending Euro to Nigeria. This ensures you will get the best options for your transfer to Nigeria from Italy.

We rate Wise as the best overall, but comparing gives you a comprehensive view of all the options for transferring money from Italy to Nigeria.

Cheapest way to send money to Nigeria from Italy: Profee

Data collected through our comparison over the past week shows that Profee is 0.39% cheaper than the second-best option.

The cost is made up of a fee of 0 EUR and an exchange rate for buying Naira with Euro that is -0.04% different to the mid-market rate.

If you want to secure the best rates on a Italy to Nigeria transfer, Profee offers value. We would still recommend searching for the amount you want to send to Nigeria.

Fastest money transfers from Italy to Nigeria: Wise.

Based on our recent data, transfer time for a €7,000 transfer to Nigeria with Wise is within minutes. This can vary by amount and method, but it is a good point of reference.

Sending money from Italy to Nigeria through Wise will cost you 46.96 EUR in fees & small markup.

Wise was one of 8 money transfer providers we compared for overall speed of sending money from Italy to Nigeria. This speed test included depositing Euros to an account and the average timeframe for sending money to Nigeria.

When fast transfers are a priority, Wise is our best choice for sending from Italy to Nigeria.

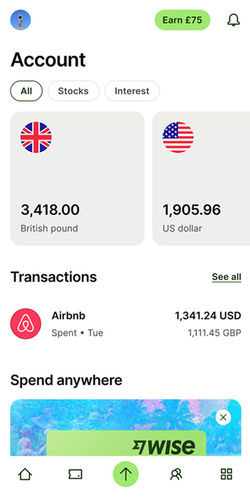

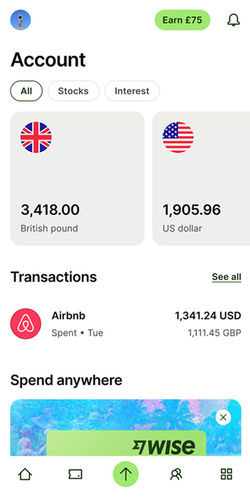

The best apps to send EUR to Nigeria from Italy

Most money transfer companies have apps you can use to send money abroad.

We've compared and analyzed over 8 apps & companies for EUR/NGN transfers and these are the best apps we found. All these apps are available on iOS and Android for free.

App | Rating | Mobile wallet |

|---|---|---|

iOS: 4.8 / 578 reviews Android: 4.7 / 12.3K reviews | Yes (4 currencies) | |

iOS: 4.9 / 2.3M reviews Android: 4.8 / 1.29M reviews | Yes (Remitly One) | |

iOS: 4.7 / 73.2K reviews Android: 4.7 / 117K reviews | No | |

iOS: 4.8 / 158K reviewsA ndroid: 4.8 / 1.52M reviews | Yes (40+ currencies) | |

iOS: 4.9 / 936K reviews Android: 4.8 / 3.64M reviews | Yes (39 currencies) |

Sending large amounts of money

Of the 8 companies compared, Wise has the strongest option for large transfers from Italy to Nigeria.

Whatever the reason, sending bigger sums of money can be costly if you get a bad exchange rate from Euro to Naira.

The Wise rate makes them great for large transfers between Nigeria and Italy.

Understanding the cost of money transfers to Nigeria from Italy

The total cost of sending money to Nigeria from Italy is a mix of the mid-market, exchange rates and transfer fees.

The Mid-Market and Exchange Rates: The mid-market for EUR-NGN is 1,608.1096 NGN per Euro.

Using a transfer company with an exchange rate as close to the mid-market rate as possible will result in being able to buy more Naira for your Euros.

The EUR-NGN mid-market rate over the last 7 days has seen the Euro worth an average 1,600.7871 NGN. Within this there has been a high of 1,610.0612, and a low of 1,592.823.

From 8 companies compared, Profee offers the strongest exchange rates.

The biggest factor in the overall cost of sending money is the exchange rate you receive on converting EUR to NGN.

Fees: When sending money there may be additional fees. Profee offers the lowest fee of the 8 providers tested, costing 0 EUR per transfer (based on €7,000 transferred).

Amount Received: When comparing providers, the best measure is the amount of Naira eventually received in Nigeria.

This number should allow you to determine if you are getting a good deal. A higher amount of money received in Nigeria, means a better overall cost of sending money from Italy.

Track the exchange rate for Euro to Naira

Sending money at the right time between EUR and NGN can make a huge difference to overall cost. The exchange rate impacts how much NGN you get for your EUR.

Over the last 7 days, the average numbers are:

The exchange rate from EUR to NGN averaged 1,600.7871 NGN.

The highest value recorded was 1,610.0612 NGN, while the lowest was 1,592.823 NGN.

8 providers currently offer transfers between Italy and Nigeria close to this rate

Want to secure the best EUR-Naira exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Italy to Nigeria!

How to pay for money transfers between Italy and Nigeria

Bank transfers

Bank transfers are often fastest, cheapest and best way to send money from Italy to Nigeria.

Using a money transfer company such as Profee for transfers from Italy to Nigeria, will mean being able to send money via a bank transfer while benefiting from lower fees and more favorable exchange rates.

On average, Profee is the cheapest provider for bank transfers of the 8 we compared for transfers from EUR to Nigeria.

To send money from Italy to Nigeria, Profee has a fee of 0 EUR.

Debit cards and prepaid options

Sending money from Italy to Nigeria with a debit card or a prepaid card is very simple with Wise.

Wise is the cheapest option for sending money with a debit card between Italy and Nigeria. This is of the 8 money transfer companies offering debit card payments on this route.

Credit cards

When it comes to credit card transfers from Italy to Nigeria, we to get the best deal.

Be aware of fees: using a credit card to transfer money often results in a fee being charged by your card issuer. That's why we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Nigeria and Italy.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Italy to Nigeria.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send EUR to NGN.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Italy

Send money to Nigeria

How much money can be transferred from Italy to Nigeria?

Are there any tax implications to sending money from Italy to Nigeria?

Can I send money from Italy to Nigeria with MoneyTransfers.com?

What are the typical transfer fees for sending Euros to Nigeria through various providers?

How long does it take to send money from Italy to Nigeria?

What is the best exchange rate I can get for sending money from Italy to Nigeria?

Are there any minimum or maximum transfer amounts for sending money from Italy to Nigeria?

Can I schedule regular transfers between Italy and Nigeria?

Tools & resources

Contributors