The best way to send money to Ukraine: Wise

After reviewing and testing 8 money transfer providers supporting UAH transfers, we found Wise to be the top choice for sending money to Ukraine as of November 2024.

Wise appeared in 63.5% of UAH transfer searches and ranked as the best option among providers supporting Hryvnia transfers.

With quick transfers, a low markup of 0% on UAH exchange rates, and a low fee of $5.82, Wise offers the ideal balance of cost, speed, and features for sending money to Ukraine.

How to get the best rate when sending money to Ukraine

Consider this before sending money to Ukraine

Always compare your options when sending money to Ukraine, as the amount of UAH received can vary based on the deposit method, the amount of UAH sent, and your home country.

Most services include fees and markups on the UAH mid-market rate.

Our comparison of 8 providers supporting Ukraine will help you find the best fit for your needs.

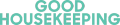

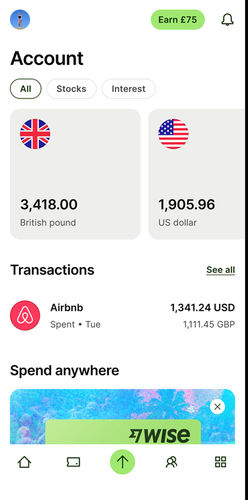

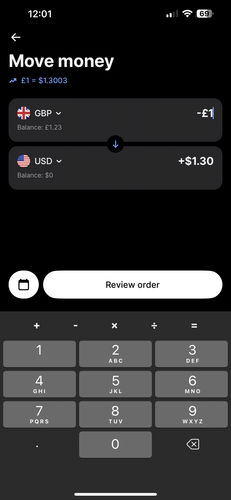

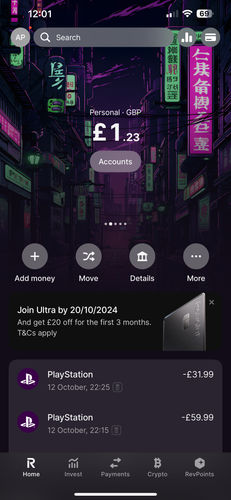

The cheapest way to send money to Ukraine: Revolut

From the 8 companies tested in the past 6 months, Revolut consistently offers the cheapest money transfer UAH to Ukraine.

Revolut appeared in 73.9% of our searches as the most cost-effective option, being 0% cheaper than the second cheapest provider.

Revolut charges $0 per transfer to Ukraine and applies a 0.13% markup on the UAH exchange rate.

For the best value, use a Bank transfer deposit to maximize the amount of UAH received.

The fastest way to send money to Ukraine: Wise

Based on a $2,000 transfer and six months of comparison data for UAH transfers, Wise appeared 59 times in our searches as the quickest option for sending UAH to Ukraine.

They charge $5.56 in fees and apply a 0% markup on the ‘real’ UAH rate. This is 0% cheaper than the second-best provider.

For the best balance between speed and cost, we suggest using a deposit when sending money to Ukraine.

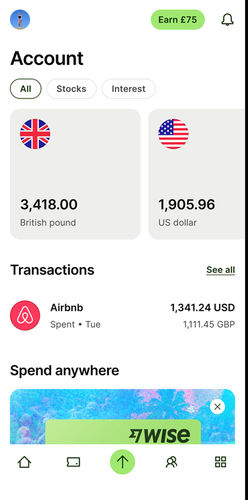

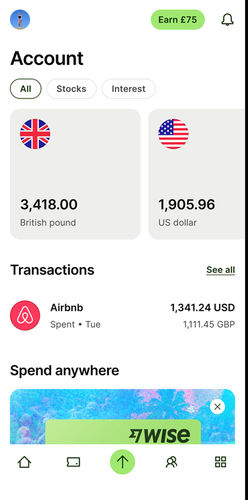

The easiest way to send money to Ukraine: Wise

In our 6-month analysis, Wise ranked as the top-rated money transfer provider in 63.5% of the searches related to Ukraine.

They’re highly transparent with fees, charging $5.82 per transfer with a 0% markup on the UAH mid-market rate.

With multiple deposit and withdrawal options and reliable customer service, getting started with Wise takes less than 10 minutes, making it a fast, cheap, and user-friendly option.

Sending large amounts of UAH to Ukraine

Based on our 6-month analysis, Wise consistently ranked as the top choice for large UAH transfers. They charge $5.82 per transfer to Ukraine and apply only a 0% markup on the UAH exchange rate.

Whether you’re purchasing property, paying tuition fees in UAH, planning a wedding in Ukraine, or making business payments, Wise ensures a smooth and secure process.

When sending large amounts of Hryvnia to Ukraine, consider factors like transfer limits, markup on the UAH rate, customer service, and any legal, tax, or government-imposed restrictions in Ukraine.

Understand the costs of money transfers to Ukraine

The cost of sending UAH depends on where you're sending from, the amount of UAH sent, deposit and delivery methods, transfer fees, and the markup applied to the UAH mid-market rate.

For example, if you're sending $2,000 from the US to Ukraine, you can expect the following:

Transfer fees to Ukraine

Depending on the service you use to send money to Ukraine, transfer fees can be percentage-based, fixed, or a combination of both.

Xoom charges only $0 per transfer based on our analysis of 8 services supporting UAH transfers in November 2024.

Markup on UAH exchange rate

A markup is a percentage added to the UAH mid-market rate by a money transfer service (or a bank).

Revolut offers the best UAH exchange rates by applying a 0.13% markup on the USD-UAH rate. This means for every US Dollar sent, you receive 41.2838 UAH minus 0.13% deducted from it.

Funding transfer to Ukraine

How you fund your transfer to Ukraine can impact the cost:

Bank transfers typically have the lowest fees, often costing up to $0 per transfer.

Debit cards may cost up to $5.96 per transfer.

Credit cards may come with cash advance fees, and increased rates, and can cost as much as $17.09 per transfer to Ukraine.

Overall, Bank transfer is the cheapest funding method for sending money to Ukraine.

How to get the best UAH exchange rate for transfers to Ukraine

An exchange rate represents the value of the Hryvnia (UAH) relative to another currency. Since it fluctuates continuously, the rate you get directly affects the amount of UAH you receive.

Recent trends in UAH exchange rates:

The average rate was 40.7046 Hryvnia per US Dollar, with a high of 41.6296 UAH/USD and a low of 39.2514 UAH/USD.

During the past 6-months, the UAH/USD exchange rate experienced some fluctuations. Ensuring you exchange or convert money at a higher rate would result in more UAH received.

Revolut is our top recommendation for sending money online to Ukraine because it offers an exchange rate that is 0.13% above the mid-market rate, which is 0% cheaper than the next best option.

Secure the best UAH exchange rates with our rate alerts

Sign up for our rate alerts, and we'll notify you when it’s the best time to send money to Ukraine!

Top payment methods to use for transfers to Ukraine

Money transfer companies will offer different ways to fund your transfer to Ukraine. Depending on the service used, deposit options can affect the speed, the cost of your transfer, and the amount of UAH received. Here are the most popular funding options available for transfers to Ukraine.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Ukraine.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Ukraine.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Ukraine

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

Related transfer routes

Send money from United States

Keep your money safe when sending money to Ukraine

To ensure the safety of your UAH transfer, send money only to trusted recipients in Ukraine and always use a regulated money transfer provider.

All the services we recommend for transfers to Ukraine are secure and regulated by recognized financial authorities.

If you're uncertain about the regulatory bodies in Ukraine or your own country, check our directory of worldwide financial regulators.

FAQs

Find answers to the most common questions on our dedicated FAQ page.

.svg)